Imagine you’re scrolling through your group chat, memes flying, when suddenly someone nonchalantly asks for your “birthdate” or “bank digits.” It feels innocent—until you realize handing out those little tidbits is basically handing over your life’s blueprint. To keep your future self from face-palming, here’s a friendly, slightly cheeky rundown of what to guard with your life (or at least your most secure password).

1. Social Security Number

Your Social Security Number isn’t just some bureaucratic afterthought—it’s the ultimate key to your financial castle. If someone gets hold of your SSN, they can open credit cards in your name, apply for loans, and even file fake tax returns under your identity. According to the Federal Trade Commission, SSNs are a top target for identity thieves who can turn them into significant financial damage. Sharing your SSN outside of official channels is like handing a master key to a stranger. This goes for random requests in your DMs, coffee shop Wi-Fi forms, or that “urgent” email from IT support. Keep your SSN tucked away only for the IRS, genuine employers, and verified government websites.

Never tote your SSN card in your wallet—if your wallet vanishes, your SSN goes right with it. Shred any documents bearing that nine-digit magic code before they hit the trash. Resist the urge to store it in plain-text files on your phone or desktop. If you must jot it down, stash it offline in a locked drawer or safe. And always verify calls or emails asking for your SSN by reaching out directly to the official organization using known contact details. Treat your SSN like your best kept secret, because once it’s out, you can’t ever change it.

2. Bank Account Number

Your bank account number is basically your personal address in the world of money moving. While routing numbers are public info you find on every check, your unique account number is strictly private. Handing it out irresponsibly is like giving someone the combination to your safety deposit box. According to Investopedia, account numbers paired with routing numbers let fraudsters set up unauthorized withdrawals and sneakily transfer your hard-earned cash. Only share it for trusted purposes—like direct deposit setup, verified bill pay, or sending your rent to that roommate who always forgets. If you aren’t 100% sure who on the internet you’re sending it to, don’t send it at all.

Always double-check that the site where you’re entering your account number is encrypted; look for the little padlock icon before you click “Submit.” Legit banks and reputable services never email or text you out of the blue asking for your full account details. If someone does, pick up the phone and dial the official number on the back of your card to confirm. And if you ever suspect weird activity after handing out your account number, report it immediately to your bank’s fraud department. They can freeze your account faster than you can say “unauthorized transaction.” In the world of digital finance, paranoia is just another word for self-preservation.

3. Credit Card Number (and CVV)

Your credit card number and its CVV are basically the Batman and Robin of plastic power. Those digits let you buy everything from a venti latte to that impulse gadget you didn’t need. Sharing both your card number and CVV is like giving someone a backstage pass to your wallet. The FDIC’s Privacy Rule Handbook specifically warns against exposing full card details because it makes fraud a trivial exercise. Never text or email a picture of your card—even to “customer service”—because that information can be misused in seconds. Only input your details on checkout pages you initiated yourself on well-known, secure sites.

Avoid entering your CVV on any site you landed on via unsolicited links or social media ads. Fraudsters often craft fake QR codes at gas pumps or coffee shops—always type the URL manually or use the official mobile app. If you notice a charge you didn’t make, call your card issuer immediately to dispute it. Most banks can instantly freeze or cancel your card, preventing further unauthorized charges. And if you think your CVV has leaked, request a new card—the old one won’t work without the new security code. Security may feel like a pain, but a little caution now saves gallons of headache later.

4. Mother’s Maiden Name

Your mother’s maiden name might sound like sweet trivia, but it’s a classic security question waiting to be exploited. Whether you’re filling out a form or answering a “fun fact,” that name is public record on genealogy sites. The Dallas Morning News warns that anyone can type your family tree into Ancestry.com and uncover her pre-marriage surname in minutes. Use that knowledge, and they can breeze past “secret” authentication checkpoints on your accounts. So ditch the real answer and invent something wild—like your favorite dessert. Store that made-up response in your password manager for safekeeping.

The same trick applies to your first pet, childhood best friend, or favorite teacher. Treat each security question like a mini password, unique and nonsensical to anyone else. This strategy makes your account recovery process hacker-proof, even if your personal details are plastered online. And if a site gives you limited options for questions, choose the least obvious one. Always verify your alternate email and phone number are up to date, so real notifications don’t go astray. That way, even when you forget your made-up answers, you can still prove you’re the real owner.

5. Login Passwords & PINs

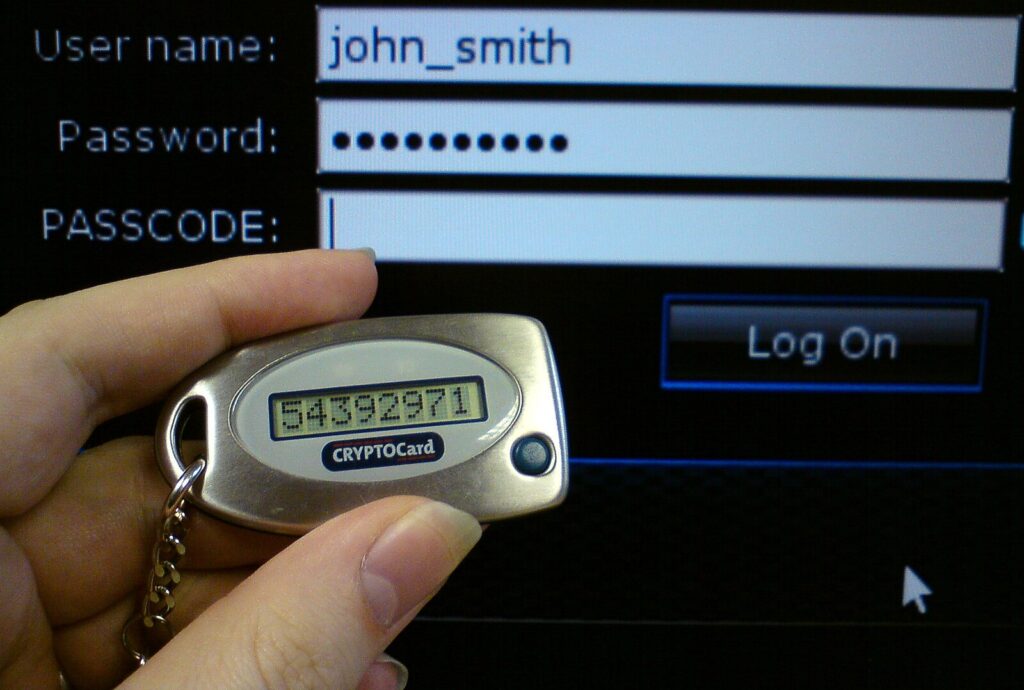

Your passwords and PINs are the bouncers at the hottest club in your digital world. Sharing them is like handing out VIP passes to strangers on the street. Experts at Wired confirm that reused or weak passwords make it trivially easy for hackers to break in. And if you’ve ever used “password123” or “1111,” you might as well have a welcome mat for cybercriminals. Always craft long, unique passwords or passphrases—think of something only you’d come up with. Then stash them in a reliable password manager and never say them out loud.

Two-factor authentication (2FA) is your best friend; it tacks on an extra hurdle even if someone cracks your password. Text messages, authenticator apps, or security keys add that crucial second layer of protection. Rotate your passwords every few months and retire any that have been compromised in breaches. If you’re old-fashioned, scribble them in a notebook kept under lock and key. But never leave them on a sticky note stuck to your monitor—that’s just cyberbullying yourself. With strong, unique credentials everywhere, your digital life stays in your own hands.

6. Date of Birth

Your date of birth might feel like harmless birthday chatter, but in the wrong hands it’s a piece of the identity puzzle. Combine your name and DOB, and you’re halfway to giving someone enough info to impersonate you. Crack that, and a fraudster can open new accounts, bypass age gates, or even fake official documents. You’d be surprised how many forms and apps request full birth dates without strong security. Only share the year, or even just the month and day, on social media to keep the real date under wraps. When a legitimate site demands your full DOB, make sure it’s secured with HTTPS and two-factor options.

If you ever accidentally share your complete birth date, monitor your credit report and bank statements like a hawk. Setting up fraud alerts with credit bureaus can act as an early warning system for unusual activity. And don’t rely on email alone—enable phone notifications so you see alerts in real time. Think twice before typing your DOB into random online quizzes asking to reveal your “spirit animal.” Those seem innocent, but often feed your data to marketing lists or shady ad networks. Your birthday may be a gift for you, but it’s a gift you don’t want to hand out to cybercriminals.

7. Credit Report Details

Your credit report is like the director’s cut of your entire financial life—it shows every loan, credit card, and bill you’ve ever had. Handing it out is basically giving someone the blueprint to your money moves. Scammers can study it for gaps or quirks, then craft perfectly targeted phishing campaigns. Only pull reports through official channels and keep them under lock and key. If someone asks to “see your report,” verify who they are and why they need it. Legit lenders and landlords use secure portals, not emailed PDFs you send on a whim.

Store any printed reports in a locked drawer or safe to avoid unwanted peekers. Shred old copies so no sneaky glances can reconstruct your financial history. Check in on your credit score periodically to catch suspicious changes early. If you ever spot accounts you didn’t open, freeze your credit immediately and enroll in identity theft protection. A nighttime credit monitoring service can give you peace of mind while you sleep. Treat your credit report like confidential intel—it’s not something to casually share.

8. Security-Question Answers

Those little security questions about your childhood pet or first car are supposed to keep strangers out. But if your answers are drawn from your Facebook feed, hackers can breeze right through. Instead of telling the truth, invent memorable gibberish—then treat it like an extra password. Store these quirked-up answers in your password manager so you never forget them. That way, even if someone knows your real first school or favorite color, they hit a dead end. Selecting the oddest question available only heightens your security.

Rotate these invented answers whenever you change your main passwords or PINs. And avoid using the same fake answer for multiple sites—it’s like reusing a password. If a service only offers basic questions, lean into the weird ones to keep attackers guessing. Periodically review your security questions in each account’s settings to ensure they’re still undiscoverable. And don’t be shy about adding extra authentication methods if they’re available. Strong, layered security questions add a silent guard rail around your accounts.

9. Utility Account Numbers

You’d think your electric bill account number would be the least exciting thing a scammer could steal. You’d be wrong. Thieves can use your gas, water, or electric account numbers to reroute services, open fraudulent utility accounts, or even create bogus proof of residence. Utility scams are a booming business—bad actors posing as “customer service” will claim there’s a problem and trick you into handing over your info. If you get a call, text, or email about your utilities, never give up your account details until you independently verify the company’s contact info.

When paying bills online, stick to official apps or websites, not random links from emails. Keep physical copies of your utility bills tucked away securely—no leaving them out for guests to eyeball. If you move, alert your utility providers immediately to shut off services at the old address and secure the new account. Some scammers even set up fake move-in services to snag your info during transitions, so stay suspicious in that in-between time. Your water bill isn’t just boring paperwork—it’s a direct pipeline to your personal data if you’re not careful.

10. Driver’s License Number

Your driver’s license number isn’t just for flashing when you get carded at the bar. It’s a juicy prize for identity thieves who can use it to create fake IDs, open accounts, and even rack up traffic violations in your name. Even if you don’t drive much, your license info is basically a mini-you in the eyes of banks, hospitals, and government agencies. If a random form or sketchy email asks for it, that’s your cue to slam the brakes. Only give it to verified employers, car rental companies, and government sites that absolutely require it.

When you do need to submit it, check that the website is secure (hello, padlock icon) and that the request actually makes sense. Never keep photos of your license floating around in your camera roll—one lost phone, and you’re giving away your second-most important ID after your passport. If your license number ever leaks, you can often request a reissue through your local DMV. Set up identity monitoring if you feel especially exposed; it’ll watch for suspicious activity tied to your license. Treat your driver’s license number like your social security number’s slightly less famous but still very powerful sibling.

11. Passport Number

Your passport number is the golden ticket that proves your identity across borders. Sharing it on sketchy apps or unsecured emails can expose you to identity fraud in any country. Only provide it to official travel agencies, government portals, and trusted employers for background checks. Keep a physical copy locked in a safe rather than a photo on your phone. If you need to email it, encrypt the file or use a secure document portal. Scammers can use a leaked passport number to clone passports or forge travel documents.

When booking flights, use the airline’s official website or reputable travel sites—you’ll know the info stays encrypted. After travel, securely delete any digital copies you made for convenience. If your passport details ever leak, report it to your country’s passport office immediately. They can flag your number in their system to prevent fraudulent issuance. And if you’re planning long trips or digital nomad gigs, invest in a secure travel document app that uses biometric locks. That way, only you can access your vital passport info, even if your phone is stolen.

12. One-Time Passwords (OTP)

One-time passwords are those magic six-digit codes sent to your phone or email. They’re meant to confirm it’s really you logging in—or completing a transaction. Never forward or screenshot an OTP, even if someone claims to be from your bank or IT department. True support staff will never ask you to share that code. Doing so hands over the final piece of the puzzle to fraudsters. Always punch in OTPs yourself and retire them immediately after use.

If you receive an unexpected OTP message, it’s a red flag—change your password right away. Add push-notification based authentication when possible; it’s more secure than SMS. Some apps even let you generate codes offline; those aren’t vulnerable to SIM swap scams. Enable biometric locks on your authentication apps to keep prying eyes out. If you lose your phone, use your backup codes to recover your account, then reset MFA from a trusted device. Treat those backup and one-time codes like gold—they only work once and then vanish.

13. Prepaid/Gift Card Numbers

Prepaid card numbers and their PINs are basically digital cash waiting to be spent. Remove that info from a chat or social media post, and someone can drain your balance in seconds. Only enter them on the retailer’s official checkout page when you’re ready to buy. If you’re reselling cards, deal in person or use a verified platform, never through random group chats. Treat the card number and PIN like you would treat cash—keep it in your pocket until you need it. Avoid storing the PIN under the scratch-off coating; that’s an invite for opportunistic thieves.

When buying gift cards in-store, check the balance immediately before leaving the premises. Scammers sometimes tamper with cards on display and replace them with drained ones. Keep your purchase receipt until you’ve used the full balance. If the card isn’t working, the receipt is your only proof for a replacement from the store. And if you ever lose a card with remaining balance, immediately contact the retailer’s customer service. Receiving a new card may cost a small fee, but it beats losing all your funds.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.