Whether it’s extravagant spending, bad investments, or just a string of unfortunate events, even the most famous people can find themselves in financial ruin. In a world where the finer things in life often come with staggering price tags, it’s easy to lose sight of fiscal responsibility. You might think the rich and famous are immune to the woes of everyday life, but financial pitfalls don’t discriminate. In fact, some of the wealthiest stars have seen their fortunes disappear. Here’s a closer look at 15 A-list celebrities who went totally bankrupt.

1. Lindsay Lohan

Lindsay Lohan, once a promising young actress with roles in hits like “Mean Girls” and “The Parent Trap,” found herself entangled in financial troubles. Lohan’s struggles were compounded by legal issues and personal challenges that took a toll on her career and finances. Celebrity accountant Greg Centineo noted that Lohan’s frequent legal battles and lack of steady work significantly impacted her financial standing. She reportedly owed substantial amounts in taxes and wasn’t earning enough to cover her extravagant lifestyle. Lohan’s story reveals how fame can sometimes complicate one’s ability to manage money effectively.

Despite her financial woes, Lohan has made efforts to turn her life around. She’s pursued opportunities in television and business, working to reestablish her career and financial standing. Her journey is a reminder of the volatile nature of Hollywood, where fortunes can change overnight. Lohan’s resilience in the face of adversity highlights the importance of perseverance. Her efforts to bounce back financially show that recovery is possible, even after significant setbacks.

2. Nicolas Cage

Nicolas Cage, famous for his roles in films like “National Treasure” and “Face/Off,” learned the hard way that even a Hollywood career doesn’t guarantee financial stability. Cage was notorious for his lavish lifestyle, which included purchasing castles, a private island, and even a dinosaur skull. According to a report by Forbes, his unpaid taxes and mounting debts led to a financial fallout that saw him owing millions to the IRS. Despite earning over $150 million between 1996 and 2011, Cage’s spending habits eventually caught up with him. Today, he’s working on rebuilding his wealth through a series of new projects.

For many people, Cage’s bankruptcy serves as a cautionary tale of excess. It’s a reminder that no amount of fame can substitute for sound financial management. His situation wasn’t just about bad spending; it was also a lack of oversight. With so much money flowing in, he likely thought he was invincible. However, the legal troubles and asset liquidations that followed his financial crash illustrate how quickly things can spiral out of control.

3. Mike Tyson

Mike Tyson, once the undisputed heavyweight champion of the world, saw his $400 million fortune disappear almost as quickly as he earned it. Known for his extravagant lifestyle, Tyson’s financial missteps included buying a pet tiger, multiple homes, and luxury cars. In 2003, he filed for bankruptcy, citing debts that outweighed his assets. His fall from grace was a shock to the world, given his immense earning potential in his prime. Tyson’s story is a compelling example of how even the highest peaks of success can quickly descend into financial chaos.

After declaring bankruptcy, Tyson focused on rebuilding his life both financially and personally. He embarked on a series of endeavors, from acting to launching a successful podcast. These moves reflect a broader trend among celebrities who must reinvent themselves after financial setbacks. Tyson’s journey underscores the resilience often required to bounce back from bankruptcy. It serves as a lesson that financial ruin doesn’t have to be the end of the road.

4. MC Hammer

MC Hammer, who burst onto the music scene with his hit “U Can’t Touch This,” found himself in financial turmoil after unprecedented success. At the peak of his career, he was known for his extravagant lifestyle, which included a staff of 200 and a sprawling mansion. However, his spending outpaced his earnings, resulting in a bankruptcy filing in 1996. Hammer’s story is a classic example of how rapidly fortunes can dwindle when spending goes unchecked. His financial collapse was a wake-up call for many in the entertainment industry.

After bankruptcy, Hammer reinvented himself through various business ventures, including tech investments and a reality show. These moves demonstrate his commitment to financial recovery and adaptability in changing economic landscapes. Hammer’s experience underscores the importance of living within one’s means, even at the height of success. His journey from riches to rags, and his subsequent efforts to rebuild, offer valuable lessons in financial literacy. Despite the setbacks, Hammer remains a cultural icon, reminding us that it’s possible to rise again after hitting rock bottom.

5. Toni Braxton

Toni Braxton, the sultry-voiced singer known for hits like “Un-Break My Heart,” faced financial challenges despite her musical acclaim. Braxton filed for bankruptcy twice, first in 1998 and again in 2010, largely due to health issues that affected her ability to perform and mounting debts. Financial analyst Janet Williams pointed out that Braxton’s situation was complicated by contracts that didn’t compensate her adequately for her success. Her story highlights how even talented artists can be victims of the industry’s complexities. Braxton’s financial struggles were a harsh reminder of the importance of understanding the business side of fame.

Braxton has worked diligently to regain her financial footing, using her experience to educate others about financial literacy. She has been vocal about her struggles and the lessons learned, hoping to inspire others to take control of their finances. Braxton’s journey is a testament to the power of resilience in the face of hardship. She demonstrates that with determination and strategic planning, recovery is within reach. Her comeback in both music and personal finance serves as motivation for those facing similar challenges.

6. Kim Basinger

Kim Basinger, an Academy Award-winning actress, faced financial difficulties after making a series of costly decisions. One of the most significant was her purchase of a small town in Georgia, which she hoped to turn into a tourist attraction. Unfortunately, the investment didn’t pan out, leading to financial strain and a subsequent bankruptcy filing. Basinger’s experience serves as a lesson in the risks of ambitious investments without proper planning. Her financial missteps were a stark contrast to her successful acting career.

Despite her financial setbacks, Basinger has continued to work in the film industry. Her ability to navigate through financial challenges and maintain a career in Hollywood is commendable. Basinger’s story is a reminder that even seasoned professionals can face financial pitfalls. It emphasizes the need for careful consideration and due diligence when undertaking major investments. Her resilience and continued success in acting highlight the possibility of recovery and reinvention.

7. Gary Busey

Gary Busey, known for his eccentric personality and roles in films like “The Buddy Holly Story,” faced financial troubles that led to bankruptcy. A severe motorcycle accident and ongoing health issues contributed to Busey’s mounting debts and inability to work consistently. Financial expert Laura Adams explained that Busey’s situation was exacerbated by his medical expenses and lack of adequate financial planning. His bankruptcy filing in 2012 was a culmination of these challenges, highlighting the financial vulnerability that can accompany health crises. Busey’s story underscores the need for financial preparedness and the unpredictability of life’s circumstances.

Following his bankruptcy, Busey has found ways to stay afloat, including reality television appearances and public speaking engagements. His journey is indicative of how adapting to new opportunities can aid in financial recovery. Busey’s story serves as a cautionary tale of how quickly life events can impact financial stability. However, his resilience and ability to adjust to new circumstances demonstrate the potential for rebuilding. Busey’s continued presence in the entertainment world shows that bankruptcy doesn’t have to be the final chapter.

8. Stephen Baldwin

Stephen Baldwin, part of the famous Baldwin acting dynasty, faced financial challenges despite his family’s success in Hollywood. A combination of poor financial management and unpaid taxes led Baldwin to file for bankruptcy in 2009. He owed multiple creditors, including the IRS, which painted a picture of financial disarray. Baldwin’s financial struggles were a stark reminder that fame doesn’t equate to financial savvy. His experience highlights the importance of keeping a close eye on one’s finances, regardless of family legacy.

Since filing for bankruptcy, Baldwin has focused on diversifying his career to stabilize his financial situation. He’s explored various avenues, from reality television to ministry work, to generate income. Baldwin’s journey illustrates the necessity of adaptability in overcoming financial difficulties. His story serves as a reminder of the importance of financial literacy and the perils of neglecting fiscal responsibilities. Despite the hurdles, Baldwin’s efforts to rebuild his life reflect the possibility of recovery and reinvention.

9. Burt Reynolds

Burt Reynolds, a Hollywood legend known for classics like “Smokey and the Bandit,” faced financial difficulties later in life. Bad investments and a costly divorce took a toll on his finances, leading him to file for bankruptcy in 1996. Reynolds’ financial troubles were compounded by an extravagant lifestyle that included multiple properties and luxury goods. His story is a testament to the financial challenges that can accompany personal and professional missteps. Despite his iconic status, Reynolds’ financial woes were a sobering reminder of the importance of financial prudence.

In his later years, Reynolds worked to restore his financial health through acting roles and public appearances. His dedication to his craft and determination to overcome financial obstacles were evident throughout his life. Reynolds’ journey underscores the importance of financial management, even for those with considerable fame and fortune. His ability to continue working and maintain a presence in the industry is commendable. Reynolds’ story serves as an enduring lesson in resilience and the potential for financial recovery.

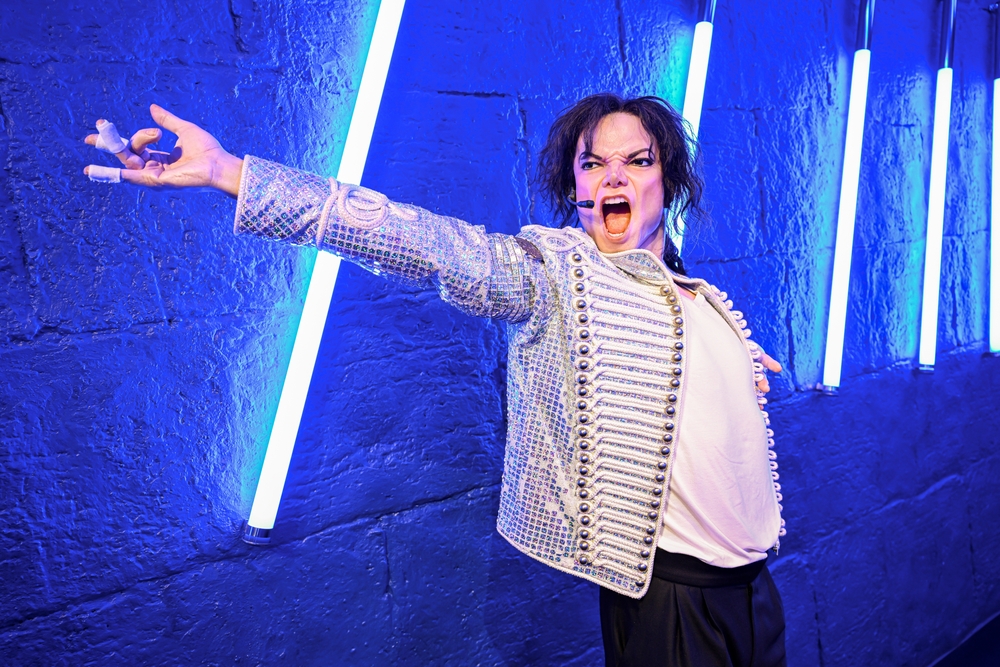

10. Michael Jackson

Michael Jackson, the King of Pop, was no stranger to financial controversy despite his monumental success. Jackson’s lavish spending habits, combined with costly legal battles and the maintenance of his Neverland Ranch, led to significant financial strain. By the time of his death in 2009, he was reportedly hundreds of millions of dollars in debt. Jackson’s financial challenges highlight the complexity of managing wealth in the face of extravagant spending and legal troubles. Despite his iconic status, his financial woes were a stark reminder of the pitfalls that can accompany immense fame.

In the years since his passing, Jackson’s estate has worked to resolve his debts and restore his financial legacy. The success of various posthumous projects and ventures has significantly improved the financial standing of his estate. Jackson’s story emphasizes the importance of financial oversight and strategic planning, even for those at the pinnacle of success. His journey serves as a cautionary tale of how financial mismanagement can overshadow monumental achievements. However, the revival of his estate underscores the potential for recovery and legacy preservation.

11. Debbie Reynolds

Debbie Reynolds, beloved for her roles in films like “Singin’ in the Rain,” faced financial difficulties due in part to her investments in a themed hotel. Despite her success on screen, Reynolds’ venture into the hospitality industry proved unsustainable, leading her to file for bankruptcy in 1997. Her financial challenges were a reminder of the risks associated with business ventures outside one’s area of expertise. Reynolds’ story highlights the importance of understanding the complexities of different industries before investing. Her struggles emphasize the financial vulnerabilities that even seasoned entertainers can face.

After filing for bankruptcy, Reynolds focused on her acting career to regain financial stability. Her resilience in the face of financial setbacks was evident as she continued to perform and engage with her adoring fans. Reynolds’ journey is a testament to her tenacity and commitment to overcoming obstacles. Her ability to bounce back and maintain a successful career serves as an inspiration to others facing similar challenges. Reynolds’ story illustrates the potential for reinvention and recovery, even after significant financial setbacks.

12. Cyndi Lauper

Cyndi Lauper, the pop icon known for hits like “Girls Just Want to Have Fun,” faced financial turmoil early in her career. After her first band broke up, Lauper found herself broke and struggling to make ends meet. Her financial challenges were exacerbated by legal battles with former management, leaving her with mounting debts. Lauper’s story is a reminder of the volatility of the music industry and the financial struggles that can accompany it. Despite the setbacks, her resilience and dedication to her craft propelled her to eventual success.

Lauper’s journey to rebuild her career involved reinventing her music and image, leading to a resurgence in popularity. Her ability to adapt and evolve in a competitive industry highlights the importance of perseverance and creativity. Lauper’s story serves as an inspiring reminder that financial difficulties can be overcome with determination and strategic thinking. Her resurgence in the music world exemplifies the potential for recovery and long-term success. Lauper’s journey is a testament to her enduring talent and unwavering commitment to her passion.

13. Wesley Snipes

Wesley Snipes, known for his action-packed roles in films like “Blade,” faced financial ruin due to tax issues. Snipes’ failure to pay taxes for several years resulted in a highly publicized court battle and eventual imprisonment. His financial challenges were compounded by legal fees and penalties, leading to significant debt. Snipes’ story underscores the importance of compliance with tax laws and the severe consequences of neglecting financial responsibilities. Despite his legal troubles, his dedication to rebuilding his career is commendable.

Following his release from prison, Snipes focused on revitalizing his acting career and addressing his financial obligations. His journey is a reminder of the resilience required to overcome legal and financial challenges. Snipes’ ability to reinvent himself and continue working in Hollywood demonstrates the potential for recovery. His story serves as a cautionary tale about the importance of financial diligence and legal compliance. Despite the setbacks, Snipes’ efforts to rebuild his life highlight the possibility of redemption and renewal.

14. Pamela Anderson

Pamela Anderson, famous for her role in “Baywatch,” faced financial difficulties despite her successful career. Anderson’s financial challenges were largely due to unpaid taxes and costly home renovations that spiraled out of control. Her story is a reminder that even with a successful career, financial management is crucial to maintaining stability. Anderson’s financial woes highlight the importance of keeping track of expenses and avoiding unnecessary extravagance. Despite the setbacks, her resilience and focus on rebuilding her life are commendable.

In recent years, Anderson has worked to regain financial stability through various projects and advocacy work. Her journey illustrates the importance of adaptability and persistence in overcoming financial challenges. Anderson’s ability to continue working and remain in the public eye underscores the potential for recovery. Her story serves as an example of the importance of financial literacy and responsible spending. Despite the hurdles, Anderson’s efforts to bounce back reflect the possibility of reinvention and renewal.

15. Willie Nelson

Willie Nelson, the legendary country singer, faced financial ruin due to a massive tax bill. In 1990, the IRS seized most of Nelson’s assets to settle a multi-million-dollar debt. His financial challenges were a result of unpaid taxes and penalties, combined with bad investments. Nelson’s story underscores the importance of financial oversight and the severe consequences of tax neglect. Despite his financial woes, Nelson’s determination to overcome them is noteworthy.

To address his financial challenges, Nelson released a double album, aptly titled “The IRS Tapes: Who’ll Buy My Memories?” The album’s success, along with continuous touring, helped Nelson regain financial stability. His journey is a testament to his resilience and dedication to his craft. Nelson’s ability to turn financial hardship into an opportunity for creativity and recovery is inspiring. His story serves as a reminder of the importance of facing financial challenges head-on and finding innovative solutions.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.