You think you’re doing all the right things. You skip the fancy lattes, hoard coupons like they’re NFTs, and proudly tell your friends you’ve canceled every streaming service except the one you’re mooching off your cousin. But somehow… your bank account still looks like it’s been ghosted by your paycheck.

Here’s the deal: not all money-saving habits are actually saving you money. In fact, some of them are quietly sabotaging your financial glow-up—kinda like doing crunches every day and wondering why you still crave pizza at 2 a.m. So if you’re hustling to be financially savvy but feel like you’re stuck in broke-ville, these 12 habits might be the sneaky culprits. Let’s spill the (budget-friendly) tea.

1. Skimping on Quality—Especially for Big-Ticket Items

Buying the cheapest laptop bag or running shoes to “save” $30 can haunt you when they fall apart in a month. That quick “win” on cheap gear often leads to repeated replacements, ultimately costing you more in aggregate. Investing a bit more upfront in durable, well-reviewed items can pay dividends through longevity, performance, and even resale value.

A consumer survey by The Guardian revealed that shoppers who invest in mid-range products save nearly 20% over five years compared to those who repeatedly purchase budget items. Sometimes, spending smarter means spending more.

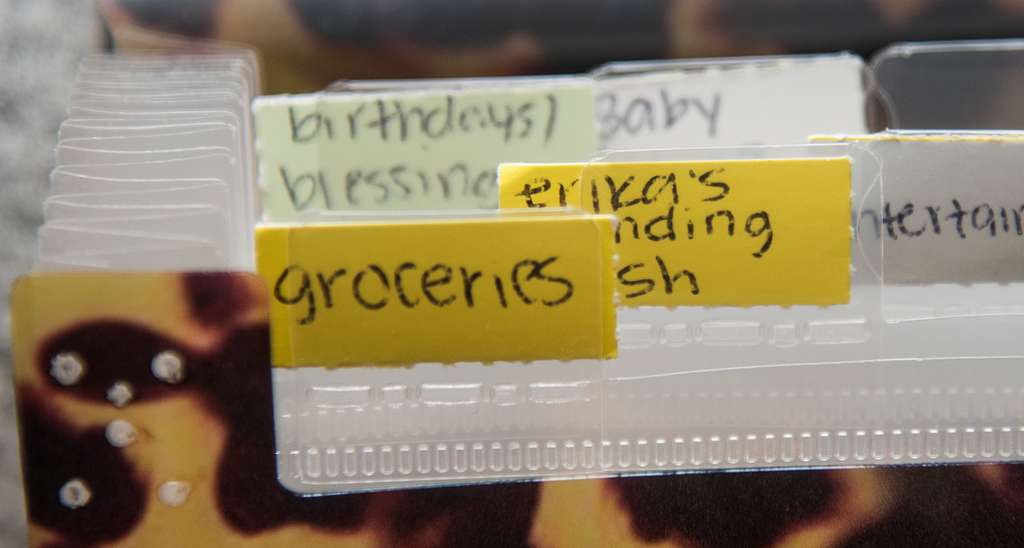

2. Buying in Bulk “Deals” You’ll Never Finish

Stocking up on giant tubs of granola sounds like a frugal dream, but it often lands you in “use-it-or-toss-it” territory. Pantry clearance feels like a victory, but if that 5-pound rice bag just sits, you’re basically throwing money in the trash. Beyond spoilage, bulk deals can mask lower per-unit prices that don’t account for storage, potential spoilage, or even the impulse to eat more just because it’s there.

Per Sofi, families waste an average of $1,500 annually on bulk groceries that never get eaten. If you’re cramming your cabinets with mega-sized packages you’ll never use, you’re paying for convenience you don’t need and clutter you didn’t ask for.

3. DIY Everything—Even When You’re Bad at It

Channeling your inner Pinterest guru is fun until you’ve spent $50 on supplies for a macramé planter that looks more like a tangled fishing net. Attempts to DIY home improvements, beauty treatments, or crafty gifts can quickly become money pits if you lack the skill or patience. Every return, redo, and replacement part cuts into your “savings,” and sometimes professional work is legitimately more cost-effective in the long run.

A report by Forbes notes that amateur home repairs can cost homeowners up to 30% more when mistakes require professional fixes down the line. So before you don that toolbelt, weigh the true cost of your “free” labor.

4. Extreme Coupon Clipping That Leads to Impulse Buys

We get it—seeing prices slashed is thrilling. But when that 75% off tag lures you into buying something you never intended just because you “saved” $20, you’re actually spending extra. Couponing can foster a “gotta catch ’em all” mentality, prompting you to load up on clearance or brand-new items that aren’t on your list.

As highlighted by CNBC, hardcore couponers often spend 25% more per trip than minimalists because they’re chasing deals rather than sticking to planned purchases. So next time you’re tempted to stockpile, ask if you’d buy it at full price.

5. Obsessively Using Cashback Apps

Ever spend ten minutes scanning barcodes and comparing ten different apps to snag that 2% cashback? While it feels satisfying to rack up points, all that time adds up—and time is money. Plus, you might end up buying items you don’t need just to hit a minimum payout threshold. Rather than saving, you’re budgeting your free hours into each purchase, and sometimes scattering small rewards across multiple stores means you never hit the payout mark.

According to a deep dive by Investopia, the average user only redeems about 60% of their earned rewards—and you could be losing hundreds of dollars in “forgotten” cash every year. Getting strategic is great, but if you’re losing sleep and time over pennies, you’ve swapped sanity for savings you’ll never see.

6. Canceling Streaming Services—Then Re-subscribing

You canceled Netflix to cut costs, only to re-subscribe a month later when your friend spoilers hit you hard. Rotating services may feel like you’re paying less, but activation fees, promotional rates that reset, and the mental labor of remembering who has what library can add hidden costs. Instead, consider a shared plan or audit your usage annually to keep only what you actually watch.

But here’s the kicker: every time you sign back up, you’re essentially hitting “reset” on those introductory discounts, meaning you pay full price sooner than you’d like. Plus, the FOMO factor is real—one friend’s binge-recommendation turns into impulse resubscription, and before you know it you’re juggling three streaming services again. The back-and-forth also means you’re not building any negotiating power; if you’d stuck with one service longer, you might score loyalty perks or family-plan savings. And let’s be honest, remembering all your login details and billing dates is a small cognitive burden you don’t need. Instead, pick a core two services that genuinely spark joy and cancel the rest—you’ll save money and your brain cells.

7. Packing Lunches—But Making Gourmet Meals

Brown-bagging it is a solid saver—unless your “homemade” lunch prep involves truffle oil, specialty cheeses, and artisanal bread. The joy of an Instagram-worthy Bento box can quickly eclipse the cost of a simple meal. Keep meal prep practical: reuse ingredients across dishes and skip the exotic add-ons.

In reality, that fancy avocado toast with microgreens can cost you three times what a basic PB&J does, and who really needs a photo op at noon? When you splurge on gourmet ingredients, you’re erasing any cost advantage over grabbing a quick deli sandwich. Plus, all those little mason jars, silicone molds, and fancy bento boxes add up—your Tupperware drawer is now its own sub-budget. Instead, lean into staples like rice bowls, pasta salads, or grain-and-greens combos that scale easily and stay fresh. Keep flavor exciting with affordable spice blends, hot sauce drizzles, or a squeeze of citrus—no artisanal garnish required.

8. Skipping Preventive Maintenance

Putting off oil changes, dentist check-ups, or HVAC tune-ups to save a few dollars often leads to catastrophes—and massive bills—down the line. Preventive care might seem like an expense you can delay, but inaction compounds risk and cost. Schedule routine visits and inspections to catch small issues before they morph into wallet-annihilating disasters.

Think of routine maintenance as an insurance policy for your stuff: a $40 oil change today can prevent a $1,000 engine overhaul tomorrow, and a $150 dental clean can save you from a $1,200 root canal. Even your home’s furnace filter swap—just $20 every few months—keeps your energy bills from spiking through the roof. Skipping these small checks also racks up stress; that nagging creak or drip becomes a background anxiety that you’ll dread every time you walk by. And let’s not forget resale value—when you finally sell your car or house, a documented maintenance history can boost your asking price. So set those calendar reminders now and beat the breakdown blues.

9. Comparing Prices for Hours—Then Buying at the First Good Deal

Spending half an afternoon price-comparing electronics feels responsible, but once you spot a “good enough” deal, you lose the momentum and impulse to buy, potentially missing even better offers. Conversely, analysis paralysis might push you to snap up the first decent price, foregoing savings that a quick revisit tomorrow could unearth. Instead, set strict time limits—five minutes per item—and stick to them.

Even with a timer, you’ll find that retailers rotate flash sales and limited-time codes, making “perfect” timing a moving target. By over-researching, you might mentally lock into one retailer, only to forget a coupon code you spotted elsewhere. It’s also easy to convince yourself that checking just one more site is worth it—until three hours later you’ve missed the sale entirely. Better is a two-step process: a quick scan to weed out overpriced options, then a bookmarked list of top three choices. If nothing beats your initial pick in 24 hours, you pull the trigger. That way, you avoid both buyer’s remorse and missed opportunities.

10. Obsessive Budget Tracking—To the Point of Burnout

Journaling every almond or gas station coffee can feel like adulting goals, but hyper-detailed budgets can lead to tracking fatigue and eventual abandonment. The best budget is the one you’ll actually use—so simplify categories or adopt rule-of-thumb systems (like the 50/30/20 rule) to maintain consistency without mental exhaustion.

When your budget spreadsheet has 47 categories, you’ll dread updating it and probably give up by February. Instead, group expenses into broad buckets—needs, wants, and savings—and focus on trends, not minutiae. Use automated tools that categorize transactions for you, then glance weekly rather than logging every single purchase. If you slip up and buy that extra oat milk latte, it’s okay—just adjust your “wants” bucket next week. This flexible approach keeps you in the game long-term, rather than dropping off in a burnout spiral. Remember: a lazy budget you stick to beats a perfect one you abandon.

11. Free Trial Hopping Without Calendaring

Signing up for every free trial under the sun is tempting until you’re juggling a dozen auto-renewals at $15/month. Those “trial” services sneakily bill you if you forget to cancel, leaving you chipping away at subscriptions you never intended to keep. Use a calendar alert or a subscription-management app to avoid unwanted charges.

Even with reminders, you’ll still get that sinking feeling when you see a random charge from a service you forgot existed. Over time, these stray subscriptions become a silent leak in your finances, nibbling away at your budget each month. And no, deleting the app doesn’t always stop the billing. By the time you notice, you might owe back charges or face cancellation fees. A simple spreadsheet or dedicated app lets you see all your trials and renewal dates at a glance, so you can cancel before they hit your credit card. Pro tip: batch-process cancellations once a month to stay on top without mental clutter.

12. Treating Credit Card Points Like Monopoly Money

Redeeming points on frivolous upgrades or minor purchases can chip away at your true purchasing power. That 2,000-point flight credit might sound juicy, but if you opted for a higher-tier card just to chase points and pay heftier annual fees, you’re actually underwater. Always do the math: factor in fees, interest, and true value before swiping for swag.

Also, don’t assume all points are created equal—a hotel’s 10,000-point night might cost $200 or $50 depending on blackout dates and peak season. Redeeming on random gadgets or gift cards often yields less than 1 cent per point, versus at least 1.5 cents on travel. And if you’re carrying a balance, interest charges can nullify any perk value in a heartbeat. The smarter move is to choose one card that aligns with your lifestyle, pay off the balance monthly, and squeeze max value by redeeming strategically—like for flights or statement credits. That way, you’re treating those points as real dollars, not colorful Monopoly pieces.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.