Boomers are passing the baton—and by baton, we mean somewhere around $84 trillion in real estate, stocks, businesses, and dusty old coin collections. It’s the biggest generational money handoff in history, and if you’re lucky, your name’s on the list. But here’s the bad news: inheritances don’t manage themselves. One bad decision, one missing document, one bitter cousin, and poof—the family lake house becomes probate court evidence.

Whether you’re inheriting a modest nest egg or passing one on, this is your inheritance warning label. It’s not enough to just “have a will” or “trust your family.” You need a plan, paperwork, and probably a few awkward conversations. From digital assets to dirty little tax traps, here are 15 ways to make sure the wealth transfer doesn’t end in disaster. Because if your family’s legacy is going to blow up, let it be for something cool—not because no one updated the beneficiary forms.

1. Have the Money Talk—Early and Often

No one likes talking about death and money, but silence breeds chaos. If your family has no idea what your wishes are—or worse, assumes—they’ll fight. Like, actual courtroom drama kind of fighting. And those fights can go on for years.

Forbes points out that inheritance fights often come from confusion, not greed. So rip off the Band-Aid and have the conversation. Be clear. Be honest. And don’t just talk once—make it a regular thing. A well-informed family is way more likely to respect the plan. Put it in writing to back it up. And remember: if you don’t speak for yourself now, a lawyer (or a judge) will later.

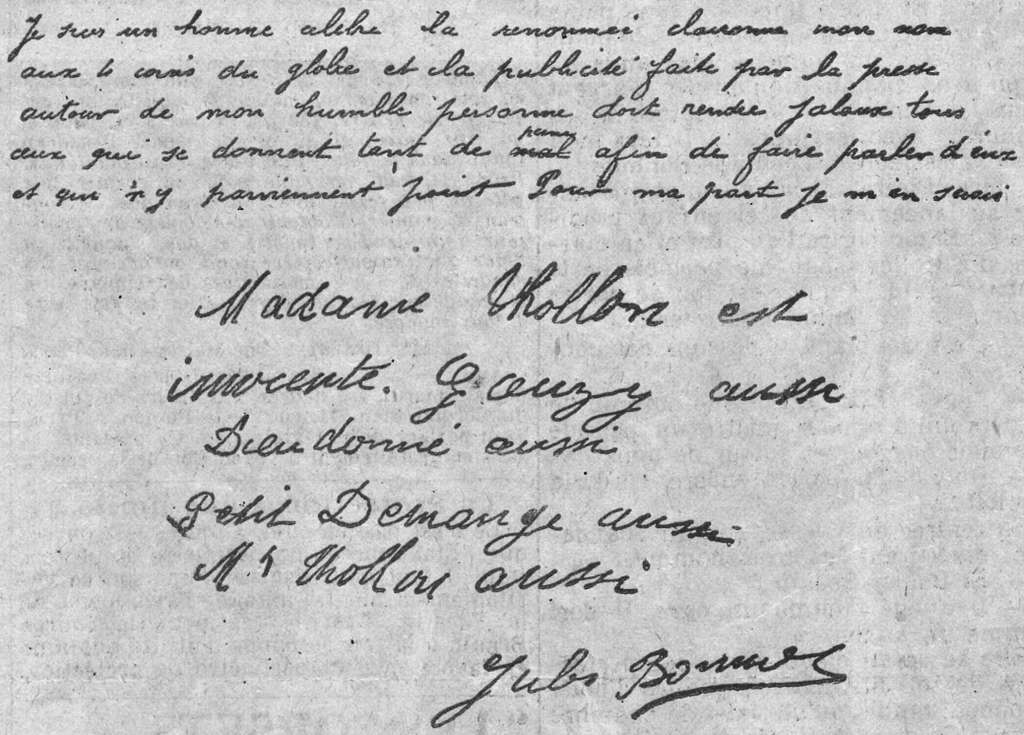

2. Get That Will in Writing—And Keep It Updated

No, you’re not too young to have a will. And yes, if you die without one, the government gets to play referee with your stuff. A will lays it all out: who gets what, who’s in charge, and what happens if people disagree. Without one, you’re basically giving the state a blank canvas.

According to The Times, there’s a push to modernize old will laws, making them easier to create and harder to dispute. Even so, a handwritten will on a napkin probably won’t cut it. Update yours after any big life change—marriage, kids, divorce, Vegas blackout. It’s not a one-and-done deal. And yes, tell someone where it is. No one wants to hunt through your sock drawer during a crisis. Bonus points for backing it up digitally, just in case. Also, have a backup executor named. Life’s unpredictable—so plan like it.

3. Set Up a Trust—Because Probate Is a Pain

You hear “trust,” you think yachts and polo. But trusts are just smart planning tools, and they’re not just for billionaires. A living trust, for instance, lets your assets bypass probate—a slow, public, expensive court process. It’s like the TSA PreCheck of estate planning.

Investopedia breaks down how trusts also offer control over who gets what and when. Want your kid to inherit your house but only after they turn 30 and stop dating losers? Boom—trust. You can even protect assets from creditors or second spouses. The key is working with an attorney who knows their stuff. Don’t DIY this one on LegalZoom and hope for the best. And yes, trusts can be revocable—you’re not locking it in forever. Update as needed.

4. Consider a QTIP or A-B Trust for Blended Families

Blended families mean more love—and more potential landmines. If you want to provide for your new spouse but also make sure your kids from a first marriage get their share, QTIP and A-B trusts are the move. These setups split the estate smartly: spouse gets support, kids get the legacy later. It’s win-win—or at least not a lawsuit.

MarketWatch outlines how these trusts protect both camps. No stepparent re-gifting the lake house to their own offspring. It’s peace of mind in a document. And when done right, it keeps everyone (mostly) happy and the drama to a minimum. These plans work best when paired with candid conversations. Transparency is the trust’s BFF. And yes, you can tweak them if life throws curveballs.

5. Stay Informed on Tax Laws—They’re Always Changing

Tax laws are as stable as a reality TV relationship. One year your estate is safe, the next it’s triggering IRS alarms. Keep an eye on the estate tax exemption, which could shrink soon, affecting even middle-class families. The game board keeps shifting—stay ready.

Kiplinger warns that changes to the step-up basis rule could mean bigger capital gains taxes for your heirs. Translation: they could owe thousands on that house you bought for peanuts in ‘89. Work with a tax pro to get ahead of this. Timing gifts, setting up trusts, and using life insurance strategically can all reduce the burden. Don’t wait until April 15 to start panicking. Make this part of your yearly financial review. And honestly, even if you think you’re “not rich enough” to care—double check.

6. Digitize Your Estate Plan

This isn’t 1974—you’ve got digital assets, whether you know it or not. Emails, crypto, photo backups, even that super embarrassing old blog—they all count. If no one has your passwords or even knows what to look for, your digital life could vanish. Not to mention any money sitting in online accounts or apps.

Create a secure, centralized list of your digital accounts and make sure your executor knows how to access it. Some people use password managers, others go old-school with a sealed envelope (just don’t store it in the freezer, Karen). Either way, don’t leave your digital footprint to rot. Appoint a digital executor if your state allows it. And yes, you can leave your TikTok legacy to someone. Think of it as an online treasure map for your digital life. Also, make a note of what should be deleted versus what can live on. You probably don’t want your Etsy store running forever. Or maybe you do—just make it clear.

7. Use Gifting to Shrink Your Estate

You can give away $18,000 per person per year tax-free (as of 2024), and it’s one of the easiest ways to trim down your taxable estate. Got grandkids who need help with tuition or a down payment? That’s a win-win. The IRS stays off your back, and you get to witness the impact of your generosity while you’re still around.

Just keep it even. Uneven gifts can cause hurt feelings or raise red flags later. And don’t go overboard—IRS gift audits are not cute. You can also pay medical or education bills directly without triggering taxes. Make sure you document the gifts properly, too—uncle Sam loves paper trails. Think of it as sneakily passing the baton before the final lap. And if you’re feeling strategic, gift appreciated assets to shift future tax burdens. Just don’t do it without talking to a pro.

8. Think Charitably—It’s Tax-Savvy, Too

Donating to charity isn’t just good karma—it’s strategic. You can lower your estate’s value and support causes you care about. Set up a donor-advised fund or leave a portion of your estate to a nonprofit. It’s philanthropy with benefits.

Want to go big? Consider a charitable remainder trust. It gives you income during your lifetime and sends the rest to charity when you’re gone. Your heirs still get what they need, and you’re remembered for more than just passing on the vintage ashtray collection. Also, donations can soften the blow of estate taxes. And if your heirs know about your plans, it avoids those awkward “Wait, who’s the SPCA?” conversations later. Bonus: charities don’t pay inheritance tax. So more of your gift actually gets used.

9. Lock In Long-Term Care Plans

You can’t protect your inheritance if you burn through it on healthcare in your 80s. Long-term care—think nursing homes, home health aides, assisted living—can be brutally expensive. One illness and your whole nest egg is toast. That beachfront condo? Gone to pay for bedpans.

Start early. Consider long-term care insurance or setting aside a dedicated fund. Medicaid planning might also be an option, but it’s tricky. Talk to an expert—someone who understands the labyrinth. It’s not just about money; it’s about dignity and peace of mind. You don’t want your kids choosing between your medical bills and their mortgage. Make a plan so your golden years don’t bankrupt your legacy. It’s the most expensive thing no one likes to think about.

10. Update Beneficiary Forms Like a Hawk

Your will doesn’t override what your 401(k), IRA, or life insurance says. If your ex from 2009 is still listed as your beneficiary, congrats—you just paid for their beach house. These forms are legally binding and take priority. Yikes.

Review and update your forms regularly—after every big life event (marriage, divorce, birth, death, midlife crisis). It’s five minutes of admin that could save years of court battles. Also, triple-check names and details. Typos have torpedoed inheritances before. Don’t rely on memory—pull up the actual docs. And if you’re unsure, call the institution and ask. The peace of mind is worth the minor hassle.

11. Shield Assets from Creditors

Worried your heirs might blow it all—or worse, lose it in a lawsuit? Asset protection trusts can keep your legacy under lock and key. These are especially useful if your beneficiaries are in risky professions or messy relationships. Because not everyone makes great life choices.

You’ll need a pro to set this up right—don’t try to wing it with a Reddit post. The protection only works if the trust is created in advance, before any financial drama hits. Waiting until trouble arrives? Too late. These trusts can also guard against future divorces and business failures. Think of it as giving your money a bulletproof vest. Not flashy, but smart as hell.

12. Life Insurance as Inheritance Backup

Life insurance isn’t just for covering funeral costs—it can be a strategic inheritance tool. If your estate is asset-rich but cash-poor (like real estate or a family business), your heirs might not have access to funds when they need them most. That’s where life insurance comes in clutch. Instant liquidity.

You can also use it to “equalize” inheritances. For example, one kid gets the house, the other gets the insurance payout. No messy property sales. And if you set it up through an irrevocable life insurance trust (ILIT), it stays out of your estate and isn’t taxed. Pretty slick. Just make sure the premiums are paid up and the beneficiaries are correct. Otherwise, it’s a very expensive mistake.

13. Plan for Special Needs Without Compromising Benefits

If someone in your family has special needs, a regular inheritance might hurt more than help. It could disqualify them from government assistance like Medicaid or SSI. A special needs trust solves that problem. It protects their access to services while still providing financial support.

The trust holds assets and is managed by a trustee for the beneficiary’s benefit. It can cover things like education, therapy, transportation—just not food or housing, which the government handles. You’re basically giving them the extras without screwing up their eligibility. Get legal help for this one—it has to be airtight. The wrong language can unravel everything. And yes, this is one of those “do it now, not later” situations.

14. Put Sentimental Stuff in Writing

Money fights are one thing—fighting over grandma’s ring is a whole new level of ugly. Heirlooms carry emotional weight, and if you don’t spell out who gets what, people assume. And people are terrible at assuming. That antique lamp might turn into World War III.

Create a separate personal property memo and attach it to your will (if your state allows it). Be specific—“the gold bracelet in the blue box for Lucy” beats “my jewelry to the girls.” If something has a story, share it. Your kids will understand its value more if they know why it mattered to you. You can also film a short video explaining your choices, which is surprisingly effective. No lawyer needed—just clarity and honesty.

15. Build Your Dream Team of Pros

Estate planning isn’t a solo project. You need a crew: an estate attorney, a financial advisor, maybe a CPA or insurance specialist. Each one brings a different set of eyes—and catches stuff you’d never think of. This is the Avengers of inheritance strategy.

Yes, it costs money. But bad planning costs more. You’re not just protecting assets—you’re protecting relationships, avoiding court, and making sure your wishes are carried out. Think of them as legacy architects. They make sure your plan stands the test of time (and family drama). And with tax laws and financial tools always evolving, your team keeps your plan sharp. Don’t cheap out here.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.