Get ready to spill the (champagne) tea on some of America’s most legendary fortunes that went from “trust fund ✔︔ to “trust fall âŒ.” Here’s a rundown of 13 dynasties where the heirs treated their inheritance like TikTok trends—hot for a minute, gone the next. Buckle up, grab your avocado toast, and let’s dive in:

1. Huntington Hartford: The A&P Art Addict

Huntington Hartford inherited supermarket billions from A&P, pocketing about $1.5 million annually in the 1950s. Instead of grocery checkouts, he built art museums, commissioned sculptures, and funded avant-garde dance companies. His Caribbean utopia, Paradise Island, promised sun, sea, and endless cocktails but bled red ink faster than tourists could sip margaritas. Hartford even financed a Hollywood studio that churned out indie films nobody watched. According to Moneywise, his annual income couldn’t keep up with construction crews and curators demanding raises. The art world buzzed about his grand openings, but few guests minded the empty wine glasses at closing time. It was like swapping a bread aisle for a bread-baking class: interesting, but not exactly revenue-generating.

Palm trees overshadowed half-finished villas, and the museum halls echoed with unpaid bills. His ventures became case studies in “if you bet everything on cool projects, you might just lose everything.” By the end, Hartford lived in a modest cottage, far from the marble palaces he’d envisioned. His billions turned into blueprints that nobody could finish. He proved that selling groceries is easier than selling grand dreams. Sometimes, the only thing you can truly own is common sense. And that’s why supermarket riches don’t always translate into cultural immortality.

2. The Vanderbilts: A Titanic-Sized Spurge

Cornelius “Commodore” Vanderbilt mortgaged a ferry route and built an empire in shipping and railroads that defined Gilded Age wealth. His descendants inherited gilded mansions like The Breakers and Biltmore, spending on parties so epic that newspapers fawned over their extravagance. Some scions collected jewels and art at such a clip that entire galleries felt like family bedrooms. By the early twentieth century, they were famous more for lavish lifestyles than for business acumen. As Forbes chronicled, by the third generation nearly 90% of the original fortune had evaporated due to inheritance taxes, philanthropy, and run-through expenses. Those massive estates turned to museum tours because the upkeep devoured annual budgets in weeks. It’s almost poetic how the Commodore’s network of railroads ended up hauling visitors through a family treasury that had already departed.

Gatsby-style balls and yacht regattas kept the name in headlines, but not the balance sheets. Parties with live orchestras and custom-made fireworks racks cost fortunes that no trust fund could outpace. Champagne fountains and diamond tiaras were Instagram-worthy long before social media existed. By mid-century, many Vanderbilts sold properties to cover legal fees and staff salaries. Today, Vanderbilt University and New York’s Vanderbilt Avenue serve as rare reminders of once-colossal cash. But if you treated every trust fund like a bottomless bucket, you’d end up throwing money overboard, too. And that’s how an empire built on rails ended up as footnote tours for history buffs.

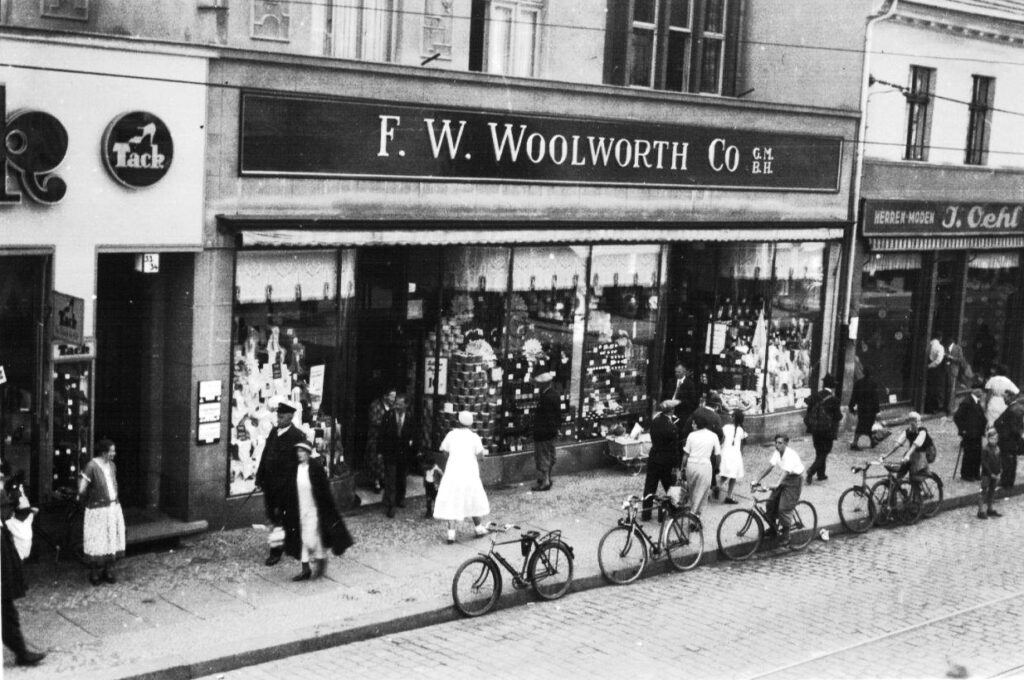

3. Barbara Hutton: The Woolworth Whirlwind

At 21, Barbara Hutton woke up to a Woolworth fortune that would have made any teenager’s jaw drop—around $50 million in the 1930s. She drained accounts buying couture gowns, private islands, and custom jewelry boxes that could rival crown jewels. Hutton’s romance headlines read like a Vegas marquee: seven marriages, multiple divorces, and real-estate sprees across continents. She splurged on palace-sized estates with ballrooms designed for only two people. Her $50 million, adjusted to today’s dollars, could be north of $900 million, and yet somehow vanished in a decade. GOBankingRates outlines how her credit card bills often arrived thicker than invitation lists. Reporters dubbed her “the world’s richest pauper” long before her money actually ran out.

By the end, she was auctioning family heirlooms to pay for her living expenses. A tiny annual stipend became her last safety net after fortune-size spending ate through every account. Private jets and Dubai penthouses gave way to modest apartments with chipped paint. Her life proved that endless credit doesn’t equal endless happiness. Every shoe box full of invoices told a cautionary tale of unchecked indulgence. She still holds the record for fastest wealth-to-zero conversion in American social-history lore. If you treat inheritance like a game of Monopoly, don’t be surprised when someone flips the board.

4. Patricia Kluge: Vineyard in Vogue, Bankruptcy in Bloom

Patricia Kluge married into a telecom fortune after John Kluge sold his empire for about $1 billion in the 1980s. Her divorce settlement granted her $1 million a year plus a sprawling 200-acre estate in Virginia Wine Country. She planted vineyards and built a resort spa that looked straight out of a travel magazine. Unfortunately, between grape-stomping festivals and spa retreats, she racked up debts like they were artisanal cheeses. A Yahoo Finance report notes that by 2011, her winery owed more than $30 million to creditors. The vines withered under foreclosure notices even as marketing brochures boasted “award-winning vintages.” It’s a reminder that picturesque logos don’t pay monthly mortgage statements.

Patricia’s bankruptcy filing read like a social-media post gone wrong: “#VineyardGoals but #DebtNightmares.” Auctioneer gavel strikes sold off prized barrels and tasting-room furniture. Her dream resort now sits in limbo between bank ownership and hopeful buyers. From red-carpet galas to courtroom filings, she went from toast of the town to cautionary headline. Some estates become tourist attractions; hers became foreclosure fodder. If you’re going to invest in wine, make sure the balance sheet can handle the hangover. Otherwise, you’ll be stuck serving up liquid regrets instead of merlot.

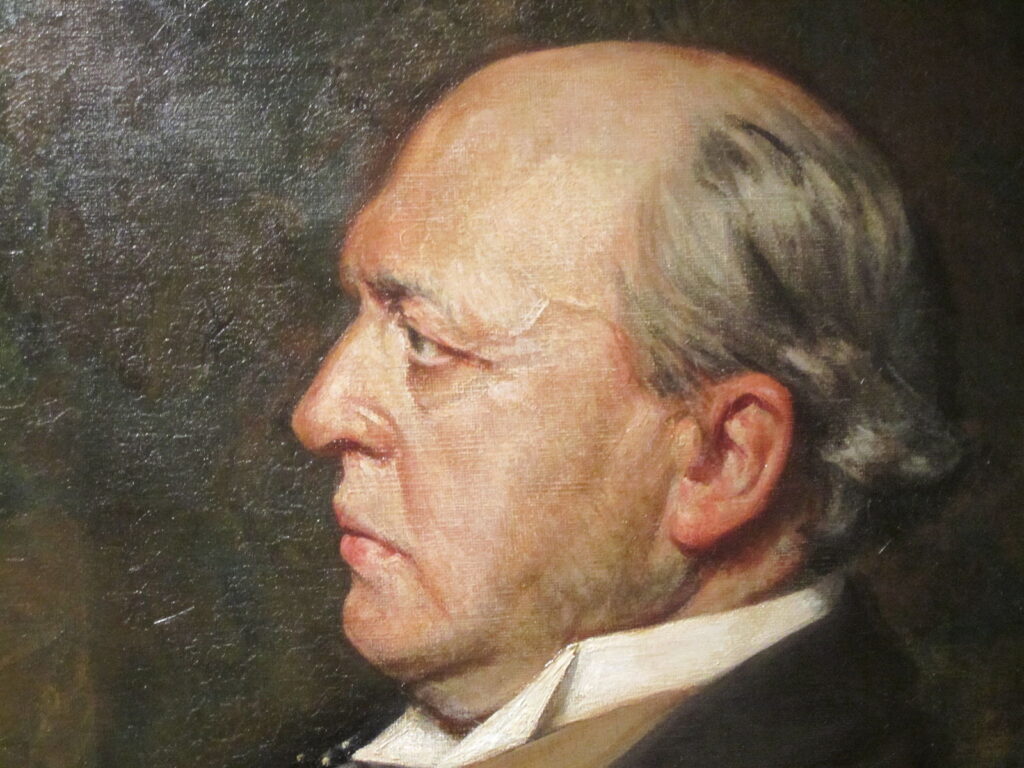

5. Henry James: When Inheritance Meets Ink

When Henry James’s grandfather passed in 1832, the struggling novelist inherited a chunk of prime real-estate income. That multi-million-dollar windfall allowed him to roam London salons and Cambridge reading circles in style. James spent more on stationery, carriage rides, and afternoon teas than on solid investments. His diaries brim with mentions of bespoke paper and vellum invitations that cost small fortunes. Analyzing his accounts, the Financial Times found that he overleveraged family properties without building a safety net. After all, he wrote masterpieces but never mastered the art of compound interest. It’s like winning a golden ticket and trading it for extra candy.

By the time his publisher offered posthumous royalties, James’s bankbooks were as empty as a potboiler plot. He relied on friends to underwrite his final writing retreats, turning generosity into a backup plan. History remembers his novels more fondly than his financial record-keeping. Future writers might learn that crafting sentences is easier than crafting spreadsheets. If inspiration alone made money, every artist would be wealthy. He proved that investing in ideas is beautiful—but not always bankable. So next time you hit the literary jackpot, maybe stash a little in the market.

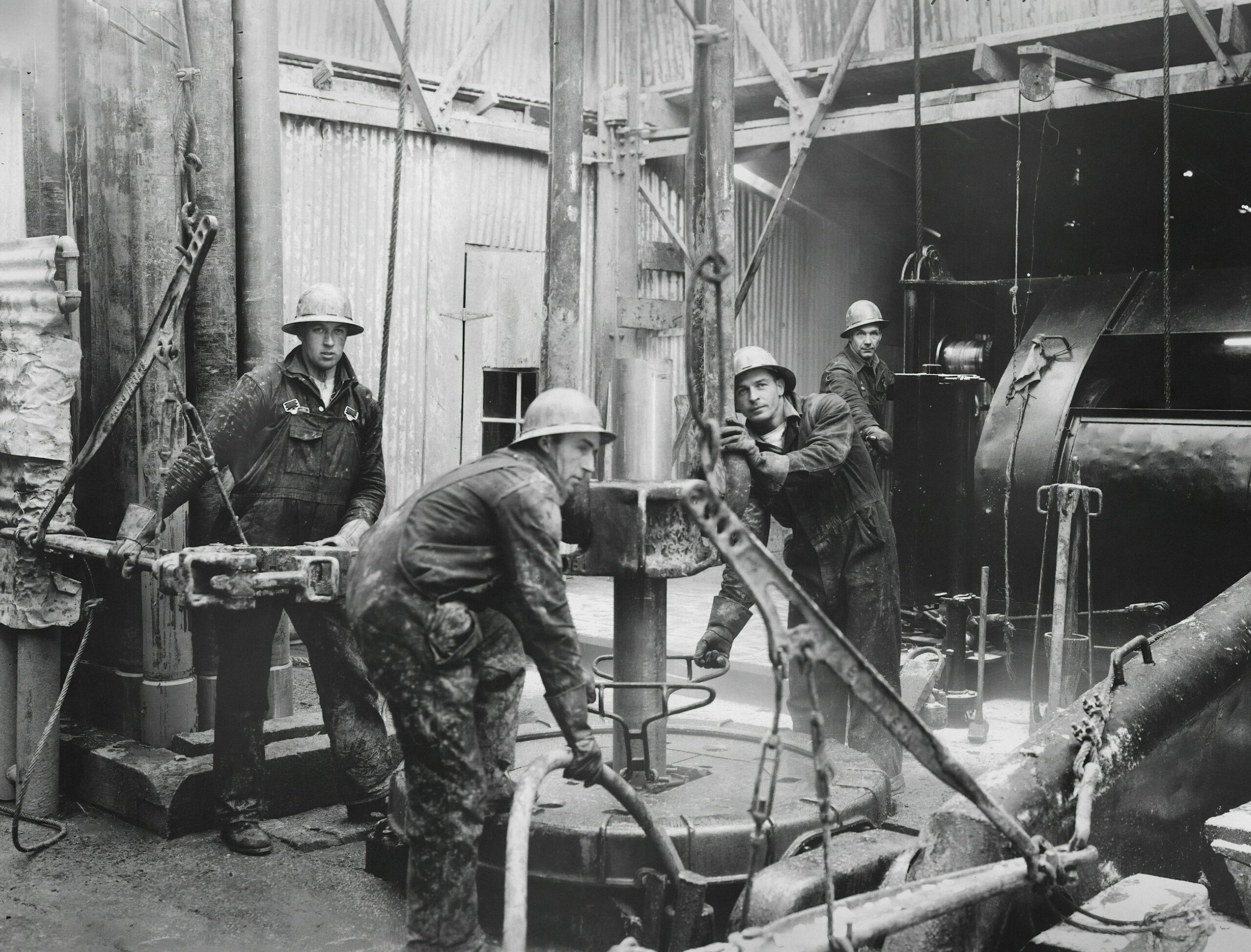

6. The Hunt Brothers: Silver Kings to Courtroom Kings

Nelson Bunker and William Herbert Hunt inherited an oil-drilling empire that left them swimming in billions. In the late 1970s, they chased the ultimate treasure by attempting to corner the global silver market. With every ounce they hoarded, silver prices rocketed higher, tanking investor portfolios and shocking economists. Soon, commodity traders called the Hunt brothers both geniuses and market villains. But markets have a way of snapping back: when silver plunged in 1980, their paper profits turned into real losses overnight. Margin calls thundered in like angry bulls at a rodeo. Their cash cushion drained faster than their bullion stash.

Regulators cracked down, suing for market manipulation and demanding billions in restitution. Lawsuits, fines, and legal fees piled up, eclipsing any surviving silver certificates they still held. The oil fields that once fueled their rise couldn’t bail them out from their metal meltdown. David vs. Goliath trading style became a cautionary tale for financiers everywhere. Today, “Hunt the silver” only gets you stock tips from antique dealers. The brothers learned the hard way that cornering a market can leave you cornered. And that even an heir to an oil fortune can be undone by glittering ambitions.

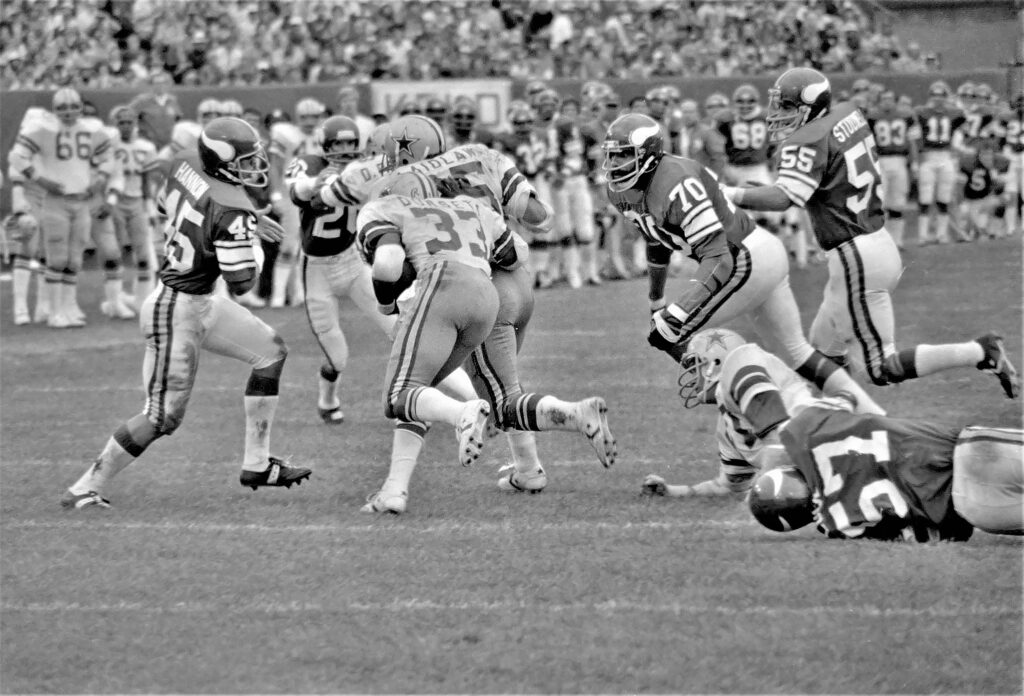

7. Clint Murchison Jr.: Football Team Fumbles

Clint Murchison Jr. strutted into the 1960s with a $200 million oil inheritance and big dreams of NFL glory. He founded the Dallas Cowboys and sank millions into stadiums, restaurants, and glitzy marketing stunts. Without a CFO in sight, his books looked more like autograph books—signed, sealed, but not delivered. Debt collectors soon made their own touchdown dances in his offices. Bankers tut-tutted at his spending on fur coats for cheerleaders and diamond-encrusted football helmets. Even “America’s Team” couldn’t hide the mounting IOUs. It was a gridiron gamble that didn’t pay off on the balance sheet.

By season’s end, Murchison had to bring in partners and refinance to keep the Cowboys from bankruptcy. Legacy sponsors balked at contracts when contracts balked at checks. The legend of the Cowboy Holy Grail tarnished under pressure from mortgage lenders. Still, the franchise survived—and eventually thrived—once real financial management kicked in. Murchison’s flair for showmanship couldn’t substitute for ledger discipline. He passed on the team but not the debts to the next generation. Takeaway: a winning streak on the field doesn’t guarantee a win in the ledger.

8. Tori Spelling: From Beverly Hills to Budget Bites

Tori Spelling grew up knowing Aaron Spelling had a $600 million TV dynasty in his back pocket. Her inheritance cap of $800,000 seemed like a fortune—until she treated it like pocket change. Reality shows, product lines, and high-falutin lifestyles turned her bank account into an episode of “Bills, Bills, Bills.” Multiple bankruptcies and tax liens read like plot twists nobody saw coming. Luxury handbags gave way to “please pay now” notices. The cash cushion vanished faster than ratings after the season finale. She discovered that nepotism may open doors but not always bank vaults.

With every foreclosure auction, her credit score dropped further than a cliff diver. Courtroom filings exposed lavish parties and unpaid vendors. Her story became a masterclass in why inheritance caps exist. She still flashes an A-list smile, even if her checkbook winced. Hollywood heirs learn quickly: spotlight doesn’t equal solvency. Use dad’s name wisely, or you’ll change your last name to “Debt.” And that’s how Beverly Hills glamour met budget reality.

9. Anthony Marshall: Brooke Astor’s Trust-Fund Trap

When Brooke Astor passed, she left about $200 million to her only son, Anthony Marshall. But instead of expanding charities, he funneled millions into speculative real-estate flips that rarely flipped anything. Plush Manhattan apartments and country estates became pawns in an elaborate game of shell companies. The District Attorney smelled something fishy and opened an investigation. Marshall responded with costly legal maneuvers, draining trust coffers in the process. His boardroom battles replaced pancake breakfasts at family picnics. What started as a Gilded Age gift turned into a modern courtroom drama.

Convicted of defrauding his mother, Anthony surrendered millions more to restitution orders. Media dubbed him “the world’s most ungrateful heir.” The headline-making trial highlighted how not to be a trustee. His name lives on in news clips rather than philanthropies. Brooke’s charities had to scramble for new funding after her son’s mismanagement. Wealth without wisdom proved its own worst enemy. And charity? It outlived every last reckless real-estate gamble.

10. George Jay Gould: Railroads Run Off the Rails

Jay Gould left a staggering $2.5 billion fortune divided among six heirs in 1892. His eldest, George Jay Gould, inherited railroads that threaded across America’s heartland. Yet George spent more time ordering champagne at Paris salons than analyzing freight contracts. Divorce settlements, polo ponies, and a wannabe rival railroad swallowed cash by the barrel. By 1923, those trusts had shrunk by over a third, thanks to lifestyle inflation and bad expansion bets. The Wall Street press called him a charming dilettante—run your railroad like you run your yacht. Trains kept running, but George’s bank account didn’t ride on schedule.

His siblings fared little better when it came to prudent spending. Endowed libraries and parks retained the family name but not the family bank. History books remember the Gould money more than the Gould management. Elliott Fitch Shepard once quipped “build trust like you build a train”—George built neither. Buildings and boulevards bear his name, but the family’s financial engine ground to a halt. Railroads outlived the riches that laid their tracks. And that’s proof that even a baron’s bloodline can end up derailed.

11. The Pritzkers: Hyatt’s Happy Empire… Until Family Feud

Jay Pritzker created a $15 billion Hyatt empire from hoteliers to high rises. His goal was a handwritten note in every lobby and a dynasty trust for every heir. But after his death in 1999, nieces and nephews squabbled over who got what. A lawsuit claimed $1 billion had simply disappeared from the trusts. Legal fees piled up like room service bills at a grand hotel. Family dinners became board-room skirmishes rather than celebratory toasts. What should have cemented a legacy turned into a soap-opera feud.

The Pritzker name still gleams above Hyatt lobbies worldwide. But the original fortune fractured under mistrust and missed opportunities. Some branches of the family still pull cash from their slice, while others fight in court. Dynasty planning hopes to avoid emptiness—Pritzkers proved it can backfire spectacularly. The only suite they couldn’t book was one without litigation looming. Keep your family and your finances in harmony, or you’ll check into Trust-Bankruptcy. And that’s the real lesson behind those glimmering lobby signs.

12. Doris Duke: The Tobacco Heiress Who Burned Through Billions

Doris Duke, once crowned “the richest girl in the world,” inherited about $1.3 billion from her tobacco and energy tycoon father. While Doris did plenty of philanthropic work—funding hospitals, the arts, and global conservation efforts—her private life was basically a Real Housewives spinoff with better jewelry. She built mansions across Hawaii, Beverly Hills, and New Jersey, staffed by armies of gardeners, chefs, and bodyguards. Doris handed out blank checks to hangers-on who played personal assistant, lover, or psychic advisor depending on the day. She spent so much cash “in the moment” that her estate needed aggressive management just to prevent complete collapse.

Her last years were marred by lawsuits and wild accusations of financial exploitation by her staff. At one point, she adopted a much-younger woman purely to have an heir she could trust—only to leave her tangled in a lawsuit when the will got contested. Endless rounds of court battles over who got what drained the trust faster than her antique fountains drained their water bills. Mansions like Shangri-La became costly burdens rather than playgrounds. Despite still having charities in her name today, the wealth she started with could’ve fueled ten foundations instead of one. Doris lived like there was no tomorrow—and for her fortune, there really wasn’t. Lesson: when your lifestyle requires an entourage bigger than a Marvel movie cast, maybe rethink the spending plan.

13. John du Pont: From Chemical Fortune to Crime Scene

John du Pont, heir to a $200 million chemical fortune, channeled his wealth into Foxcatcher, a wrestling team fit for Olympic champions. On the surface, he looked like the ultimate sports patron, building a palatial estate and sponsoring elite athletes. Deep down, paranoia crept in through ornate hallways and gold-plated doorways. He fired coaches on a whim, lavished huge bonuses, and installed booby traps around his compound. When tensions peaked in 1996, tragedy struck: he murdered wrestler Dave Schultz on those manicured lawns. The trial laid bare a fortune funneled into instability and obsession. His $200 million wasn’t enough to buy mental peace—or a get-out-of-jail-free card.

Convicted and imprisoned, du Pont spent his final years behind bars, reportedly broke and betrayed by the very wealth he worshipped. Foxcatcher dissolved, estates sold off to cover legal claims and restitution orders. Documentaries and films now dissect his downfall, reminding viewers that money can’t cure madness. His name echoes not in boardrooms but in cautionary headlines. The du Pont name still looms large in industry, but not because of John. An inheritance can fund greatness—or fuel a fatal unraveling. And that’s how a family’s chemical legacy ended in courtroom echoes instead of lab breakthroughs.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.