Let’s be real—Social Security isn’t exactly the sexiest topic on your feed. But if you plan on getting old (spoiler: you will), it’s kinda important. And with President Trump back in the Oval for round two, a lot has been happening behind the scenes that could seriously mess with your future checks—or maybe boost them, depending on the headline. Whether you’re decades from retirement or helping your grandparents decode their benefits letter, Social Security has quietly become a political battleground again.

So, what’s Trump actually done this time? We scrolled through the policy weeds, press briefings, and lowkey bombshells to bring you 12 big moves from his second term that could shape your benefits, your taxes, and even how you prove you’re alive. Some are dramatic. Some are sneaky. A few might surprise you. Let’s dive in, receipts and all.

1. Tighter Identity Proofing Requirements

President Trump’s SSA rolled out a new rule requiring beneficiaries to verify their identity in person at a local field office if they can’t apply online—no more “Hey, it’s me!” phone calls allowed. This means if you’re not tech-savvy (or just hate waiting on hold), you’ll have to schlep to an SSA office with your ID in hand, even for simple retirement or survivors benefits. The change was slated to kick in March 31 but got bumped to April 14 after advocates cried foul about travel challenges for seniors and people with disabilities — you know, the folks who rely most on Social Security — and the agency finally blinked.

Under the carve-outs, SSDI, Medicare, and SSI applicants in dire straits (think terminal illness or pre-release prisoners) still get a pass on the in-person visit. Critics warned this was going to snarl service and delay checks, since many field offices were already closing under Trump’s staff-cutting spree. SSA insisted it was cracking down on fraud, but seniors’ groups called it a “stealth benefit cut” masked as security. If you were banking on phone ID’ing to update your direct deposit or address, sorry fam—you’re in line at the brick-and-mortar. And yes, that line might be loooong. PBS NewsHour has the full rundown on how this “safety” measure could leave vulnerable Americans out in the cold.

The bigger picture? It’s a signal: Trump’s team isn’t messing around when they talk “efficiency.” But every efficiency move seems to come with a service trade-off, leaving beneficiaries scrambling. There’s also a whiff of “digital divide” drama, since rural areas may now see fewer SSA offices even as they force more people to visit in person. For folks who rely on Social Security as their main income, these extra hurdles could mean missed rent or prescription payments. Meanwhile, tech-forward urbanites are probably high-fiving, saying “Finally, modern times!”—while Grandma in flyover country wonders why this wasn’t optional. All this to “protect taxpayer dollars,” though some argue it’s really about shrinking the agency. Either way, buckle up for tighter checks next time you need a benefit tweak.

2. Overpayment Clawback U-Turn

Earlier this year, SSA announced it would reclaim 100% of any overpaid benefits—meaning if Social Security mistakenly sent you $200 instead of $150, they’d grab the full $200 back. The agency argued full clawbacks would protect taxpayers and save an estimated $7 billion over a decade. But after uproar (and some horror-story headlines), SSA quietly slashed the clawback rate to 50% of monthly benefits effective April 25, 2025, giving recipients some breathing room while still recouping funds, per MarketWatch.

Beneficiaries now have 90 days to appeal or request a lower rate before collections begin. Critics say even half your check can wreck budgets for disabled workers and fixed-income seniors, but it’s a ton better than losing your entire benefit that month. This pivot was driven by backlash from advocacy groups and Congress, which warned of homelessness and food insecurity for those hit by 100% clawbacks. It’s a textbook example of “policy by crisis,” where sweeping changes get rolled back when the dust settles. In short: justice (mostly) served—though you might still feel the pinch.

The saga highlights the tension between cost-cutting and care. SSA leaders insist the partial roll-back balances fiscal responsibility with compassion, but beneficiaries say the remaining 50% clawback still hits like a ton of bricks. Meanwhile, software errors that caused many overpayments in the first place haven’t been fully addressed, so calls for better system checks are growing louder.

3. Frank Bisignano’s Confirmation Shake-Up

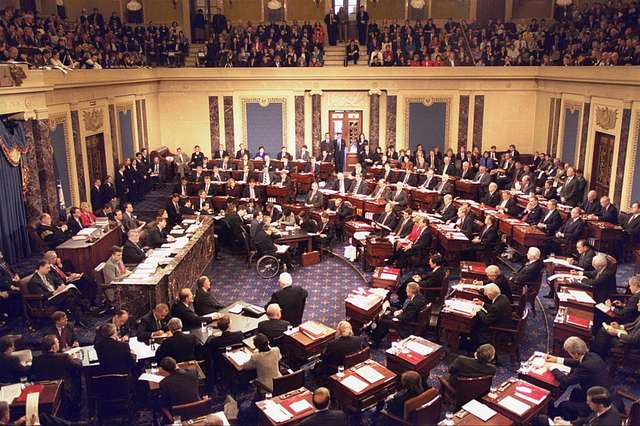

In a nail-biting 53–47 Senate vote on May 6, Wall Street vet Frank Bisignano got the nod to run the SSA, replacing Acting Commissioner Leland Dudek. Bisignano—formerly CEO of Fiserv—will oversee benefits and hundreds of billions in payouts to some 73 million Americans, so yes, it’s a big deal. His confirmation came amid uproar over proposed office closures, phone-service cuts, and massive layoffs under Trump’s efficiency czar, DOGE (that’s Elon Musk’s crew). Democrats called it a “power grab” aimed at gutting Social Security; Senate Minority Leader Chuck Schumer warned this choice “threatens the promise we made to every American.”

Bisignano campaigned on improving customer service via tech upgrades and promised no benefit cuts—though critics remain skeptical. He also vowed to speed up SSA modernization, including an internal push to ditch paper checks by September 2025 and require users to sign in with Login.gov for most online services. Supporters say he brings private-sector know-how; detractors fear Wall Street priorities will trump beneficiary needs. It’s a classic “pros and cons” moment: will his corporate chops streamline your next benefits check or just streamline the workforce out from under you? Only time—and maybe a few public-service reports—will tell. You can read the blow-by-blow at Business Insider.

4. Canceling Immigrants’ Social Security Numbers

In a controversial move, the Trump administration flagged about 6,300 legally present immigrants as “dead” in the SSA Death Master File—effectively canceling their Social Security numbers to encourage “self-deportation.” These were people judged (often on shaky evidence) to be on terror watch lists or with criminal records, but no one’s given a clear accounting of the vetting process. The shift prevents affected immigrants from accessing banking, signing leases, or even enrolling kids in school. Critics blasted it as “digital murder,” a draconian step that could leave long-standing community members destitute. Immigration advocates say the policy violates privacy, due process, and civil liberties.

According to Reuters, some affected folks have already shown up in person—armed with driver’s licenses—to get reinstated. The administration defends the tactic as a tool to cut fraud and reduce “incentives” for unlawful stay, but opponents fear it’s a slippery slope to broader beneficiary purges.

The aftermath? Lawsuits are piling up, immigrants’ rights groups are mobilizing, and Congress is weighing oversight hearings. Many argue this rush to reclassify living people as deceased could backfire if applied too broadly—or mistakenly. Tech glitches, human error, or biased watch-list criteria could leave even more innocent people locked out of their benefits.

5. Defunding the Social Security Advisory Board

Trump’s OMB notified the bipartisan Social Security Advisory Board that its $3 million annual budget would be slashed to zero, effectively defunding the independent panel that offers expert analysis and recommendations. The board has been a non-partisan check on SSA policy, providing Congress and the president with data-driven insights, according to Newsweek. Cutting this lifeline threatens to silence independent voices just when the agency is navigating major overhauls, from staff cuts to digital transformations.

Critics warn it’s a classic move to “de-fund, de-vote, and eventually defund” any oversight body the administration finds inconvenient. Administration spokespeople argue the board duplicates work done in-house and trimming it saves taxpayer dollars. But watchdogs counter that without the Board’s external evaluations, policy decisions become less transparent and more prone to errors. Board members and retirees are up in arms, calling on Congress to restore funding. Their worry? A politicized SSA that answers only to the White House’s efficiency dogma, rather than to beneficiaries.

6. Blitz to Rewrite SSA’s Legacy Code

Enter DOGE, Elon Musk’s Department of Government Efficiency: they vowed to migrate SSA’s COBOL-based core systems to a modern language “in months,” not years. Tech experts warned this could trigger payment disruptions, citing rigorous testing timelines typical for mission-critical code. Yet Trump’s team pushed forward, aiming to eliminate “zombie code” and speed up benefit processing. The project kicked off in late March, with a skeletal team parachuted into SSA’s IT division. Early reports suggest progress—but outside auditors worry about shortcuts. Some see it as a much-needed overhaul; others fear a tech-driven nightmare if payments grind to a halt. No matter which side you’re on, it’s shaping up to be the biggest system migration in SSA history.

In practice, though, replacing decades-old code is like performing open-heart surgery on the nation’s safety net—live. Congress is demanding regular updates, and stakeholders are binging on every progress memo. Stay tuned: one mishap could mean missed checks for millions.

7. Court Fights Over Data Access

After a federal judge blocked DOGE’s political appointees from diving into individual beneficiary records—citing privacy concerns—the administration appealed directly to the Supreme Court in early May. The 4th Circuit refused to lift the injunction, so the fight heads to the highest bench. Trump officials argue unfettered access is essential for rooting out fraud, waste, and abuse; opponents warn it risks exposing personal data on millions of seniors and disabled Americans. Legal experts say the case could define limits on political appointee power over civilian agencies. Meanwhile, beneficiaries nervously wonder who’s poking around their files.

Whichever way the Court leans, it will set a precedent for data governance across every federal program. Privacy buffs are eyeing the docket closely.

8. Phase-Out of Paper Checks

In a bid to “modernize” payments, SSA announced plans to eliminate paper checks entirely by September 2025, shifting everyone to direct deposit or U.S. Treasury debit cards. The rationale: reduce costs, cut fraud, and speed up delivery. But for the 5 million folks without bank accounts—often rural residents or low-income seniors—this feels like a penalty.

SSA insists it will offer prepaid cards and outreach to unbanked populations, but financial-access advocates warn it may still strand some beneficiaries. With April’s paper-check mail taking longer than usual, complaints are rising faster than interest in TikTok. Still, most Millennials might applaud digital-only payments—just don’t forget about Grandma!

9. Mandatory Login.gov for Online Services

Complementing the in-person ID shift, SSA now requires beneficiaries to set up and use a Login.gov account for most online applications and updates. No more SSA online account shortcuts: if you need to change your address, switch direct-deposit banks, or request a benefit verification letter, you’ll be funneled through this centralized federal portal.

The idea is tighter security and one username/password across agencies, but early adopters report multi-factor authentication headaches and account-lockouts. For those who aren’t tech ninjas, forget resetting your password at midnight—SSA offices and call centers are swamped. It’s a classic “one-stop shop” that might end up feeling like a long checkout line in the DMV of the internet. Keep patience on tap, and maybe grab a latte before logging in.

10. Social Security Fairness Act Rollout

Remember the Fairness Act signed by President Biden in late 2024 to fix the Windfall Elimination Provision and Government Pension Offset? Trump’s SSA has quietly implemented its retroactive payments to over 3.2 million public servants and teachers affected by those quirky benefit reductions.

Checks started going out in early 2025, boosting monthly payments for folks who had seen unfairly low benefits. It’s been a rare win for retirees, and Trump touted it as proof he won’t leave seniors hanging—even if he disagrees with parts of the law. For once, bipartisan vibes in Congress meant more money in pockets, and SSA staffers scrambled to process the paper and digital claims. Millions of teachers, first responders, and civil servants finally saw justice served—in the form of larger checks.

11. Reinstatement of National Social Security Month

In March 2025, Trump brought back National Social Security Month, after it had lapsed under the prior administration. The gesture is mostly symbolic: SSA offices hosted community events, webinars, and outreach fairs to promote benefit literacy and fraud awareness. Some locales served ice cream at office lobbies, while digital town halls covered topics from SSI to spousal benefits.

Critics called it “feel-good fluff,” but beneficiary advocates appreciated the extra outreach, especially for hard-to-reach rural and minority communities. After all, education and humor can be powerful tools against scams. If you missed the webinar on “SSN scams 101,” they’ve archived it—just Google “SSA National Social Security Month.”

12. Promise (So Far) on Taxing Social Security Benefits

Throughout his second term, President Trump has repeatedly promised to eliminate federal taxes on Social Security benefits entirely—though no legislation has passed to make it happen. In speeches and executive orders, he’s vowed to “take the tax burden off our seniors,” arguing it would leave retirees with an extra $700–$900 per year on average.

Congressional Republicans have toyed with the idea as part of broader tax-cut talks, but budget hawks warn it would blow a $400 billion hole in revenues over ten years unless offset by cuts elsewhere. As of spring 2025, it remains more campaign soundbite than reality—yet another policy to watch in the months ahead. Feel-good promise? Absolutely. Practical reality? TBD.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.