Here are 12 jaw-dropping zoning twists that could zap a chunk out of your home’s worth—because nothing says “surprise expense” like a law you never saw coming. Whether you’re an OG millennial who thought owning property was the ultimate adult flex or you’re just trying to hang onto your hard-earned equity, these off-the-wall requirements are worth a double-take. Ready to get your mind blown (and maybe your wallet a little lighter)? Let’s dive in.

1. Shipping Container Home Restrictions

Believe it or not, some states have quietly enacted bans on unconventional dwellings like shipping containers—and your willingness to go off-grid could tank your home’s appeal. In a vivid exposé by The New York Times, lawmakers in several Midwestern states cited “aesthetic incongruities” to outlaw these eco-friendly homes outright. Suddenly, that trendy container guesthouse you built in your backyard is a code violation, and you’re staring down a hefty fine or forced teardown.

More than just a quirky design choice, these bans reflect a broader suspicion of non-traditional housing that many zoning boards harbor. They’ll argue it’s about “community character,” but the real kicker is the market: buyers flock to novelty and sustainability, and outlawing it shrinks your potential buyer pool. Plus, retrofitting an existing container to meet traditional building codes already costs a pretty penny—now add penalties to the tab.

2. Accessory Dwelling Unit Density Overhaul

Municipalities across the country are now forced to approve up to four units on your single-family lot, whether you like it or not—thanks to sweeping density mandates that lean on your property like a needy roommate. In fact, a recent deep-dive by Bloomberg points out that state governments are increasingly pre-empting local rules to jam extra units wherever they can, all under the guise of “addressing housing shortages.” This means your quiet cul-de-sac could become a mini-apartment complex overnight, diluting the exclusivity that once made your home so valuable. Even if you never build the extra units, your neighbor’s new duplex could drive down your street’s average sale price faster than you can say “lot split.”

Suddenly, that backyard you once dreamed of converting into a zen garden is now “entitled” land for another dwelling, and your property value could flatten like a pancake. Financing, insurance, and property tax rates all start to shift when properties multiply—so get ready for a paperwork blitz every time you think about refinancing. And if you’re part of an HOA that balks at these state-level mandates? Prepare for turf wars that dwarf any front-yard competition you’ve faced before.

3. Short-Term Rental Prohibitions

If you’ve been raking in side-hustle cash from Airbnb, brace yourself: a wave of short-term rental bans is sweeping from coast to coast, and it’s not just your extra bedroom on the chopping block. As Granicus reports, dozens of jurisdictions have slashed vacation-rental allowances by limiting the number of nights you can lease, imposing onerous licensing fees, or banning rentals in certain neighborhoods altogether. That spare-room profit margin you banked on? Now it looks more like Monopoly money.

These crackdowns aren’t just about zoning—they’re political flashpoints over rising rents and housing scarcity. While the goal is noble, the unintended consequence is a property market that suddenly loses its rental income allure, scaring off investors and first-time buyers alike. You might need to refund guests you already booked or pay back taxes on income you budgeted for years—and when word gets out that your area is anti-Airbnb, buyers get cold feet fast.

4. Reinforced Parking Minimums

Remember the days when a two-car garage was a selling point? Well, some places are reversing course and demanding even more asphalt. According to a recent analysis by CNN, several cities have doubled down on parking minimums—forcing developers (and by extension, homeowners) to carve out extra spots or pay steep mitigation fees. That means your lawn could get sacrificed at the altar of “ample parking,” or you’ll face a quarterly surcharge for falling short of the mandated stall count.

Between land-use inefficiencies and skyrocketing paving costs, the new rules turn quaint properties into parking lots. Developers respond by hiking home prices to make up for the expense, and buyers end up paying for empty concrete expanses instead of green space or cozy patios. Plus, if you live in a walkable neighborhood, these mandates undo all that charm—who wants a bunker-style driveway when you moved for tree-lined streets?

5. Synthetic Turf Prohibitions

In drought-prone states especially, zoning boards are now outlawing artificial grass in favor of “real” lawns—or vice versa, depending on your locale—and your yard upgrade could violate local code. As noted by NPR in a recent feature, environmental advocates have lobbied for complete bans on petroleum-based turf, citing microplastic runoff, while others ban natural grass for water conservation. Either way, if your emerald-green carpet isn’t on the approved materials list, you’ll be paying removal and replacement costs that could equal a kitchen remodel.

These bans often come with strict maintenance stipulations, too—think weekly pruning demonstrations and mandatory irrigation audits—so your weekend DIY dreams turn into a bureaucratic nightmare. And since landscaping directly influences curb appeal, potential buyers might balk at a yard that’s either brown scrubland or forbidden plastic mimicry. In the end, your front lawn becomes a legal headache instead of a homeowner’s pride.

6. Minimum Floor Area Mandates

Picture zoning that says “your home must be at least 2,000 square feet”—even if that’s not your vibe. A growing number of jurisdictions are slapping on minimum size requirements to weed out “inexpensive” or “inferior” housing stock, perversely limiting the tiny-home movement. While it may sound like an attempt to preserve neighborhood “quality,” it effectively shuts out smaller, more affordable dwellings from the market.

Homebuyers seeking cozier, energy-efficient spaces now find themselves priced out or forced into cookie-cutter floor plans. Developers steer clear of lots zoned for high minimums, shrinking overall housing supply and driving up per-square-foot costs everywhere else. Plus, resale values dip when your quaint cottage becomes a code violation waiting to happen.

7. Facade Color Control

Some municipalities have enacted state-backed aesthetic codes that dictate paint palettes down to Pantone numbers—no daring teal or moody charcoal allowed. The argument? Uniformity supposedly preserves historic character. Reality check: that rainbow cottage you fell in love with might now need to be repainted in “approved beige,” sucking the soul (and the resale premium) right out of your façade.

Buyers chase standout curb appeal, so cookie-cutter exterior rules make your home feel like every other on the block. And if you bought under one code, but the law shifts to ban your current color, you suddenly face repaint mandates at your own expense.

8. Mandatory EV Charger Installations

Going green? Your zoning board insists. Numerous states now require new residential developments to pre-wire or install electric-vehicle chargers in every garage. While eco-friendly on paper, the up-front costs (often thousands per charger) get passed straight to homebuyers, padding mortgage balances before you even move in.

If you’re not an EV owner, you’re stuck subsidizing your neighbor’s Tesla habit. And when shopping for resale, prospective buyers might shy away from houses with outdated 240V outlets or missing conduit, fearing costly retrofits.

9. Tree Preservation Canopies

Urban canopy protection laws now give every mature tree “landmark status,” preventing you from cutting down branches—or even trimming root-intrusive limbs—without a permit. While well-intentioned for ecology, these rules can halt construction projects, force property setbacks, and saddle you with arborist fees whenever a limb dares to grow over your driveway.

Potential buyers allergic to pollen—or those who just hate raking—will see your leafy fortress as a liability. Plus, if a protected tree damages your foundation, you’re legally on the hook for repairs, hurting both equity and peace of mind.

10. Dark-Sky Lighting Restrictions

Stargazers rejoice, but your backyard lighting might be dimmed to near-pitch black by regulations designed to cut light pollution. Some states now require all outdoor fixtures to be full cutoff and under a strict lumen cap. Hosting a barbecue or illuminating a path could get you a zoning ticket faster than you can say “ambiance.”

Buyers accustomed to well-lit exteriors for security will balk, and resale photos will look like haunted-house previews. The lack of outdoor lighting might cut your curb appeal almost as much as your electric bill.

11. Drone Landing Zone Requirements

In an era of drone deliveries, several states are trialing zoning that mandates a designated drone landing pad—complete with safety barriers and GPS-fencing—on every single-family property. While early-adopter neighborhoods might think it’s the future, most buyers aren’t ready to trade backyard real estate for a mini-helipad for Amazon Prime.

The costs of installing compliant landing infrastructure, plus insurance and liability coverage, fall squarely on homeowners—and a fenced-off yard is a hard sell to families and pet owners.

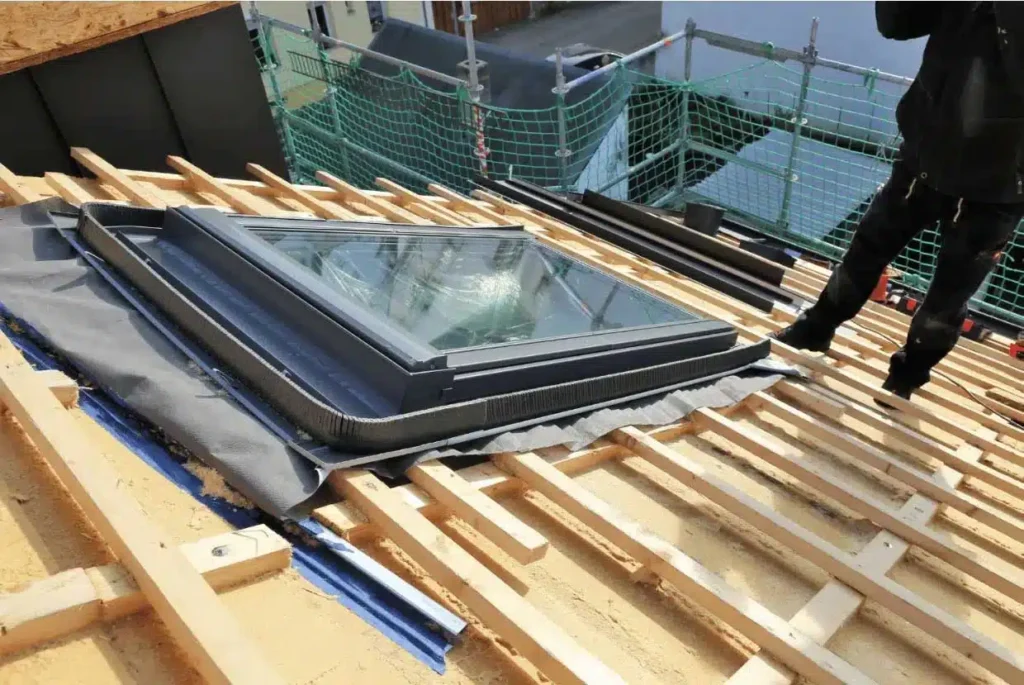

12. Metal Roof Bans

Believe it or not, zoning in certain storm-prep zones forbids reflective metal roofs, insisting on traditional asphalt shingles to preserve “aesthetic cohesion.” While metal roofs can last twice as long and lower energy bills, you must rip them off—often before they’ve even paid for themselves—to comply.

Homebuyers educated on long-term savings will see your shingle-only home as a red flag, and your forced reroof is a sunk cost. In the end, banning the very upgrade that could boost your home’s efficiency becomes a recipe for depressed property values.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.