You ever make a financial plan that feels airtight—like you’ve cracked the code—and then bam, the world changes overnight? One minute you’re stacking ETFs like LEGO bricks, the next you’re Googling “should I panic sell during a trade war?” These days, markets move on tweets, tech tantrums, and climate curveballs—and the usual rules? Out the window. If you’re still building your portfolio like it’s 2015, it’s time to rethink the whole strategy. These 13 global trends are already in motion, and trust us, they’re not asking for your permission before shaking things up. Read on, recalibrate, and maybe pour yourself a coffee (or something stronger).

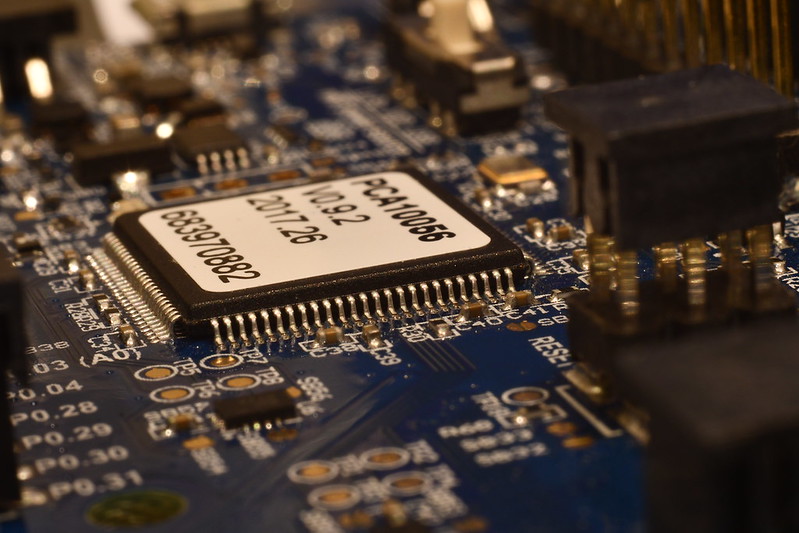

1. AI-Powered Everything

Forget “robots taking over,” think “robots making you richer…if you invest right.” Over the next three years, 92 percent of companies plan to ramp up their investments in AI—and not just chatbots answering FAQs. According to McKinsey’s Global Economics Intelligence, only 1 percent of firms feel truly “AI-mature,” which means there’s massive upside for early adopters who back the right players.

But here’s the kicker: while execs are hyped (87 percent expect revenue growth from GenAI by 2028), the scramble for AI talent is turning into a bidding war that could inflate costs faster than crypto in 2017—er, 2025. If you thought stock buybacks were hot, wait until you see firms duking it out over data scientists. Keep an eye on AI ETFs and startups applying AI to niche industries (hello, precision agriculture)—these are where the real alpha lives. This isn’t just a tech trend—it’s reshaping how entire industries hire, operate, and grow. If you’re ignoring this wave, you’re basically investing with blinders on. AI isn’t optional anymore—it’s the new baseline.

2. Climate Policy U-Turns and Energy Shocks

Just when you thought “green is in,” politics can send prices sideways. At Davos 2025, Western nations doubled down on sustainability, but the U.S. pivot under President Trump cast a shadow over global climate accords. The Financial Times reports that the Fed even withdrew from the NGFS coalition—so don’t be surprised if carbon markets get choppy.

This topsy-turvy policy environment means renewables could see boom–bust cycles faster than Bitcoin. If clean-energy subsidies vanish or tariffs on solar panels spike, valuations could tumble. On the flip side, companies building microgrids and energy storage (think Deutz’s new U.S. push) may be your secret weapon. Strategically overweight those names—but keep your stop losses tight. Markets love consistency, and energy policy is currently the opposite of that. Your ESG plays might need more agility than ever. Bottom line: green is still good—but expect whiplash.

3. Geopolitical Fragmentation and Tariff Tango

Globalization? More like global “froze-a-lot.” Heightened tensions between the U.S., China, and Europe could spark fresh tariffs—heck, Trump 2.0 is already muscling for deals in Davos. As Reuters noted, discussions included “mainstream finance” embracing crypto but also threats of fresh trade barriers that could jack up costs across industries.

When countries play tariff tag, multinational earnings forecasts go out the window. Tech hardware, autos, even food producers could see margins squeezed. To dodge the worst, look at firms with onshore manufacturing or diversified supply chains in Southeast Asia. Bond durations matter too—rising geopolitical risk often pushes yields down, lifting static-income returns. Supply chains aren’t snapping—they’re stretching and rerouting in ways we haven’t seen since the Cold War. Investors betting on cross-border smooth sailing are in for a reality check. Global trade isn’t dead, but it’s definitely got a limp.

4. Demographic Divergence: Aging vs. Emerging Markets

Don’t sleep on demographics: in advanced economies, greying populations are driving up healthcare spending and pension liabilities. The IMF’s World Economic Outlook highlights that aging could shave off GDP growth in Europe and Japan by up to 1 percent by 2030. Meanwhile, younger populations in India and parts of Africa are itching for everything from smartphones to solar panels.

This split means defensive healthcare and dividend-paying blue chips in the West, and selective equity plays in high-growth EM consumer staples. Pension funds may underweight long-term bonds as liabilities stretch out, favoring real assets instead—think infrastructure and property in growing cities. Adjust your asset mix accordingly: balance the “silver wave” with a dash of emerging-market spice. The future isn’t one-size-fits-all—it’s split across age lines, policy frameworks, and spending habits. You’ll need one hand in walkers and the other in mobile wallets. Smart investors won’t choose sides—they’ll balance both.

5. Digital Assets Go Mainstream (…Sort Of)

Crypto hasn’t vanished into the void—and regulators are scrambling to catch up. As industry leaders at Davos debated, we could see the first wave of tokenized bonds and equities hit major exchanges by year-end, but only if clear rules arrive. According to a recent FNLondon piece, “crypto investment is expected to gain momentum,” provided institutions bridge that pesky “trust gap”.

If you believe blockchain’s long game, now’s the time to scout platforms with strong compliance frameworks. But beware: crypto volatility still makes GameStop look like a snoozefest. Use small allocations in regulated products, and stick with large-cap tokens or ETFs that track them. That way, if the market has another “crypto winter,” your portfolio’s meltdown will be limited. Traditional finance is flirting with Web3 harder than ever—but the relationship status is still complicated. Digital assets are graduating from hype to homework. Be ready to back the winners, but don’t forget your seatbelt.

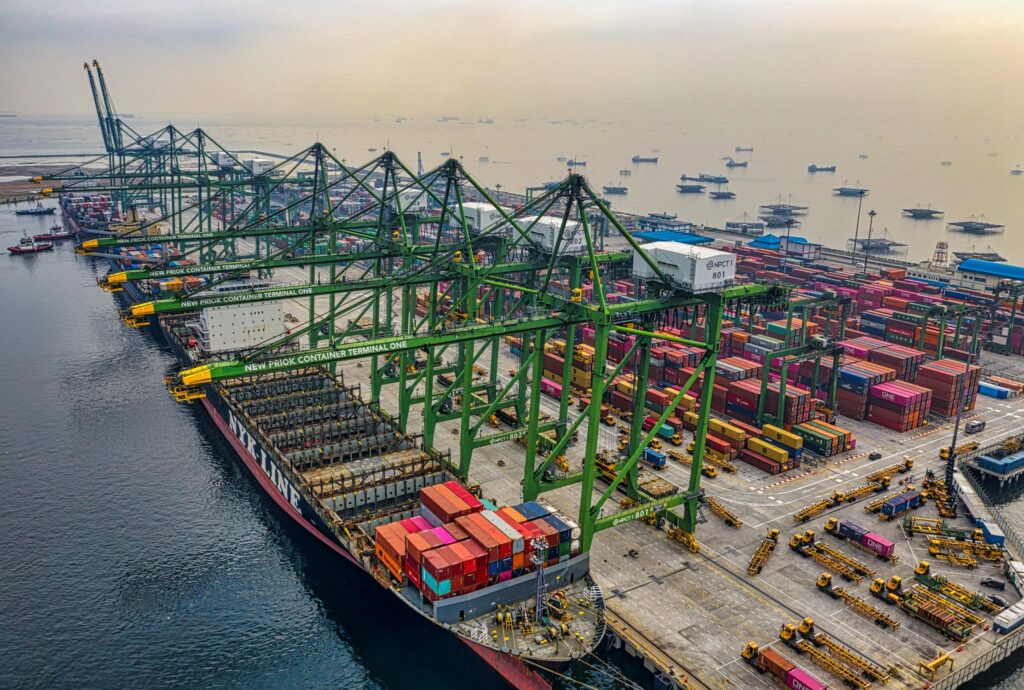

6. Supply-Chain Reshoring and “Friend-Shoring”

With geopolitical chills in the air, companies are moving production closer to home—or to friends’ homes, anyway. Sixty percent of Fortune 500 firms are diversifying suppliers to reduce China exposure. This means industrial and logistics stocks could surge, while pure-play Chinese exporters may lag.

For investors, that spells opportunities in port operators, cold-chain specialists, and industrial REITs near manufacturing hubs. Keep tabs on semiconductor-capex plays, too—reshoring chip fabs is a government priority in the U.S. and Europe. The entire manufacturing narrative is shifting from “just in time” to “just in case.” This isn’t a temporary detour—it’s the new map. Expect growing capital flows into regions like Mexico, Vietnam, and even the U.S. Midwest. If your portfolio still leans on the old global grid, it might be time for a supply-chain makeover.

7. Cybersecurity Wars—and Wallets at Risk

Ransomware attacks are up 50 percent year-over-year, with hackers targeting everything from hospitals to Hollywood studios. Cyber firms are beefing up AI-driven defenses, though only a handful can truly scale. As breaches become board-room nightmares, expect cybersecurity budgets to swell.

Look for managed-service providers and niche software vendors with recurring-revenue models. Legacy security giants may underperform if they fail to integrate AI and cloud-native solutions. Attacks are getting faster, smarter, and nastier—and boards are finally treating them like existential threats. Cyber insurance is booming, and risk modeling is becoming its own vertical. This isn’t just a tech problem—it’s a financial one. Ignore this space, and you’re missing one of the decade’s biggest defensive growth plays.

8. Infrastructure Renaissance

Governments worldwide are unleashing trillions on roads, ports, and power grids to stimulate growth—and hedge against recession. Forecasts warn about inflation and rising materials costs, but also spotlight massive opportunity in mid-market projects. Public–private partnerships (P3s) in green hydrogen, EV charging, and 5G towers are prime targets. Infrastructure equity ETFs and muni bonds with green labels could deliver steady yields—and an ESG halo boost. This is old-school meets next-gen: concrete and cables powering data and decarbonization. From rural broadband to cross-border rail, there’s money flowing into the veins of future economies. It’s not sexy, but it’s serious. And in volatile markets, stable yield with public support sounds pretty appealing.

Don’t overlook legacy maintenance either—aging bridges, water systems, and grids all need upgrades, creating long-term demand. Construction tech and smart materials firms stand to benefit too. The shift is away from short-term shovel-ready projects toward strategic, resilient infrastructure. And that means more predictable cash flows for investors in the right names. It’s not just about pouring concrete—it’s about laying the foundation for the next economy. If you’re not allocating here, your portfolio may miss the most grounded play of the decade.

9. Insurance Industry Shake-Up

Natural disasters and cyber-threat spikes are pushing insurers to innovate or evaporate. Net-investment income is rising, but reinsurance costs remain sky-high—especially for climate risks. Insurtech startups deploying IoT sensors for real-time risk assessment could be the next unicorns. Legacy carriers slow to adopt could see their market share—and stock prices—erode. Think of this less like insurance and more like predictive analytics with a cash buffer. The better a company gets at understanding risk before it hits, the more they save—and the more they profit. This space used to be sleepy; now it’s becoming aggressively digital. Don’t snooze on insurers rebranding as tech-first risk platforms.

Also worth watching? Parametric insurance—payouts triggered automatically by predefined events like hurricanes or earthquakes. It’s scalable, faster, and way more efficient than traditional claim models. Big data isn’t just powering fintech—it’s transforming how insurers price and mitigate risk. And reinsurers are quietly becoming the most underrated players in climate finance. A portfolio with insurance exposure isn’t boring anymore—it’s strategic. You’ll want to be on the side of those predicting the storm, not reacting to it.

10. BlackRock’s “Mega Forces” Thesis

The world has left “boom and bust” behind, driven by five mega forces: AI, net-zero, geopolitics, demographics, and digital finance. Asset managers are now leaning into thematic investing over broad, diversified indexes. To play this, overweight thematic ETFs—think AI, clean energy, and fintech—and underweight generic large-cap funds. These forces aren’t random; they’re systemic, directional, and long-term.

Playing defense won’t cut it anymore—you’ll need focused conviction. It’s less about timing and more about alignment with the big picture. Portfolios that don’t evolve with these forces risk becoming fossils.

Investing based on old frameworks—like geographic exposure or backward-looking sector splits—is getting riskier by the year. Thematic exposure offers a shot at outperformance and narrative-driven momentum. Plus, it resonates with younger investors who want their money aligned with future-proof trends. This isn’t hype—it’s structural shift. Ignore the mega forces, and you’ll end up swimming against the tide.

11. Rising ESG Regulatory Heat

Once niche, ESG disclosure rules are going mainstream: climate reports, board diversity targets, and Scope 3 emissions are no longer optional. Companies without robust ESG frameworks face fines, delistings, and stranded-asset risk. Investors should favor firms with clear transition plans and avoid “greenwashing” suspects. Green-bond ETFs and sustainability-linked loan portfolios could shine. ESG is growing teeth, and regulators are sharpening them. This is less about virtue signaling and more about regulatory survival. If a company doesn’t know its Scope 3 emissions, expect markets to punish it. You don’t have to be an ESG die-hard to care—you just have to want your investments to stay listed and liquid.

We’re moving into a world where sustainability reporting is just as scrutinized as earnings per share. That means ESG-savvy analysts and products will outperform their sleepy, checkbox-driven peers. As companies scramble to comply, those with cleaner books and better frameworks will unlock cheaper capital. For investors, this creates a two-lane highway: one for compliant winners, the other for regulatory roadkill. Pick your lane wisely.

12. Renewable-Energy Investments Climb

Despite near-term policy swings, global renewables investment is smashing records. The surge is critical to hitting net-zero—but financing gaps persist in emerging economies. Solar and wind developers with strong project pipelines are on the fast track. Energy-transition funds and yieldcos may deliver yield plus growth. The money is clearly moving toward cleaner, cheaper power—even if the politics are murky. Innovations like green hydrogen and long-duration storage could supercharge the next wave. The grid of the future is being built now, often in places investors haven’t looked yet. Don’t miss it because you’re still hung up on fossil fuel nostalgia.

Battery tech, carbon capture, and demand-response platforms are all on the rise. What used to be high-risk bets are turning into infrastructure-grade assets. Fossil fuels may stick around for a while, but their market dominance? That’s slipping. Investors who stay nimble and track tech breakthroughs will ride the next big clean-power rally. It’s not about hugging trees—it’s about hugging opportunity.

13. The WEF’s “Intelligent Age” Vision

This year’s Davos theme, “Collaboration for the Intelligent Age,” stressed multi-stakeholder action across trust, growth, planet, industry, and people. Companies not engaging in those conversations risk losing license to operate—and investor capital. Watch for firms partnering on public–private AI ethics, circular-economy pilots, and upskilling initiatives. Those at the forefront could see stock-price premiums—and better long-term returns. This isn’t just talk—it’s becoming the new due diligence. A company’s social footprint is now a valuation factor. Investors are asking: “Do you get it, and are you part of it?” If not, capital is going elsewhere—fast.

The “Intelligent Age” isn’t about smart tech alone—it’s about how tech, policy, and people interconnect. Investing in companies that understand this shift isn’t woke—it’s wise. Culture risk is now investment risk. Ignore it, and you might miss what markets are really pricing in: alignment with a new global consensus.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.