Some purchases look totally manageable—until you realize they’re sneaky little money pits in disguise. What starts as a reasonable upfront cost quickly spirals into hidden fees, ongoing upkeep, and surprise expenses you didn’t see coming. From “cheap” gadgets to lifestyle upgrades that quietly drain your budget, ownership isn’t always as affordable as it seems. Before you swipe that card or click “buy now,” it’s worth asking what you’re really committing to. Here are 15 things that seem affordable—until you actually own them.

1. Gym Memberships

Securing a gym membership is like a rite of passage for the wellness-minded. It feels straightforward: pay a monthly fee and get fit. But once you’ve committed, the hidden costs start to accumulate. From personal training sessions that you suddenly can’t live without, to the yoga classes that aren’t included in your base rate, your wallet starts to feel the burn as much as your quads.

Consider the 2019 study by the International Health, Racquet & Sportsclub Association, which found that nearly 50% of new gym members quit within the first six months, often due to the unexpected expenses that arise. That new protein powder your gym buddy swears by? It’s another hit to your budget. Suddenly, the humble gym membership morphs into a lifestyle choice with a price tag to match.

2. Pets

Those puppy-dog eyes make you believe that a furry friend is not only affordable but a vital part of your life. The initial adoption fee seems like a small price to pay for such unconditional love. However, once the pet is settled in, the costs come as fast as a wagging tail. Vet bills, grooming, and that premium pet food you can’t imagine not feeding them all add up to a financial commitment you might not have anticipated.

The cost of owning a pet is escalating quite rapidly. Each year brings new expenses, from replacing chewed-up shoes to specialized training classes. You realize that the price of maintaining the pet’s health and happiness is far beyond the initial outlay. In the end, those puppy-dog eyes you fell for come with a price tag that keeps growing.

3. Home Ownership

Buying a home feels like you’re stepping into the American Dream with both feet. You’ve done the math, crunched the numbers, and the mortgage seems doable. But lurking behind that mortgage is a parade of costs you didn’t quite see coming, from property taxes to essential repairs. You quickly learn that owning a home is less a one-time purchase and more a lifelong financial obligation.

Kevin Mahoney, a certified financial planner, points out that many homeowners underestimate the ongoing costs associated with home maintenance. The surprise expenses start with leaky roofs and end with unexpectedly high property taxes. You envisioned a white-picket-fence lifestyle, but the reality includes a never-ending cycle of bills and repairs. Turns out, the dream is a costly one to maintain.

4. Weddings

The images of a perfect wedding day often come with a romantic haze that clouds financial judgment. Setting a wedding budget seems easy enough until you realize how quickly costs can spiral. Venue fees, catering, flowers, and that dress all add up to a princely sum. The day you say “I do,” you might also be saying goodbye to your savings.

Every little detail, from monogrammed napkins to party favors, demands its share of your budget. Suddenly, keeping up with Pinterest-perfect weddings feels less like a goal and more like a financial struggle. The wedding day itself, while magical, is a stark reminder of the vast financial commitment that came with it. What seemed like a single day of celebration quickly becomes a long-term financial memory.

5. A New Car

Who hasn’t walked into a car dealership and been lured by the smell of new leather seats? That monthly car payment seems manageable, a small price for the freedom a new car brings. But then comes the reality: insurance premiums, maintenance, and the dreaded depreciation. In fact, according to Dr. Peter Kelly, an economist at the National Automobile Dealers Association, a new car loses about 20% of its value the minute you drive it off the lot.

Every oil change and tire replacement chips away at your budget, and before long, you’re spending more than anticipated. The freedom of the open road comes with a toll booth at every turn. That shiny new car, once a symbol of independence, transforms into a reminder of the ongoing costs of ownership. It’s a fast ride to financial realization.

6. Smartphones

Smartphones are the modern-day sirens, promising connectivity and convenience in one sleek package. The initial cost, often hidden within a two-year contract, feels like a bargain. Yet, the expenses don’t end there: apps, accessories, and inevitable repairs make sure of that. The constant upgrades encouraged by manufacturers add an extra layer to this financial commitment.

A cracked screen or a worn-out battery quickly deadens the affordability illusion. The cycle of upgrades and replacements becomes a never-ending loop. This small device, which fits so neatly in your pocket, ends up draining your wallet with stealthy efficiency. The real cost of ownership rears its head long after the initial purchase.

7. Streaming Services

In the era of cord-cutting, streaming services captivate with promises of endless entertainment for a modest fee. Signing up for one or two feels like a savvy financial move, until you realize how many you need to cover all your favorite shows. A 2020 report by media analyst Sarah Perez from TechCrunch highlights that the average household subscribes to more than four streaming services, each with its own fee structure.

The allure of choice quickly translates to a compounded monthly expense. Each service provides something the others don’t, leading to a situation where you’re paying for more than you can watch. What started as a cost-saving measure morphs into a bloated monthly bill. There’s a reason streaming services are often bundled with regrets.

8. Designer Clothing

Owning designer clothing is a declaration, a personal style statement that tells the world you value quality and exclusivity. The initial purchase, whether on sale or a moment of indulgence, feels justified. But then you realize that each garment’s upkeep is its own saga, demanding special dry-cleaning and care. What you thought was an occasional splurge becomes a constant drain.

Fashion is a hungry beast, always demanding the next season’s must-haves. Soon, your closet is filled with items that require delicate handling and high maintenance. As the cost of ownership grows, the allure of the designer label dims. The “investment” in your wardrobe requires more than just currency; it demands your constant financial attention.

9. High-End Kitchen Appliances

That state-of-the-art coffee maker seemed like the key to a perfect morning ritual. The lustrous finish and promises of barista-quality beverages at home were irresistible. However, each cup brewed reveals the hidden costs: specialty beans, filters, and regular cleaning that rival your old morning café tab. The illusion of convenience shatters when you see the ongoing expenses.

Kitchen appliances promise efficiency and luxury, yet require costly upkeep to deliver on those promises. From pricier ingredients to specialty cleaning products, these items demand more than just counter space. Your kitchen quickly becomes a testament to aspirational living with a cost that matches. The dream of culinary mastery comes with a hefty price tag.

10. A Boat

The idea of smooth sailing on a sun-kissed lake is undeniably appealing. You’re seduced by the notion of escapism, of owning a piece of luxury that dances on the waves. But very soon, you’re caught in the undertow of maintenance fees, storage costs, and insurance premiums. The watercraft reality hits hard and fast, leaving your finances feeling shipwrecked.

Each outing requires more than just fuel; it demands costly upkeep and attention. The lure of the open water fades as the bills pile up. A boat, often the symbol of freedom, ends up anchoring you to a financial burden. The high seas come with a high cost of entry and an even higher cost of ownership.

11. Home Renovations

Walking through a newly renovated space can inspire visions of transforming your own home into a haven of style and comfort. Initial estimates might seem reasonable, but as anyone who’s dared to embark on this journey knows, those figures rarely hold. Surprise structural issues and endless material upgrades inflate the budget faster than you can say “open concept.” The dream of enhancement quickly turns into a financial nightmare.

Every additional corner of your redesign seems to come with an exponential price increase. Suddenly, the excitement of choosing paints and fixtures is overshadowed by the dread of unforeseen expenses. What was meant to be a personal oasis becomes a money pit. The price of renovation is a lesson in expectations versus reality.

12. A Camper

The idea of hitting the open road with a home-on-wheels is irresistibly romantic. The freedom to explore at your own pace is a siren song for the adventurous spirit. However, the costs of maintenance, repairs, and campground fees soon sour the romance. Every trip reveals another financial layer you didn’t expect.

The initial purchase entices with promises of endless adventures, yet the upkeep demands constant investment. Each journey taxes both your patience and your wallet as unexpected costs crop up. In the end, the camper that was supposed to embody freedom becomes a complex puzzle of financial burdens. The open road, it turns out, is riddled with tolls.

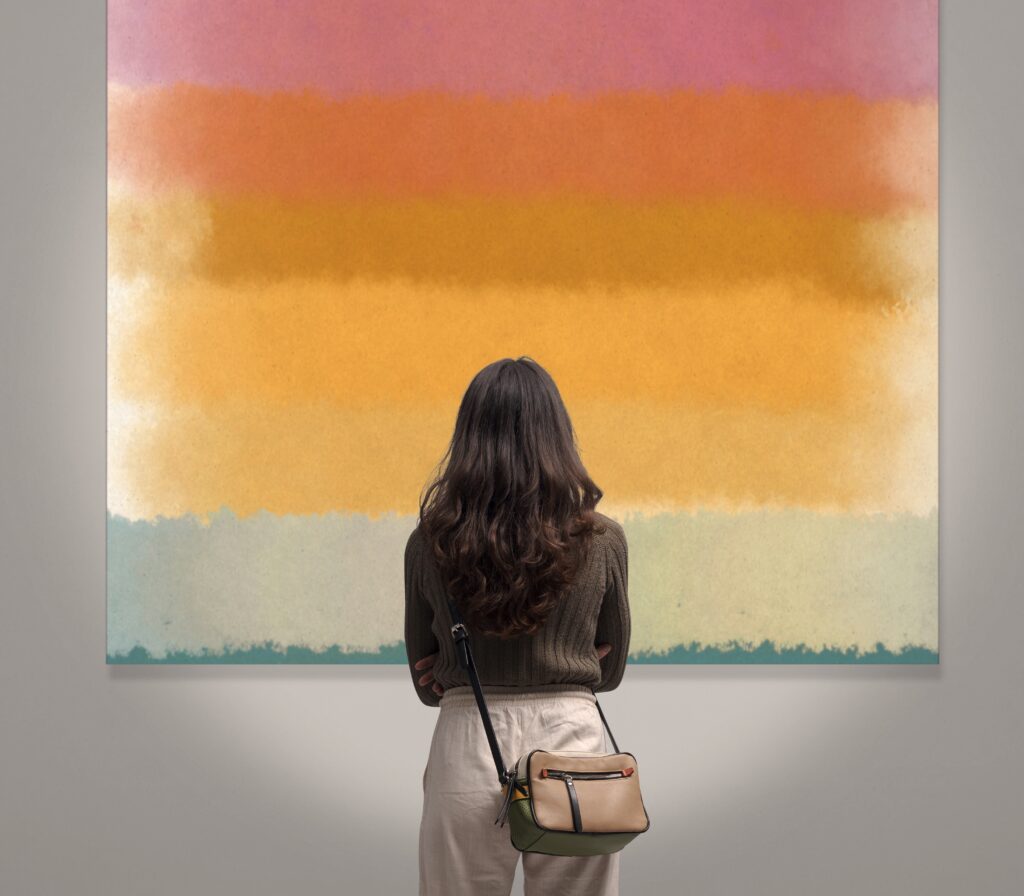

13. Art

Art collecting is more than an investment; it’s a passion that speaks to the soul. That initial acquisition feels like a wise financial move, a cultural asset that appreciates over time. But once it’s on your wall, the costs become apparent: insurance, restoration, and secure storage for your growing collection. Each piece demands care, with a price tag that keeps pace with its aesthetic value.

The world of art ownership is fraught with hidden expenses. Beyond the gallery price, maintaining and protecting your collection becomes a costly endeavor. The initial thrill of acquisition is tempered by the ongoing financial commitment. In the end, the value of art is as much about monetary investment as it is about personal enrichment.

14. Wine Collections

At first, growing a wine collection seems like a sophisticated hobby, a way to invest in both pleasure and prestige. The allure of rare vintages beckons, and you imagine a cellar full of liquid treasures. But the reality of climate-controlled storage, insurance, and the temptation to constantly add to your collection quickly erodes your budget. It becomes clear that each bottle carries an ongoing financial obligation.

The act of collecting transforms into a delicate balance between passion and practicality. As your collection grows, so does the complexity of managing it. What starts as a leisurely pastime evolves into an intricate dance of logistics and finance. Wine may age gracefully, but the cost of keeping it does not.

15. Vacation Homes

A second home promises a personal retreat, a permanent vacation from the everyday. The initial cost may seem manageable, especially in a buyer’s market. However, additional taxes, maintenance fees, and the demands of managing a property from afar soon follow. The dream of a getaway turns into a constant financial juggle.

Maintaining a second home requires more than occasional visits. It demands a commitment to upkeep and a readiness for unexpected costs. The reality of ongoing expenses overshadows the vision of a serene escape. In the end, what was meant to be a sanctuary feels more like a second set of responsibilities.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.