Ever feel like your budget is on life support and your paycheck is whispering, “That’s all I got, chief”? Yeah, same. Living on a fixed income isn’t just about being careful—it’s about being clever. You’ve got to outsmart rising prices, sneaky fees, and the temptation to DoorDash your way through the week. But here’s the good news: you don’t need to be a spreadsheet wizard or coupon queen to make your money stretch.

There are budget hacks that actually work—tricks that don’t require you to give up everything fun or eat plain rice for dinner (again). We’re talking simple shifts that make a real difference, without sacrificing your comfort or your sanity. So if you’re ready to keep your wallet from gasping for air by the 15th of the month, here are 14 budget hacks that still slap—even if your income isn’t changing anytime soon.

1. Declutter and Sell the Extras

You know that closet full of “maybe someday” stuff? It might be time to turn it into a cash machine. Between Facebook Marketplace, Poshmark, and even local , selling unused items is easier than ever. It’s like turning clutter into a bonus check without lifting more than a couple totes.

You don’t have to Marie Kondo your whole house—just start with what you no longer use or wear. Old electronics, kitchen gadgets, even furniture can go fast with the right listing. AARP says the average American household could make hundreds by selling things they no longer need.

And here’s the real kicker: decluttering not only brings in extra income, but it also helps you want less. Fewer temptations to buy, more appreciation for what you already have. That’s a minimalist win for your home and your wallet.

2. Automate Your Savings (Even if it’s $5)

You might think saving money on a fixed income is impossible, but that’s where automation comes in to flex like a quiet financial ninja. Setting up an automatic transfer—even if it’s just $5 a week—builds savings without the mental math. It’s like sneaking veggies into your pasta sauce: you barely notice it, but the benefits pile up. And when it’s automatic, you’re less likely to skip it or spend it.

Even better? Many banking apps now let you round up purchases to the nearest dollar and save the difference. That $3.60 coffee becomes $4, and the extra 40 cents goes into your stash. According to Business Insider, this kind of micro-saving can lead to hundreds saved each year—without you even realizing it.

It’s like a money cheat code for grownups. And yes, it works even if you’re living on retirement income, Social Security, or a fixed pension.

3. Use a Grocery Rebate App

Gone are the days of clipping coupons with scissors and hope. Grocery rebate apps like Ibotta or Fetch turn your weekly shopping trip into a sneaky little cashback party. You shop, scan your receipt, and boom—money back for buying stuff you were already gonna buy.

The real kicker is that these apps often offer cash or gift card rewards, not just store credit. And while it might feel like small potatoes, it adds up surprisingly fast. One survey from Nerd Wallet found users could pocket up to $20–$30 a month in rebates without changing their habits.

You’re not going to retire off your cashback, but you might treat yourself to a free pizza night every month. And that’s a vibe. Pro tip: stack these apps with your store’s loyalty card and a manufacturer coupon and watch the savings triple-stack like a Big Mac.

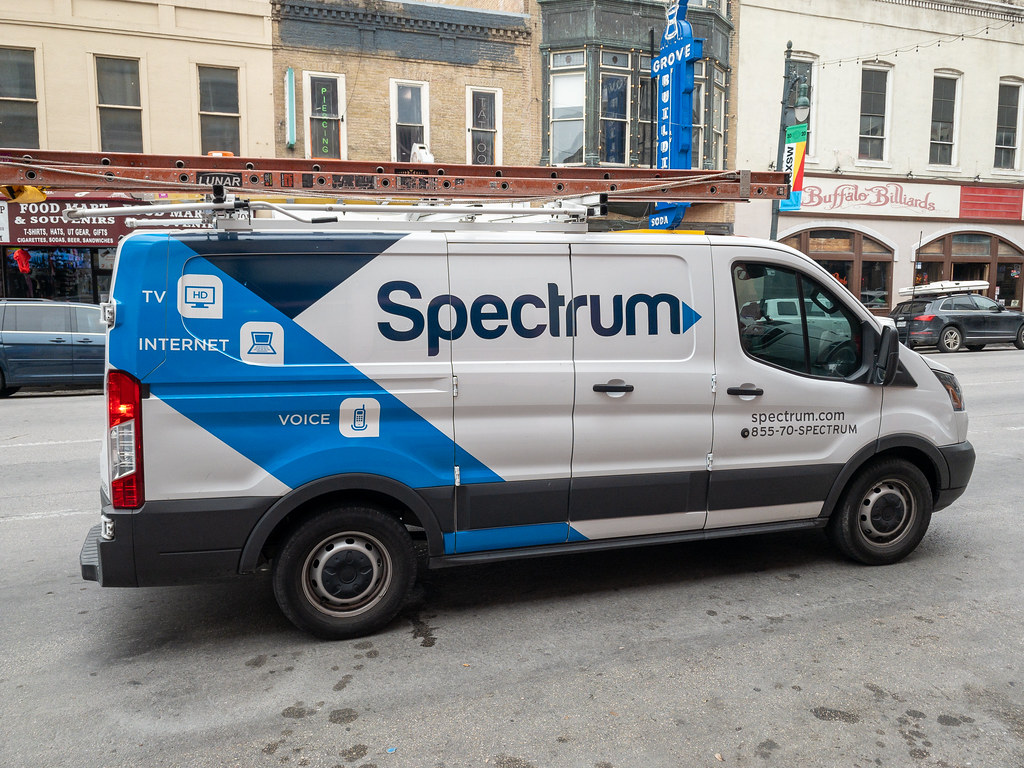

4. Shop Utilities Like They’re Cell Plans

Most of us treat our utility bills like they’re carved in stone—but surprise, you can often negotiate or switch providers for a better rate. Especially when it comes to internet, cable, or electricity in deregulated states, shopping around can shave serious dollars off your monthly expenses. Many people don’t know that utility companies sometimes offer fixed-rate plans or low-income assistance programs you actually qualify for.

One trick? Call your provider, mention you’re comparing competitors, and let the awkward silence do the heavy lifting. According to Forbes, many people save $50 to $100 just by asking nicely—or threatening to walk. No screaming necessary.

And if you’re still paying for cable in 2025, it might be time to have “the talk.” Cutting the cord doesn’t mean cutting entertainment—it means cutting that bloated $180 monthly bill into something that won’t give you anxiety. Keep what you love. Ditch the fluff. Your budget will thank you.

5. Embrace the “Library Life”

Books, movies, music, and even online courses—all for the low, low price of zero dollars. If you’re not already milking your public library for everything it’s worth, you’re missing one of the best kept budget hacks in town. Libraries today are less about dusty bookshelves and more about free Wi-Fi, streaming services, eBooks, and even free museum passes.

Some offer language classes, legal workshops, or job retraining programs—because yes, your library is secretly kind of a life coach. A piece by PubMed Central highlighted how post-pandemic libraries have seen a renaissance as community hubs and digital resource centers.

Plus, returning things for free just feels better than paying $14.99 to “rent” a movie on a streaming service you already pay for. No late fees (thank you, modern library policies), no guilt, just pure budget-friendly bliss. You’re not just borrowing books—you’re borrowing breathing room for your budget.

6. Create a “No-Spend” Day (or Two) Each Week

You don’t have to go full monk mode, but designating one or two days a week where you intentionally spend zero dollars? Total game changer. It turns budgeting into a little personal challenge—like adult hide-and-seek, but with your wallet. You start to realize how many “little” purchases actually add up.

A coffee here, a snack there, a $9 magnetic flashlight you definitely didn’t need at checkout—it all adds up. Choosing no-spend days helps build awareness and makes spending feel more intentional. Plus, it’s kind of fun to get creative with meals, activities, and routines. Need to curb online shopping? Use your no-spend days to delete temptation-inducing apps from your phone.

It’s not about depriving yourself—it’s about giving your bank account a breather.

7. Buy Generic Everything (Except for Like… Two Things)

Most store-brand products are basically the same as their name-brand cousins—just in less flashy packaging and with way less drama. From medicine to pasta to cleaning supplies, generics often cost 20–40% less and work just as well. Sure, there are a few sacred exceptions (looking at you, peanut butter and toilet paper), but most of the time? It’s a no-brainer.

Switching to generic can save you hundreds over the course of a year without changing your lifestyle one bit. You’ll get the same vitamins, same tomato sauce, same shampoo—minus the “paying for the logo” tax. Try a one-month experiment where you go full generic and track how much you save.

You’ll be shocked how little you miss the fancy packaging. And the money you save? That goes straight to your pizza fund or rainy-day stash.

8. Use a Prepaid Card for Discretionary Spending

Here’s a fun trick for curbing impulse buys: preload a prepaid debit card with your “fun money” budget for the week or month. Once it’s gone, it’s gone—no overdrafts, no guilt, no surprise credit card bills. It’s like giving yourself a digital envelope of permission to spend without going overboard.

This is especially handy if you tend to overspend on dining out, gifts, or Target strolls that turn into cart-filling marathons. The visual cue of watching your available balance dwindle makes you think twice before going ham on candle aisles. Plus, you still get to enjoy your splurges—just with boundaries.

It’s budgeting in disguise, and your future self will be obsessed with you for it.

9. Batch Cook Like a Pro (and Actually Eat the Leftovers)

Meal prepping doesn’t have to mean eating sad chicken and rice every day like a gym bro. Think of it as giving your future self the gift of not cooking (or overspending on takeout) five days in a row. Make one or two big meals a week—chili, pasta bakes, soup, casseroles—and portion them out.

Store extras in the freezer for your own DIY TV dinners. It saves time, energy, and money, especially when you buy ingredients in bulk or use whatever’s on sale. Add a little variety with different toppings or side swaps, and you’ll never get bored.

Most importantly: actually eat the leftovers. Don’t let them become fridge decor. Your budget (and your garbage bin) will thank you.

10. Cancel One Subscription Per Season

We’re all guilty of subscription creep. One minute, you’re trialing a streaming service for that one show, and the next thing you know, you’re subscribed to seven different platforms and still watching reruns of “Frasier.” Make it a habit to cancel at least one subscription every season.

It forces you to reassess what you’re actually using and what’s just hanging out, silently siphoning your money. Rotate between platforms if you can’t part with them completely—watch everything on one, cancel it, then binge the next. The beauty of modern subscriptions is they’re easy to start and stop.

You don’t have to give up fun, just be smarter about when and how you pay for it. Even $10/month adds up to $120 a year—aka a nice dinner out or a heating bill paid. Treat your subscriptions like houseguests: welcome the ones you love, but don’t let them overstay.

11. Use the 24-Hour Rule for Non-Essentials

Impulse spending is a sneaky little beast, especially online. But here’s your new mantra: if it’s not food, medicine, or a bill, wait 24 hours before buying. Add it to your cart, close the tab, and walk away. Chances are, by the next day, you’ll either forget about it or realize you didn’t actually need it.

This one hack alone can save you from hundreds of dollars of “What was I thinking?” purchases over time. It’s like Marie Kondo-ing your cart before money even leaves your account. If you still really want the item after a day, go ahead and grab it—guilt-free. But more often than not, you’ll just close the browser and walk away feeling smug and empowered.

Delayed gratification = long-term satisfaction. You win both ways.

12. Set Micro-Goals with Micro-Rewards

Saving $1,000 sounds great but also kind of terrifying when your income is fixed. So break it down. Set small, manageable goals—like saving $50 in a month—and pair them with tiny, joyful rewards. It turns budgeting into a game, and suddenly you’re actually excited to hit a target.

Once you hit that $50, treat yourself to a fancy coffee, a used book, or a movie night. These mini-wins build momentum and help you stay on track emotionally and financially. If your goals are too big, it’s easy to give up. But tiny wins? You’ll chase those like Pokémon.

Budgeting doesn’t have to feel like punishment. It can feel like winning—one baby step at a time.

13. Barter and Swap with Friends

Why buy when you can trade? From books and clothes to tools and home goods, chances are your friends or neighbors have exactly what you need—and vice versa. Hosting a swap party or joining a local “Buy Nothing” group can score you major items for zero dollars.

Plus, it builds community, which is priceless on its own. You’ll be shocked how many people have extra stuff they’re thrilled to offload. Whether it’s lending out a ladder, trading puzzles, or swapping garden veggies, bartering helps you stretch your budget and cut clutter.

And it’s way more fun than clicking “add to cart” and crying later. Call it the original sharing economy—with less tech and more friendship.

14. Take Advantage of Senior & Local Discounts

You earned that AARP card—now make it work for you! From grocery stores and pharmacies to museums, theaters, and travel sites, tons of places offer senior discounts, but they don’t always advertise them. Ask at checkout, browse discount days, and keep a running list of places that cut prices just for being fabulous and over 55.

Also, check local city programs and utility companies—some offer serious perks for seniors or low-income households. Stack those discounts with loyalty programs and coupons, and suddenly your “small” savings start to look pretty major.

There’s no shame in asking. In fact, there’s power in it. Saving 10–15% regularly is like giving yourself a raise—without changing a thing.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.