Start your engines—because sometimes the people peddling “get-rich-quick” schemes are the ones getting rich… off of you. In the ’80s and ’90s, before Instagram ads and TikTok gurus, there were real-life high-stakes salesmen who sold hope, hype, and hype-sized promises. They cashed huge checks from late-night infomercials, glossy newsletters, and packed-to-the-gills seminars—often while the folks who bought in walked away with empty pockets. Here are 12 finance gurus whose questionable advice and flashy marketing made them millions (even if their fans didn’t see a dime back).

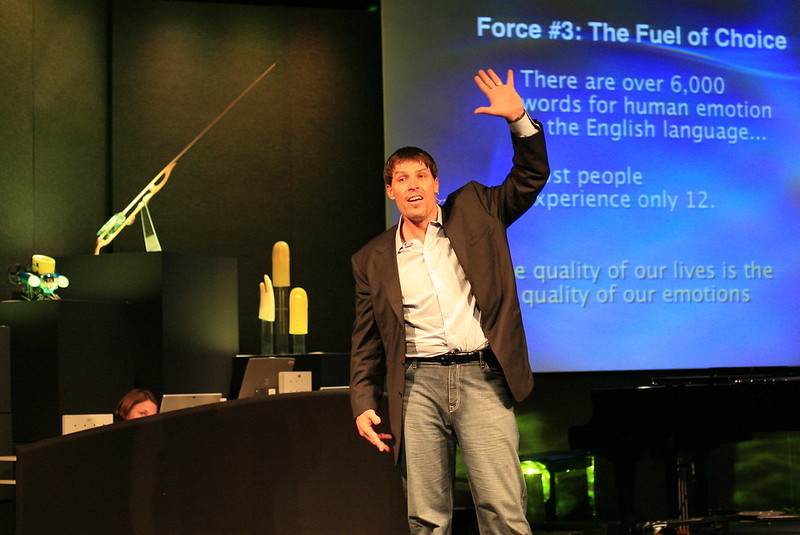

1. Tony Robbins

Long before he was coaching celebrities, Tony Robbins hosted seminars in the late ’80s and ’90s that dabbled in finance alongside mindset work. He advised audiences to shift 20% of their portfolios into “explosion indexes” and to shun industries he deemed overvalued, like tech in 1999. But those sectors went on to soar, and investors who followed his caution missed massive gains—like the Nasdaq’s doubling in the early 2000s. Despite this, Robbins’ seminars and books sold millions of copies, building him a net worth north of $500 million.

His focus on personal power over product analysis proved lucrative for him, but investors learned the hard way that skipping entire market segments can cost you a fortune when the tide turns. According to Forbes, his focus on mindset over market fundamentals built a personal fortune, even if it cost early followers the chance at those tech-driven windfalls.

2. Robert Kiyosaki

Before personal finance influencers were a thing, Robert Kiyosaki’s Rich Dad Poor Dad (1997) was the Bible of entrepreneurial hustlers—pushing “good debt,” real-estate leverage, and aggressive tax strategies. His seminars and board game empire spun off millions in ticket sales, coaching fees, and licensing deals. But critics argue Kiyosaki’s advice encourages risky debt loads and oversimplifies complex investments, often leaving seminar-goers to navigate barebones how-tos on their own. Slate investigated Rich Dad seminars in Canada and found attendees were steered toward overpriced trailer-park investments that never materialized.

Kiyosaki has sold over 40 million copies of his books and made a small fortune teaching “financial independence,” but many who attended his weekend boot camps walked away feeling sold—not schooled. His brand remains a testament to how a catchy personal-growth narrative can out-earn the actual returns of the strategies it peddles.

3. Jordan Belfort

Before becoming the “Wolf of Wall Street” movie muse, Jordan Belfort built Stratton Oakmont into a boiler-room powerhouse in the late ’80s and early ’90s. He taught rookie brokers the art of the “pump and dump,” inflating penny-stock prices before cashing out once clients were hooked—and then dumping massive amounts of inventory for huge profits. Belfort’s high-octane seminars and autobiography sold dreams of Wall Street glory, but behind the scenes, investors lost tens of millions. Per Investopia, Belfort himself made an estimated $50 million at the height of his scam, only to end up cooperating with the FBI and serving 22 months in prison.

Today, Belfort runs pricey “Straight Line” sales-training courses that echo the same aggressive persuasion tactics he used at Stratton Oakmont. Though he publicly warns entrepreneurs about ethical sales, the core techniques remain remarkably similar to those that once triggered his downfall.

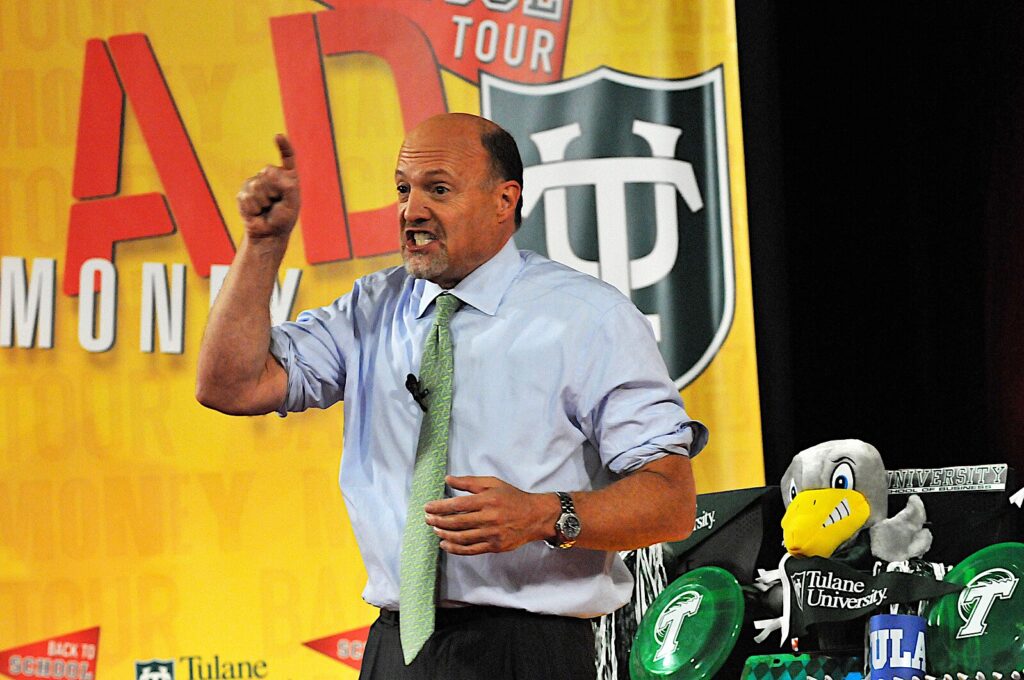

4. Jim Cramer

In 1996, Jim Cramer co-founded TheStreet.com, positioning himself as a bullish, brash market guru who could pick winners like nobody’s business. His TV show, Mad Money, which debuted in 2005, built on his ’90s success, with catchphrases and stock-picking theatrics galore. But, according to the New York Times, Cramer’s track record has been littered with whiffs—from missing the dot-com crash to wrongly advising viewers to load up on financial stocks just before they tumbled in 2008. Despite being worth well over $100 million from his media empire, Cramer’s on-air advice has been criticized for encouraging panic trading and reactionary moves that often underperform the market.

While he’s a charismatic host with a loyal following, Cramer’s “buy or sell” calls don’t always pan out—reminding us that entertainment and education are two very different shows.

5. Kevin Trudeau

Long before social media ads, Kevin Trudeau mastered late-night infomercials that hawked miracle weight-loss cures, memory-boosting tips, and “Debt Cures” books. He claimed anyone could erase their credit card debt or cure diseases with natural supplements—if they just bought his book. By 2005, Trudeau was topping The New York Times bestâ€seller list, raking in some $39 million from his weight-loss title alone. Yet the FTC proved his claims were baseless, and in 2014 he was sentenced to ten years for criminal contempt (after repeatedly violating court orders).

Trudeau’s empire of infomercials and spin-classes disguised thin research and flatâ€out false promises, but it was wildly profitable—until regulators finally shut him down. His saga remains a prime example of how sensational claims and slick marketing can turn flimsy advice into cold, hard cash.

6. Irwin Schiff

Tax protestor Irwin Schiff spent the ’80s and ’90s selling seminars and books claiming that filing federal income tax was voluntary, constitutional, and optional. He encouraged clients to funnel income through offshore shell companies and ignore IRS notices—with promises of keeping 100% of their earnings. Schiff’s crusade made him a hero to tax-rebels and filled his wallet through seminar fees and book sales. But the IRS saw fraud, and Schiff served a combined 13 years in prison for tax evasion, conspiracy, and willful failure to file returns.

His followers lost not only on the bills they didn’t pay but also on the fines, penalties, and prison sentences that ensued—while Schiff’s own bank accounts were drained to satisfy judgments.

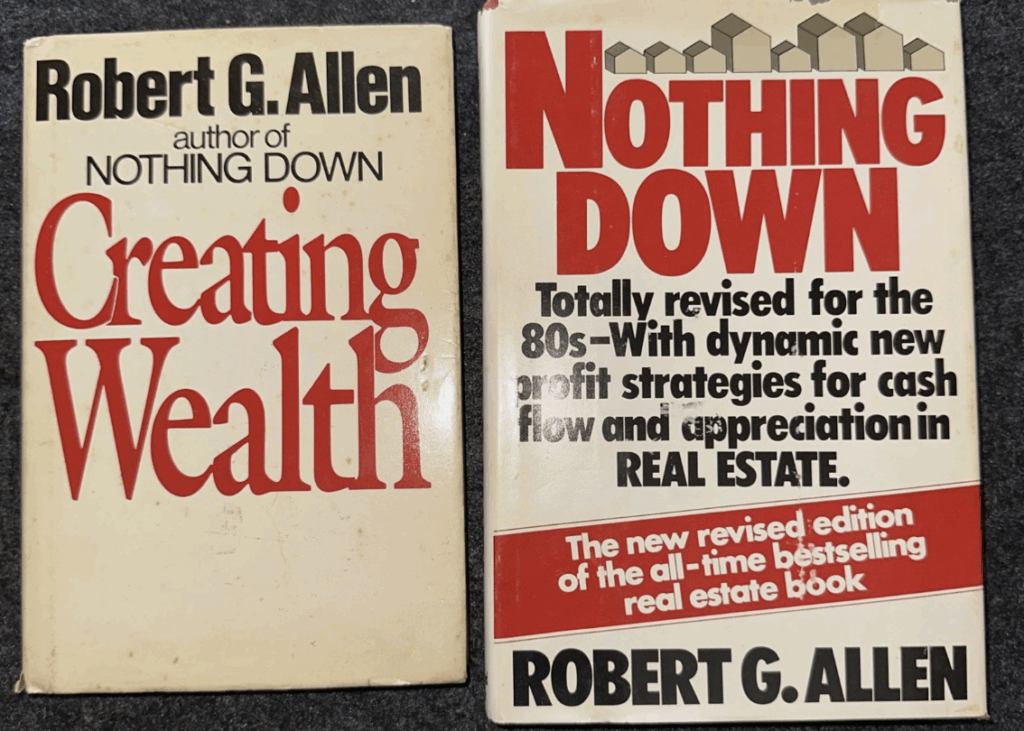

7. Robert G. Allen

In the mid-1990s, Robert G. Allen’s book Multiple Streams of Income taught readers how to create passive revenue through rental properties, joint ventures, and network marketing. Allen’s “five-asset” model was seductive: invest a little here, a little there, and watch money pour in. His seminars sold out by the thousands, and his publishing empire generated substantial royalties. Yet many attendees discovered that the strategies required heavy leverage, sophisticated legal setups, and capital far beyond what Allen’s average fan possessed—leading to portfolio stress and, in some cases, foreclosure.

Though Allen made millions selling the blueprint, the average buyer often lacked the safety nets or expertise to replicate his high-leverage tactics, turning rich-dad dreams into lender nightmares.

8. Robert Prechter

Robert Prechter Jr. rose to fame in the early ’80s after correctly calling the 1987 stock market crash using Elliott-wave theory, making him a legend overnight. He parlayed that win into a newsletter empire that promised to predict every major market move—only to run flat when his forecasts failed to materialize in the ’90s and 2000s. Subscribers who rode with him through repeated “impending crash” calls watched bull markets persist, as their chances to book gains slipped away. Meanwhile, Prechter’s Socionomics Institute and newsletter subscriptions kept cash flowing into his coffers.

His story shows that one big win doesn’t make a lifetime of perfect calls—and that persuasive selling can sometimes outsize genuine skill.

9. Dave Ramsey

Dave Ramsey’s debt-snowball method exploded onto the scene in 1992, urging listeners to pay off the smallest debt first, build an emergency fund, and avoid credit cards at all costs. His radio show and Financial Peace University seminars have generated millions in product sales and speaking fees. Yet critics argue his one-size-fits-all approach can leave savvy investors sidelined, missing out on tax-advantaged investments or growth opportunities by hoarding cash in low-yield savings while markets climb.

Ramsey’s advice has built a multimillion-dollar brand, but following it to the letter sometimes means sacrificing long-term returns for the comfort of zero-debt status—proof that even “safe” advice can have opportunity costs.

10. Irwin “Sonny” Bloch

Irwin H. “Sonny” Bloch was the king of late-night financial radio from 1980 until 1995. He promised listeners that buying “exclusive memberships” to fledgling wireless-cable ventures would transform them into mini-millionaires, touting everything from gold-bar schemes to private cable networks. Yet many of those ventures were either flat-out failing or outright scams, and Bloch quietly diverted millions into real-estate purchases, fancy cars, and personal legal fees—leaving investors holding the bag. According to the Los Angeles Times, federal authorities charged him in May 1995 with conspiracy, wire fraud, mail fraud, and selling unregistered securities to his radio audience.

His listeners were promised exclusive deals in Florida, Washington State, and even Venezuela, but the SEC estimated investors lost over $21 million to Bloch’s schemes. After fleeing to the Dominican Republic to dodge subpoenas, he was eventually captured, pleaded guilty to multiple counts of fraud and tax evasion, served two years in federal prison, and was ordered to pay nearly $4 million in restitution.

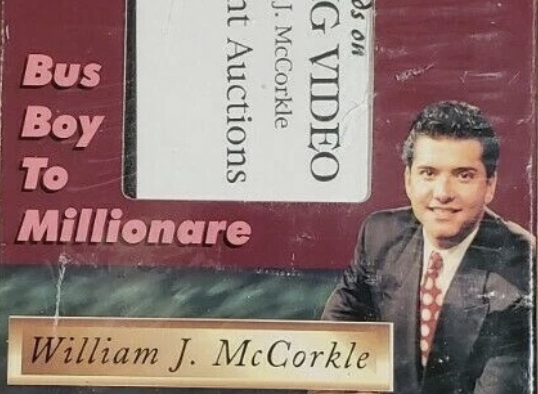

11. William J. McCorkle

In the 1990s, William J. McCorkle and his wife, Chantal, sold “secret” real-estate systems on late-night infomercials, only to be exposed as grifters who leased the fancy homes, cars, and helicopters they used for marketing. Viewers were told they could buy foreclosed properties for pennies on the dollar—if they just paid for the McCorkle Seminars package first. Yet many seminar attendees never closed a deal, and those who did often found deals riddled with legal headaches or ghost properties. As the New York Times noted, a 1998 indictment charged McCorkle with mail and wire fraud after prosecutors showed he and his wife bilked customers out of millions with false promises.

Convicted in 1998 alongside his wife, William was sentenced to prison time (over two decades initially, later reduced) and fined heavily. Chantal served her term and was released in 2010; William followed in 2014. Today, their seminars are a cautionary tale: if the spokesperson’s lifestyle looks too good to be true, it probably is.

12. Jerome Schneider

From the mid-1970s through the late ’90s, Jerome Schneider sold books and seminars on how to set up your own private offshore bank—guaranteed to hide wealth from taxes and creditors. His flashy marketing boasted jaw-dropping privacy and returns, but many clients wound up ensnared in IRS investigations. Schneider was ultimately convicted in 2004 on charges of conspiracy to defraud the United States, wire fraud, and mail fraud—accusations that he’d pushed sham banks with little more than shell-company paperwork. As ABC News reported, Schneider’s offshore-bank seminars were a booming business… until they weren’t.

After prosecutors in 1997 began to close in (including a primeâ€time 20/20 expose), Schneider pleaded guilty, cooperated with investigators, and was sentenced to six months in prison. Today, his “hidden bank” playbook serves as a reminder that when you pay for advice that sounds too secretive, you’re often buying a ticket into legal trouble.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.