Let’s be real: getting older comes with its fair share of “meh” moments—early dinners, weird back pain, and people shouting when you’re not even hard of hearing (yet). But here’s the silver lining no one talks about enough: there’s a ton of free stuff out there just for seniors. We’re talking full-on perks, programs, and money-saving hacks that most folks either don’t know about or never think to use. And no, we’re not just talking about 10% off at IHOP (though, let’s be honest, that’s also solid).

Whether you’re inching toward 65 or already deep in your golden years, these are legit services you can tap into today—for zero dollars. From museum passes to free tech classes to companion airfare (yes, really), it’s time to claim what’s yours. Because saving money is always sexy, and frankly, you’ve earned it. Let’s get into the good stuff.

1. Free Home-Delivered Meals (Meals on Wheels)

If cooking two meals a day feels like a chore, “Behind 34 Million Meals, 34 Million Tales,” according to Yahoo News, Meals on Wheels delivers hot or shelf-stable meals right to your door—totally free or based on ability to contribute. Volunteers drop off balanced, diet-friendly dinners that meet dietary needs (low-sodium, diabetic-friendly, etc.).

You’ll get not just food, but a friendly knock, a safety check, and maybe even a daily chat—because social isolation is a real struggle for homebound seniors. Even if you live alone in a rural area, regional nonprofit affiliates partner with government programs to make sure no one goes hungry. It’s like ordering takeout without the tip, plus the bonus of human connection.

2. Free Tax Preparation Assistance

According to Investopedia the IRS’s Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs have been around for over 50 years, offering free help for seniors filing simple returns. If you’re wrestling with W-2s or sinking in 1099s, trained volunteers can walk you through e-filing without charging a dime.

Most senior citizens don’t realize that you only need to make under $67,000 (or be over 60 for TCE) to qualify, and there are drop-off options if you hate waiting in line. These programs often pop up at libraries, community centers, and AARP chapters. Plus, if you’ve got a side gig or rental income, they’ll give you the lowdown on whether that disqualifies you (it sometimes doesn’t!). Tech-shy seniors love the paper option, but if you’re up for some tech, you can even schedule virtual sessions. It’s like having a personal tax consultant—except they actually like volunteering their time.

3. Free Prescription Discount Cards

Believe it or not, drugmakers realized that steep medication costs were bad PR—and back in 2003, “Drugmakers Give Seniors a Break,” per Bloomberg, many rolled out free discount-card programs that seniors can redeem at pharmacies nationwide. Suddenly, that $200 insulin injection looked more like $100 or less.

These cards aren’t insurance—they’re coupons that can lower your cash price, sometimes beating your copay. They’re super simple: print it, scan it at the pharmacy, and watch your receipt drop. Third-party PBMs (pharmacy benefit managers) and nonprofits like GoodRx or SingleCare often run them, but you pay nothing to sign up. Before you shell out for that “insurance” tier, try the card and compare prices—your pill bottle might just say “Gotta catch ’em all!”

4. Free Reduced-Fare Public Transportation

Seniors 65+ can score half-price (or even free) rides on public buses, subways, and trains thanks to federally funded reduced-fare programs, per NADTC. You just flash your senior ID card, swipe at the turnstile, and zoom past the cash group.

Beyond standard transit, many cities offer paratransit or door-to-door shuttle services for free or at steep discounts—perfect if walking two blocks sounds like a marathon. Local senior centers usually have application flyers, so nobody’s left standing. Think of it as your personal Uber, minus the surge pricing, plus the chance to people-watch and wave at neighbors through the window.

5. Free Legal Aid and Advice

Need help with wills, powers of attorney, housing issues, or Social Security disputes? You can get pro bono or low-cost legal assistance through programs funded by the Legal Services Corporation—just plug in your zip code at USA.gov to find free help near you, per USAGov. They’ll connect you with local legal aid societies, law-school clinics, or bar-association programs.

Whether it’s negotiating with a landlord, handling elder-abuse questions, or navigating conservatorships, qualified attorneys volunteer their expertise. Often, there’s income eligibility, but many seniors qualify under modest-income thresholds. Imagine having a lawyer on speed dial—for legal paperwork, court appearances, and the peace of mind that comes with it—all without the six-figure retainer.

6. Free Museum and Cultural Institution Passes

Loads of museums, zoos, and botanical gardens offer free or heavily discounted admission for seniors—but you gotta ask! Some public libraries lend “museum passes” that grant free entry for up to four people. Why stare at old catalogs on the couch when you can stroll Monet exhibits without dropping a dime?

These passes often include special tours and programs, so seniors can skip the general crowd and enjoy quieter, more personalized experiences. All you need is a library card or senior center membership, and boom—culture binge unlocked. Time to flex your artsy side. Your local art museum could even host “silver socials,” curated especially for seniors with extra perks like coffee, cookies, and curator chats. Plus, with rotating exhibits, it’s a whole new vibe every visit—talk about an upgrade from daytime TV. Next time you’re at the library, don’t just borrow a mystery novel—borrow a whole museum day.

7. Free Vision and Hearing Screenings

Organizations like the Lions Club and local health departments hold free vision and hearing clinics for seniors year-round. Eye exams, basic screenings, and sometimes even discounted eyeglasses or hearing aids are on the table. No more squinting at the menu or cranking the TV volume to 11.

These pop-up health fairs often coincide with community festivals or senior expos—bring your shades and earplugs for the after-party. It’s quick, painless, and you’ll walk away knowing if you need a prescription update or just a new Netflix volume setting. Even better? Some programs offer vouchers for follow-up exams or hearing aids if your screening shows you need more help. Catching problems early could save you thousands—and a few awkward “huh?” moments at dinner. Seriously, it’s time to hear your grandkids’ jokes in full stereo.

8. Free Financial Counseling and Housing Advice

HUD-approved housing counseling agencies offer free or low-cost sessions for seniors facing foreclosure, budgeting woes, or reverse mortgage questions. They’ll guide you through loan modifications, tenant rights, and government assistance programs—no money down.

These agencies can also help with credit counseling, debt management, and avoiding scams. They speak English, Spanish, and many other languages—basically financial therapy for your wallet. 💸 Counselors are certified and trained to spot red flags, so if that “urgent call from Medicare” sounds fishy, you’ve got backup. Some even offer virtual sessions, so you can stay in your bathrobe while getting expert advice. Think of it as life coaching—but for staying housed, fed, and financially fierce.

9. Free Tech and Internet Training

Public libraries and community colleges offer free classes on everything from smartphones to social media to basic coding. Seniors can learn to Zoom with grandkids, shop online safely, or even dabble in TikTok—because it’s never too late to go viral.

Workshops often include one-on-one help and loaner laptops or tablets. Bonus: you’ll meet other tech-curious seniors and maybe start a new trend: the “RetireTok” dance challenge. You’ll also learn how to spot online scams, use health apps, and maybe even manage your smart thermostat. It’s like unlocking a whole new level of independence, with a tech-savvy twist. Forget calling your nephew every time your email breaks—after this, you’ll be the family IT department.

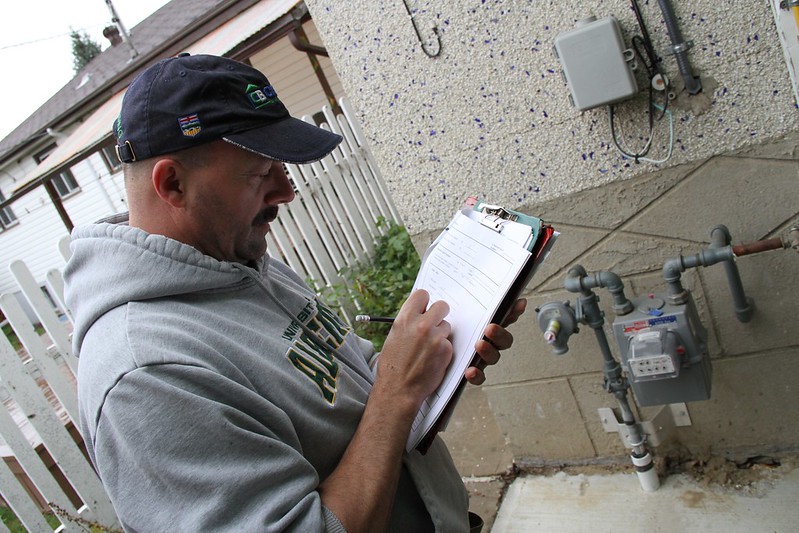

10. Free Home Energy Audits

Utility companies—under state mandates—provide no-cost home energy audits for seniors. An energy specialist visits, checks insulation, HVAC systems, and lighting, then outfits you with free LED bulbs, smart thermostats, and weather-stripping. Your heating bill drops like it’s on Black Friday.

Some programs even install minor upgrades at no cost, like low-flow showerheads or pipe insulation. It’s green, it’s lean, and it keeps more cash in your pocket. 🌱 You could even qualify for bigger repairs or replacements, like new windows or heating units, through government weatherization programs. It’s basically a home glow-up paid for by your utility provider. Saving energy has never looked so cozy—or cost so little.

11. Free Flu Shots and Preventive Screenings

Medicare Part B covers annual flu shots and some preventive screenings at no cost. No co-pay, no out-of-pocket—just roll up your sleeve at your local pharmacy or clinic. The only soreness you’ll feel is from bragging about avoiding the flu. 🤧

Plus, many community health centers offer free blood pressure, cholesterol, and diabetes checks. Early detection is key, and it doesn’t cost a thing. You can also get screened for conditions like osteoporosis and colorectal cancer, depending on your coverage. Some clinics even throw in free wellness workshops, yoga sessions, or nutrition consults afterward. Basically, it’s like hitting the health jackpot with zero damage to your wallet.

12. Free Companion Airfare for Caregivers

Did you know some airlines offer free or discounted companion tickets for caregivers traveling with a senior? Programs like Alaska Airlines’ “Caregiver Companion Fare” slash fares for a helper on the same itinerary. That’s two seats for the price of one—perfect for family trips or medical appointments out of town.

Check with each carrier’s disability services or AARP travel partners—many promotions fly under the radar but can save hundreds per round trip. Some programs are limited-time or require a quick application, so it’s worth planning ahead and asking at booking. It’s a game-changer for seniors who need a little extra help navigating busy airports or mobility devices. Traveling with backup means less stress, fewer hiccups, and more time to enjoy the window seat.

13. Free Identity-Theft Monitoring Trials

Seniors are prime targets for identity theft, but many credit-monitoring services offer free trial periods or senior discounts—often up to six months of alerts, freezes, and Dark Web scans. Companies like LifeLock (through AARP partnerships) provide trial periods that can be stacked or renewed.

Just remember to cancel before the trial ends if you don’t want to pay—set a calendar alert on your phone so you don’t get surprised by monthly fees. Better safe than sorry when it comes to your credit score. These tools alert you if someone tries to open a credit card in your name or changes your mailing address. Some even include stolen-wallet assistance or recovery support if things go sideways. Identity thieves don’t stand a chance when Grandma’s rolling deep with cyber defense.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.