Ever stumble on a headline about Bill Gates owning more acres than some countries and wonder if he’s lost his mind—or if dirt is the new crypto? From tax loopholes to carbon credits, the ultra-wealthy have discovered farming is the ultimate flex. So grab your cold brew and let’s unpack 14 totally unexpected (and strangely brilliant) reasons why the rich are rushing for rural real estate this year.

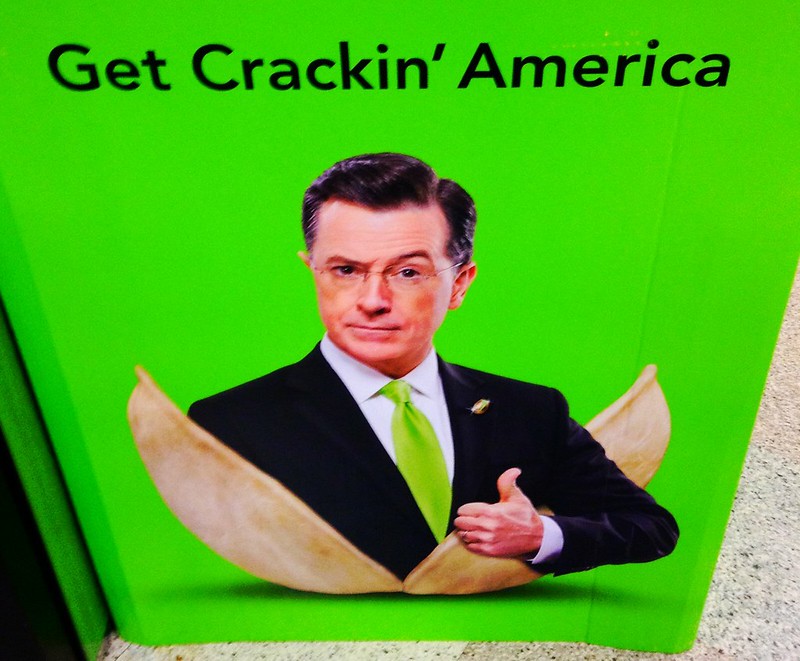

1. Celebrity Passion Projects

From Gwyneth Paltrow’s “goop garden” to NBA stars starting ag-tech incubators on their own ranches, farmland is the perfect canvas for celebrity turnkey pet projects, according to Vogue Magazine. It marries wholesome branding with luxe lifestyle imagery—and IG loves it.

Celebs are flying in entourage for weekend farm retreats, complete with curated barn dinners and goat-yoga sessions. They host ticketed harvest festivals, inviting fans to stomp grapes and sample olive-oil tastings, turning land ownership into experiential merch. And because every selfie from a chestnut grove translates into goodwill, brands line up for collabs faster than you can say “farm-to-table.” Behind the scenes, actor-turned-farmer collectives trade notes on regenerative practices and crypto-ioT livestock trackers. It’s the ultimate win-win: audiences see their idols giving back to the earth, and stars snag tax deductions under the guise of “artisanal community outreach.”

2. Betting on Population Booms and Climate Crunches

The world’s population is set to hit 8.1 billion by 2025, and climate change is turning prime cropland into mini deserts—making arable soil the hottest commodity on Earth. According to the Financial Times, institutional investors have doubled their farmland allocations in just three years, driven by expectations of soaring food demand and dwindling supply. With global grain stocks wobbling from extreme weather events, owning real farmland feels like owning a billionaire’s version of bottled water—except tastier.

This is less about tractors and more about strategic foresight: when everyone’s fighting over GMO-free kale, you need to control the fields at the source. Farmers vs. the globe’s hungry masses? Spoiler: farmland owners win either way. And while small-scale growers scramble for subsidies, the rich can afford to play the long game—planting trees today for timber profits decades from now. They’re also experimenting with tech like satellite-based yield prediction to squeeze every last bushel from their acreage. So yes, that pastoral vista is quietly humming with data-driven agriculture and profit projections.

3. Farming Carbon Credits for Big ESG Points

Companies desperate to hit net-zero targets are buying up farmland to generate carbon credits via regenerative practices. Large tracts of cover crops, no-till fields, and agroforestry projects sequester COâ‚‚ that can then be sold to emitters hoping to offset their footprints. As highlighted by the Financial Times, land values are surging where these nature-based carbon schemes promise both environmental impact and hefty returns.

For the well-heeled investor, packing soil with carbon is like minting eco-coins. And since these offsets often trade at premium prices, farmland becomes a dual-purpose asset: grow corn…and capital. Some hedge funds are even sponsoring university research to quantify soil-carbon improvements, turning dirt into an R&D expense. Meanwhile, huge conglomerates are locking in forward-purchase agreements for credits produced five or ten years down the road—securing future green brownie points today. It’s like a perpetual motion machine for PR and profit.

4. Sneaky Estate-Tax Loopholes

Passing down a family fortune without Uncle Sam scooping half of it? The wealthy have long used farmland to shield their heirs from crushing estate taxes. A recent guide from Nationwide reminds estate planners that conservation easements and agricultural exemptions can slash taxable estate values by up to 40 percent. By gifting land or placing a permanent easement on it, heirs dodge development-value assessments and keep more dough in the family pocket.

Plus, with the TXJA estate tax exemption set to halve on January 1, 2026, now’s prime time to snatch up acreage and lock in today’s generous limits. Think of it as a BOGO deal on tax savings—land edition. Some ultra-wealthy families even rotate properties through LLCs and trusts to maximize deductions and obscure ownership. And because farmland valuations tend to rise steadily, those deductions grow more valuable each year—almost like magic potion for wealth preservation. In short, no accountant’s dream is complete without a few thousand acres in the portfolio.

5. The Ultimate Inflation Hedge

When stocks gyrate and bonds yawn, farmland has historically marched upward in value. It’s a finite, essential resource—you can’t print more of it. A deep dive by Nasdaq shows that, over decades, agricultural land yields an average annual return north of 8 percent, with rentals alone churning out about 6 percent cash flow per year.

In an era where “money in your mattress” isn’t exactly lucrative, farmland offers the kind of low-volatility stability that makes insurance-policy investors drool. Plus, every harvest is a literal receipt. What’s more, inflation often bites into cash holdings, but crop prices usually climb in tandem with—or above—inflation rates, cushioning returns further. Some investors are even layering on water-rights purchases to goose the land’s scarcity premium. Essentially, farmland is the adult version of a piggy bank—solid, reliable, and very much alive.

6. Low Correlation to Tumultuous Markets

Farmland’s performance barely flinches when tech shares swoon or crypto collapses. The CIO Investment Club notes that this low correlation with stocks and bonds helps portfolios breathe easy during economic storms. While Wall Street runs scared, farm-land values generally inch upward thanks to steady global food demand.

For the megabucks crowd, that means farmland acts like an anchor, keeping portfolios from drifting into rough seas—no LifeVest required. Some even claim that farmland’s calmness during crises rivals gold’s reputation as a safe haven—minus the heavy lifting of vault storage. And because each parcel produces both a hard asset and operational income, you’re effectively diversified within the same investment. It’s like having a built-in hedge fund that actually grows veggies.

7. Prepping for Food-Supply Chain Armageddon

Post-pandemic panic taught the rich that grocery shelves can go bare overnight. Owning farmland is a literal seat-of-the-pants way to guarantee access to rice, beans, and those fancy heirloom tomatoes. Far from a survivalist bunker, this is pragmatic food-security planning—just with a luxury twist.

Now, instead of fighting crowds at Whole Foods, the ultra-wealthy can stroll their own avocado groves and declare “we’re good” with an air of casual benevolence. Some have even installed on-site grain silos and custom processing facilities, because convenience is the ultimate accessory. They’re stockpiling heirloom seed vaults—yes, really—to safeguard against future crop failures. Meanwhile, bespoke farm managers curate seasonal menus for their households, turning staple grains into five-star tasting menus. It’s less Mad Max and more Martha Stewart meets Bear Grylls, complete with hand-crafted pantry reserves. This is food insurance with artisanal jam.

8. Status Symbol: More Exotic Than a Superyacht

Ditching the typical Lambo flex, next-gen moguls are showing off acres of rolling green fields on TikTok. “Here’s my organic orchard, #FarmLife” has replaced “Here’s my private jet, #LivingTheDream.” In 2025, farming chic is the new valet parking brag.

Turn on your FYP and you’ll spot drone footage of manicured vineyards and pasture-raised goats, all hashtagged “#LandlordGoals.” Influencers are partnering with their farm-owning friends for cross-promo farm-tok collabs—imagine goat-milk latte tutorials live from your own barn. It’s all about lifestyle clout: controlling the narrative that you’re eco-aware, self-sufficient, and still absolutely dripping in capital. Even the farmhands get stylish uniforms so every Instagram Story looks like a luxury catalog. Forget plastic yachts; real flex is vintage tractors and custom barns with floor-to-ceiling windows. Who needs Monaco when you have Montauk-meets-Milan on your own plot?

9. Tax-Deferred 1031 Exchanges

Got a big gain on commercial real estate? Swap it into farmland via a Section 1031 exchange and delay capital gains taxes indefinitely. It’s a classic move for anyone with a $50 million warehouse profit to park somewhere greener.

But wait—there’s more. Savvy advisors are carving farmland acquisitions into staggered exchanges, rolling gains from one property into another to perpetually push back the taxman’s claim. These exchange sequences often involve multiple family members and LLCs, multiplying the tax-deferral magic. And because farmland is often easier to finance and holds value well, there’s a lower risk of triggering recapture taxes. Meanwhile, the underlying crops provide real income, so investors avoid empty buildings that sit vacant waiting for a buyer. It’s the long con: flip warehouses into wheat fields and let Uncle Sam chase his tail.

10. Part of the ‘Billionaire Prepping’ Trend

Alongside luxury bunkers and remote retreats, farmland buys are cropping up in ultra-prepper playbooks. Securing miles of defensible land—with majestic mountains in the background, naturally—checks the “long-term survival” box in the billionaire playbook.

These properties often come with bespoke security perimeters, underground generator systems, and multiple water wells to guarantee self-sufficiency. Elite prepping groups hold secret meetups on members’ ranches, swapping intel on everything from crop-rotation best practices to improvised solar arrays. And because farmland ownership is so publicly innocuous, it flies under the radar of doomsday documentaries. Some preppers even host coded “harvest regen retreats” where they test emergency food kits and bartering simulations with friends. It’s not paranoia—it’s proactive luxury contingency planning, complete with gourmet freeze-dried meals and artisanal pickles for every scenario.

11. Branding Tie-Ins for Food and Beverage Startups

Want to launch an artisanal kombucha or single-origin coffee brand? Owning the raw-material source is the ultimate marketing angle. “From our sustainable farm to your gut” is more than a tagline—it’s a full-circle narrative investors crave.

These entrepreneurs tour VCs around their estates, showing off demonstration plots of exotic heirloom beans and testing fermentation techniques right in the on-site lab. Packaging proudly bears hand-drawn maps of the family’s land, and tasting rooms on the property double as influencers’ playgrounds for launch events. It’s vertical integration with a personal touch: the press release quotes the founder strolling through fields at dawn, harvesting produce by hand. And when demand spikes, they upsell “experience harvest” farm stays, turning customers into agritourists. In a world of bland CPG pitches, nothing says “premium” like owning the dirt.

12. Influence Over Local Policy and Development

Airbnb bans? Zoning changes? Farm owners often wield outsized influence in rural county boards. Buying farmland can translate to community sway—perfect for billionaires who want a say in where their neighbors park their RVs.

Donations to local election campaigns are often timed to coincide with land purchases, giving owners automatic seats at planning tables. Some throw exclusive farm-to-table fundraisers for county commissioners in their new barns, sealing zoning loopholes over artisanal charcuterie boards. And when infrastructure upgrades are up for debate—like a new highway exit—they’re the first to lobby for farm-access roads that double as private driveways. It’s grassroots power plays, but with Rolexes and designer wellies. In essence, farmland is the ultimate political currency in small-town America.

13. Land Banking: The Mother of All ‘Buy-and-Hold’ Strategies

Much like buying land on Mars but with immediate utility, farmland banking is the OG “future value” play. As available ag land shrinks and population grows, these acres become an increasingly scarce commodity.

Institutional land banks pool investor capital to buy huge swaths of farmland, then parcel it out over decades as demand rises—kind of like farmland venture capital. Investors get initial rental income and watch parcel resale prices climb as urban sprawl edges closer. Some funds even embed development options for eco-resorts or renewable-energy projects, skyrocketing land valuations without tilting a single plow. Meanwhile, the model attracts endless private-equity interest, turning bucolic fields into high-net-worth retirement accounts. It’s passive income meets prestige real estate, wrapped up in soil.

14. Philanthropic Conservation Goals

Finally, for the genuinely green-hearted—or those seeking S-status in donor circles—buying and preserving farmland can align with high-profile conservation pledges. It’s the ultimate double-win: protect biodiversity and earn major goodwill.

These conservation-minded investors often partner with non-profits to rewild portions of their property, sponsoring wildlife corridors and native-plant restorations. They use their estates as research hubs for endangered species and carbon-sequestration pilots, attracting media coverage that frames them as eco-heroes. And when the tax year ends, they claim charitable deductions for every acre under a conservation easement—no small potatoes when you’re talking tens of thousands of acres. It’s philanthropy with a side of portfolio realignment, and it looks great on a donor wall.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.