Ever get that sinking feeling when your phone buzzes with an “IRS” alert just as you’re about to curl up with Netflix? Scammers posing as tax agents have perfected their hustle, snatching personal data and hard-earned cash faster than you can say “audit.” With recent high-profile busts uncovering rings peddling fake tax credits and dirty-dozen frauds splashed across the news, it’s clear these con artists are getting bolder. Thankfully, the IRS’s annual Dirty Dozen list—and a little street smarts—gives us the lowdown on how to outfox these fraudsters. So, channel your inner detective and, armed with these 14 foolproof telltale signs, you’ll spot scammers from a mile away—no Sherlock Holmes hat required.

1. Phony Phone Threats: “IRS” on the Line

Everyone’s worst nightmare is answering a call from the “Internal Revenue Service” demanding immediate payment on back taxes. These scammers spoof official IRS phone numbers so your caller ID looks legit. They’ll drop personal details—like your name or last four of your SSN—just to build credibility. Next thing you know, they’re threatening arrest or license revocation if you don’t pay up via gift cards, wire transfers, or cryptocurrency. It’s all designed to freak you out into compliance before you even have time to think. According to the FTC, no real IRS agent will ever demand payment that way. So when your phone lights up with that ominous ring, make sure you never hand over sensitive info.

Real IRS notices always start with mailed letters, not midnight phone threats. If you suspect foul play, hang up and call the IRS at the official number on IRS.gov. Don’t let a panicked voice message rush you into sending code numbers from gift cards. And if they insist on a “final notice” from a “supervisor,” it’s almost definitely a scam. Remember, the only way you’ll settle legitimate tax bills is through direct bank debit, check, or official online portals. So flex your millennial sass, hit end call, and let the scammers talk to a dial tone instead.

2. Sneaky Email Scams: Fake Refund Notifications

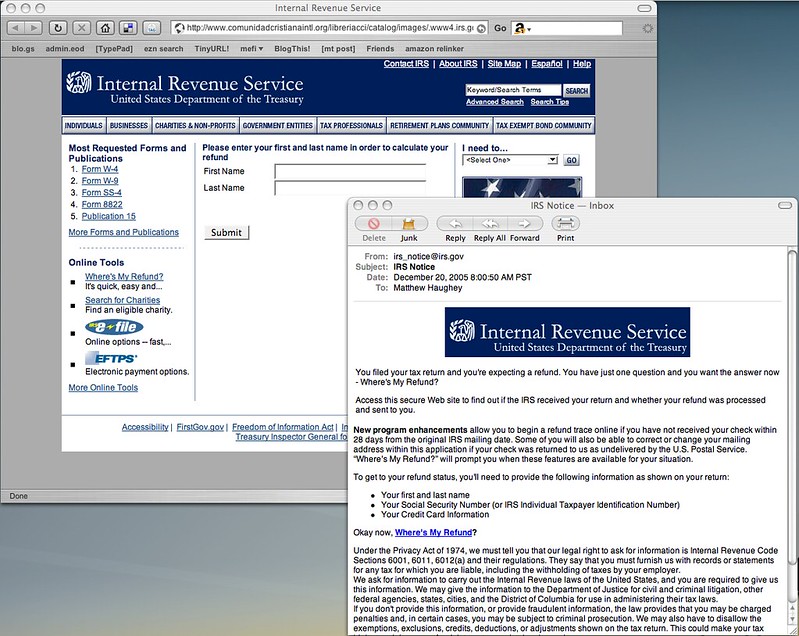

You check your inbox and spot an “URGENT” email claiming you’re owed a huge IRS refund. It’s complete with official-looking logos and a PDF attachment that appears totally legit. But once you click the link, you’re whisked off to a phishing site built to steal your login credentials. Scammers mirror IRS.gov down to the last pixel, tricking even the most security-savvy users. The IRS warns that these schemes often use lookalike domains and spoofed email addresses. And if you naively enter your details, you’ll become a prime target for identity theft. It’s the digital equivalent of handing your wallet to a stranger on the street.

Real IRS notices never arrive in your email inbox with threats or refund lures. Instead, log in directly to IRS.gov to verify any refund status. Always hover over links to check the URL before clicking anything. And if you’re unsure, go old-school: call the IRS helpline rather than engage with the email. After spotting a scam, mark it as spam and report it to phishing@irs.gov. That way, you’ll keep your data—and your bank account—safe from sneaky hackers.

3. Gift Card Demands: Because Who Doesn’t Love Starbucks Cards?

Imagine a scammer telling you to pay your “tax debt” with gift cards because it’s “the safest” way to transfer money. They’ll claim the IRS only accepts payments via Apple, Google Play, or Amazon gift cards. Next, they’ll demand you scratch off the codes and read them aloud over the phone. Once they have those numbers, your money is as good as gone. According to the Better Business Bureau, legitimate agencies never ask for gift card payments. Yet these scammers latch onto gift cards because they’re untraceable. It’s like handing over Monopoly money and hoping the IRS plays along.

Real IRS transactions happen via direct debit, check, or approved online gateways. If someone tells you to buy gift cards to solve a tax problem, run the other way. Save yourself the headache and verify payment options on IRS.gov before sending any money. If you’ve already sent gift card codes, contact the store where you bought them and report the fraud. Then file a complaint with the FTC at ReportFraud.ftc.gov. That might not get your money back, but it can help clamp down on these card-shackling scammers.

4. Robocall Roulette: AI Voices and Endless Drip Campaigns

You pick up your phone and hear a calm, robotic voice warning that you’re under IRS audit. No live human, just an eerie automated message urging you to call back immediately. These robocalls crank out thousands of pre-recorded threats every hour. They’ll rotate numbers to dodge call-blocking apps, making it impossible to sideline them all. A recent Justice Department press release detailed how one ring used this tactic to net over $32 million. That’s a lot of itchy ears waiting for a bite. And since they never tire, robocallers lay siege to your voicemail until you crack.

Legitimate IRS agents do not use robo-voicemails to collect debts or deliver audit notices. If you get one, resist the urge to call back and instead verify by phoning the official IRS number. Check your personal tax transcripts online for any real audit activity. And please, don’t feed these automated beasts by answering or pressing any buttons. Those inputs often confirm your number is valid, scoring you more calls. So hang up, block, and let them recycle their own robocall scripts instead.

5. Bogus COVID-19 Tax Credit Schemes: The Fancy Refund You Never Asked For

Remember the pandemic tax credits that saved businesses millions? Scammers hijacked that joyride, promoting phony credit schemes to anyone with payroll data. They’d promise “instant” relief, charging hefty finder’s fees as high as 20% of the alleged refund. Then they’d ghost you once the fake claims were filed and the refunds never arrived. According to a Forbes report, prosecutors charged 27 people for a $600 million pandemic relief fraud. Their shell companies filed thousands of bogus claims before authorities shut them down. It’s the tax-credit version of a flash mob—lots of action, zero substance.

If advertisers promise “exclusive” or “secret” credits, alarm bells should ring. Always check eligibility rules directly on IRS.gov before handing over any data. And if someone asks for payroll or financial info up front, treat it like a Tinder red flag. Reach out to a qualified tax professional to confirm any unfamiliar credits. No legitimate promoter will demand big upfront fees without transparent paperwork. So keep your guard up and let official IRS channels handle the real pandemic relief action.

6. Spoofed IRS Websites: Clicking on Trouble

Picture yourself Googling “IRS tax payments” and clicking the top result without checking the URL. What looks like IRS.gov turns out to be “irs-payments.com,” a carbon copy site built to harvest your credentials. These spoofed domains are getting so slick they even sport that little padlock icon. Scammers invest in SSL certificates to lull you into a false sense of security. They’ll even buy domains with familiar words like “paymytaxes” or “usetaxes” to hide in plain sight. At this point, you need to channel your inner hyperlink detective. Be suspicious if anything about the URL or page design seems off.

Always bookmark IRS.gov and use that for any tax-related login. If you stumble upon a site asking for sensitive info, close the tab immediately. Check for spelling errors or strange subdomains before you type in your password. Hovering over links to preview their destination can save you a world of trouble. If you suspect a fake site, report it to phishing@irs.gov without delay. Treat your digital hygiene like brushing your teeth—do it daily and you’ll avoid cavities in your data.

7. Social Media Tax Tips: Too Good to Be True

Scrolling through Instagram reels, you see a flashy clip claiming to boost your refund by thousands. It’s got slick graphics, catchy music, and an influencer promising “insider” tax hacks. But most of these 15-second tips are either oversimplified or outright dangerous. Some will tell you to inflate your deductions with expenses you never actually had. Others push you to reclassify income in ways auditors love to hate. The problem is, real tax strategy takes context, nuance, and sometimes a CPA who’s seen it all. Flashy social media fame doesn’t translate into IRS compliance.

Always cross-check any viral tax advice against official IRS publications. If it sounds too good to be true, it almost certainly is. Instead of hitting “Like,” bookmark IRS.gov’s FAQ or call a qualified professional. That way, you’ll avoid penalties, interest, or the dreaded audit letter. Save your scrolling for memes, not tax planning. Your bank account—and your peace of mind—will thank you.

8. Fake Charities: So Helpful, Yet So Fraudulent

In the aftermath of a disaster, your heart is open and donation appeals flood your inbox. Scammers posing as charities will tug on your heartstrings with photos of furry kittens or devastated families. They create convincing websites that claim 100% of your gift goes to relief efforts. But truth is, your money ends up in scammers’ pockets, not at the frontline of disaster zones. They often register shady non-profits with names nearly identical to big charities. You’ll see impressive-sounding acronyms but zero verifiable track record. It’s a philanthropic bait-and-switch at its finest.

Always verify charity status on the IRS’s Tax Exempt Organization Search tool. If a site won’t provide its Employer Identification Number (EIN), walk away. Major charities publish audited financial statements—scammers won’t. Check Charity Navigator or GuideStar ratings before you give. And if you feel pressured to donate immediately, pause and research. Genuine altruism deserves a little due diligence.

9. Business Imposter Scams: Your Accountant Was Never That Friendly

If you’re a tax pro, you know that client emails usually start with “Hope you’re well,” not “Send me all W-2s now.” Yet scammers pretend to be major clients requesting urgent payroll or refund-related fixes. They’ll send letters on fake letterhead or emails from spoofed domains. Those attachments often hide malware that steals employee data or locks up your systems. Tax professionals are lucrative targets because they hold troves of sensitive info. A single click can turn your office into a data-breach disaster zone. And that’s before regulators come knocking.

Always verify unexpected client requests by calling a known number on file. Don’t enable macros in any document you didn’t anticipate. Multi-factor authentication on email and portals adds an extra layer of defense. The IRS Security Summit issues annual warnings about these con calls for a reason. Stay updated on common imposter tactics through your professional associations. A skeptical mindset will keep both you and your clients safe.

10. Text Message Teasers: IRS In Your SMS

Your phone dings with an SMS reading “IRS: You owe $2,350. Click here to resolve.” It looks urgent, but the IRS doesn’t send payment notices via text. These “smishing” messages contain links that lead to credential-harvesting sites or malware downloads. Scammers bank on your fear of immediate consequences to override caution. One tap and you could be handing over your login info or infecting your device. Suddenly, your smartphone becomes an identity thief’s playground. All because you indulged a quick peek at a suspicious text.

If you get a tax-themed SMS, don’t click—delete it immediately. Report the phishing attempt to phishing@irs.gov for good measure. Real IRS communications come by mail and sometimes by secure online portals. When in doubt, log in directly through IRS.gov rather than via any link. A little digital discipline goes a long way toward avoiding heartbreak. Keep your phone free of fake IRS alerts and spam.

11. Phishing Link Mines: Attachments as Weapons

Some scammers send “IRS Form Update” attachments that hide malicious links within PDFs or Word docs. You might think you’re downloading an official form, but instead you’re installing ransomware. Once that payload activates, your files could be encrypted or your keystrokes tracked. Attackers then ransom your data or steal credentials to file fraudulent returns. They count on busy taxpayers clicking attachments on autopilot. And let’s face it, who actually reads every email before downloading? That’s the gap they’re targeting.

Only open attachments you explicitly requested or confirmed. Scan every file with reputable antivirus software before clicking. The IRS never sends unsolicited forms via email attachments. They’ll direct you to secure IRS.gov portals if they need docs. If an email looks suspicious, delete it and report it as phishing. Better safe than locked out of your own digital life.

12. Artificial Agent Scams: Deepfake Danger

With AI tools on the rise, scammers can generate audio and video that sounds eerily real. Imagine answering a Zoom call with someone who looks and sounds exactly like an IRS agent. They’ll walk you through “urgent” instructions to transfer funds or share sensitive info. Deepfake voices can mimic accents, tones, and memorized scripts flawlessly. And video deepfakes? Creepy enough to trick even family members. Once you comply, your accounts or data are compromised. It’s the ultimate catfishing, but with government intimidation.

The IRS will never initiate audits via video call or social media DM. If someone shows up on your screen claiming to be an agent, terminate the call. Verify any suspicious outreach by contacting the IRS directly through official channels. Keep your software updated to guard against hidden malware. And educate friends and family about these AI-powered pitfalls. Staying one step ahead of tech-savvy scammers is the new normal.

13. Social Engineering Through Pretense: The “IRS Genie” Promise

They advertise themselves as “IRS Genies,” claiming they can make tax debts vanish overnight. Their slick websites boast 100% success rates and glowing testimonials. Upfront fees range from hundreds to thousands of dollars, paid in cash or Bitcoin. Once they have your money, they disappear like smoke up a chimney. These “age-old secrets” they peddle are nothing but clever marketing. The IRS requires credentials like PTINs for tax professionals, not magic wands. Yet these scammers exploit desperation, promising a tax-free fairy tale.

Legit tax pros follow IRS Circular 230 and provide transparent fee structures. If someone guarantees debt elimination, view it as a red flag. Always ask to see their IRS Preparer Tax Identification Number. And check for disciplinary actions on IRS.gov’s Office of Professional Responsibility page. No legitimate service can legally erase tax liabilities overnight. Keep your financial wishes magical and your vigilance realistic.

14. Old School Junk Mail: The Envelope Doesn’t Lie (Or Does It?)

Even in our digital age, scammers still bank on snail mail to catch you off guard. You’ll open an envelope stamped with an official-looking IRS logo and barcode. The letter might threaten liens, lawsuits, or passport revocation if you don’t respond. It’s easy to assume the printed threats are real when they look so official. But scammers buy low-quality letterhead and imitate IRS formatting down to the font. They hope the weight of that envelope convinces you to call the number inside. Sometimes the phone number even comes with a local area code just to sell authenticity.

Real IRS letters come with specific notice numbers—check those against samples on IRS.gov. If the letter’s format seems off or lacks your personal tax ID, it’s fake. True IRS mail always arrives from one of a handful of official campuses. When in doubt, compare the suspicious notice to IRS templates available online. Then shred any junk mail bearing a fake agency seal. Your shredder will become your best ally in the battle against paper cons.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.