Building wealth doesn’t always require a big salary or significant investments. Many of the wealthiest people have gotten there by adopting simple, inexpensive habits. These habits aren’t flashy or complicated, but when practiced consistently, they can have a substantial impact over time. Ready to find out how some small changes can lead to big results?

1. Automate Your Savings

Setting up automatic transfers to your savings account ensures you save consistently without even thinking about it. Automating savings takes the effort out of saving, making it a seamless part of your financial routine. According to financial planner Lauren Anastasio, people who automate their savings tend to accumulate more over time compared to those who rely on manual transfers. It’s about making saving the default action rather than a decision you need to make each month.

By automating your savings, you’re essentially paying yourself first. This method prevents you from spending money you intended to save, as it never sits in your checking account long enough to be tempting. Even small amounts add up over time, thanks to the power of compounding interest. Ultimately, this habit builds a safety net for emergencies or future investments, quietly growing in the background.

2. Track Your Spending

Keeping an eye on where your money goes is crucial to building wealth. Tracking your spending helps you identify patterns and areas where you might cut back. By understanding your spending habits, you can make more informed choices about how to allocate your resources. This awareness is often the first step towards making meaningful changes in your financial life.

There are plenty of apps available that can help you track your expenses effortlessly. By categorizing your spending, you gain insights into how much you’re spending on essentials versus non-essentials. Once you see the numbers, you can set realistic budgets and stick to them more effectively. Over time, this disciplined approach can create surplus funds for saving or investing.

3. Embrace Meal Planning

Meal planning is a simple way to save money while maintaining a healthy diet. By planning your meals in advance, you can make a shopping list that prevents impulse buys and food waste. Financial expert Emily Guy Birken notes that meal planning can significantly reduce the amount you spend on dining out and last-minute grocery runs. This habit not only keeps more cash in your wallet but also encourages healthier eating habits.

When you know what you’re going to eat each day, you can buy ingredients in bulk, which often reduces cost per meal. Cooking at home is nearly always cheaper than eating out, and with a plan in place, it’s easier to resist the convenience of takeout. Plus, you’ll likely find you enjoy meals that are made exactly to your taste and dietary needs. Over time, the savings from this practice can be redirected towards your financial goals.

4. Use Cashback And Rewards Programs

Taking advantage of cashback and rewards programs is a savvy way to make your spending work for you. Many credit cards and retailers offer incentives that give you a percentage back on your purchases. By using these programs for regular expenses, you can accumulate points or cash that can be redeemed for discounts, travel, or even direct deposits into your savings account. It’s like getting a small discount on everything you buy.

To maximize these benefits, choose programs that align with your spending habits. For example, if you spend a lot on groceries, look for a card that offers high cashback rates in that category. Just be sure to pay off your balance in full each month to avoid interest charges. Over time, these rewards can add up to substantial savings, making it well worth the effort to shop smarter.

5. Practice Mindful Spending

Mindful spending involves being intentional about where and how you spend your money. Instead of buying impulsively, take a moment to consider whether a purchase aligns with your values and financial goals. A study by behavioral economist Dan Ariely found that people who practice mindful spending often experience greater satisfaction with their purchases and a firmer grasp on their financial health. This habit encourages you to focus on what truly matters, rather than momentary desires.

When you practice mindful spending, you prioritize quality over quantity. This means you might spend more on certain purchases that offer lasting value while cutting back on things that don’t contribute to your happiness or financial well-being. Over time, this approach can lead to a more fulfilling financial life and help you build wealth more effectively. It’s all about making each dollar work towards your broader life goals.

6. Invest In Financial Education

A little knowledge can go a long way when it comes to building wealth. Investing in your financial education doesn’t have to be costly, thanks to the wealth of free or low-cost resources available. Books, podcasts, and online courses can provide valuable insights into budgeting, investing, and retirement planning. The more you know, the better equipped you are to make smart financial decisions.

Taking the time to educate yourself can pay off in unexpected ways. By understanding financial principles, you can more confidently navigate complex decisions and avoid common pitfalls. This knowledge empowers you to take control of your financial future, turning the abstract concept of wealth-building into a tangible reality. Remember, the best investment you can make is in yourself.

7. Set Financial Goals

Setting clear, achievable financial goals gives your saving and spending a purpose. Goals provide direction and motivation, helping you stay focused on what’s important. Research by psychologist Edwin Locke has shown that goal-setting can significantly enhance performance and motivation, leading to better outcomes. When you know what you’re working towards, it’s easier to make sacrifices and prioritize your finances accordingly.

Your goals can be short-term, like building an emergency fund, or long-term, such as saving for retirement or buying a home. The key is to make them specific, measurable, and realistic. By breaking larger goals into smaller steps, you can track your progress and celebrate milestones along the way. This not only keeps you motivated but also reinforces the habits that lead to lasting wealth.

8. Limit Subscription Services

In today’s digital age, subscription services can quickly eat away at your finances. It’s easy to lose track of how much you’re spending monthly on music, streaming, magazines, and apps. By regularly reviewing and canceling subscriptions you no longer use or need, you can prevent unnecessary expenses. This simple habit can free up money for saving or investing, without impacting your quality of life.

Prioritize subscriptions that provide genuine value and enhance your life. If you’re unsure about a service, take advantage of free trials before committing. Keep a list of all active subscriptions and review them quarterly to ensure you’re maximizing their benefits. Over time, these small adjustments can lead to significant savings, contributing to your wealth-building journey.

9. Buy Quality, Not Quantity

When it comes to building wealth, sometimes it’s better to spend a little more upfront for something that will last. Investing in quality items reduces the need for frequent replacements, saving you money in the long run. This principle applies to clothing, appliances, and even furniture. By focusing on quality over quantity, you make purchases that offer longevity and durability.

Quality items often come with warranties or guarantees that provide peace of mind and additional savings. While the initial cost may seem higher, the long-term savings and satisfaction often outweigh the upfront expense. This approach also encourages a more sustainable lifestyle, which is not only good for your wallet but also for the environment. Over time, these thoughtful purchases can lead to a more stable financial future.

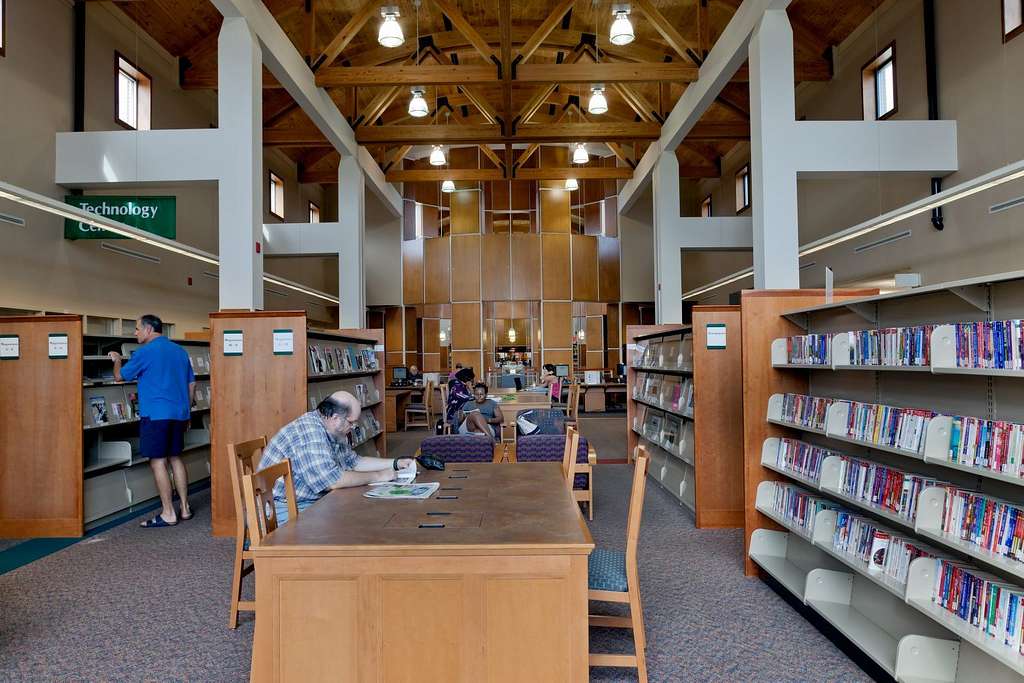

10. Make Use Of Public Resources

Public resources like libraries and community centers offer a wealth of free or low-cost services. From books and movies to workshops and events, these resources can provide entertainment and education without breaking the bank. By taking advantage of what’s available, you can enjoy a rich and fulfilling lifestyle while keeping your expenses low. This habit encourages you to explore and make the most of your local community.

Libraries often offer free access to digital resources as well, such as e-books and online courses. Community centers might host free fitness classes or cultural events that would otherwise cost money. Instead of paying for individual services, consider what you can access for free. Over time, the money you save can be redirected towards your financial goals.

11. Practice Energy Efficiency

Being mindful of your energy usage is not only good for the planet but also for your wallet. Simple actions like turning off lights when you leave a room or unplugging devices when they’re not in use can lead to noticeable savings on your utility bills. Investing in energy-efficient appliances and light bulbs is another cost-effective strategy. These small changes might seem insignificant, but they add up over time.

In addition to saving money, practicing energy efficiency can increase the value of your home. Many energy-efficient upgrades are also eligible for tax credits and rebates, further lowering your expenses. By reducing your energy consumption, you’re contributing to a more sustainable future while building wealth. It’s a win-win scenario that pays off in both the short and long term.

12. Declutter And Sell Unused Items

Take a look around your home, and you might find plenty of items you no longer use or need. Selling these items online or at a garage sale can bring in extra cash that can be directed towards savings or debt repayment. Decluttering your space not only simplifies your life but also provides a financial boost. This habit can be particularly effective if done regularly, as it keeps you mindful of what you truly need and appreciate.

There are plenty of platforms where you can sell your unused items, from furniture to clothing and electronics. Websites like eBay or apps like Decluttr make it easy to reach potential buyers. As you clear out the clutter, you might also find that you’re less tempted to buy new items. Over time, this practice helps streamline your environment and finances, making room for wealth to grow.

13. Plan Free Activities

Entertainment doesn’t have to come with a hefty price tag. By planning free activities, you can enjoy your leisure time without overspending. Check out local parks, free community events, or organize a potluck with friends. Not only does this save money, but it also encourages creativity and connection with others.

There’s a world of free entertainment out there if you know where to look. Museums often have free admission days, and many cities offer free concerts or movie nights in the park. Exploring these options can lead to enriching experiences that don’t cost a dime. Over time, prioritizing free activities can significantly reduce your leisure expenses, contributing to your wealth-building efforts.

14. Combat Impulse Purchases

Impulse buying is a common money drain that can sabotage your financial goals. To combat this, give yourself a cooling-off period before making non-essential purchases. Waiting 24 hours before purchasing gives you time to assess if the item is truly needed or just a fleeting desire. This simple practice can prevent buyer’s remorse and keep more money in your pocket.

By reducing impulse purchases, you’ll find that your spending aligns more closely with your budget and financial goals. This discipline can lead to more thoughtful spending habits, where every purchase is intentional and valuable. Over time, the money saved from avoiding unnecessary buys can be redirected towards savings or investments. This mindful approach to spending is a cornerstone of wealth-building.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.