Not every “hot tip” is worth your money. And yet, time after time, people throw their savings into trendy traps, shady schemes, or risky “side hustles” that sound smarter than they are. Sometimes it’s desperation. Sometimes it’s FOMO. But the outcome is usually the same: regret.

So before you chase a flashy promise or buy into a too-good-to-be-true pitch, take a moment to consider where that road leads. Here are 12 investments people love to brag about—but that almost always end in financial faceplants.

1. Penny Stocks

Penny stocks are often sold as the underdog investment—cheap shares that might one day explode into the next big thing. But the reality is, most of them are tied to tiny, unstable companies with little to no transparency or market credibility. According to SEC and FINRA, they’re a playground for pump-and-dump schemes and are incredibly difficult to sell once purchased. Translation: you’re likely throwing your money into a black hole.

New investors especially fall for the illusion of “getting in early.” The low buy-in makes it feel like a bargain, but these stocks are rarely listed on major exchanges and can be wildly volatile. There’s a reason most brokers steer clear. You’re better off investing in something boring and real, like index funds that don’t vanish overnight.

2. Timeshares

Timeshares seem luxurious in theory: a recurring escape to a vacation destination, without the full cost of ownership. But in reality, they’re notoriously hard to resell, packed with hidden fees, and often come with contracts that are nearly impossible to break. According to the FTC, timeshare resale scams are one of the most common types of real estate fraud, and the ongoing maintenance costs don’t make it any easier to get out. You’re not buying freedom; you’re buying a financial leash.

People get lured in by slick sales pitches during vacations when they’re relaxed, buzzed on piña coladas, and not thinking long-term. They forget they’re signing up for years (sometimes decades) of fees, inflexible dates, and increasing annual dues. Even the so-called “points systems” can be convoluted and misleading. By the time you realize it’s a mistake, the damage is already done.

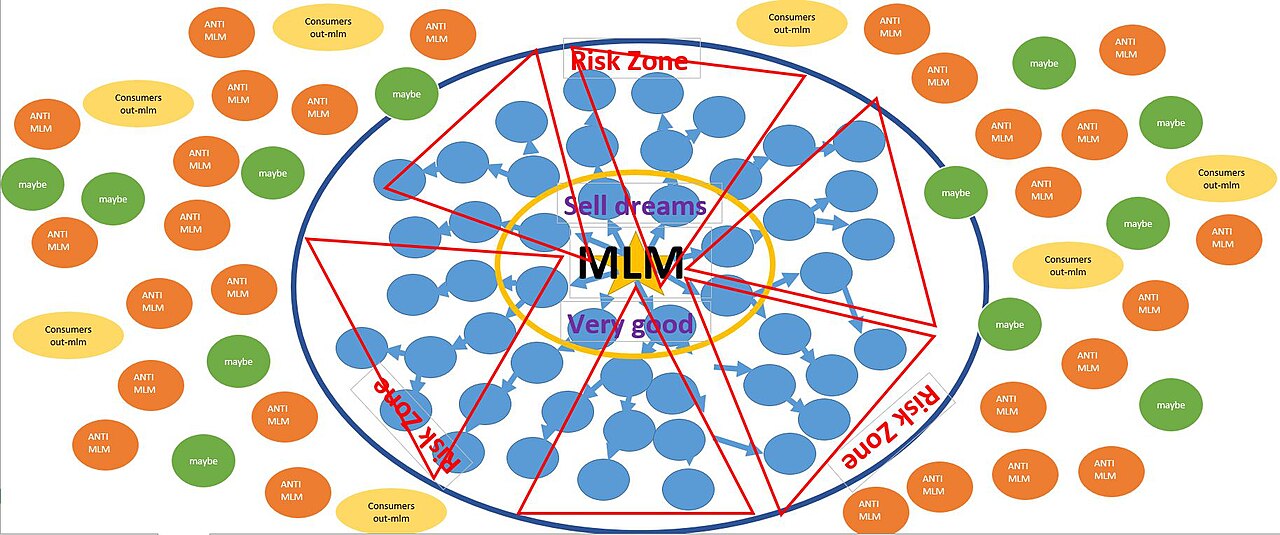

3. MLMs (Multi-Level Marketing)

Multi-level marketing companies love to present themselves as “business opportunities,” but they almost always benefit the people at the top, while draining those at the bottom. Whether it’s selling supplements, makeup, or kitchen gadgets, these companies rely on endless recruiting rather than real consumer demand. The FTC warns that 99% of MLM participants lose money, not make it. And yet, the dream of “being your boss” keeps reeling people in.

MLMs prey on emotion and community, making participants feel like they’re part of a movement rather than a sales machine. But the reality is often burnout, damaged friendships, and garages full of unsold inventory. If a business model relies more on getting others to sign up than selling an actual product? Run.

4. Trendy Crypto Coins

Everyone loves a good crypto success story—until the bubble pops. While Bitcoin and Ethereum have gained a level of credibility, most new “altcoins” are speculative at best and scams at worst. These coins launch with slick branding, celebrity endorsements, and promises of overnight riches… and then disappear, taking investors’ money with them. If it sounds like the next Dogecoin, it’s probably already too late.

People confuse tech buzz with financial viability. Just because something is built on blockchain doesn’t make it valuable. Unless you truly understand the technology, the team, and the use case, it’s not an investment; it’s a gamble. And in the crypto world, the SEC warns that cryptocurrencies are highly volatile, speculative, and often lack critical investor protections.

5. Flipping Clothes or Sneakers Without Research

Hype culture has made flipping sneakers and “rare” apparel feel like a shortcut to fast money. And while some people do strike gold, most end up holding a pile of unsellable merch. Markets shift fast, fakes are rampant, and platforms take big cuts of profits. If you’re not deeply immersed in the resale game, it’s easy to lose your shirt.

The problem? Everyone thinks they’re the next grailled mogul. But if you can’t spot trends before they peak or verify authenticity in seconds, you’re more likely to get burned than bank. Resale takes hustle, storage space, and sharp instincts—not just a shopping habit. Treat it like a job, or don’t touch it.

6. Rental Properties You Can’t Afford to Maintain

On paper, owning a rental property looks like the path to passive income. But what no one talks about is the constant maintenance, unexpected repairs, and nightmare tenants. If you don’t have the cash to cover a new roof or months of vacancy, that “investment” turns into a money pit real fast. And in some cities, short-term rental restrictions are killing profitability.

A bad tenant can do thousands in damage. Property taxes climb. Insurance premiums fluctuate. And if you’re managing it yourself? Say goodbye to weekends. Real estate is great for people who can afford the risk, not those who are stretching just to buy in.

7. Precious Metals You Hide in a Closet

Yes, gold and silver have their place in a diversified portfolio—but hoarding bars or coins in your closet isn’t a strategy. Physical precious metals don’t generate income and are vulnerable to theft or loss. Plus, the price swings can be more volatile than people expect. Unless you’re storing it securely and know how to liquidate it, it’s mostly symbolic wealth.

Too often, people treat gold like an end-times insurance policy without understanding the actual logistics. Selling isn’t always easy, and premiums eat into profit. It’s not 1850—you can’t just trade silver for bread at the market. If you’re going to buy metal, understand the system you’re entering.

8. Celebrity-Endorsed “Opportunity” Funds

Every year, some B-list celebrity gets behind a sketchy investment—energy drinks, crypto apps, green startups—and it makes the rounds as a “can’t-miss opportunity.” These funds rarely deliver. And when things go sideways, the celeb vanishes while your money’s still missing. Just because someone famous is on the brochure doesn’t mean the math checks out.

Fame is not a business credential. These endorsements often mask weak fundamentals or overhyped ideas. If the opportunity relies more on name recognition than actual numbers, walk away. Clout is not currency.

9. “Passive Income” Courses From Internet Gurus

They promise freedom, yachts, and six-figure months with minimal effort—but they’re selling overpriced PDFs and access to vague video lectures. These internet “mentors” often make their real money from selling the dream, not building the business. And you can learn most of what they teach for free on YouTube. Buying into these programs is usually just funding someone else’s lifestyle, not your own.

If someone’s flexing too hard on social media, that’s your first red flag. Real experts don’t need to scream credibility—they show it in results. If the pitch is “make money while you sleep,” you’ll probably lose it while you’re awake. Save your cash—and your expectations.

10. Art You Don’t Actually Understand

Investing in art sounds glamorous, but unless you’re tapped into the market and buying with strategy, it’s a high-risk, low-liquidity move. Prices are subjective, trends are fickle, and resale is harder than people think. The people making real money in art? Usually dealers, galleries, and legacy collectors—not casual hobbyists.

If you’re buying art, do it because you love it—not because you think it’ll triple in value. That viral “investment-grade” piece you saw on TikTok might be worth less than the frame. And unless you can name five artists in that style, you’re probably not ready to play the game. Appreciation takes more than hope.

11. Custom Merch Startups With No Audience

Everyone knows someone who dropped thousands launching a t-shirt brand with no real following. Custom merch can work—if you already have a built-in audience or niche demand. But printing hundreds of hoodies and hoping strangers will bite is not a strategy. It’s expensive, time-consuming, and brutally competitive.

Success stories make it look easy, but most small merch brands disappear within months. Without strong branding, community, and repeat buyers, you’ll drown in dead stock. If you wouldn’t wear it yourself every day, why would someone else? Validate demand before you build the store.

12. Getting Rich Off Lottery Tickets

We all know it’s statistically ridiculous. But when the jackpot hits nine figures, people still convince themselves it’s “worth a shot.” Lottery tickets are one of the worst investments you can make—the odds are worse than almost any other form of gambling, and the returns are essentially nonexistent. But hope sells.

It’s the illusion of a shortcut. A one-dollar fantasy that costs way more over time. If you’re spending $50 a week chasing a dream, that’s $2,600 a year gone forever. Invest that instead, and you might build something real—slowly, but surely.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.