You know how everyone talks about retirement like it’s one long beach vacation? Yeah—turns out, it’s more like an expensive Airbnb that keeps charging you hidden fees. Hitting 65 is a major milestone, and while you should be cruising into your golden years with nothing but time and travel plans, reality has other ideas. The truth is, a bunch of stuff you thought would get cheaper or at least stay steady suddenly gets way more expensive. Like, plot twist: your expenses didn’t retire when you did.

From sneaky surcharges to “senior” pricing that’s more insult than deal, plenty of everyday things quietly cost more once you’re Medicare-aged. Some costs go up because your body needs more maintenance. Others spike because companies know you’ll pay extra for convenience, comfort, or just plain necessity. And no one tells you this stuff—until you’re staring at a bill for $400 hearing aid batteries wondering what decade you’re living in. So before you blow your retirement fund on a fifth cruise or a king-sized adjustable bed, let’s break down the real budget busters.

Here are 15 things that’ll cost you more after age 65—because “aging gracefully” apparently comes with an upcharge.

1. Long-Term Care That’s Not-so-Long on Affordability

Thinking you’ll never need long-term care? Think again—and start saving yesterday. With nursing home costs averaging around $117,000 per year, even a short stay can decimate savings. Assisted living isn’t much kinder, clocking in at roughly $48,000 annually. Home health aide rates hover around $52,000 per year, assuming a 44-week schedule—because who can afford to go 52 weeks straight? Private long-term care insurance policies have become scarce and expensive, with premiums that rise faster than your blood pressure. Fewer than 5% of Americans even carry these policies, thanks to sticker shock and underwriting gatekeepers. Medicaid covers some costs, but only after you’ve spent down nearly all assets—and then it’ll only cover a nursing home, not home care. States are experimenting with payroll-tax funded public options, but federal solutions remain elusive. Unless you’re packing a multi-million-dollar lifeboat, long-term care is poised to be your biggest post-65 budget buster. According to MarketWatch, nursing home rooms cost about $117,000 a year on average—and most of that isn’t covered by Medicare. Spoiler: your nest egg might need a lifeline.

Research shows that about 70% of people over 65 will need some form of long-term care, yet most retirees underestimate both the duration and costs. If you live into your 80s, plan on a multi-year bill that outpaces typical retirement savings. For DIYers, consider converting home equity via reverse mortgages or tapping into a Health Savings Account (HSA) before 65. Hybrid life insurance plus LTC policies can hedge your bets but still carry hefty premiums. Community care and shared living arrangements are growing, but supply lags demand. Family caregivers often shoulder the burden—sometimes sacrificing their own retirement security. Bottom line: don’t assume silk-lined nursing home dreams; long-term care budgets require serious upfront planning.

2. Prescription Drugs That Pinch Your Pocket

Pop goes the pill budget once you turn 65—and it’s not just the meds themselves. Between Part D premiums, deductibles, and coverage gaps, prescriptions can feel downright punitive. You’ll likely pay an average premium of about $46.50 per month, which adds up to over $550 a year before any out-of-pocket costs. Then comes the deductible (up to $590 in 2025) and copays that vary wildly depending on your drug tier. Step therapy and prior authorization hoops can delay your meds, sometimes costing you in skipped doses or pricier alternatives. Even after you hit the catastrophic coverage threshold, you’re still responsible for 5% of costs. Meanwhile, brand-name drugs are soaring faster than avocado toast prices did in your twenties. Without careful plan hopping each fall, you could be stuck with the same old formulary—and higher bills—year after year. If you’re on multiple medications, that “small” monthly premium can swell into a serious expense. According to the National Council on Aging estimated average Part D premium of $46.50 in 2025 will leave many seniors surprised by the sticker shock. Time to track your meds like a Wall Street portfolio!

Navigating formularies is basically a part-time job: compare plans, calculate copays, and watch for changing drug tiers. Don’t assume your same plan from last year is still the bargain it once was. Humana, UnitedHealthcare, and others shuffle drugs in and out of tiers annually—you’ve gotta stay on top. Using GoodRx coupons doesn’t count toward your Medicare deductible, so those “free” savings can feel like a tease. If you’re willing, consider pill-splitting generics or mail-order options to save a few bucks. And don’t sleep on your pharmacy’s discount programs—they sometimes undercut even your Part D plan. Bottom line: once you reach 65, prescription management isn’t just about health, it’s about your bottom line too.

3. Medicare Premiums Just Got Real

When you hit 65, congratulations! You’re officially on the hook for Medicare Part B premiums—no more free rides. Gone are the days of employerâ€sponsored coverage, replaced with a mandatory monthly bill that rises faster than your grandkid’s screen time. Expect to pay around $185 every month (and that’s before any income surcharges). You’ll cough up a deductible too, and if you delay enrollment you might even face penalties that last your entire retirement. High earners get an extra “thank you” in the form of IRMAA surcharges, which can add hundreds to that $185 base. If you thought Social Security was pricey, wait until you juggle premiums, deductibles, and co-pays. Budget-wise, this shift can mean shelling out nearly $2,200 a year just to stay enrolled—and that’s not even counting Part A deductibles or gaps in coverage. According to Medicare.gov the standard monthly premium for Part B jumps to $185 in 2025, up from $174.70 in 2024. Welcome to the thrilling world of premium planning!

From picking the right plan to navigating penalties, Medicare management becomes a full-time gig. Don’t forget that Part A can cost up to $518 a month if you didn’t pay enough into Social Security during your working years. And if you skipped your initial enrollment, brace for a 10% penalty for each 12-month period you delay. Annual open enrollment windows feel like Black Friday—chaotic, mandatory, and stress-inducing. Pro tip: enlist a State Health Insurance Assistance Program (SHIP) counselor to avoid rookie mistakes. Despite the headaches, thoughtful plan selection can save you thousands over retirement. Bottom line: at 65, healthcare budgeting skyrockets—get that spreadsheet ready.

4. Travel Insurance for Jet-Setting Seniors

Ready to globe-trot in your golden years? Spoiler: travel insurance premiums get steeper once you hit 65. While younger travelers pay roughly 5–10% of trip costs, seniors can see daily rates of $28 or more—and that adds up fast on a two-week cruise. Age-based surcharges, coverage caps on pre-existing conditions, and strict purchase windows (often within 10–21 days of trip booking) make policies pricier and more restrictive. Medical evacuation costs alone can eclipse $50,000, so that $400-per-trip premium might feel like small change—until you buy multiple policies a year. Cruise insurers tack on extra fees for shore excursion mishaps, and multi-destination trips often demand separate riders. Even “cancel for any reason” add-ons—which reimburse up to 75% of non-refundable costs—come at a 40% premium lift. Policy fine print is your new bedtime story: exclusions for adventure sports, pre-existing flares, and pandemics lurk in the small text. According to Kiplinger, retirees who snag travel deals still face higher insurance costs, making that “deal” a bit less dreamy. So yes, you can still chase waterfalls—just don’t forget that pricier safety net.

Before you pack your fanny pack, shop early, compare daily rates, and prioritize “cancel for any reason.” Look for multi-trip annual policies if you plan more than two escapes per year. Don’t assume your credit-card “free” coverage is enough—most caps sit below $50,000 for medical. If you have a Health Savings Account, pre-fund emergency funds since HSA dollars roll over tax-free and can cover deductibles. For European rail tours, check if Eurail passes or inter-rail tickets include medical evacuation benefits—sometimes they sneak those in. Finally, always read reviews—claims processing can be as tricky as navigating a foreign bureaucracy. Travel smart, travel insured, and travel often.

5. Dental Work That Bites Back

Smile! Your teeth are about to cost more than your streaming subscriptions. Medicare famously skips dental cleanings, crowns, and implants, leaving you to pay 100% out-of-pocket unless you snag a separate dental policy. Private dental plans for seniors can demand premiums north of $30 a month for basic coverage—plus waiting periods, annual maximums, and missing-tooth clauses. Out-of-network dentists charge up to 50% more, and specialty treatments like gum surgery or dentures can hit five figures. Even basic fillings have seen 20% price hikes in recent years. Fluoride treatments and cleanings might be “preventive,” but at $75–$150 a pop, they’re hardly free. Many retiree group plans cap benefits at $1,500 annually—barely enough for two crowns. Without coverage, a root canal plus crown easily tops $2,500 per tooth. According to the JHU Bloomberg School of Public Health, proposals to add dental benefits to Medicare would cost billions, but until then seniors foot the full bill. Dental care is your new luxury experience—brace yourself.

To soften the blow, consider dental discount plans or membership clubs that offer 10–60% off services. Some HSAs can cover dental costs if contributions began before 65. Negotiate fees—many dentists will shave 10–20% for cash payments. Travel north for “dental tourism” if you dare—the savings can be massive, though follow-up care gets complicated. Alternative clinics (like dental schools) provide rock-bottom rates in exchange for student-performed work. And flossing? It’s still free—but apparently not enough to ward off wallet pain.

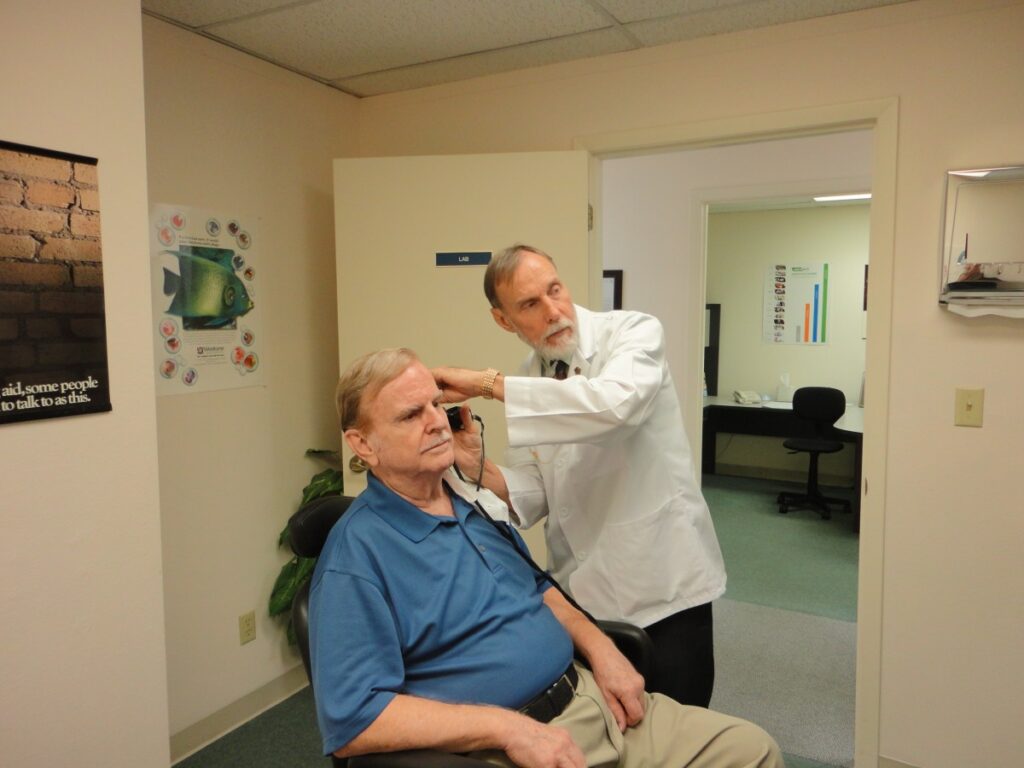

6. Hearing Aids That Hear Your Wallet Cry

Once you hit 65, it’s not just your inner ear that needs tuning—it’s your budget. Premium, prescription hearing aids generally run $3,000–$6,000 per pair, and over-the-counter models still start near $200 each. You’ll likely face annual service fees for cleanings, battery replacements, and firmware updates. Many insurers cap reimbursements or exclude hearing devices altogether, so out-of-pocket costs can skyrocket. Bundled “care packages” sound nice but often renew at higher rates. And if your hearing shifts, you’ll pay for refitting or entirely new devices years before younger users would need upgrades. Group discounts through AARP or veterans’ benefits help—but you have to navigate eligibility hoops. DIY fixes like waxing off debris can void warranties. Ultimately, maintaining and replacing hearing tech turns into a mini-enterprise.

Interestingly, some states mandate partial Medicaid coverage for hearing aids, but you’ll need to qualify and endure lengthy application timelines. Financing plans may spread the pain over months, but interest charges sneak in. Non-profit clinics sometimes offer sliding-scale fees, though waitlists can stretch to months. If you buy online to save, remote adjustments may lack precision, costing extra follow-up visits. Bottom line: clarity of sound comes at a premium once you reach senior status—plan accordingly.

7. Life Insurance Premiums That Age with You

Planning ahead always sounded wise, until those insurance renewals started soaring. Term-life rates for a healthy 65-year-old can be double or triple what a 55-year-old pays. Permanent policies aren’t immune: whole life and universal life premiums climb steeply in your late 60s. Insurers base rates squarely on mortality tables, so each birthday can ratchet costs upward. Insurability riders vanish after 75, forcing you into pricier guarantees or “simplified issue” plans with limited coverage. Medical exams required by underwriters become more invasive and frequent—goodbye, annual blood draw free passes. If you skip or reduce coverage, beneficiary protection shrinks right when estate needs grow. Converting term to permanent avoids health underwriting but triggers a premium spike. Trust me, those “lifetime level premiums” often last only until age 85. You’re essentially paying for peace of mind that costs more at the point you need it most.

Some carriers offer final-expense policies geared to cover funeral costs, but their small face values (e.g., $10K) still demand surprisingly high monthly payments in your 70s. Policies with accelerated death benefits can ease costs if you become chronically ill—but riders tack on extra percentage points. Shopping around every few years is key, yet time-consuming. Group life through retiree associations might cut costs, but payout limits can disappoint loved ones. Pro tip: review your coverage needs annually and consider downsizing face amounts to keep premiums manageable.

8. Auto Insurance That Inches Up

You might expect driving less to shave your premiums, but insurers aren’t always convinced. After 65, average auto rates plateau, then begin climbing again in your late 70s—accident risk statistics say so. Even if you log fewer miles, age-based surcharges for slower reaction times apply. Mandatory state minimums stay the same, but add-ons like roadside assistance or rental reimbursement get pricier. Multi-car discounts shrink if younger drivers leave the policy. If vision or cognitive tests flag you, some insurers reserve the right to decline renewal or impose high-risk surcharges. Your credit score still factors into rates in many states, so retirement-related credit changes can backfire. Accident forgiveness perks often vanish after a certain age. And while telematics (“drive safe” apps) help prove your competence, installing them incurs upfront fees. Basically, your golden years can feel like a golden leash on your car insurance bill.

To keep costs down, consider usage-based or pay-per-mile plans, but check for service fees. Bundling home and auto still offers savings, though homeowners insurers may tighten underwriting on older properties. Shop non-standard markets if you get hit with a “preferred plus” drop to “standard.” Defensive driving courses for seniors sometimes earn discounts—just not always advertised. In short, make time for annual rate comparisons and policy audits.

9. Gym Memberships That Pump Your Budget

After 65, many gyms add senior surcharges or limit access to premium classes. While some chains offer steep discounts in theory, the best rates often require enrolling in platinum-level tiers. Your free trial period may shrink, and initiation fees can double. Group-fitness liability waivers and specialized equipment workshops cost extra. If you book personal trainers for balance or mobility work, you’ll pay senior coaching rates that can be 20–30% above standard fees. Spa amenities (saunas, pools) often require “amenity passes” at extra cost. Locker rentals, towel service, and towel-pressing fees jump once you’re in an older adult category. And if you join a silver-sneakers program through Medicare Advantage, verify that your preferred location participates—otherwise you’ll end up in a higher-priced alternative. Those “free” fitness apps probably won’t address osteoporosis-friendly routines, so you might shell out for specialized online subscriptions. Welcome to the age-graded fitness economy.

Beware annual rate hikes pegged to “cost of living”—they hit hardest when inflation climbs. Many gyms grandfather existing members, but transferring or downgrading resets your base rate. Community centers and YMCAs have lower senior pricing, though class capacities can be limited. If you go off-peak only, check for “off-peak only” plans that cut fees by 15–25%. Managing your fitness budget is almost as much work as the workout itself.

10. Cell Phone Plans with Fewer “Senior” Sweeteners

By 65, you’d think pricing would reward loyalty—but cell carriers often invert that logic. Senior discount plans cap data allowances at minimal levels (1–3 GB), with overage charges north of $10 per extra GB. Unlimited plans cost the same or even more than basic adult tiers, since discount programs get buried under newer branding. International calling add-ons become pricier when you’re a retiree wanting to chat with family abroad. Data throttling kicks in sooner too—senior plans are lowest priority in congested networks. Mobile hotspot usage is generally excluded or locked behind an “add-premium” wall. Early upgrade promotions rarely apply to senior-designated plans, so you’re stuck with market rates for new devices. And if you switch plans, you often lose grandfathered pricing you didn’t know you had. Surprise: your monthly phone bill is basically an anti-loyalty program.

To save, compare MVNOs (Mobile Virtual Network Operators) that piggyback on major networks but don’t advertise “senior” branding—they often have low-data, low-cost tiers without age gating. Wi-Fi calling at home helps, but watch for chargeable minutes when you land in “no Wi-Fi” zones. Finally, audit your bill quarterly for phantom fees: administrative, regulatory, and convenience fees can add $5–$15 per month without actual service enhancements.

11. Home Maintenance That Ages Like Fine Wine—Expensive

Your fixer-upper phase didn’t end just because you retired. After 65, your home’s wear-and-tear accelerates: roofs need replacing every 15–20 years, HVAC systems require more frequent servicing, and older plumbing springs leaks more often. Handyman rates climb too—contractors charge premium fees for small jobs rather than bundling projects. Permit and inspection fees also increase with new code requirements, especially for accessibility upgrades (handrails, ramps). Landscaping and snow removal services tack on “senior care” surcharges to cover liability and specialized equipment. Painting, caulking, and gutter cleaning promotions for seniors exist, but lock you into annual contracts. If you go DIY, joint pain slows productivity, so you pay for scaffolding rental or extra labor. Replacement windows and energy-efficiency retrofits qualify for rebates only if you front the full cost. And forget volunteer “grandparent crews”—labor shortages mean a 20% uplift in service charges for expedient scheduling.

Preventive maintenance can shave costs, but only if you remember to schedule it. Online bidding platforms sometimes gouge new retirees with “new customer” pricing tiers. Multi-year service contracts may look tempting, but read the fine print for automatic renewals and rate escalators. Essentially, keeping a home running post-65 has its own inflation curve.

12. Vision Care That Focuses on Your Wallet

Glasses, contacts, and eye exams all creep up in price after 65. Medicare skips routine vision, so the average eye exam bill hits $100–$200 out-of-pocket. Progressive lens upgrades, anti-glare coatings, and blue-light filters tack on $150–$300 extra per pair. Contact-lens renewals and fittings—often required yearly—run $100–$150. Specialty lenses for presbyopia or astigmatism cost double basic single-vision frames. If you switch styles more than every two years, you may lose loyalty-discount status. Appointments at ophthalmologists (versus optometrists) become necessary once you hit an age-based screening threshold for cataracts and glaucoma, bumping exam fees into the $250 range. Photographic retinal imaging, now standard for seniors, often isn’t covered. Repair or replacement warranties for high-end frames come with 20% price hikes. And on-site “discount racks” frequently exclude popular designer brands. Your vision of savings starts to blur once you enter the senior bracket.

If you bundle an eye-care plan through a retiree group or union, check the fine print on provider networks—out-of-network exams still bill at full rate. Membership clubs (like Costco Optical) offer lower frame prices but limit your lens-upgrade options. Keep receipts: some FSA/HSA dollars can reimburse exams and lenses, but only if contributed before age 65.

13. Funeral and End-of-Life Expenses That Haunt Your Heirs

Facing your own end isn’t fun, but the cost sure is. The median funeral with burial runs around $8,500; cremations average $6,000. Plot purchases, headstones, and service fees can add another $3,000–$5,000 on top. Funeral homes levy administrative and “staff” fees, often opaque until you review the itemized bill. Cemetery perpetual care funds tack on yearly assessments. Vault liners, embalming, and obituary notices each come with their own line-item charges. Pre-need packages can lock in lower rates but demand upfront deposits you lose if you move or your plans change. Grief counseling add-ons and memorial videos are billed separately—sometimes at $1,000 per package. Transport services, especially cross-state or international repatriation, cost $2,000–$4,000 extra. Ultimately, estate settlements may shrink drastically once these fees are paid.

Some life-insurance carriers offer accelerated death benefits to cover funeral costs, but riders typically increase premiums. Veteran and fraternal organization benefits help, but face strict eligibility—and caps. Compare funeral home pricing online via FTC-mandated price lists to avoid surprise mark-ups. In short, your final chapter can leave loved ones with a hefty bill.

14. Pet Care That Ages with Your Companion—and Wallet

Post-65 pet parenting requires a bigger budget, especially as your furry friend’s healthcare needs grow. Senior dog and cat vet visits jump from $50–$70 for routine checks to $150–$200 for geriatric panels (bloodwork, X-rays). Dental cleanings under anesthesia average $500–$700. Joint supplements, prescription diets, and mobility aids add $30–$100 monthly. Pet insurance premiums increase by 25–50% once your companion hits “senior” status, often around age 7–10. Specialty medications (arthritis, diabetes) are rarely generic, costing $100+ per month. Behavior or physicalâ€therapy sessions for aging pets run $75–$120 per appointment. At-home euthanasia services cost $200–$400, plus hospice care add-ons. Boarding and daycare fees exclude seniors from group rates—solo accommodations cost 20–30% more. Grooming for senior pets, with gentler handling and specialized shampoos, also carries a surcharge. Loving a long-lived pet comes with a growing vet bill.

To manage costs, consider wellness plans through your veterinarian—pre-pay bundles that lock in rates. Look for local non-profit clinics offering sliding-scale fees for seniors. Home delivery of medications often includes free shipping but minimal discounts. Budget extra in your monthly pet fund to avoid financial stress when your companion needs extra care.

15. Storage and “Just in Case” Lockers

Empty-nest moves or downsizing often spur a storage unit rental—and seniors pay for that extra space. Standard 10×10 units average $80–$120 per month, but “senior discounts” rarely dip below $10–$15 off. Climate-controlled units tack on another $20–$30 monthly—critical for heirlooms and furniture. Insurance riders for stored items cost about $12–$25 extra per month. Administration fees for late payments or gate access cards hit seniors who travel seasonally. Moving and packing services recommended by facilities come at premium rates, and referral credits often require loyalty contracts. Long-term rentals usually qualify for lower rates, but automatic annual escalators (3–5%) still apply. Drive-up access and 24-hour facilities charge higher square-foot costs than standard interior units. Selling off belongings to avoid storage costs means dealing with estate-sale fees or auction commissions. In short, holding onto “just in case” boxes can become a surprisingly permanent budget line.

If you prepay three to six months, you might get a deeper discount, but it ties up cash. Try peer-to-peer storage marketplaces as a cheaper alternative, though liability coverage varies. Negotiate move-in specials outside peak moving season to shave off setup fees. Always read rental agreements for automatic renewal clauses—you don’t want to keep paying for a unit you’ve forgotten.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.