Imagine trying to explain to a Gen Zer that people used to pay for directions, or that your music came in the form of shiny plastic discs you couldn’t even skip ads on. Yeah… that’s a generational gap wide enough to park a ‘98 Buick LeSabre in. Boomers grew up buying the world piece by piece—maps, music, software, even information. Meanwhile, Gen Z just taps an app, swipes a screen, and boom—it’s free, instant, and usually way cuter.

This list isn’t a roast (okay, maybe a light roast). It’s a scroll through the stuff Boomers still pay real money for—while Gen Z’s over here living their best life with free versions, digital shortcuts, or just a totally different mindset. So whether you’re clutching your checkbook or deleting five antivirus pop-ups, let’s dive into the top 14 things Boomers are still paying for (that Gen Z gets for free).

1. Standalone GPS Devices

Remember those chunky GPS devices suctioned to windshields? Boomers do. They invested in standalone GPS units like Garmin or TomTom, paying a premium for navigation, according to The Outdoor Life. These devices were game-changers in their time, offering turn-by-turn directions without the need for paper maps.

Fast forward to today, and Gen Z navigates the world with free apps like Google Maps or Waze on their smartphones. These apps provide real-time traffic updates, alternative routes, and even speed trap alerts—all without additional cost. It’s a classic case of technology evolving to offer more for less. In fact, TomTom has discontinued the sale of portable navigation devices in the USA and Canada, reflecting the shift towards smartphone-based navigation.

2. Cable TV Subscriptions

Ah, cable TV—the OG of home entertainment. Boomers often stick with their trusty cable packages, paying upwards of $100 a month for a lineup filled with channels they might not even watch. It’s a comfort thing, a habit formed over decades. But let’s be real, with streaming services offering tailored content at a fraction of the price, it’s like paying for a buffet when you only want dessert.

Gen Z, on the other hand, has embraced the streaming revolution. Platforms like Netflix, Hulu, and Disney+ provide on-demand content without the clutter. And with the rise of ad-supported free streaming options, they’re watching their favorite shows without the hefty price tag. According to Cord Cutters News, the average household now spends $61/month on streaming, while cable bills still hover around $147. It’s clear who’s getting more bang for their buck.

3. Physical Music Collections

Boomers have a deep appreciation for tangible music—vinyl records, CDs, and cassette tapes. They built impressive collections, spending significant amounts over the years. There’s a certain charm in flipping through album covers and reading liner notes.

Gen Z, however, streams music effortlessly. With platforms like Spotify and Apple Music, they have access to millions of songs at their fingertips. Many opt for free, ad-supported versions, making music consumption virtually costless. According to Music Ally, boomers are more inclined to stick with traditional formats, while younger generations embrace streaming, often without paying a dime.

4. Print Newspapers

The rustle of a newspaper and the smell of ink—Boomers cherish their morning ritual of reading the paper. Subscriptions to print editions are still common among this generation, who value the tactile experience and in-depth reporting.

Gen Z gets their news digitally, often for free. Social media platforms, news apps, and online publications provide instant access to headlines and stories. According to Pew Research Center, total U.S. daily newspaper circulation (print and digital combined) was 20.9 million in 2022, down 8% from the previous year. This decline reflects the broader trend of younger generations moving away from traditional print media.

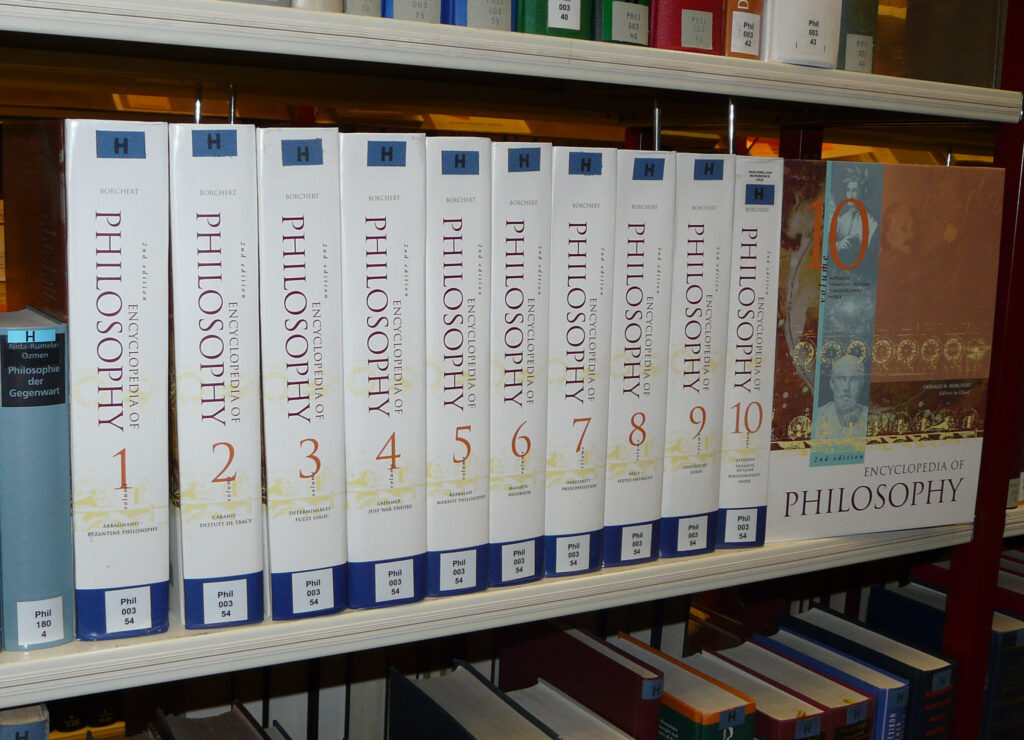

5. Encyclopedias

Once a staple in every household, encyclopedias were the go-to source for information. Boomers invested in these hefty volumes, often purchasing updated editions to keep up with new knowledge.

Enter Wikipedia—a free, constantly updated online encyclopedia. Gen Z relies on it for quick information, research, and fact-checking. While teachers once warned against its use, it’s become a trusted resource for many. The shift from physical to digital has made information more accessible and, importantly, free. Notably, according to Harvard Business Review, Encyclopædia Britannica ceased producing bound volumes in 2012, marking the end of an era for printed encyclopedias.

6. Landline Phones

Boomers still have that beige rotary energy—and we love that for them—but most younger folks don’t even know their home number. Landlines are clinging on in some households, mostly for emergency backup or because “we’ve always had one.” But they come with monthly fees and maintenance costs, which add up fast for something that basically just collects robocalls now.

Gen Z? They’re not about that life. Smartphones are their one-stop shop: calls, texts, internet, memes, maps, and even banking. The idea of being tethered to a wall feels like ancient history. And why pay for a whole extra service when your mobile does it all? Some Gen Zers don’t even bother with traditional voice calls—FaceTime, DMs, and voice notes have taken over. Plus, every app from Discord to Instagram is a new communication channel. The landline didn’t just die—it got ghosted.

7. Paper Checks

There’s a whole generation that still writes rent checks every month like it’s 1993. Boomers keep those checkbooks in pristine condition, flipping them open with the same satisfaction some of us reserve for unboxing a new phone. But checks are slow, vulnerable to theft, and let’s be honest—totally unnecessary now.

Gen Z handles payments with Venmo, Zelle, Cash App, or whatever the next fintech darling is. Splitting a pizza, paying a bill, sending your roommate money for toilet paper—it’s all done in seconds, with emojis and memes attached. No stamps, no envelopes, no waiting three business days. It’s fast, digital, and fully integrated into their lives. Many don’t even know how to fill out a check. It’s a vibe shift from “write and mail” to “tap and done.” Boomers still balancing a checkbook is peak analog energy.

8. Fax Machines

Yes, they still exist—and yes, some Boomers are still paying for eFax services or maintaining dusty machines at home or in small businesses. Faxes were once revolutionary, and for Boomers, they were a daily tool. Contracts, legal docs, prescriptions—zip ‘em through in black-and-white, screechy modem glory.

Meanwhile, Gen Z has never needed to fax anything. PDFs? Sign them digitally. Need to send something? Scan it with your phone and email it, or upload it to the cloud. Their entire document workflow lives in Google Drive, Dropbox, or whatever app came with their tablet. Even banks and doctor’s offices are finally giving up the fax. It’s not just about speed—it’s about the sheer absurdity of owning a machine whose entire purpose has been replaced by a smartphone camera. Boomers may keep faxing, but Gen Z barely knows what that funky phone-copier hybrid even is.

9. Roadside Paper Maps

Boomers still love a good glovebox stocked with Rand McNally road atlases and state-specific foldouts. For them, there’s a certain romanticism in tracing your route by hand and highlighting stops along the way. But practically? That’s a whole lotta paper to fumble with at a rest stop.

Gen Z has never needed to know where the compass points. GPS apps give turn-by-turn instructions, show you traffic in real-time, and re-route you if there’s a detour or a wreck. They can share locations with friends, track trips together, and get gas station suggestions mid-drive. Boomers might say, “What if your phone dies?” and Gen Z replies, “Power bank, babe.” Paper maps are beautiful artifacts, but as a navigation tool? They’ve been retired. Some Boomers keep them as a backup. Gen Z keeps charging cords and confidence.

10. Greeting Cards

Boomers still spend $4–$10 a pop for paper cards from Hallmark with cursive fonts and pastel roses. And don’t forget the stamps and the careful trip to the post office to mail it. Cards for birthdays, anniversaries, and holidays are still a serious thing—and honestly, they’re sweet! But they also add up in cost and clutter.

Gen Z sends love in digital form: custom memes, TikTok slideshows, Canva graphics, and emotional Spotify playlists. A “happy birthday” is more likely to arrive via Instagram story than USPS. It’s faster, more personal, and let’s be honest—funnier. They value authenticity over tradition. No one’s throwing away a handmade meme. While Boomers cherish the handwritten touch, Gen Z is rewriting the rulebook with pixels and gifs. And yeah, no one had to pay $6.99 at Walgreens.

11. Antivirus Software

Boomers are still out here paying annual subscriptions for Norton or McAfee like it’s a Windows XP world. They feel safer knowing they’ve installed “real protection.” And with all the phishing scams targeting older generations, we get it—better safe than sorry. But here’s the thing: modern devices don’t always need it.

Gen Z trusts built-in security like Windows Defender or Apple’s native protections. Their digital hygiene comes from browser extensions, password managers, and multi-factor authentication. And let’s be honest, their instincts for spotting sketchy links are next level. Plus, they know not to download “Free iPad” popups. Boomers still budget for antivirus, while Gen Z’s devices quietly block threats in the background. It’s not that they’re reckless—it’s that they’re optimized. And all that security? Comes baked in, baby.

12. Photo Printing

Boomers still hit up Walgreens or CVS with a USB stick full of grandkid pics to print 4×6 glossy photos. They put them in albums, frames, and sometimes even mail them in holiday cards. There’s something undeniably charming about it—but also, it costs money and effort.

Gen Z? Their camera rolls have 34,000 photos and zero intention of printing any of them. Memories live in the cloud now, organized by face and location thanks to smart AI. Instagram, Snapchat, BeReal—those are their photo albums. And if they do print something? It’s for a highly curated photo wall or DIY craft project, not every blurry beach pic from 2022. The idea of printing every photo is like watching movies on VHS—quaint, but unnecessary. Boomers capture memories in paper. Gen Z captures them in pixels, filters, and vibes.

13. Software Suites Like Microsoft Office

Boomers are loyal to Microsoft Word like it’s a sacred scroll. They pay for annual licenses or shell out for Office 365 subscriptions just to type a grocery list or build a simple spreadsheet. For them, it’s what they’ve always used, and old habits die hard.

Meanwhile, Gen Z has never paid for a word processor in their lives. Google Docs, Sheets, and Slides do everything Office does, but for free—and collaboratively. They can access their work from anywhere, share it instantly, and co-edit in real time. Plus, it auto-saves every keystroke. To them, paying for basic software is like paying to breathe. They don’t not respect Microsoft—it’s just outdated for their workflow. Boomers bought the box set. Gen Z just logs in and types.

14. Credit Score Monitoring

Boomers still pay for monthly credit monitoring services, worried about identity theft and keeping their score in check. Companies have convinced them that $20/month is the only way to stay safe. And to be fair, there was a time when that made sense.

But Gen Z lives in the age of fintech. They get free credit monitoring from apps like Credit Karma, NerdWallet, and even some banks. Alerts, simulations, and tips? All for zero dollars. Plus, they actually understand their credit score in a way previous generations didn’t. No more mystery numbers or hidden criteria. For Boomers, it’s a monthly bill. For Gen Z, it’s a few taps and boom—credit health check unlocked.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.