You know that smug little moment when you think you’ve gamed the system? Like when you proudly scan five coupons, snag a “buy in bulk” deal, and strut out of the store feeling like Warren Buffett with a reusable tote? Yeah… about that. Turns out, a lot of the money “hacks” we swear by are actually just booby traps in disguise—marketing ploys, psychological tricks, or habits we think are frugal but are lowkey bleeding us dry.

Don’t get us wrong, budgeting is a vibe. But sometimes the things we do to “save” money quietly boomerang and smack our bank account in the face. From gym memberships you haven’t touched since January to those sneaky free trials you swore you’d cancel (but didn’t), we’re breaking down the habits that trick you into feeling thrifty—while draining your wallet one small charge at a time. Let’s bust some myths, shall we?

1. Buying Perishables in Bulk

You spot a 10-pound bag of strawberries at Costco and think, “What a steal!” Yet Investopedia warns that per-unit savings vanish when you toss spoiled fruit—and sudden “stock-pile” fridge chaos forces impulse buys of more snacks.

Upfront cost might be lower, but food waste averages around 30–40% for bulk shoppers, turning “bargains” into landfill fodder. You also incur hidden storage costs: extra freezer space drives up your energy bill, and if you can’t eat it fast enough, you’ve paid for nada. Only true if you have a large family and a meal plan; otherwise stick to just-in-time shopping or subscribe to a farmers’ market box.

And don’t get me started on that awkward moment when you rediscover last month’s frozen blueberries—now a shriveled glob of freezer burn. Meal-planning apps exist for a reason: they help you actually eat that bulk haul before it stages a mutiny. If you really love savings, chop, freeze, and label everything immediately—your future self will thank you.

2. That Gym Membership You Never Use

You sign up in January, flush with New Year’s resolve, and before you know it, your debit card is feeding the treadmill while you binge-watch instead. According to The Guardian, Americans waste over $1.8 billion on unused gym memberships each year—because a membership only saves money if you actually go.

Meanwhile, most people go fewer than once a week, meaning those $700-a-year fees might as well vanish into thin air. Sure, “per-visit” costs look low… until you realize the denominator on that equation is zero. Behavioral economists call this “pre-commitment bias”—paying up front to guilt yourself into action, which seldom works. If you’re not walking through the door weekly, you’re effectively burning cash. A cheaper pay-as-you-go class or free YouTube routine could cost you a fraction—and actually get you moving.

Plus, that auto-draft sneaks up so quietly you barely notice it draining your account—kind of like a financial ninja. You can’t burn calories from guilt, but you sure can burn dollars. Hit pause on the membership machine, and try a month-to-month drop-in or a “bring-a-buddy” deal so you actually see your money turn into sweat.

3. Coupon Stacking That Expands Your Cart

Coupon-hunters brag about 90% off deals, but stacking promos often lures you into buying items you’d never pick at full price. A Fast Company investigation found that 15% of coupon users splash out on unnecessary products just to hit minimum spend thresholds.

Plus, digital “cashback” apps encourage trial purchases you end up ditching—netting zero savings after return fees. In the hunt for free laundry detergent, you end up with random health bars you’ll never eat and subscription trial fees you forgot to cancel. By the time you tally up the “savings,” you spent more than double what you planned.

It’s like hunting for treasure and accidentally filling your trunk with polished rocks. Before you know it, your cart is screaming “Lord of the Rings” meets Black Friday—and you’re the one footing the bill. Next time, stick to a strict shopping list and remember: if you wouldn’t buy it at full price, it’s not really a deal.

4. DIY Home Repairs (That You Botch)

YouTube TUTORIAL: “Fix your own leaky sink in 5 minutes!” Reality: you flood the kitchen, call a plumber anyway, and pay surge rates. Homes & Gardens reports that DIYers spend an average of 25% more per repair when mistakes require professional fixes.

Sure, painting a wall yourself is fine—but electrical or plumbing blunders can escalate into catastrophes and code-violation fines. Tool costs, replacement parts you ordered incorrectly, and hours wasted mean you’re often better off hiring pros from the get-go.

That weekend warrior vibe feels good—until you’re elbow-deep in old pipes at midnight. Ordering the wrong fittings online only doubles the panic when your sink is still gushing. Trust me, that “savings” vanishes faster than you can say “where’s the wrench?”

5. Skipping Annual Physicals

You dodge that doctor’s visit to “save” a $50 copay—but missing early warning signs (high blood pressure, diabetes) can lead to a $5,000 ER bill later. Per Eating Well, preventive care reduces total healthcare costs by up to 30% over a lifetime.

It’s counterintuitive: you spend a few bucks now to avoid six-figure medical catastrophes down the line. Think of it as an investment in your body’s “infrastructure.”

Beyond the wallet, peace of mind is priceless—you’ll sleep better knowing your heart’s actually ticking along nicely. Catching a sneaky melanoma or early cholesterol spike can save you years of treatment costs and drama. Even a quick telehealth check-in beats an ambulance ride—so keep that appointment on your calendar.

6. Homemade Cleaning Solutions That End Up Costing More

You mix vinegar, baking soda and “free” citrus peels and feel eco-proud… until you realize store-bought concentrates clean harder, faster, and less bleach gel = more elbow grease. A cost comparison in Keeper of the Home showed that homemade all-purpose cleaner can cost nearly as much once you factor in spray bottles, essential oils, and your time.

Many DIY recipes can’t tackle mold, grease or pet odors—so you buy specialized products anyway, doubling your outlay. Plus, homemade solutions lack preservatives, so batches spoil and you toss them. Over a year, you’ll spend more on pantry staples and replacements than you would have on a multi-surface bottle of store cleaner—no sale needed.

7. Those “Refillable” Coffee Subscriptions

You pay $15 a month for unlimited refills… then realize you visit Starbucks only twice, meaning at full price you cross-subsidize everyone else.

On top of your missed value, you’re also locked into visits—meaning you skip that indie café you actually like, or worse, end up paying for an occasional latte elsewhere at full price. The psychological guilt of “wasting” your flat fee can drive you back for a brew you don’t even want. And when you finally cancel, you’ll notice you’ve spent more on add-on snacks and pastries than you ever saved on sips. If your barista knows your name but you’re only there monthly, that’s a pretty steep friendship tax. You’ll end up treating your refill plan like an unwanted pet—something you’re obligated to feed but don’t actually enjoy. Instead of locking into a subscription, try a punch-card or occasional loyalty stamp so you only pay for cups you actually drink.

8. Brand-Name Clothing “On Sale”

You snag designer denim for 60% off, but original prices are inflated so deep discounts still exceed the cost of fast-fashion.

Meanwhile, your closet fills with semi-luxe pieces that still cost more per wear than a basic tee from H&M. You pat yourself on the back for being a “smart shopper,” but your wallet begs to differ. Better to invest in a few timeless basics that actually fit your style and budget, rather than chase phantom savings on labels you’ll ditch next season. And let’s be real—chasing sale racks can feel like a second job, complete with FOMO and elbow jostling. Those markdowns might make your heart race, but your bank balance? Not so much. Quality over hype wins every time.

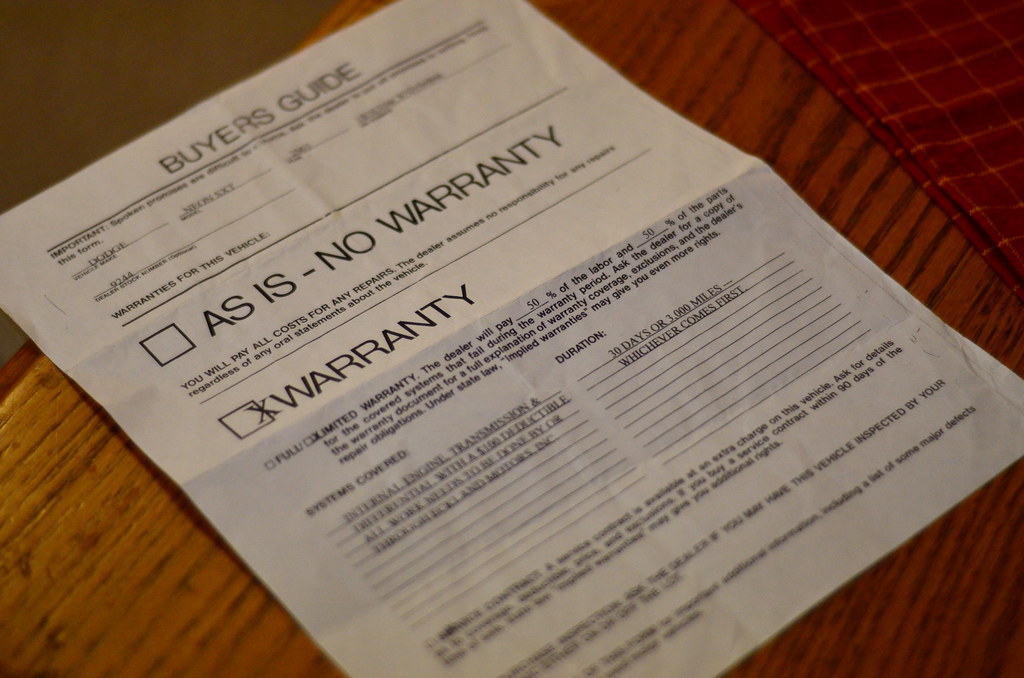

9. Extended Warranties on Tech

That 3-year laptop warranty costs 20% of your purchase price—but tech failure rates make you better off self-insuring.

If the worst happens, you’ll probably replace or upgrade anyway—rendering that warranty moot. Plus, reading through the fine print is like decoding an ancient scroll: coverage exclusions abound, and you’ll pay shipping fees or deductibles that eat into any refund. DIY fixes, local repair shops, or setting aside a tiny “break-it fund” often deliver more peace of mind. You’ll learn way more if you Google a quick tutorial than you will filing a claim. And hey, the satisfaction of fixing your own gadget? Priceless life hack.

10. Credit Card Reward Churning

You juggle five cards for sign-up bonuses, but annual fees and blackout dates often outweigh the free flights.

Those points feel like Monopoly money until you try booking during holiday weekends or flight sales—where you’ll get stuck with steep taxes or zero availability. Then there’s the mental load of tracking deadlines, minimum spends, and category rotations—time is money, too. A single, straightforward card with low fees can net real rewards without the spreadsheet gymnastics. Plus, constant applications ding your credit score, which can haunt you when you least expect it. And the thrill of a big bonus? Over in three months, leaving you chasing the next carrot on a stick.

11. Bundling Home Insurance

You bundle auto and home to “save,” but cross-subsidy means your safe, low-risk home pays for that neighbor’s high-claims record.

Loyalty discounts often diminish over time, turning your “hey, I’ve been with you forever” status into a coupon that barely covers your next renewal. And if you move, you lose the so-called perks—forcing you to restart the bargain hunt. Running a quick comparison every couple years is worth five minutes of your time and can slash premiums by double digits. Don’t let “convenience” blind you to real savings. You might discover switching carriers nets you bigger cuts than any bundled “loyalty” could.

12. Free Trial Subscriptions You Forget to Cancel

Netflix, Audible, Dropbox trials lure you in—then silently charge full price.

Before you know it, your bank statement looks like a subscription graveyard: “oh yeah, I did sign up for that,” you whisper in horror. Canceling is a mini-quest through settings menus and support chats, so most of us just pay and move on. Use a single “trial tracker” card or set calendar reminders to dodge these stealthy charges—your future self will thank you. And maybe set an alarm for five days before the trial ends, not the day it starts. That tiny nudge saves hundreds over time—and zero awkward calls to customer service.

13. Meal-Kit Subscriptions

HelloFresh “savings” still cost $10–12 per meal, double grocery prices for the same ingredients.

You also pay for packaging—tons of plastic and insulated liners—which is basically an environmental surcharge. And when you skip a week, you’ll get guilt-trip emails begging you to “come back” as if you’ve ghosted your bestie. Buying basics in bulk and experimenting with simple recipes can be just as fun without the subscription shackles. Plus, cooking skills actually scale: mastering one chicken dish means endless variations, not just what’s on this week’s menu.

14. Rideshare Pooling

“Shared” rides seem cheap, but surge pricing kicks in unpredictably, and time-penalties (waiting for detours) can cost you in lost productivity.

Worse, that stranger-in-the-back can stir awkward small talk or hog the aux—making you late or just annoyed. And if you’re in a rush, you’ll end up waiting forever while the app hunts down another pickup. Sometimes that extra buck for a direct ride is worth the sanity and time you reclaim. Factor in the hidden “time tax”—minutes you could’ve spent earning or unwinding—and you’ll realize solo rides aren’t such a splurge.

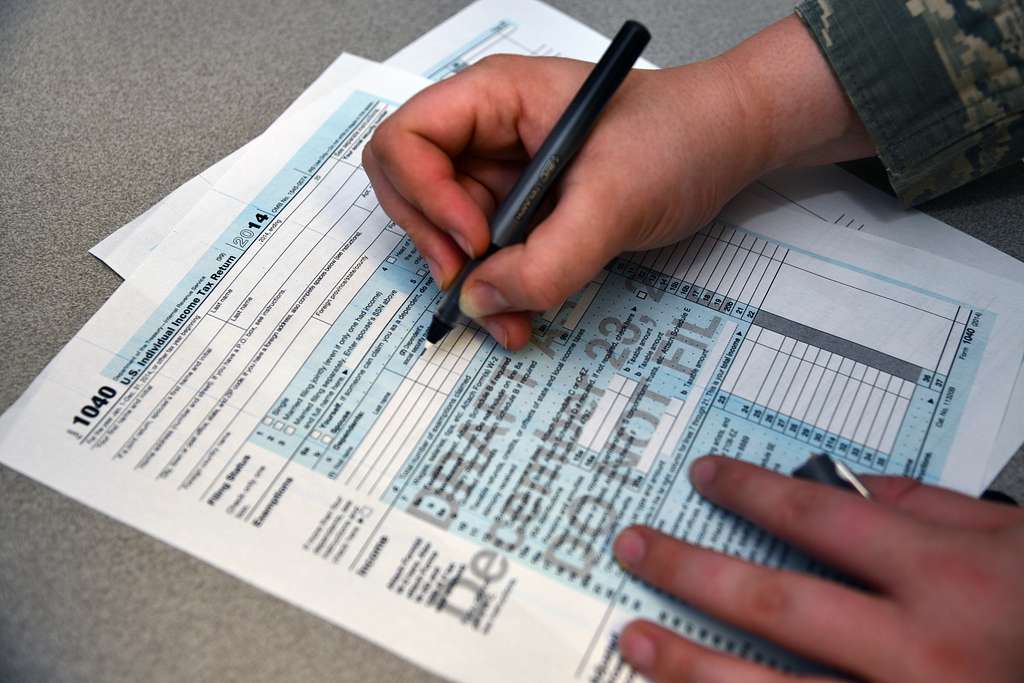

15. DIY Tax Software

You save $50 on TurboTax, then miss deductions or misfile and owe penalties. Tax codes change faster than your favorite meme, and one small oversight can trigger an audit or fee. Plus, when it’s crunch time you’re stuck refreshing the help forum instead of sipping a celebratory beer.

A basic tax pro or even a lower-tier virtual service can catch nuances you’d never spot—making that upfront fee look like pocket change in comparison. And the peace of mind? Totally worth the price tag.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.