1. Mexico

Mexico’s sunshine-filled beaches might still be Insta-worthy, but its factories are sweating bullets. The country is so entwined with U.S. supply chains that a 25% tariff could shave off 12% of its exports and send GDP tumbling by around 4% in 2025 alone, according to Bloomberg. Manufacturers from auto giants to electronics assemblers would face sky-high costs, leading companies to either hike prices or shutter plants. That spells fewer jobs, less investment, and a serious case of economic indigestion.

Mexico’s peso would likely wobble, inflation could surge above the central bank’s 4% ceiling, and social programs might get the budget ax as revenue dries up. The Bank of Mexico has already cut rates to prop things up, but if trade tensions stick around, those rate cuts might not be enough to stop a full-blown slowdown. In short, Mexico’s deeply integrated economy could collapse under the weight of tariff shockwaves—ole!

2. Canada

If you thought igloos and maple syrup were enough to keep Canada cozy, think again—tariffs are like an unwelcome blizzard. The U.S. is Canada’s biggest trading partner, and slapped-on levies could slash Canadian exports of lumber, steel, and automobiles, triggering a downturn that some economists say might erase two years of growth, per Reuters. With about 75% of its goods heading south, Canada would almost certainly be on the ropes.

Unemployment could climb, consumer confidence would tip from “eh” to “ugh,” and the loonie would take a nosedive, ratcheting up import costs and inflation. The Bank of Canada might be forced into emergency rate cuts or even unconventional stimulus, all while negotiating trade spats instead of, you know, watching hockey and enjoying poutine.

3. Vietnam

Vietnam’s export engine is humming—until the U.S. decides to jam the throttle. A looming 46% “reciprocal” tariff threatens to hack at the heart of Vietnam’s export-led model, wrenching away about $123 billion in U.S. trade surplus last year, according to The Economist. That’s like pulling the rug out from under an economy that relies on everything from textiles to electronics to caffeine-charged instant noodles.

In response, factories might scale back or shutter, layoffs could surge in industrial hubs, and growing income inequality might spark social pressures. With input costs rising—remember, many components come from China—Vietnam’s fragile supply chains could unravel, leaving the country to scramble for alternative markets and domestic reforms that take years, not weeks.

4. South Korea

Known for K-pop and killer tech exports, South Korea could find itself in a diplomatic—and economic—pickle. U.S. tariffs on semiconductors, batteries, and automobiles could strike at the core of chaebols like Samsung and Hyundai, with Financial Times analysis warning of a “hostage situation” where Seoul has little leverage to fight back. Tariff-induced price hikes might slash foreign orders and dent investor confidence.

That’s not just bad news for Seoul’s skyline of gleaming towers; it’s a threat to household wallets too, since exports account for nearly 50% of GDP. The Bank of Korea is already hinting at rate cuts to cushion the blow, but if exports dive, the ripple effects could trigger a consumer slowdown and a full-scale recession (and fewer surprise K-dramas greenlit).

5. Germany

Germany’s auto-centric economy is revving up for trouble. Picture BMWs and Mercedes facing a new 25% U.S. levy—suddenly your dream sedan costs tens of thousands more. The Wall Street Journal warns that such tariffs could inflate German car prices, erode market share, and push luxury brands to reroute production or absorb losses, squeezing profit margins hard.

When Germany’s powerhouse sectors cough, the entire EU feels it: suppliers of steel, chemicals, and precision machinery would also reel. Industrial confidence would slump, investment might dry up, and the knock-on effects could reverberate through Europe’s economic core, risking a domino collapse no one wants an invitation to.

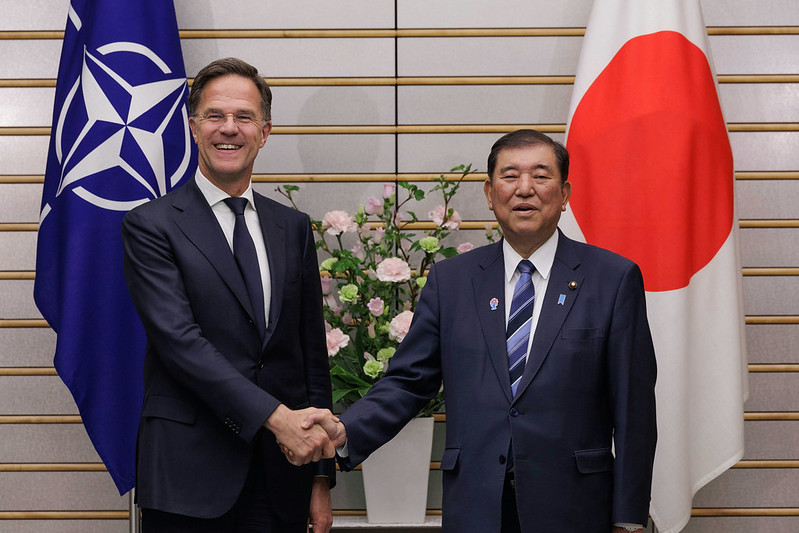

6. Japan

Japan’s export machine—think cars, electronics, and high-tech components—would face steep headwinds if U.S. consumers see price tags surge. A 25% tariff on automobiles alone could wipe out Japan’s slim auto trade surplus with America, hindering corporate earnings and prompting production shifts back to North America. Factory bosses might scramble to automate even more, but that risks displacing workers and fueling social unease in industrial cities. Meanwhile, component suppliers up and down the chain would feel the pinch, from tiny parts makers to robotics firms, creating bottlenecks that ripple through global tech industries.

Combine that with yen volatility, and domestic consumption could cool off, dragging GDP growth below its long-stagnant average. Household budgets would tighten as imported goods become more expensive, crushing the modest rebound in consumer spending seen this year. The government, already wrestling with high debt levels, might be forced into fresh stimulus measures just to keep the economy limping along. And tourism—one of the few growth bright spots—could suffer second-order effects if domestic retailers slash hours or shutter shops in response to slower factory towns.

7. Italy

Italy’s precious fashion, machinery, and agri-food exports could get pruney under tariff pressure. Tariffs on leather goods and gourmet foods would raise prices on Italian jerseys, pasta, and cheese in U.S. boutiques, shrinking demand. Artisanal producers, who rely on boutique margins rather than volume, could find their niche market evaporating overnight. And once these small businesses start closing, Italy’s famed regional craftsmanship could take decades to rebuild.

With already-sluggish growth, Italy could see a spike in unemployment and public debt soar as Rome tries to prop up businesses—no small feat when debt-to-GDP is already over 130%. Younger Italians, facing fewer job prospects, might accelerate their migration to other EU countries, hollowing out local communities. The strain on social welfare programs would rise just as the population ages further, forcing tough political choices. And without fresh investment, the industrial north-south divide could deepen, sowing fresh social and economic tensions.

8. Thailand

Thailand’s tourism rebound might get a black eye if supply chains slow and consumer spending dips in key markets. Tariffs on automotive and electronics exports—two of Thailand’s biggest earners—could undercut industrial zones and send foreign investment packing. Factories in the Eastern Economic Corridor may go quiet, leaving workers idle and local shops pinned under sagging foot traffic. Meanwhile, regional airports that thrived on business travel could see cancellations spike, undoing months of recovery effort.

Domestic retailers and farmers, reliant on export income, might scale back, dampening urban growth and social stability in Bangkok and beyond. With less income circulating in rural provinces, migrant workers could flood back into cities in search of odd jobs, driving down wages. The central bank might slash rates to stimulate credit, but that could fan asset bubbles in property and stocks. And as investor confidence wanes, Thailand’s ambitions to become a Southeast Asia logistics hub may stall.

9. Malaysia

A hub for electronics and palm oil, Malaysia would feel the pinch as U.S. tariffs drive up component costs and hit palm-derived edible oil exports. Manufacturing zones could idle, and smallholders might struggle as commodity prices wobble. Tech startups, which sprouted alongside manufacturing giants, could see funding dry up as venture capitalists tighten belts. And with fewer goods rolling out of ports, logistical arteries around Penang and Klang Valley could clog with idle shipping containers.

Rising unemployment in export clusters could push the ringgit downward, inflating import costs for fuel and food, and squeezing living standards. Urban households might cut back on luxuries and even staples, dragging retail sales into the red. The government, nursing deficits from pandemic relief, may face hard choices between subsidies and essential services. And any further political uncertainty could scare off investors just as Malaysia needs them most.

10. Brazil

Though shielded by smaller U.S. trade exposure, Brazil’s agribusiness giants exporting soy and beef could face retaliatory tariffs or non-tariff barriers. Reduced demand might drive down commodity prices, pressuring farmers and rural economies. The real could weaken further, pushing up the cost of imported fertilizers and machinery just when margins are already razor-thin. And as farm incomes dip, rural credit defaults could rise, risking strain on local banks.

Slumping agricultural income would ripple through domestic banks and consumer markets, potentially blowing holes in fiscal budgets amid high public debt. State governments that rely on export-driven royalties could see revenues collapse, forcing cuts to education and infrastructure projects. Urban unemployment might climb as agricultural workers migrate to cities in search of work. And social safety nets, already stretched, could buckle under fresh demand.

11. South Africa

South Africa’s mining and automotive sectors rely on exports to the U.S. and EU. Tariffs on auto parts and minerals could strip profit margins, fuelling layoffs in regions already battling high unemployment. Mine operators might mothball shafts, leaving towns that sprang up around them ghostly and desolate. And with jobless rates sky-high, social tensions could flare into protests or strikes, disrupting everyday life.

With limited fiscal room to breathe, Pretoria might struggle to offer stimulus, risking social unrest and capital flight. The rand could swoon, making debt servicing more expensive and squeezing government coffers. Pension funds and retirement savings, heavily invested in mining stocks, would take a hit, denting citizen confidence. And without fresh growth engines, brain drain could accelerate as skilled workers seek greener pastures abroad.

12. New Zealand

Even the land of sheep and All Blacks isn’t immune. Tariffs on dairy, meat, and wine exports would spike costs for Kiwi producers, thinning export revenues. Small dairy farmers could be forced to consolidate or exit, undermining rural communities that are already grappling with a housing crisis. And with wineries seeing fewer orders, regions famous for their vineyards might go quiet during peak season.

That could slow rural economies, reduce government tax take, and force Wellington to tighten belts at a time when global growth is already faltering. A weaker fiscal position might delay much-needed infrastructure upgrades, from roads to broadband. Tourism operators, who benefit indirectly from a healthy farming sector, could see fewer visitors if word spreads of economic gloom. And as young Kiwis consider opportunities abroad, demographic pressures could leave some towns struggling to stay afloat.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.