Ever found yourself marveling at that impulse buy that actually makes your wallet breathe a sigh of relief later? Whether it’s swiping your card in a panic or splurging during a sale, we’ve all been there. But sometimes, the bigger the ticket, the bigger the payoff in saved cash down the line. Ready to adult like a pro and invest in the kind of purchases that make your future self high‑five you? Let’s dive into the first five game‑changers that pay dividends on your bank account (and your sanity).

1. Solar Panels

Ever squinted at your utility bill like it’s ancient Greek and wondered why you’re basically renting electrons? Splashing out on a solar array might sound like a mid‑life crisis in the making—after all, you’re looking at $15,000 to $30,000 for a whole‑house system. But hang on before you gasp: according to Architectural Digest, most U.S. homeowners see their solar setup pay for itself in just 7–9 years. That means a decade of virtually free electricity once you clear that break‑even point. Plus, most panels come with 25‑ to 30‑year warranties, so you’re squeezing every sunny dime for decades.

Beyond slashing your monthly bill, you’re buffering yourself against the dreaded utility rate hikes—no more crying over a 10% spike next summer. By year five, you’ll already be cash‑positive, and every kilowatt‑hour after that is like printing money. Did we mention net metering? If your panels crank out more juice than you can guzzle, some states pay you back for the surplus—hello, passive income. And don’t forget the federal Solar Investment Tax Credit, which shaves 30% off that upfront sticker price. Solar’s not just for tree‑huggers: it’s a bankable investment that pays dividends on your roof.

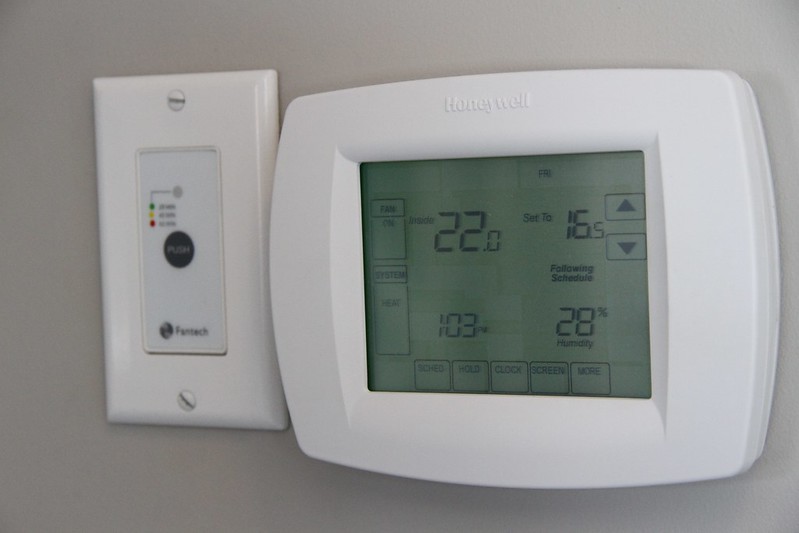

2. Programmable Thermostat

Ever leave the heat blasting while binge‑watching Netflix all day? A programmable or smart thermostat learns your groove and dials back the heat (or AC) when you’re out, cranking it up only when you’re home sweet home. The sticker price—around $100–$250—pales compared to the savings. Think of it as training your pad to chill out automatically.

By simply setting back 7–10°F for eight hours a day, you can slice up to 10% off your heating and cooling bills—about $220 on a typical annual energy spend, per the U.S. Department of Energy. Some models even geo‑fence your phone so your place is 72°F when you roll in after work, not a sauna or Arctic tundra. And it’s a gift that keeps on giving every season. Less wasted HVAC time means you’ll recoup the cost quicker than you’d imagine—perfect for those who’d rather spend on avocado toasts than runaway energy bills.

3. Electric Vehicle

Remember the last time you walked into a gas station and nearly fainted at the pump? Swapping your ride for an EV can be way more than an eco flex—it’s a wallet‑friendly move. According to The Washington Post’s deep‑dive, the average American logging 14,000 miles annually can pocket about $700 in fuel savings driving an electric sedan or SUV, and up to $1,000 if you’re piloting an EV pickup. Those dollars add up fast—no more oil changes, spark plugs, or transmission tune‑ups, because EVs have far fewer moving parts.

Factor in the federal tax credit of up to $7,500, plus state rebates in many places, and that upfront premium gap starts to look pretty cozy. Charging at home is a breeze—overnight rates can be as low as 10 cents per kWh, meaning you’re literally charging on the cheap while you binge Netflix. Public chargers can cost a tad more, but with a growing network of fast chargers, road trips are no longer battery‑anxiety fodder. Over a 10‑year ownership window, lower maintenance and fuel bills can tilt the total cost of ownership in your favor, outpacing gas cars in pure dollars saved. Ready to plug in and flex on those at the pump?

4. High‑Quality Mattress

Pulling an all‑nighter to cram for an exam? Your mattress isn’t judging, but your body definitely is. A premium mattress—think $1,000 to $3,000—may seem steep until you realize the health‑and‑happiness ROI. Better sleep leads to fewer sick days, sharper focus, and lower risk of chronic conditions linked to sleep deprivation.

Studies by the Harvard Business Review show poor sleep can cost employers $3,156 per insomniac employee in lost productivity and health expenses each year. Investing in a mattress that lasts a decade or more keeps you off the doctor’s couch and out of that midday slump. Plus, many top‑tier brands offer 10‑year warranties and free trials—so if it’s not your dream, you can send it back. Quality Z’s for less Zzz guilt? Win‑win.

5. Stainless Steel Cookware

Remember that flimsy frying pan that warped after one month of pancake duties? High‑end stainless steel sets start around $300 but can outlast nonstick pans by a decade (or more) without peeling or warping. You’re investing in a kitchen workhorse that transfers heat evenly and plays nice with metal utensils—no toxic coatings to flake into your omelets.

Food & Wine notes that premium tri‑ply sets, like All‑Clad’s D3, will last a lifetime with proper care. Over time, you’ll dodge the recurring cost of multiple cheap replacements, and your cooking performance skyrockets. Plus, resale value on well‑maintained cookware is surprisingly decent, so if you ever do upgrade, you recoup some cash. Solid steel equals solid savings—no sticky aftermath.

6. Comprehensive Home Insulation

Upgrading your home’s insulation might feel like an afterthought, but sealing leaks and adding proper attic or wall insulation can slash your heating and cooling bills in half over the lifecycle of your home. Choosing dense, certified insulation materials and professional air‑sealing can yield energy savings of around 15% on heating and cooling costs—equal to hundreds of dollars a year off your utility bills. Beyond the direct cost savings, better insulation stabilizes indoor temperatures, meaning less strain on your HVAC system and a longer equipment lifespan.

Not only do you recoup the cost in energy savings—often in under a decade—but you also qualify for federal tax credits and state rebates that can knock thousands off the price tag. With a typical payback period of 7–10 years and insulation lasting 20+ years, you’ll be in the black long before you consider replacing it. Plus, improved indoor comfort and reduced noise infiltration are welcome side benefits.

7. Energy‑Efficient Windows

Drafty old windows are like money flying straight out the cracks—swap them for ENERGY STAR® certified models, and you’ll see up to a 13% reduction in heating and cooling bills nationwide, translating into $126–$465 saved annually per household. Modern dual‑ or triple‑pane windows with low‑E coatings not only curb heat loss in winter and heat gain in summer but also boost home value and curb appeal—a perk if you ever sell.

Although window replacement costs can range from $150 to over $1,000 per window, high‑quality installations typically recoup 78% of that investment at resale, not to mention potential rebates of up to $1,200. Add to that the comfort of consistent indoor temperatures and less condensation, and you’ve got a package that pays dividends far beyond the straight energy savings.

8. ENERGY STAR® Dishwasher

Ditch the hand‑washing marathon and load up an ENERGY STAR certified dishwasher—it uses less than half the energy of hand‑washing, saves about 8,400 gallons of water a year, and runs at roughly $35 per year in electricity costs. Using eco‑modes and air‑dry settings can further trim energy use without sacrificing cleanliness, making it one of the most cost‑effective kitchen upgrades you can make.

Beyond the raw utility savings, dishwashers free up more than 230 hours of personal time annually. Ten days back each year? That’s priceless. And since modern dishwashers last 10–15 years with proper maintenance, you’ll keep reaping those benefits without a second thought.

9. Under‑Sink Water Filtration System

Trading in bottled water for a quality under‑sink filter means paying cents per gallon instead of dollars—households spending $340 a year on bottled water can cut that to roughly $1.08 for tap water plus filter costs, totaling under $100 annually. Over a decade, you’re looking at savings in the thousands, not to mention eliminating plastic waste.

Installing a whole‑house system also protects appliances from scale buildup—extending the life of your dishwasher, washing machine, and water heater—so you dodge hundreds in repair and replacement costs. Cleaner water, better appliance performance, and fiscal peace of mind? Win‑win.

10. High‑Quality Ergonomic Office Chair

Investing $300–$600 in a top‑tier ergonomic chair is a direct line to better health and productivity: studies show ergonomic seating reduces musculoskeletal strain and can boost work output by up to 40%, while cutting absenteeism and related healthcare costs. Imagine fewer sick days, less neck and back pain, and a more motivated you—or your employees.

With warranties often spanning 10 years, these chairs become cost‑effective over their lifespan. Less turnover, lower workers’ comp claims, and a happier workforce mean the ROI stacks up fast—especially for remote workers who spend hours a day at their desks.

11. Robotic Vacuum Cleaner

Picture this: you roll out of bed on a Saturday morning, coffee in hand, and your floors are already sparkling without you lifting a finger. Enter the robotic vacuum cleaner. It costs a few hundred bucks, sure, but think of it as hiring a tiny, tireless house elf for a fraction of normal cleaning costs. You’ll dodge backaches from pushing a vacuum around and evade hours wasted on dust‑bunny battles. These gizmos map your space, tackle pet hair like a pro, and zigzag their way under couches you’d never reach. When you factor in how much you’d pay for a monthly cleaning service or just the value of your free time, the ROI hits way above its weight class. Plus, many models even self‑empty into a base station, so you can truly set it and forget it.

The beauty is in the consistency of daily maintenance without you having to remember chores. You can schedule it to run when you’re at work or binge‑watching your favorite series, and come back to pristine floors. That constant upkeep actually extends the life of carpets and hardwood by preventing dirt from grinding in. With older homes especially, you’ll reduce allergens floating around, breathing easier without splurging on air purifiers. The upfront spend starts paying dividends fast, because you’re basically outsourcing the grunt work for good. Think of it as a robotic subscription service without recurring fees. Even if research and development goes wild and prices drop, your trusty model will still be cranking away. So grab your tech buddy and wave goodbye to vacuum‑induced apocalypse scenes in your living room.

12. Wholesale Warehouse Membership

If you’ve ever cringed at how much that 12‑pack of paper towels costs at the corner store, let me introduce you to the world of wholesale warehouse clubs. For an annual fee that’s basically one dinner out, you unlock bulk deals on everything from snacks to gas. Case quantities and giant tubs might seem like overkill for one person, but split that rotisserie chicken with friends and suddenly you’re the hero of the group menu. Beyond the obvious paper goods and pantry staples, you can score killer discounts on big‑ticket items like TVs and tires. That means the membership fee can vanish into thin air when you upgrade your gadgets or stock up your pantry. Plus, many warehouses have hit‑or‑miss deals on sale items that feel like treasure hunts for the frugal shopper. Whether you’re feeding a crew, prepping for a party, or just hate making weekly grocery trips, it’s an adulting win.

And yes, that hot dog and soda combo for a couple of bucks is just the cherry on top of the savings sundae. Fuel discounts at the pump alone can shave off dozens of cents per gallon, which adds up if you’re commuting. You’ll become a pro at inventory management, optimizing storage and learning how long that giant bag of rice really lasts. Stocking up also means fewer midweek panic runs when you’re down to one lonely roll of toilet paper. Many members report saving hundreds per year—money you can redirect into travel, side hustles, or just a bigger avocado‑toast budget. And the communal shopping experience? It’s kind of like joining a frugal friends club. Just remember to bring reusable bags and avoid impulse buys of giant jars of marshmallows (unless you’re me). Before you know it, you’ll wonder how you ever survived without those bulk bargains and cheesy food‑court treats.

13. Premium Rain Gear

Nothing kills a mood like stepping into puddles and realizing your cheap raincoat is basically a soggy napkin. Premium rain gear—I’m talking Gore‑Tex or pro‑level membranes—might set you back a couple hundred bucks, but it keeps you bone‑dry through every downpour. Waterproofness, breathability, and durability mean you can wear it season after season without seam leaks or fabric failure. Sure, the price tag on a top‑shelf jacket and pants combo might elicit a mini heart attack, but when you avoid replacing cheap duplicates year after year, you’re actually saving. You’ll stay comfortable on rainy commutes, epic hikes, and outdoor concerts without that clammy, pancake‑on‑your‑skin feeling. Plus, you’ll look like you know what you’re doing, instead of resembling a drenched chihuahua with insufficient coverage. High‑end gear also often packs down small, so you’re not lugging a massive folded poncho in your bag.

With proper care, a solid rain jacket can last a decade or more—no more dumpster‑diving for $10 clearance shells. The waterproof coating and taped seams hold out the rain for years, keeping mold and funk at bay. You’ll avoid cold‑related sniffles and the wasted dollars on hand warmers or multiple sweaters layered under a leaky coat. Lightweight designs let you layer strategically without bulk, which is a godsend when you’re off to the airport in a soggy hurry. And if you’re a commuter, you’ll dodge that post‑rain meltdown of wet seats and soggy bags. Outdoor enthusiasts know that one good storm‑soaking season can ruin inferior gear—invest once, avoid that heartbreak. Rain or shine, your investment keeps you chasing adventures instead of sheltering under a tree with a flimsy poncho. Trust me, the upfront spend is nothing compared to the freedom of dancing in the rain without hesitation.

14. Home Espresso Machine

If your daily coffee ritual involves a $5 latte and a two‑block trek, it’s time to upgrade your barista game at home. High‑end espresso machines can run from a few hundred to a couple grand, but hear me out: that’s one fancy appliance versus endless café bills. Grinding fresh beans, dialing in the perfect shot, and steaming milk like a pro are not just flexes—they’re savings in disguise. The cost‑per‑cup at home can dip under $1.50, compared to $4–$6 out in the wild. Plus, you get to control strength, temperature, and milk texture to the letter of your caffeinated soul. Many machines come with built‑in grinders and temperature controls, offering consistency that your local barista might struggle to match on a busy morning. And let’s be real: the aesthetic of a gleaming espresso machine on your counter is an envy‑inducing conversation starter.

Over a couple of years, the saved coffee‑shop cash adds up to fund a vacation or a shiny new gadget. No more waiting in lines or settling for someone else’s definition of “just right.” Learning latte art is a fun flex‑worthy party trick that also pays dividends in quality. Removable water tanks and descaling reminders keep maintenance manageable, avoiding costly repairs. You’ll develop a refined palate and appreciation for single‑origin beans, turning coffee into a mini‑hobby rather than a habit. And if friends swing by, you’re the hero offering polished cappuccinos instead of instant coffee. The milk‑pitcher frothing alone feels like a zen moment, rewarding you daily. Trust that lifetime of coffee love far outweighs those fleeting convenience‑store impulses.

15. Electric Bicycle

Weekend warriors and weekday commuters, perk up: e‑bikes are the secret weapon to slash your transport costs. While some models sit in the $1,200–$2,500 range, think of it as buying a car that costs pennies to charge and zero to insure. No more morning gas‑station tedium or parking‑lot roulette. The electric assist means you’re not showing up sweaty after hill repeats or lengthy rides. Your only stops are for selfies with scenic backdrops, not to catch your breath. Riding more often means less wear‑and‑tear on your car, stretching its life and reducing maintenance bills. Plus, you’re scoring bonus health perks when you pedal through the occasional workout segment.

Charging an e‑bike overnight can cost as little as 10 cents, making the per‑mile math laughable next to a gas engine. Many cities now offer designated bike lanes and e‑bike incentives, sweetening the deal. Folding e‑bikes even fit in your trunk or under your desk, merging public transit with personal mobility. With fewer insurance and registration headaches, you’re free to roam without bureaucratic fuss. And let’s not ignore how much more fun it is to breeze past traffic jams and arrive at work invigorated. You’ll also dodge gym membership guilt by integrating fitness into your commute. E‑bike maintenance is simple: chain lube, tire checks, and software updates keep it humming. Ultimately, you’re investing in a lifestyle upgrade that rewards your pocket and your wellness meter.

16. Electric Pressure Cooker (e.g., Instant Pot)

Instant Pots and other electric pressure cookers have taken kitchen counters by storm, and for good reason. They might run you $80–$150, but consider them miniature energy‑saving dynamos that reduce cooking times by up to 70%. Faster cook times mean less electricity or gas burn, so your countertop hero pays for itself in utility savings. From stews to yogurt to rice, it handles dozens of recipes without heating up the whole house. One‑pot convenience means fewer dishes, which translates to less dishwasher energy or manual scrubbing. The sealed environment traps nutrients and flavors, giving you gourmet results without the fuss. Busy bees save hours weekly by shredding chicken or steaming veggies in record time.

Meal prep becomes a breeze, cutting stress and last‑minute takeout splurges. If you swap just a couple of dinner orders each month, the device pays off in less than a year. Many models now feature sous‑vide, air‑fry, and ferment modes, making them kitchen Swiss Army knives. The timer and slow‑cook functions let you sleep in and still wake up to ready‑made hot breakfasts. A decade of reliable service is common, as long as you replace the sealing ring now and then. You’ll slim down your gadget drawer because this baby replaces rice cookers, yogurt makers, and slow cookers all at once. Even picky eaters love the consistent textures and flavors that rival homemade restaurant meals. End result: more money in your bank, more time on your hands, and actual joy in cooking without the drama.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.