Here’s the scoop: drugmakers are about to face the music as Medicare’s negotiation engine kicks into high gear in 2025. If you’ve ever peeked at your pharmacy receipt and done a double-take, you’re not alone—sky-high list prices have made life a little too spicy. Thanks to the Inflation Reduction Act, CMS is picking off the costliest single-source drugs with no competition and leaning into some serious bargaining power. This year’s roster includes a mix of diabetes giants, cancer blockers, asthma lifesavers, and more. Buckle up as we count down 16 prescription drugs that could see jaw-dropping price cuts next year—no medical degree required, just your best “I want affordable meds” face.

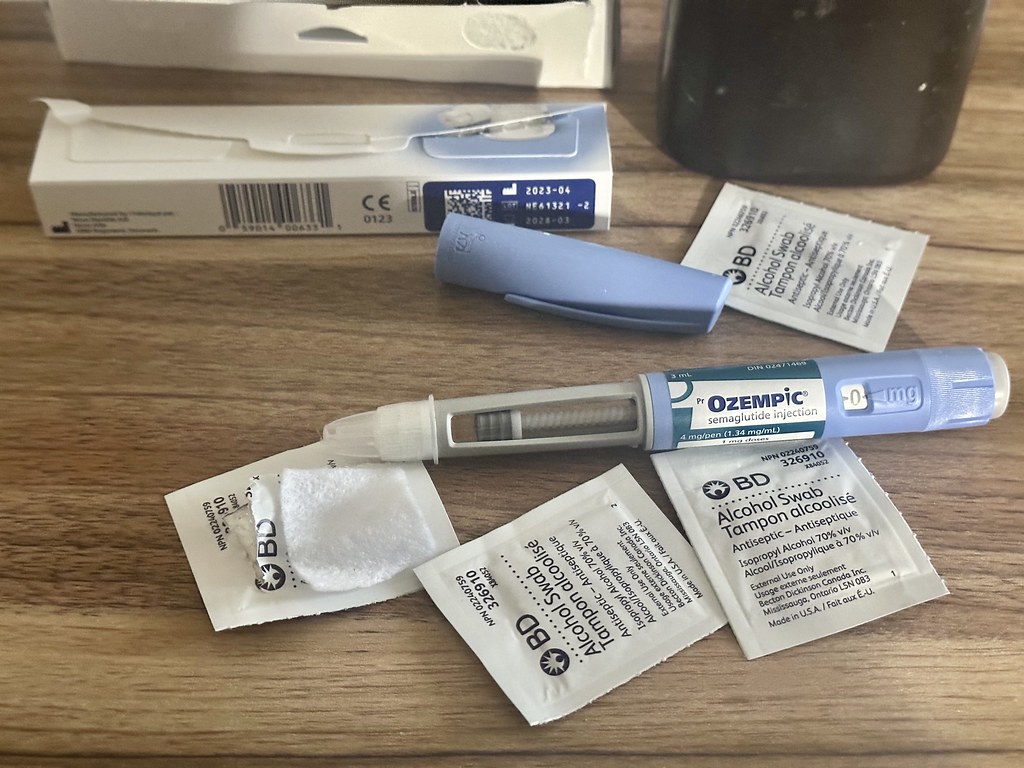

1. Ozempic

Ozempic is the OG of GLP-1 injectables, starring in countless TikTok transformations and showing up in your therapist’s anecdote about “that new diabetes med.” Its $900-plus price tag per month has made it as notorious as avocado toast in Manhattan, and with its patent exclusivity expiring and CMS eyeing big-spend drugs, it’s prime negotiating fodder. According to the Fortune, this semaglutide superstar could see list prices slashed by up to 50% once CMS sits at the table. Expect manufacturers to sweat as CMS factors in clinical benefit, unmet need, and budgetary impact, aiming to make Ozempic more wallet-friendly for the 4.5 million Medicare Part D users relying on it.

Patent cliffs and no biosimilar challengers mean Ozempic checks the Qualifying Single-Source Drug box, and its blockbuster billing—over $10 billion in Medicare Part D spend in 2024—makes it too big to ignore. With rivals like Wegovy (more on that soon) also in the pipeline, Novo Nordisk may have to recalibrate pricing across its semaglutide family. If negotiations succeed, seniors could see their copays drop by hundreds of dollars annually—imagine the extra frappuccino funds. Manufacturers will likely resist, but CMS has teeth: if a deal stalls, rebates kick in automatically under the IRA’s “backstop” mechanism. So, keep an eye on your inbox—2025 could be the year Ozempic becomes as affordable as your old metformin script.

2. Wegovy

Wegovy exploded onto the scene as the buzziest weight-loss shot since sliced bread, but its $1,300 monthly list price has left many dreaming of month-long ramen noodle diets. With obesity and diabetes tightly intertwined, CMS sees Wegovy’s dual benefits as a negotiating sweet spot. Per AP News, negotiators are already circling Wegovy, predicting that a deal could shave its price by nearly 40%. That’s a serious win for patients who’ve been on the hook for out-of-pocket costs north of $5,000 a year.

Aside from weight loss cred, Wegovy’s massive Medicare spend—over $4 billion in 2024—puts it squarely on CMS’s hit list. As part of the same semaglutide family as Ozempic, manufacturers will have to juggle pricing across both brands to avoid arbitrage headaches. The IRA’s statute demands CMS weigh clinical benefit against R&D recoupment, so Novo Nordisk’s negotiating stance will be watched like a reality TV reunion. If they play ball, seniors may finally get to enjoy their weight-loss wins without draining their 401(k) health fund. But if talks go south, those automatic rebates could still force a hefty markdown under the IRA’s enforcement rules.

3. Trelegy Ellipta

Asthma and COPD sufferers have long hailed Trelegy Ellipta as a “three-in-one” inhaler hero—combining an ICS, LABA, and LAMA in one sleek device. Still, its $700 per-inhaler list price has some patients rationing doses like precious hot sauce. CMS flagged Trelegy as a top-spend inhaled therapy in its January announcement, making it a negotiating priority. As Medical News Today reports, CMS officials see potential to cut Trelegy’s sticker price by 30–45%, easing access for the estimated 1.2 million Medicare beneficiaries who depend on it.

The negotiation calculus is straightforward: Trelegy’s lack of generic competitors and its $3.5 billion Part D tab earn it a front-row seat at the bargaining table. Manufacturer GSK will need to justify its price by demonstrating superior patient outcomes compared to mono- or dual-therapy alternatives. If CMS drives a hard bargain, patients could see copays drop from $50 to the Part D tier floor of $8.50—or even lower if rebate penalties apply. With both asthma and COPD patients often juggling multiple inhalers, a significant Trelegy discount could transform adherence and long-term lung health across the senior population.

4. Xtandi

Xtandi has been a game-changer in prostate cancer, extending lives for men with metastatic castration-resistant disease. But its list price—roughly $160,000 per year—makes it the luxury SUV of oncology drugs. CMS picked Xtandi for the 2025 negotiation cohort, aiming to rein in eye-popping oncology spending. As Investopia notes, Medicare’s $2.5 billion annual outlay on Xtandi marks it as “high on the cut list,” with potential price reductions of up to 25% in play.

Pfizer and Astellas will bring their A-game to defend R&D investments, but CMS holds the upper hand—if talks falter, the backstop rebate mechanism kicks in, imposing penalties that could exceed 95% of the list price. With no generic competitor until at least 2028, Xtandi’s negotiating window is wide open. CMS will assess clinical benefits like overall survival gains against launch and manufacturing costs. If successful, Medicare patients could save tens of thousands of dollars annually, while CMS’s overall oncology budget gets some breathing room—freeing resources for emerging therapies.

5. Pomalyst

Multiple myeloma patients often rely on Pomalyst for its potent, late-line activity, but that potency comes with a price: roughly $230,000 per year at list. Yet CMS’s 2025 selection list placed Pomalyst front and center for price talks. According to CNBC, analysts anticipate negotiations could push Pomalyst’s net price down by 35–50%, given its high spend and lack of biosimilars until at least 2026.

Celgene (now part of Bristol Myers Squibb) will need to make a compelling case that Pomalyst’s survival benefit justifies its cost, but CMS is under pressure to curb specialty drug spending. With Medicare shelling out over $1.2 billion on Pomalyst in 2024, even a one-third reduction translates to hundreds of millions in savings. If negotiations succeed, patient coinsurance could shrink from 20% of list price to 5%, meaning families keep more of their life savings. And if meetings break down, automatic rebates could still force a hefty markdown, making Pomalyst marginally less painful at the pharmacy counter.

6. Ibrance

Ibrance, a CDK4/6 inhibitor for HR-positive, HER2-negative breast cancer, has become a top earner for Pfizer and has no biosimilar rival until 2027—meaning Medicare’s tab hit $3.8 billion in Part D spend last year. It ticks all the Qualifying Single-Source Drug boxes: blockbuster spend, no generic competition, and critical benefit for patients. CMS’s second-cycle selection underscores its focus on specialty oncology drugs that drive runaway spending. Though manufacturers will cite R&D costs and innovation incentives, CMS can threaten up to a 95% rebate if negotiations fail. That leverage makes Ibrance a prime candidate for a 30–40% list-price reduction, helping patients avoid thousands in annual coinsurance.

With those kinds of savings on the table, recipients could see their out-of-pocket costs dip by four figures—money they could redirect toward everything from groceries to grandkid road trips. Pfizer will likely highlight Ibrance’s survival and quality-of-life benefits in response, but CMS’s “backstop” rebate means a stalemate is a lose-lose. If a deal is struck, oncologists might cheer a boost in adherence as fewer patients skip doses to save cash. Even if talks stall, the looming rebates could force a net price cut anyway—so either way, seniors stand to win big at the pharmacy counter.

7. Ofev

Ofev treats idiopathic pulmonary fibrosis and certain interstitial lung diseases, but its $110,000 annual list price has made it one of Medicare’s priciest Part D drugs. CMS flagged Ofev in its January 2025 announcement thanks to the drug’s steep price tag and lack of generics until at least 2029. The negotiation process will weigh Ofev’s lung-function preservation against its cost—analysts expect net price cuts of 25–35%. Even if Ingelheim pushes back, CMS’s rebate backstop looms large, ensuring patients may see copays drop from $2,200 per fill to under $1,000.

A sweeter sticker price could mean the difference between filling the script or rationing doses—and for lung-disease patients, every puff counts. Ofev’s manufacturer will underscore clinical trial data on slowed fibrosis progression, but CMS knows that better health outcomes often save Medicare money downstream. If negotiations succeed, pulmonologists might report fewer flare-ups and ER visits, which is a win for everyone. And thanks to the IRA’s enforcement teeth, even a reluctant manufacturer could find itself slashing costs if talks don’t yield a mutual deal.

8. Linzess

As a go-to therapy for IBS with constipation and chronic idiopathic constipation, Linzess has become a Medicare staple, with more than $1.1 billion in Part D spending in 2024. exclusivity extends until 2028, leaving plenty of spending on the table for CMS to target. Negotiators will assess Linzess’s symptom-relief metrics alongside price, likely driving at least a 30% reduction. For seniors battling daily GI woes, a heftier discount could translate to big savings on a drug that visits plenty of pharmacy shelves.

Imagine trading those gut-wrenching copays for a smooth morning routine—because no one wants a surprise bathroom sprint. If Linzess’s price comes down, adherence could tick up, meaning fewer frantic calls to the gastroenterologist and more stress-free breakfasts. AstraZeneca will champion the drug’s impact on quality of life, but CMS will counter with cost-effectiveness data. Ultimately, patients stand to gain both comfort and cash, turning Linzess from a budget-buster into a true relief.

9. Calquence

Calquence, used in chronic lymphocytic leukemia, pulled in $1.5 billion in 2024 Medicare Part D spend, and no generics are slated until 2028. With its proven survival benefit but steep price tag—roughly $135,000 per year—Calquence fits squarely into CMS’s negotiation lens. Discussions will focus on balancing patient benefit with affordability, aiming for a 25–35% markdown. Even a modest cut could mean thousands less out-of-pocket for the roughly 10,000 Medicare patients on therapy.

A lower list price might translate to smoother sailing through treatment cycles—fewer financial side-effects means patients can focus on healing, not hustling to cover bills. AstraZeneca and AbbVie will emphasize Calquence’s targeted action and low toxicity, but CMS will remind them that taxpayer dollars shouldn’t fund sticker-shock meds. If negotiations land in that mid-20s range, leukemia warriors could breathe easier, both health- and wallet-wise—turning what once felt like a luxury into a sustainable lifeline.

10. Austedo

Austedo and its extended-release sibling Austedo XR treat chorea in Huntington’s disease and tardive dyskinesia, but their combined $800 million Part D tab in 2024 makes them targets. With no generic or biosimilar competition until at least 2029, CMS will push to lower list prices by 30–40%. For patients coping with movement disorders, that could mean a drop from $1,500 to under $1,000 per month—still hefty, but less crippling to monthly budgets.

Cutting Austedo’s price could free up funds for supportive therapies, caregiver respite, or even that overdue family vacation. Neuropsychiatrists will stress how Austedo improves daily functioning, but CMS will press for a balance: innovation reward vs. real-world affordability. If the manufacturer meets CMS halfway, patients could see steadier dosing and fewer treatment interruptions. And because the IRA’s rebate rule is the ultimate ace, even a partial agreement could translate into real relief at the pharmacy counter.

11. Breo Ellipta

Breo Ellipta, another triple-therapy inhaler for asthma and COPD, rang up $2 billion in Part D spend in 2024. Its lack of alternatives until 2027 makes it ripe for CMS’s cost-cutting. Expect negotiations to target a 30–45% list-price cut, potentially bringing per-inhaler costs to the low hundreds instead of upwards of $600. That shift could dramatically ease financial strain for the 1.5 million seniors using it.

Lowering Breo’s sticker price could spark better adherence, fewer skipped doses, and smoother breathing days—literal breath-of-fresh-air potential. GSK will tout Breo’s superior exacerbation prevention, but CMS will counter with the bigger picture: fewer hospitalizations and lower overall spend. A successful deal could also encourage uptake of combination inhalers over multiple single-agent devices, simplifying regimens for older adults. At the end of the day, more affordable Breo means more relief—no panicked wheezing required.

12. Tradjenta

Janssen’s Tradjenta, an oral DPP-4 inhibitor for type 2 diabetes, pulled in $900 million in Medicare Part D spend last year without generic rivals until 2026. CMS will scrutinize Tradjenta’s A1C-lowering benefits versus cheaper comparators, pushing for at least a 35% price cut. Even a 20% reduction would save patients hundreds annually, making Tradjenta significantly more competitive.

If Tradjenta’s price drops, endocrinologists might switch more patients to an easy-to-swallow pill versus injectable alternatives—boosting compliance and convenience. Janssen will highlight the drug’s well-tolerated profile, but CMS will press them on budget impact. A fair deal could mean seniors keep more of their fixed income while staying on track with diabetes management. And with Medicare kicking in less, plan premiums could stabilize over time—so everyone’s wallet wins.

13. Xifaxan

Xifaxan, used for travel-related diarrhea, IBS-D, and hepatic encephalopathy, accounted for $1 billion in Part D spending in 2024. Its unique mechanism means no direct generic alternative until 2027, so CMS is poised to negotiate a 30–40% markdown. For patients enduring recurrent GI issues, that could translate to several hundred dollars of annual savings.

A lower Xifaxan sticker price could reduce the dreaded “I can’t afford it” moment at checkout—freeing patients to stick with their prescribed regimen and avoid symptom flare-ups. Salix will underscore data on reduced hospital admissions for hepatic encephalopathy, but CMS will counter with cost-offset analyses. If a we-both-win price emerges, patients could see smoother trips and steadier GI health, while Medicare watches overall spend ease up. It’s a win for digestive peace of mind and budget balance.

14. Vraylar

Vraylar, an antipsychotic for bipolar disorder and schizophrenia, saw $1.2 billion in Part D spend last year, with no generics until 2028. Medicare will press for price cuts of at least 25%, balancing mental-health benefits against cost burdens. Even a 20% reduction would ease monthly copays by dozens of dollars, a meaningful relief for long-term users.

Cheaper Vraylar could encourage broader adherence, reducing relapse rates and crisis-driven hospital stays—big wins for patients and the system alike. Allergan (AbbVie) will defend the R&D behind its dual-indication status, but CMS knows that untreated or undertreated mental illness can drive up emergency care costs. A negotiated discount could translate to better stability for thousands of individuals, empowering them to stay on track with work, family, and life.

15. Janumet

Janumet (metformin/sitagliptin combo) racked up $1.4 billion in Medicare Part D spending in 2024, with no generic equivalents until 2026. As a therapy for type 2 diabetes, it’s valuable but pricey—around $600 per month. CMS negotiations could trim 30–40% off the list price, saving patients thousands annually.

If Janumet becomes more wallet-friendly, patients might be less tempted to skip doses or split pills—leading to better glycemic control and fewer diabetes-related complications. Merck will point to combination-therapy convenience, but CMS will weigh that against costlier downstream care. A middle-ground price could keep seniors on track with their A1C goals, reducing ER visits and hospitalizations—and leaving more cash for avocado toast once in a while.

16. Otezla

Otezla treats psoriasis and psoriatic arthritis, with $850 million in Part D spend last year and no generic until at least 2026. Its dual-indication status and high list price—about $18,000 per year—make it a prime target for a 30%+ cut. A successful negotiation could drop annual costs by thousands, boosting access for chronic patients.

A leaner Otezla price could let more dermatologists and rheumatologists prescribe it without guilt trips over cost, improving quality of life for plaque-battling and joint-aching patients alike. will highlight Otezla’s oral dosing advantage over injectables, but CMS will press for real savings. If negotiations yield that 30%-plus chop, patients can focus less on bills and more on bump-free skin and flexible fingers—arguably the best kind of therapy outcome.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.