Financial scandals have a way of capturing our attention, and when they involve celebrities, the intrigue only amplifies. These public figures, who seem to have it all, sometimes find themselves embroiled in financial fiascos that are as shocking as they are educational. From tax evasion to Ponzi schemes, these scandals remind us that even the rich and famous can fall prey to poor financial decisions. Let’s take a look at 12 of the biggest celebrity financial scandals of all time, where money, fame, and folly collided in spectacular fashion.

1. Johnny Depp’s Financial Freefall

Johnny Depp, one of Hollywood’s most bankable stars, saw his financial world unravel due to a toxic combination of lavish spending and legal battles. At his peak, Depp was earning tens of millions of dollars for his roles in blockbuster films. However, his $2 million monthly spending habits, including homes, private jets, and a $30,000 monthly wine budget, led to severe financial strain. Depp’s troubles were compounded by a high-profile legal battle with his former business managers, whom he accused of mishandling his funds.

The legal battle exposed Depp’s extravagant lifestyle and the challenges of managing immense wealth. While he has since taken steps to address his financial issues, the damage to his finances and reputation has been significant. Depp’s saga is a lesson in the importance of financial management and the risks of unchecked spending. Even with immense earning potential, financial mismanagement can lead to dire consequences.

2. Lindsay Lohan’s Financial & Legal Battles

Lindsay Lohan, once a promising young actress with a bright career ahead, found herself entangled in a web of financial and legal issues. Her struggles with addiction and legal battles took a significant toll on her earnings and reputation. Lohan’s financial woes were compounded by unpaid taxes, with the IRS seizing her assets to cover her debts. The actress’s spending habits, combined with her legal troubles, led to a precarious financial position.

Despite efforts to revive her career, Lohan has faced ongoing challenges in regaining her former financial standing. Her situation serves as a stark reminder of how quickly fortunes can change in the entertainment industry. While Lohan has made strides in recent years to rebuild her life and career, her financial troubles remain a cautionary tale. Her journey underscores the importance of financial responsibility and the risks of personal and professional mismanagement.

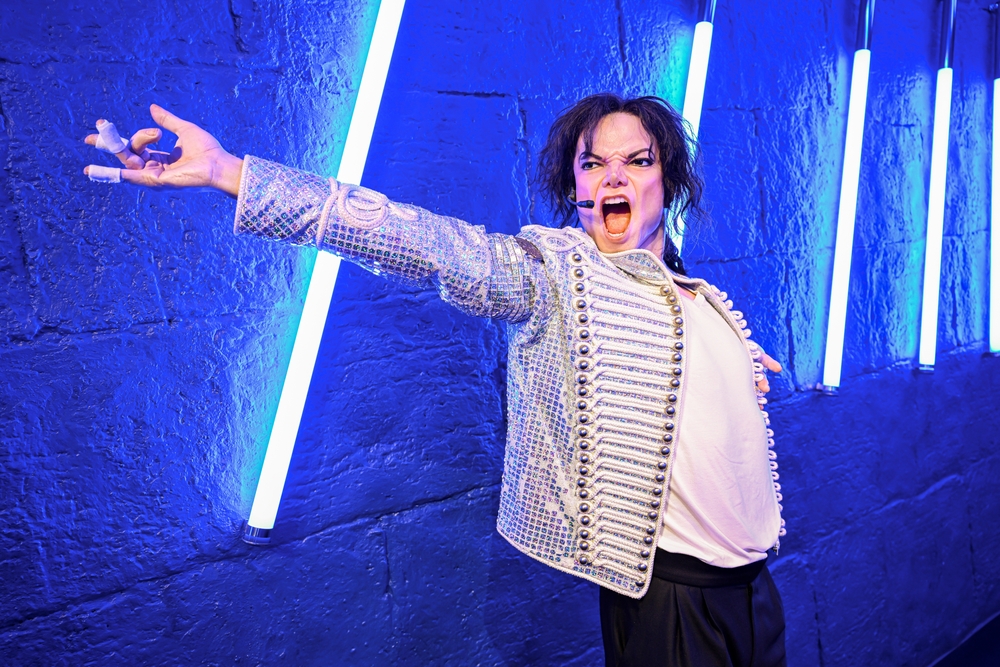

3. The Michael Jackson Loans Debacle

Michael Jackson, the King of Pop, was no stranger to financial troubles, despite his immense success and wealth. In the years leading up to his unfortunate death, he faced mounting debt largely due to extravagant spending and ill-advised loans. According to News.com, at one point, Jackson was reportedly $400 million in debt, resulting in a precarious financial situation. His lavish lifestyle, including the upkeep of Neverland Ranch and various legal battles, took a significant toll on his finances.

To manage his debt, Jackson often resorted to taking out loans against his valuable assets, including the rights to his music catalog. Unfortunately, this only added to his financial woes, as he struggled to keep up with the repayments. The situation became so dire that foreclosure on his beloved Neverland Ranch was narrowly avoided. Even after his passing, the financial saga continued as executors worked to stabilize his estate. Jackson’s story is a testament to how quickly even astronomical wealth can diminish.

4. The Downfall of Wesley Snipes

Wesley Snipes, known for his iconic roles in movies like “Blade,” found himself in a different kind of spotlight when he was indicted for tax evasion in 2006. According to Forbes, Snipes neglected to pay taxes on his income from 1999 to 2004, amounting to a whopping $7 million. Claiming to be a victim of bad advice, he argued that he had no legal obligation to pay taxes. However, the court disagreed, finding him guilty of three misdemeanor counts of failing to file tax returns.

The scandal resulted in Snipes serving a three-year prison sentence starting in 2010. While he attempted to appeal the conviction, the courts upheld the decision, leaving his career and finances in a precarious state. The entire ordeal served as a costly lesson in the importance of adhering to tax laws. Although Snipes attempted a comeback after his release, the financial hit and the damage to his reputation were significant. This saga is a reminder that no matter how famous or successful one may be, avoiding tax obligations can lead to serious repercussions.

5. Nicolas Cage’s Spending Spree

Nicolas Cage, one of Hollywood’s most diverse actors, made headlines not just for his eclectic roles, but also for his extravagant spending habits that led to significant financial trouble. At the height of his career, Cage amassed a fortune, reportedly earning $40 million in 2009 alone. However, his penchant for luxury purchases, including multiple mansions, exotic cars, and rare collectibles, saw his bank accounts dwindle rapidly. According to ABC News, Cage found himself in hot water with the IRS, owing $6.3 million in back taxes.

To alleviate his debts, Cage was forced to sell off many of his treasured assets, including a rare $276,000 dinosaur skull and a haunted mansion in New Orleans. Despite these measures, the financial strain took a toll on his acting career, with Cage taking on numerous roles to pay off his debts. The actor has since bounced back, though he continues to work tirelessly to maintain financial stability. Cage’s saga is a stark reminder of how unchecked spending, even for a superstar, can lead to financial ruin.

6. MC Hammer’s Bankruptcy Blues

MC Hammer, the rap sensation who dominated the early ’90s with hits like “U Can’t Touch This,” became a cautionary tale of financial mismanagement. At the peak of his career, Hammer was worth an estimated $33 million, a fortune he quickly spent on a lavish lifestyle. His expenses included a 40,000-square-foot mansion, a staff of 200, and a collection of luxury cars. However, by 1996, his empire came crashing down, resulting in a bankruptcy filing that revealed a staggering $13 million in debt.

Hammer’s financial woes were compounded by lawsuits from former employees and unpaid taxes. His extravagant spending habits, coupled with poor financial advice, led to his downfall. Despite the setback, Hammer worked to rebuild his career and finances, eventually finding success in tech investments and as a preacher. His story serves as a poignant example of the perils of excessive spending and the importance of sound financial planning. Even in the face of financial ruin, Hammer’s resilience and adaptability allowed him to reinvent himself.

7. Kim Basinger’s Town Troubles

In the late 1980s, Kim Basinger was a prominent Hollywood actress enjoying the height of her career. However, her ambitions took a hit when she decided to purchase the small town of Braselton, Georgia, for $20 million, with plans to turn it into a tourist attraction. This bold move, however, turned into a financial disaster when she encountered legal troubles over a movie deal she backed out of. The resulting financial strain forced Basinger to sell her share in the town and file for bankruptcy in 1993.

The financial fallout from these ventures led to strained relations with those involved and a significant hit to her reputation. Basinger’s decision to invest heavily without a clear plan highlights the risks of impulsive financial decisions, even for those with deep pockets. Despite the setback, she managed to revive her acting career with roles in critically acclaimed films like “L.A. Confidential.” Her story is a reminder of the importance of due diligence and strategic planning in business ventures.

8. The Rise and Fall of Mike Tyson

Once the undisputed heavyweight boxing champion, Mike Tyson is as well known for his financial implosion as he is for his prowess in the ring. At the height of his career, Tyson accumulated over $300 million, much of which was squandered on extravagant purchases and a lavish lifestyle. Legal battles, a costly divorce, and a prison sentence hastened his financial downfall. By 2003, Tyson found himself declaring bankruptcy, with debts totaling millions.

Tyson’s rollercoaster of financial highs and lows was a cautionary tale for athletes and celebrities alike. Despite these setbacks, he reinvented himself, succeeding in entertainment and business ventures, including his cannabis company. Tyson’s journey underscores the importance of financial literacy and the risks associated with fame and fortune. His ability to rebound from financial ruin showcases resilience and adaptability.

8. Tori Spelling’s Mountain of Debt

Tori Spelling, daughter of legendary TV producer Aaron Spelling, has been open about her lifelong struggle with debt, despite her privileged upbringing. Her financial troubles have been well-documented, with Spelling reportedly owing significant amounts in taxes and credit card debt. The pressure to maintain a lifestyle reflecting her Hollywood roots contributed to her financial woes. Spelling has faced multiple lawsuits and liens over unpaid bills and has admitted to living paycheck to paycheck.

Her financial issues were further exacerbated by the expenses associated with raising her children and maintaining her family’s lifestyle. Despite these challenges, Spelling has remained a fixture in entertainment, leveraging her reality TV career to address her financial obligations. Her story highlights the challenges of living beyond one’s means, even in the face of substantial earnings. Spelling’s candidness about her financial struggles has resonated with many, providing a cautionary tale of Hollywood excess.

10. Pamela Anderson’s Tax Troubles

Pamela Anderson, best known for her role on “Baywatch,” has faced a series of financial challenges over the years. Despite her success, Anderson has been plagued by unpaid tax bills, leading to multiple liens against her assets. Her financial struggles have been well-publicized, with reports of lavish spending contributing to her woes. Anderson’s situation was further complicated by a series of unsuccessful relationships and legal battles that drained her finances.

Despite these challenges, Anderson has remained a public figure, leveraging her fame for various advocacy and business ventures. Her financial troubles serve as a reminder of the pitfalls of fame and the importance of managing one’s finances wisely. Anderson’s resilience in the face of financial adversity is a testament to her determination to maintain her public image and personal life. Her journey highlights the need for sound financial planning and the dangers of living beyond one’s means.

11. Toni Braxton’s Repeated Bankruptcies

Toni Braxton, the Grammy-winning singer known for hits like “Un-Break My Heart,” has faced financial trouble multiple times in her career. Despite her musical success, Braxton has filed for bankruptcy twice, citing issues with her recording contracts and health problems that impacted her earning ability. Her financial woes were exacerbated by a lavish lifestyle and significant medical expenses related to her lupus diagnosis. Braxton’s legal battles over her contracts highlighted the challenges artists face in the music industry.

Despite these setbacks, Braxton has managed to regain her footing, continuing to release music and tour successfully. Her candidness about her financial struggles has helped demystify the challenges faced by artists in the public eye. Braxton’s story is a lesson in resilience and the importance of financial literacy in the entertainment industry. Her ability to bounce back from financial adversity is a testament to her talent and determination.

12. Burt Reynolds’ Money Woes

A Hollywood icon, Burt Reynolds experienced significant financial struggles despite a successful career spanning decades. Known for his roles in classics like “Smokey and the Bandit,” Reynolds faced numerous financial setbacks, including a costly divorce from actress Loni Anderson. The divorce, coupled with poor investments and lavish spending, led to a bankruptcy filing in the 1990s. Reynolds’ financial troubles were compounded by bad business decisions and a declining career in his later years.

Despite these challenges, Reynolds continued to work in the industry, making a comeback with roles in acclaimed films like “Boogie Nights.” His financial journey serves as a cautionary tale of the risks of poor financial management, even for seasoned actors. Reynolds’ ability to persevere in the face of financial adversity underscores the importance of resilience and adaptability. His story highlights the need for careful financial planning, especially for those in the volatile entertainment industry.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.