Here’s a romp through nostalgia — and cautionary tales — as we spotlight 18 of your favorite ’80s icons who hit the financial skids faster than you can say “parachute pants.” From mega-millionaire to mini-miser, these stars prove that fame and fortune can vanish in the blink of a neon-lit dance break. So grab your Leg Warmers™ and dive into the saga of flashbulbs, bad bets, and bios that went bust.

1. Kim Basinger

In ’93, Oscar-winner Kim Basinger thought she’d struck gold by dropping out of a cheesy thriller—until the studio hauled her into court. Basinger’s decision to walk away from Boxing Helena triggered an $8.9 million judgment that led her to file for bankruptcy just weeks later according to Best Life Online. She’d been on Hollywood A-list status, flipping between blockbusters like Batman and L.A. Confidential, but that lawsuit slammed her with unpaid legal fees and crippling interest. Once her assets were claimed, the actress saw her bank account drain faster than her character’s legs did in the film. She converted a Chapter 11 into Chapter 7 to simplify things, selling off property and jewelry. Even a heart-wrenching appeal to a higher court only cut her losses to $3.8 million. Rumor had it she got dropped by some agencies, too, leaving her agent phone silent for months. Still, she managed to bounce back on smaller, indie flicks that barely covered her legal tab.

Post-bankruptcy, Basinger’s Hollywood glow dimmed. Indie roles paid peanuts compared to studio paychecks. She relocated, trading L.A. for a quieter life in Georgia, where her payday per movie dropped into the six figures instead of seven. Tabloids speculated about financial desperation, but she kept mum. Eventually, she negotiated profit-share deals, hoping future blockbusters could stitch her wallet back together. A cameo in Fifty Shades Darker and a cameo-heavy filmography stitched her residuals, but those checks are tiny compared to her ’90s heyday. She admits in interviews that she learned “never to underestimate small legal contracts.” Despite the blow, she’s managed a steady, if frugal, career, reminding everyone that survival trumps stardom.

2. MC Hammer

Remember Hammer pants? Well, those roomy trousers had room for more debt than anyone expected. At his zenith, Stanley “MC Hammer” Burrell was reportedly hauling in around $70 million, parlaying smash hits and superstar tours into a lifestyle of private jets, a 40-person entourage, and a mansion that looked less like a home and more like a small city. According to Forbes, Hammer’s empire collapsed under $13 million in debt, forcing the rapper to file for bankruptcy in 1996 after lavish spending and tax woes threw him offbeat. His business manager reportedly funneled money into side projects that tanked. He hired so many dancers and staff that his monthly payroll rivaled a small corporation’s budget. Meanwhile, legal battles over unpaid taxes piled on. Hammer’s financial downfall became textbook “how-not-to” material in business schools. It’s a classic tale of peak-millionaire turned penniless icon. Fans watched in disbelief as the guy who once danced on TV in golden parachute pants begged for smaller checks.

Post-bankruptcy, Hammer tried to reboot as a preacher and reality-TV staple, but those gigs hardly rewrote his money story. Tours under the name “MC Hammer Xperience” drew nostalgia buffs rather than big bucks. He released Christian rap albums that earned modest sales but weren’t enough to cover the legacy debts still haunting him. Public speaking gigs and seminars showed glimpses of income but came with lean audiences. Meanwhile, shoe deals and merch lines fizzled out. Hammer’s brand, once synonymous with “U Can’t Touch This,” now screams “Touch the Bankruptcy Filings.” Even guest spots on shows like “Dancing with the Stars” didn’t yield long-term payday gold. Rumor has it he occasionally pops up at In ’N’ Out Burger to stay grounded, but that’s more about humility than cash flow. In 2024, Hammer admitted in interviews that he still wrestles with financial shake-ups, calling his journey a roller coaster he never wants to ride again.

3. Gary Coleman

Dif-ferent Strokes? More like Dif-ferent Debts. Once America’s favorite pint-sized sitcom star, Gary Coleman earned millions on Diff’rent Strokes, but childhood medical bills and mismanaged earnings gobbled up his savings. CNN reports that in 1999 Coleman filed for bankruptcy after racking up unpaid taxes and losing $200,000 on a failed arcade venture. His adoptive parents and managers were accused of dipping into his trust fund, leaving him with a $70,000 annual income and no buffer against legal and medical expenses. Fans were shocked to learn that his trademark “What’ chu talkin’ ’bout?” catchphrase had margins tighter than his wallet. A stint as a security guard barely made rent. Earnings from guest spots and endorsements trickled in, but hungry creditors caught every dime. Courts even scrutinized his residuals, garnishing checks before they hit his bank account. By the time he sought protection, multiple lawsuits had drained his assets. It’s a bitter lesson in guardianship gone wrong and kid-star pitfalls.

In his final years, Coleman bounced between charity shows and sporadic acting gigs to scrounge up cash. He auctioned off memorabilia, including his Diff’rent Strokes scripts, just to afford basic living expenses. Celebrity benefit events offered pocket change but no security. Late-night radio spots and infomercials paid per appearance, but it wasn’t enough. Health complications meant hospital stays ate into whatever savings he’d scraped together. His tragic death at 42 cut short any comeback dreams. Even posthumously, royalties from his old show barely trickled to his estate, swallowed by unpaid debts. Gary’s story stands as a cautionary tale of childhood fame’s tax traps and the importance of trustworthy guardians.

4. Tonya Harding

Once America’s “bad girl on ice,” Tonya Harding traded triple axels for triple-digit debts. After the infamous Nancy Kerrigan incident, Harding’s professional skating career shattered, leaving her without lucrative endorsements. She tried boxing, reality TV, and brief music ventures, but none matched the six-figure checks she once banked. By 2009, she was begging for $1,500 up front just to option her life story for a low-budget film. As the Irish Times chronicled, Harding cashed that tiny check, but rent in Portland costs more than a month’s paycheck. Legal fees from decades-old court battles still leech her limited earnings. Tabloid outlets reportedly sued her for defamation when she tried to set the record straight. Her day jobs—swimming instructor, paralegal temp—paid far below skating-star level. She pawned trophies just to make mortgage. Meanwhile, residuals from 30 for 30 episodes were taxed and garnished before she saw a dime.

Today, Harding sometimes streams Q&A sessions on social media for fan donations. But those Venmo tips seldom cover a month’s utilities. She’s become a cautionary pop culture footnote: epic rise, catastrophic fall. Skating rinks offer “Tonya Harding Ice Skating Clinic” nights, but the organizers keep most of the profits. Even tabloids sometimes pay her ghostwriters pennies for memoir snippets. A handful of shoes she once wore to competition auctions on eBay for charity, but Harding often picks up the tabs to guarantee sales. She’s tried book deals, but advances evaporate in lawyers’ fees. A recent cameo in a B-movie paid in product placement—she got free protein shakes instead of cash. Hard lessons, indeed, for the girl who once dared to land like a lightning bolt on ice.

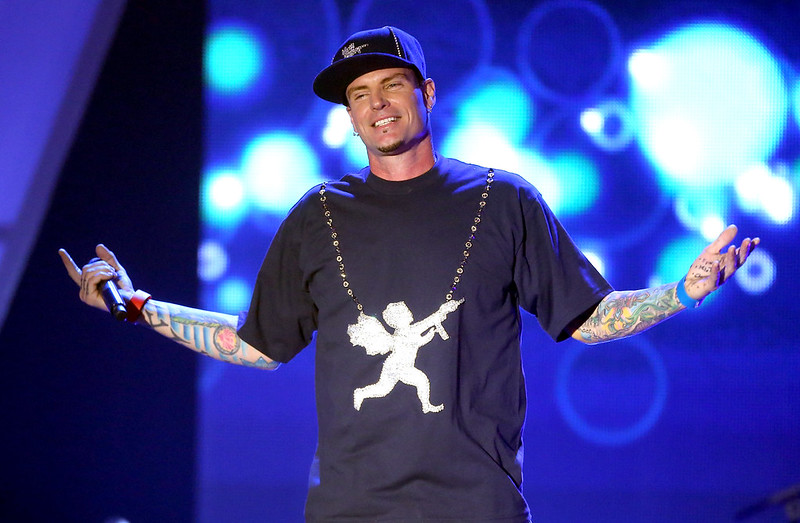

5. Vanilla Ice

“Ice Ice Baby” was the soundtrack to many ’80s TikTok dance challenges—back when TikTok was called MTV. Robert Van Winkle stunned the world by flipping that hit into a reported $7 million payday, but a Yahoo Finance exposé revealed his real fortune squirreled away in real estate rather than cash. While he now owns several rental properties worth north of $20 million, poor tax planning, bad mortgages, and an ill-fated VH1 reality show wiped out almost everything he had on paper. Early in his career, he shelled out thousands on personalized champagne and branded merch that never sold. Lawsuits over trademark infringement snipped away at his residuals. His clothing line, meant to resurrect his brand, folded after one season. Even guest-DJ fees at Miami clubs barely covered his studio rent. By the time he jumped into the home-renovation biz, contractors had him underwater on flip projects. Rumor has it he once put a property into foreclosure just to dodge a big tax lien.

These days, Vanilla Ice survives on nostalgia tours and podcast cameos. He hosts home-makeover seminars that pay in free blenders and small honoraria. Social media endorsements earn him bus fare more often than private-jet charters. A cameo on “Celebrity Big Brother” netted him exposure, but the paycheck went straight to expired liens. He occasionally performs at bachelor parties for modest sums, sometimes as low as $500 a gig. Every once in awhile, he sells signed records on eBay, but shipping costs leave him at break-even. His YouTube cooking channel rakes in subs, yet ad revenue barely keeps the lights on. As any savvy savvy SCUBA diving instructor will tell you, it’s not the bikes you ride—it’s how you maintain them. Ice once ruled the charts; now he’s scraping spare change to power a microphone.

6. Mike Tyson

Iron Mike punched his way into boxing history and out of a multi-million-dollar empire. At his peak in the late ’80s, Tyson reportedly hauled in over $300 million in purse money alone. He spent lavishly on mansions, exotic pets, and a stable of Rolls-Royces that each cost more than most people’s houses. His divorce settlement with Robin Givens demanded exorbitant alimony, and legal fees from his rape conviction drained another chunk. Gambling in Atlantic City bleeds fortunes overnight, and Tyson was no exception—he lost tens of millions on luckless bets. A brief foray into licensing and video games netted modest returns but couldn’t offset mounting costs. His security team and entourage expenses reportedly topped $2 million a year. Even endorsements turned sour when brands distanced themselves after his ear-biting incident with Evander Holyfield. By 2003, facing $23 million in tax liens, Tyson filed for bankruptcy.

Post-bankruptcy life hasn’t been all knockouts and comebacks. Tyson’s Las Vegas show, “Mike Tyson: Undisputed Truth,” brought in steady income, but its profits split heavily with promoters. A line of cannabis products pays residuals, yet overhead on cultivation and licensing wipes out a big slice. Tyson’s one-man Broadway debut scored critical nods but tepid ticket sales. Movie cameos in The Hangover films padded his wallet in the short term, but residuals trickle slowly. His podcast and memoir deal generated a decent advance, though book tour expenses slashed the net. Occasional guest spots on late-night talk shows yield airfare stipends, not gold bars. With multiple marriages and properties worldwide, the taxman always collects first. The Iron Mike who once had the world in his gloves now practices financial self-defense just to stay afloat.

7. Burt Reynolds

He ruled the screens in Smokey and the Bandit, wore nothing but charm, and bankrolled a drinking habit that tasted more like bankruptcy than bourbon. Burt Reynolds splurged on yachts, exotic cars, and a Palm Beach mansion that came with staff costs big enough to make any accountant sweat. Divorce settlements from Loni Anderson and other flings guaranteed alimony that drained millions every year. Reynolds also lost a $10 million defamation lawsuit, plus another due to mismanagement by his agent. His casino-themed restaurant ventures in Florida and Texas shuttered within months, leaving back rent and loans unpaid. He financed indie films that never saw the light of day, sinking capital into vaporware. IRS liens piled up when he skipped quarterly tax payments. Even lucrative endorsements for cigars and cologne ended early when sales tanked. By the late ’90s, Reynolds’ bank account matched his leather-jacket budget: empty.

Reynolds tried to tweak his image with Broadway attempts and cameos on TV dramas, but paychecks came with high agent commissions. A memoir deal provided an advance, yet travel costs for signings offset most of the take. His star turn on Celebrity Apprentice generated buzz but scant net profit after production fees. One final film role in The Last Movie Star yielded a SAG residual small enough to fit in a tip jar. Pension from Screen Actors Guild isn’t generous, given his box-office pedigree. With health issues cropping up, medical bills started eating into whatever savings remained. In his twilight years, he auctioned personal memorabilia to keep property taxes current. Even at his passing in 2018, estate valuations barely covered estate-planning fees. Burt’s legend lives on, but the wallet he used to have could fill a loo loo.

8. Cyndi Lauper

Girls just wanna have funds, but Cyndi Lauper’s finances haven’t always matched her bubble-gum persona. Lauper’s early ’80s smash album sold millions, but royalty structures and a costly music video budget meant smaller checks than fans realized. She poured earnings into backing other artists and funding high-budget shows that flopped. A string of divorces in the ’90s came with alimony and legal fees that sliced into her nest egg. Attempts at Broadway productions post-career peak left her on the hook for production overruns. A self-produced album that critics panned barely recouped studio costs. When she branched into vintage clothing boutiques, a slow retail market left her storefront shutting doors. She once confessed in interviews that she lost track of quarterly tax filings, leaving a multi-thousand-dollar IRS bill. Licensing deals for advertising used snippets of “Time After Time,” but those checks were modest. By the early 2000s, Lauper was hustling side-gigs on cruise ships just to keep afloat.

Today, Lauper still belts out anthems on nostalgia tours but pockets go-funded checks that often return to producers and managers first. Her Vegas residency brings fans in droves, yet revenue shares favor the casino. A recent memoir advance got eaten up by legal battles over rights to her early demos. Collaborations with young pop stars spark streaming royalties, but Spotify payouts mean cents, not dollars. She’s on a national theater tour, but travel and crew costs sap touring profits. Merch sales at shows cover costume designers more than Cyndi herself. Even songwriting royalties for Christmas carols aren’t life-changing. She occasionally DJs retro nights for a fixed fee, but gig costs (sound crew, lighting) leave her taking home only the tip jar. Lauper’s hair is still big, but her bank balance? Not quite as bold.

9. Tom Petty

“Free Fallin’” but not free-of-debts: Tom Petty’s early recording contracts trapped him in a royalty cage big enough to force him into bankruptcy—yes, bankruptcy—back in 1979. Signed to Shelter Records, Petty received minuscule royalties for his smash hits, leading him to file Chapter 11 just as he was becoming a household name. The court fight liberated him from a deal that paid pennies on the dollar, but legal fees and settlement costs kept him in the red well into the ’80s. He poured earnings from tours and album sales right back into lawyers’ pockets, watching profits vanish. Deadlines for studio recording and touring obligations forced him into overwork, sapping creativity for new, more profitable projects. His homage album to Mudcrutch wasn’t a chart-buster, so advances barely covered production. A side project with the Traveling Wilburys delivered fun collaborations but little financial relief. Petty’s property investments in Florida and California carried hefty maintenance and tax bills. Personal lifestyle upgrades—vintage car collection, sprawling houses—added to the burden, even as the hits kept coming.

By the late ’80s, Petty negotiated better deals with MCA, but prior debts still lingered. He occasionally sold rare demos to fan clubs for cash infusions, but those one-off sales couldn’t erase decades-old liabilities. Petty’s final MTV Unplugged performance generated buzz but limited physical sales meant small residuals. A handful of songs licensed for film soundtracks paid lump sums that went straight to manager commissions. He faced IRS audits for years, with tax penalties gnawing at tour earnings. Even his fence-mending with record labels came with silent cuts to album credits and royalty percentages. After his passing in 2017, his estate faced claims from former collaborators and studios demanding unpaid royalties. The Florida mansion he loved became collateral for settling old debts. Free-spirited rock gods sometimes pay the price for contracts written in the shadows.

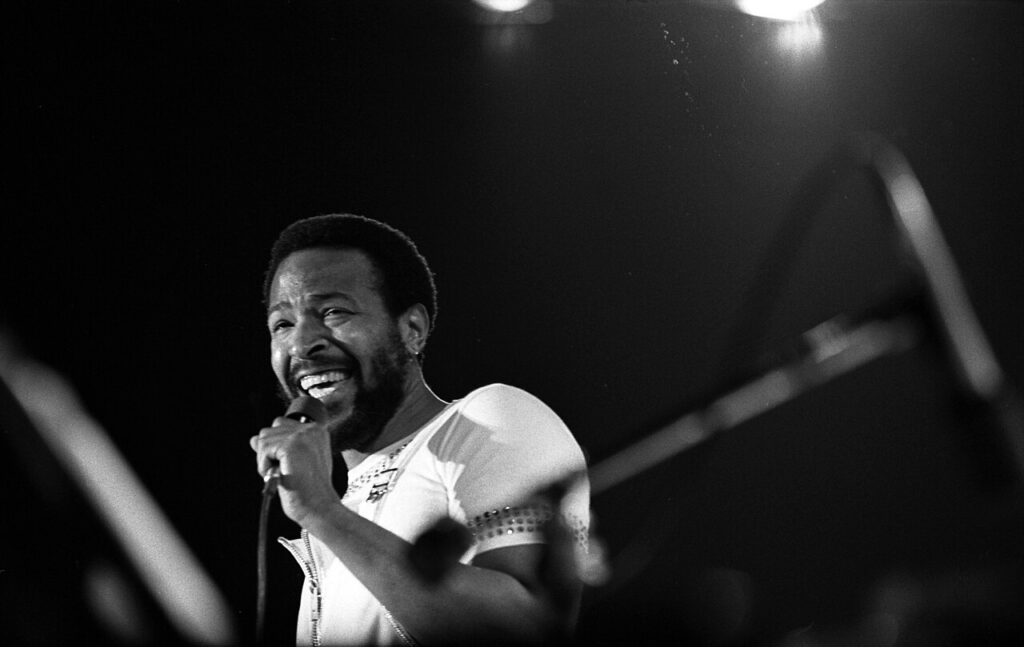

10. Marvin Gaye

Soulful melodies, empty pockets: Marvin Gaye’s tumultuous life ended with a tragic gunshot, and he died owing around $770,000 to the IRS and various creditors. Despite his legendary Motown hits, Gaye’s songwriting royalties were tied up in publishing contracts that disproportionately favored his label. He’d signed away rights to some of his biggest songs—“What’s Going On,” anyone?—for advances that seemed generous at the time but turned stingy with interest. His divorce from Anna Gordy drained his finances, with alimony and child support wiping out a huge chunk of income. Addiction to painkillers led to hospital stays, medical bills, and rehab costs covered out of pocket. Gaye splurged on a yacht and a Beverly Hills estate, only to see property taxes pile up. Studio time for new albums ran up tabs in the six figures, and Mercury Records frequently refused to cover overruns. When he sued Motown for creative control, legal fees swallowed any settlement he won. Eventually, his music catalog was mortgaged just to pay back taxes.

Posthumously, Gaye’s estate has seen a revival in streaming, but old debts still bind royalty checks. His heirs receive a fraction of global plays’ income after administrators and lawyers take their cut. The catalog rights were sold multiple times, with original family publishers getting sidelined. Merchandise ventures slapped his name on shirts and posters, but most licensing revenue skips past the estate to corporate pockets. A biopic deal in the works comes with a hefty production budget that eats any upfront cash. Every time one of his songs features in an ad or film, mounting administrative fees slice off the top. Even the honors and awards he receives now do not translate into financial restitution. Marvin’s soulful legacy sings on—but his bank account remains a somber note in the soundtrack of his life.

11. Mick Fleetwood

The medicinal cocktails of rock ’n’ roll culture left Fleetwood Mac’s drummer nursing more than hangovers. Mick Fleetwood splurged on lavish Los Angeles homes, thoroughbred racehorses, and art collections, with upkeep that dwarfed album royalties. His flamboyant yacht parties and hedonistic tours funneled millions into hedonism, yet tax planning was an afterthought. Multiple divorces—he was married and divorced four times—meant endless alimony and child support payments that drained his bank balance. His side project, The Zoo, sold modestly, leaving production costs unpaid. Fleetwood’s Palm Beach mansion languished in foreclosure due to missed mortgage payments. He financed boutique hotels that went belly-up within a year. Stock investments in dot-com startups collapsed in the early 2000s, vaporizing fortunes overnight. Even rights to the band’s biggest tracks were tied to joint ownership agreements, making individual payouts tiny. By 2010, reports surfaced that Fleetwood carried IRS liens for back taxes in the seven-figure range.

Today, Fleetwood still tours with a revamped Mac lineup, but ticket sales revenue goes largely to crew and venue costs. His memoir advance vanished in promotional tours and media appearances. A handful of solo gigs at charity events pay in donations rather than dollars. Fleetwood operates a small restaurant in Maui, yet chef salaries and import costs cut deeply into profits. Every time the band’s Fleetwood Mac: The Dance DVD sells, most profits settle debts rather than pad pockets. Tribute bands pay licensing fees, but per-show payouts go to corporate administrators. His longtime LA house finally sold at a loss, with the proceeds covering just outstanding lien balances. Even a lifetime achievement award gala barely nets more than a hotel room credit. It’s a slow-roll retirement for the man who helped define ’70s and ’80s rock.

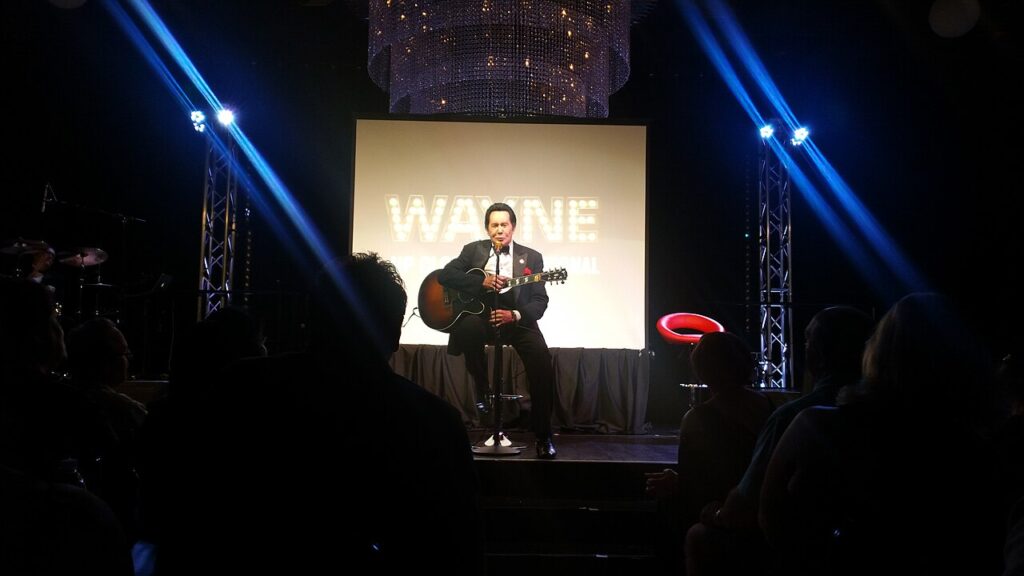

12. Wayne Newton

Mr. Las Vegas once earned $30 million a year headlining casinos, but a gambling problem and rumored mob debts knocked him off his stride. “Mr. Las Vegas” sank hundreds of thousands in junket bets and high-stakes poker nights that never paid out. He co-owned and financed several casinos that later declared bankruptcy, leaving him with personal guarantees on loans. His divorce from Kathleen McCrone brought expensive alimony and legal fees. Newton’s licensing deals for his likeness in slot machines fizzled when the machines underperformed. He invested in failing Florida real estate developments that went bust in the ’90s property slump. Tax liens of $10 million hovered over his Las Vegas mansions. Even his PBS specials—though critically praised—paid him a flat fee that barely covered production costs. Junior clubs recruited him for appearances but paid in comped buffets. His gospel album didn’t chart, leaving him with unsold inventory he’d personally funded.

In recent years, Newton’s residencies at the Tropicana still draw crowds, but reductions in comp packages for performers mean less take-home. A cameo in Vegas Vacation netted him an eight-figure paycheck, yet agent commissions nibbled away at half before taxes. His collectibles—signed boots and rhinestone jumpsuits—sell at auction, but shipping and auction fees devour most proceeds. Newton’s autobiography advance got eaten up by marketing commitments. A one-man show at small theatres pays a stipend that barely matches his former nightly salary. New sponsorship deals for Western apparel pay in product samples, not cash. His themed restaurant closed after one season, unable to cover overhead. Even a biography film in development has yet to green-light, so no payday is coming soon. Wayne’s star still shines in neon, but his wallet’s glow is decidedly dull.

13. Robert Downey Jr.

Before Iron Man fronted him in gold, Robert Downey Jr. spent the ’80s as a hot young actor with cooler legal bills than paychecks. By the late ’90s, a long battle with substance abuse landed him in rehab multiple times, and legal fees topped $2 million as he faced DUI charges and probation violations. Studios blacklisted him, forcing him to take low-budget indie roles just to stay afloat. He lived in a loft that doubled as a rehab center—rent was paid through small part-time gigs and odd jobs. Agents report that Downey once earned less than $20,000 a movie during his darkest days. His lavish spending on new cars and flashy jewelry evaporated once Hollywood doors closed. Several lawsuits from creditors forced him to hand over residual checks from early work. He sold personal items—signed scripts, costume pieces—to cover living expenses. Without the Marvel resurgence, his bank account would likely be a footnote in Hollywood cautionary-tale books.

Thankfully, Downey’s comeback paid off spectacularly, but ride-or-die debts still linger. Even with multi-million-dollar salaries, agent and manager percentages plus taxes slice off a big portion. He set up a trust for his children, meaning some earnings bypass him entirely. Charity auctions sometimes require donated movie props, leaving less for personal keepsakes. Luxury homes in Malibu and Beverly Hills carry hefty property taxes he still pays. Downey’s philanthropic work in recovery charities is unpaid but tax-deductible—a small consolation. And though he’s iron-clad on screen, there’s no armor against hefty IRS audits. The modern RDJ is flush, yes, but that doesn’t erase the lean years that bankrupted him emotionally and financially.

14. Peter Frampton

Frampton Comes Alive gave Peter Frampton platinum status, but that crown came with gold costs. He poured tour profits into building custom studios and buying expensive gear that collected dust during slow years. A disastrous ’90s album led record labels to back out of multi-album deals, triggering penalties. He financed tribute tours that underperformed, leaving him on the hook for venue guarantees. Legendary fiddles and guitars he owned were sequestered by creditors for unpaid debts. His mansion in England went into receivership when mortgage payments lapsed. Insurance premiums on his vintage instrument collection drained annual earnings. Frampton’s attempt to crowdfund a solo album fell short of targets, leaving him to self-fund anyway. Tour managers sued him over canceled shows, and legal settlements ate his advance payments. That one-off collaboration with David Bowie paid in prestige, not cash.

Frampton now does smaller club gigs, but fees are a fraction of arena days gone by. Live-stream concerts on Patreon net modest monthly stipends but no lump sums. He sold off personal memorabilia—handwritten lyric sheets and stage outfits—to private collectors for a fraction of their sentimental value. His instructional guitar DVDs pay residuals but only after honorariums, shipping, and web hosting costs. A recent autobiography advance vanished in travel expenses for promotional tours. Frampton’s website sells merch, but production and shipping costs leave him with a thin margin. Though still revered among guitarists, his bank account hums a quieter tune than hit-factory days.

15. Pia Zadora

Pia Zadora’s transition from golden-glow ingénue to financial punchline started with overspending on Hollywood hype. Her producing husband backed her career with millions—on costumes, sets, even private makeup artists—but movie roles flopped. Critics skewered her acting, and audiences stayed away, tanking box-office returns. Yet she continued squirreling away funds for vanity projects, audition tapes, and self-funded film festivals. Lawsuits over breach of contract added legal fees. A Las Vegas showroom residency promised returns but led to an eight-figure loan she couldn’t repay. Zadora’s attempt at a pop album bombed, leaving pressing and distribution costs unpaid. She invested in boutique hotels that never turned a profit, and kit-car manufacturing that never delivered a single car.

Today, Zadora capitalizes on nostalgia at retro-cabaret nights, but fees go largely to venue promoters. She runs a lavish home décor blog that attracts sponsors, though sponsored posts pay in free furniture more than dollars. Her for-hire singing telegram service earns pocket change. Zadora’s charitable auction of old gowns nets little after auction house commissions. A lifetime achievement award at a fringe festival came with a ribbon, not a check. She sometimes DJ’s ’80s nights at malls for free tickets to the event. Even her personal social media ads for skincare lines pay in product samples. Pia’s shimmer may still catch the light, but her bank account keeps the blinds drawn.

16. Leif Garrett

Teen heartthrob Leif Garrett hit millions of fans with his blonde locks and pop hits, but a whirlwind of rehab stays and legal woes chased his inheritance into pink slips. Garrett blew through his childhood earnings—estimated at $700,000—on party scenes and fast cars before he was 18. By his early 20s, addiction to prescription pills landed him in and out of clinics, each stay costing thousands. Creditors from hotel bills, car rentals, and forfeited concert fees chased him across states. He tried teen-actor conventions and nostalgia tours, but promoter mishandling meant he seldom saw guaranteed payouts. Lawsuits from former managers over unpaid commissions added another layer of debt. His attempted rap album sold so poorly that distributors demanded reimbursement. Broken TV pilots meant advance repayments too. Garrett’s cameo gigs for reality shows paid only union scale, leaving him scraping for rent.

Now, Garrett occasionally performs at biker bars for cash in hand, but rides home in a borrowed van. He sells signed Polaroids online, but shipping and PayPal fees leave next to nothing. His YouTube channel discussing celebrity gossip pulls views but not advertisers. A small role in a YouTube series paid in “exposure,” which doesn’t cover groceries. He’s tried stand-up comedy, but audience tips barely tip the scale. Garrett’s memoir advance vanished in lawyer retainer fees. Even his appearance on Celebrity Rehab—ironically—gave him only lodging, not cash. He lounges through day jobs as a mover and warehouse worker for stable, if modest, pay. Leif’s star-boy days remain a headline; his bank statement tells a different story.

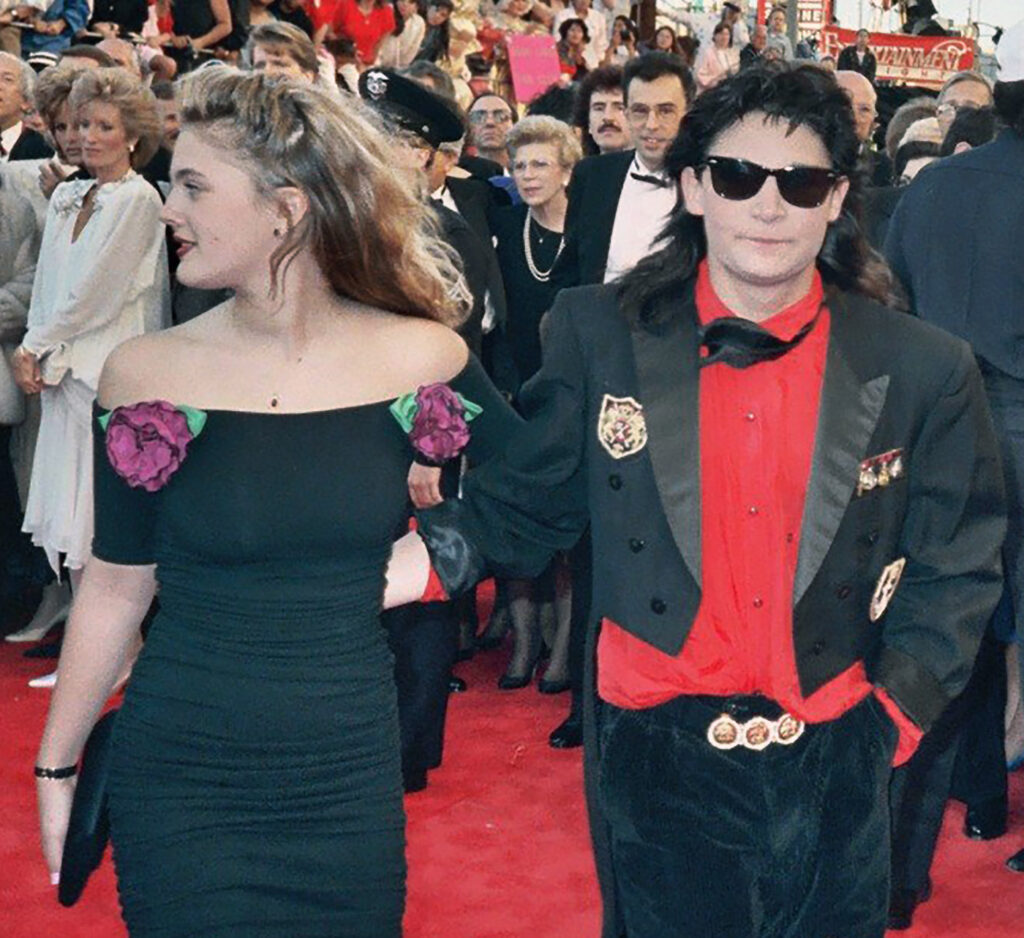

17. Corey Feldman

Child star turned teen icon Corey Feldman pocketed big bucks in The Goonies and Stand by Me, but parental mismanagement and legal fees over alleged abuse claims chewed through his net worth. Feldman says he slipped millions into escrow mechanisms meant to protect kids, but outdated trusts released funds early in adulthood. He used that cash on studio time to record music that never charted. Lawsuits from ex-bandmates over unpaid royalties added legal headaches. Independent film ventures cost more to produce than they returned at art-house box offices. Feldman’s reality show paid per episode, but reality shows don’t pay residuals in perpetuity. He sued former manager David E. Talbert for fraud, and legal costs surpassed any settlement. Property investments in North Hollywood faced liens due to missed HOA fees. He launched a crowdfunding campaign to fund his #MeToo advocacy, but processing fees nibbled at contributions.

Today, Feldman sells “Child Star Counseling” sessions via Zoom for token fees. His SoCal clinic rents are paid through a subscription podcast that gets a handful of listeners. Autograph signings at horror conventions net small piles of dollar bills that get split with promoters. He launched a perfume line called “Dream a Little Dream,” but production delays led to investor lawsuits. Streaming royalties for his music project only kick in after he surpasses high streaming thresholds. Feldman’s book advance was underwhelming, barely covering a round of PR appearances. A cameo in a indie horror flick paid in merch vouchers, not cash. Even the foundation he set up for survivors took startup costs that eclipsed early donations. Corey’s name still rings bells; his bank balance? Radio silence.

18. Tiffany

The “I Think We’re Alone Now” teen queen had the mall-tour circuit seething in the late ’80s, but those teeny bopper dollars evaporated with changing musical tides. Tiffany Darwish’s first two albums went platinum, yet record advances and over-eager marketing budgets meant she saw limited royalties. She hired expensive vocal coaches and choreographers under long-term contracts she couldn’t exit. A pivot to country music alienated core fans while failing to earn new ones, leaving unsold albums stacked in warehouses. She financed a chain of dance studios that shuttered in under a year, saddling her with lease obligations and unpaid staff. Guest spots on soap operas paid scale, not pop-star fees, so residuals were minimal. Legal battles over the use of her stage name cost tens of thousands in court fees. Her reality TV comeback got canceled mid-season, prompting breach-of-contract settlements she couldn’t afford. Even her podcast, which promised ad revenue, fell victim to platform changes that slashed payouts.

Tiffany now gigs at private corporate events for modest flat rates, often under $2,000 a night. She sells signed CDs and vinyl at conventions, but shipping costs cut into profits. A line of scented candles under her brand name sold well initially but incurred trademark renewal fees that she missed. She wrote a memoir with an advance that evaporated in legal checks to clear up old contracts. Mid-tier brand sponsorships on Instagram get her free beauty products instead of cash. The small venue tour she embarked on in 2024 paid per cap, but promoter fees meant she occasionally walked away with zero. She appeared in a Hallmark movie cameo, but that paid in a gift basket. Even the streaming of her hits on nostalgia playlists delivers pennies per play. Tiffany’s voice still sparkles in your earbuds, but her bank balance? Let’s just say it’s quieter than her high notes.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.