So, you’re doomscrolling through headlines about inflation, AI taking over, and the price of iced coffee hitting $8—and you’re wondering what else could skyrocket before 2030? Spoiler: it’s not just rent and your existential dread. A bunch of everyday (and not-so-everyday) commodities are quietly lining up to triple in price, thanks to a spicy mix of climate change, tech shifts, supply chain chaos, and good old-fashioned greed.

From the metals powering your EV to the beans powering your barista, the next five years are shaping up to be an absolute rollercoaster for the global supply chain. And if you play your cards right, some of these price surges could actually be opportunity knocking—whether you’re investing, hoarding, or just mentally preparing to cry at the checkout line. So grab your oat milk latte (before it costs $12) and let’s run through 12 commodities that could triple in price by 2030. You might want to take notes—your future self could thank you, or at least stop panic-Googling “why is everything so expensive?” at 2 a.m.

1. Lithium

Lithium is basically the Beyoncé of battery metals right now—every EV wants it, and demand’s set to go through the roof. With global lithium-ion battery capacity forecast to balloon by over 500% by 2030, you can practically hear the price tag singing “Single Ladies” in the background. A Reuters report estimates U.S. demand alone could hit $55 billion annually by decade’s end, thanks to electric cars, grid storage, and a general “more juice, please” vibe .

Supply is still catching up—new mines take years to get going, and a few bottlenecks here and there mean buyers may end up in an all-out bidding war. Add in geopolitical juju (hello, export controls) and you’ve got a recipe for some spicy price moves. Don’t be surprised if we see lithium prices tripling as manufacturers scramble for every last ounce.

Plus, startups are scrambling to develop lithium extraction from geothermal brines, which could either flood the market or prove fantastically expensive—it’s a coin flip. Analysts joke that by 2030, we might refer to lithium like we do oil: “that cheap stuff we take for granted.” And hey, if you manage to snag a few shares of a lithium-kingpin miner now, you might just thank yourself later.

2. Copper

Copper’s that trusty sidekick in electrification—wiring homes, power grids, and EV motors all crave it. With AI data centers projected to gulp down 1 million extra tons by 2030, Trafigura analysts warned that demand could cause a supply pinch no one saw coming. In fact, a Yahoo Finance flagged looming deficits that might send copper prices on a “to the moon” trip .

Don’t sleep on grid upgrades, either—many developed countries need to modernize aging infrastructure. And if renewable builds keep accelerating (looking at you, solar farms), copper per watt requirements keep climbing. All these factors together could have copper multiplying its current price as every new wind turbine and skyscraper reaches for more of that rosy metal.

Rumors of huge underground deposits in remote regions keep tantalizing investors—but if those discoveries don’t pan out, it’s pure FOMO driving prices. Meanwhile, scrap copper isn’t going to fill the gap fast enough, so primary copper remains king. If you’ve ever noodled with wiring a DIY speaker, you’ve already paid homage to this underrated superstar.

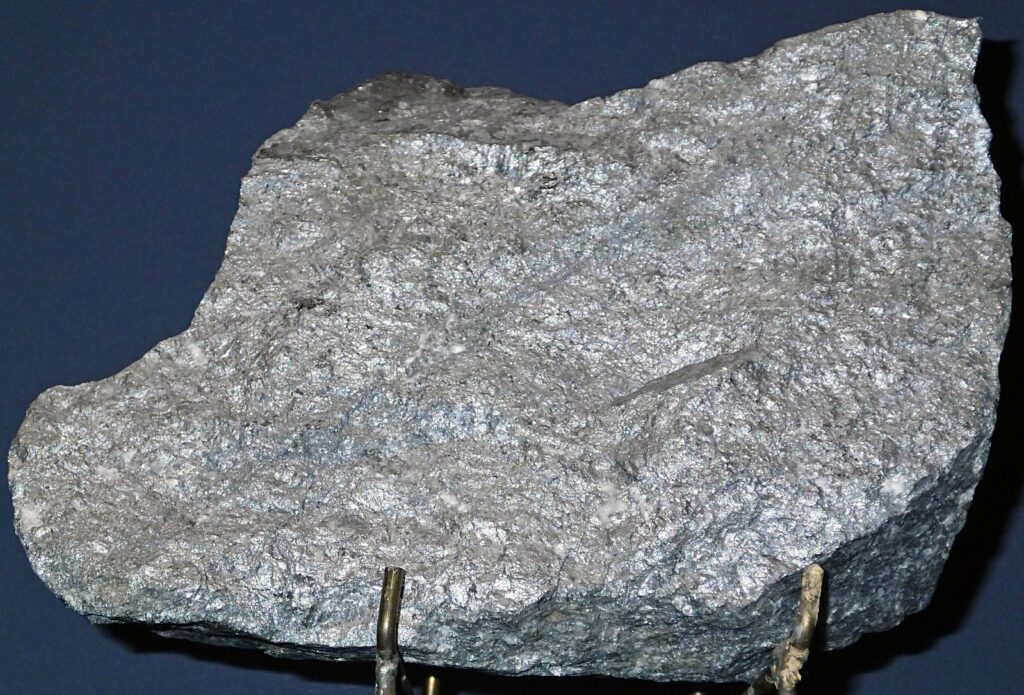

3. Rare Earth Elements

Rare earths are the unsung heroes in magnets, wind turbines, and EV motors. McKinsey projects that by 2030, battery-electric vehicles and charging infrastructure alone could gulp up about 50% of global rare earth output, plus 36% of nickel and 55% of cobalt for good measure. That’s enough to make any investor do a double-take at their portfolio .

Mining and processing these bad boys are complicated, expensive, and often environmentally fraught, which keeps new supply sluggish. Meanwhile, clean-energy demand is only accelerating. Price shocks could easily follow if a single major producer hiccups—or if a trade spat bans shipments. A triple-digit surge? Totally plausible, according to McKinsey.

Plus, emerging tech like permanent-magnet motors and wind-turbine upgrades could suck down even more rare earths than expected. Recycling rare earths is still in its infancy, so don’t expect scrap to bail the market out anytime soon. Oh, and whispers of a new deposit in Greenland keep popping up—but turning ice into magnets is no small feat.

4. Uranium

Nuclear’s back in vogue as countries hunt low-carbon energy sources, and reactors need uranium like we need our morning latte. Prices have already climbed north of $100/lb this year as utilities locked in supplies, and Financial Times commentary notes that production will struggle to meet reactor requirements through 2030, stoking “scarcity mode” in the market .

That’s right: with dozens of new reactors planned (hello, China and India) and limited mine openings, we could see uranium prices triple as buyers scramble to fuel clean-energy expansions. Hedge funds might even pile in—because who doesn’t love a radioactive rollercoaster?

Also, next-gen small modular reactors (SMRs) are on the horizon, potentially boosting fuel demand further. If these compact nukes catch on in remote areas, uranium consumption could spike unexpectedly. And if geopolitical tensions ever jolt supply, prices could skyrocket overnight—talk about a glowing opportunity!

5. Nickel

Nickel’s starring role in stainless steel is yesterday’s news—today it’s all about battery-grade nickel for EVs. Bloomberg analysts warn that annual nickel supplies need to balloon from 3.4 million to over 5 million tons by 2030 just to keep pace with battery demand. That’s a ginormous gap that could leave prices feeling the FOMO .

Production hiccups (looking at you, Indonesia’s environmental protests) and the slow ramp-up of new smelting technology only compound the crunch. If automakers can’t secure enough high-purity nickel, expect them to bid prices sky-high, according to Steel News. Triple by 2030? Honestly, it’s looking more like a light forecast.

Smelting innovations like “green nickel” (hydrogen-based refining) could either ease supply or add extra premiums for clean certifications. Plus, any slowdown in Indonesian exports would send shockwaves through battery supply chains. So if you’re eyeing nickel ETFs, buckle up—it’s going to be a bumpy ride.

6. Cobalt

Cobalt’s that sometimes controversial sidekick in EV batteries—key for stability but often sourced from sketchy spots. As battery chemistries trend toward higher cobalt content (to boost energy density), demand could outstrip ethical supply, sparking price spikes. Investors might triple-down on cobalt, betting that the rush for solid-state and next-gen batteries keeps cobalt in the VIP queue.

But here’s the kicker: recycling will only scratch the surface of future needs, and ethical sourcing standards could jack up costs even more. Plus, political instability in key producing regions like the DRC means any disruption could send cobalt prices into orbit. Technological shifts to “cobalt-lite” chemistries might temper some demand—but don’t count on a wholesale replacement anytime soon. On top of that, strategic stockpiling by governments could tighten the market further.

7. Copper Scrap

Yes, we already love copper, but here’s a twist: recycled copper. With primary copper mines under pressure, scrap’s set to become premium. Municipal recycling programs and urban mining could send scrap copper prices soaring—imagine paying triple the rate just to reclaim old wiring and piping. When virgin supply is tight, old pennies, wires, and shell casings become liquid gold.

Electric utilities may even start charging premiums for taking your old motors and transformers off your hands. And manufacturers could prefer scrap to avoid long lead times on new ore. With scrap traceability becoming a selling point, “green copper” might fetch a hefty sustainability premium. If enough end-users pivot to recycled material, scrap prices might eclipse primary metal costs.

8. Palladium

Palladium powers catalytic converters in gasoline cars, and until EVs fully dominate, auto emission standards will keep palladium demand strong. With supply centered in just a couple of regions, any mine strike or geopolitical drama could have palladium prices doing somersaults. A triple-dip rally by 2030? Don’t rule it out.

Meanwhile, investors are already treating palladium like the belle of the ball in precious metals portfolios. Jewelry demand remains surprisingly robust, adding a luxury-market layer to the mix. Central banks dipping into their metal reserves could also tighten available supply. On the flipside, a faster EV transition might cool combustion demand but only after mid-decade. And if recycling rates from old vehicles improve, it could slightly temper price surges—but probably not enough to stop a bull run.

9. Natural Gas

It might seem odd—many peg gas as a “bridge fuel”—but as renewables face intermittency, grid operators increasingly rely on gas peaker plants. Plus, global LNG exports are booming. If piped-gas infrastructure can’t expand fast enough, regional crunches could send spot prices soaring to three times current levels, especially in winter-hungry markets.

Speculation during cold snaps already shows how volatile north-hemisphere gas can be. Emerging markets building new LNG import terminals add another layer of demand unpredictability. Meanwhile, supply growth in North America depends on drilling pace, which can stall on regulatory or environmental grounds. Natural gas storage levels, especially in Europe after recent geopolitical scares, will keep traders on edge. And don’t forget methane-capture rules—if producers need to rein in flaring, supply might tighten further.

10. Coffee

OK, not a metal—but hear me out. Climate-driven yield declines in Brazil and Vietnam, coupled with surging demand from specialty coffee shops (looking at you, oat-milk peppermint latte crowd), could pressure prices. If a single frost hits a major bean region, we could see spot prices triple as baristas and bean-chain giants scramble for supply.

Add in logistics snarls—shipping coffee beans isn’t as easy as sending an email—and you’ve got a recipe for skyrocketing bean bills. Trader positioning in futures markets can amplify price swings, turning small weather hiccups into massive spikes. Plus, illnesses like coffee leaf rust could decimate crops if left unchecked. With forecasted global consumption climbing by over 10% through 2030, roasters might have to pass those sticker shocks straight to your morning brew.

11. Sugar

Biofuel mandates are gobbling up more sugarcane for ethanol, and climate woes threaten yields in Brazil. When ethanol demand peaks, sugar supply tightens, pushing prices up. Compound that with growing sweet-tooth economies, and sugar could taste three times as expensive at your grocery checkout by 2030.

Meanwhile, speculative funds are piling into soft-commodity ETNs, adding another speculative layer to price formation. Worker strikes in major producing countries can halt cane harvests overnight, disrupting global supply. Disease outbreaks in cane fields—hello, smut and rust—could also dent yields significantly. And shifting diets toward plant-based proteins (which use sugar derivatives) could boost industrial sugar demand unexpectedly. All told, we might be stirring our drinks with gold by the end of the decade.

12. Soybeans

Soy’s everywhere—from tofu to pet food to that sneaky oil in crackers. Asian demand is climbing, and if global crop pressures (pests, floods) get worse, we could see soybean prices triple. With just a handful of exporting giants, any hiccup in planting season could send soy futures through the roof.

Then there’s the biofuel angle—soybean oil is a major feedstock for renewable diesel, and mandates are tightening across Europe and North America. Crop insurance costs have been creeping up as weather volatility grows, which could discourage farmers from planting as much. Land-use shifts toward palm and canola pose competition, tightening soybean acreage even further. And don’t forget tariffs: trade disputes could reroute demand suddenly, igniting regional price spikes. In short, everything from your morning tofu scramble to your dog’s kibble could cost a lot more soon.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.