You ever get one of those calls where someone says your grandkid’s in jail in Mexico and needs bail money… but your grandkid is literally sitting across the table eating a grilled cheese? Yeah. Welcome to the wild world of online scams, where the cons are slicker than a used car salesman in a velvet tracksuit and they love targeting Boomers. Why? Because scammers think y’all are polite, trusting, and less likely to hang up mid-sentence—which is exactly what they’re banking on.

But here’s the tea: retirement should be about margaritas and morning crossword puzzles, not accidentally Venmo’ing $500 to “IRS Agent Dave.” So if you’ve ever clicked a sketchy link, answered a mysterious number, or wondered why someone on the internet is suddenly professing their love in broken English, this list is for you. We’re breaking down the 13 most devious scams targeting older adults right now—so you can scroll smarter, shop safer, and avoid getting finessed by someone with a fake badge and a Gmail address. Let’s go

1. The “You’ve Won!” Lottery Scam

Imagine this: you’re sipping your morning coffee when an email pops up saying you’ve won a million bucks. Jackpot, right? Not so fast. These scammers dangle the promise of a big win, but there’s a catch—you need to pay a “processing fee” or “taxes” upfront. Before you know it, you’re out thousands, and that promised prize? Nowhere to be found.

According to The Sun, one 77-year-old woman was tricked into sending over $130,000 to claim her so-called prize—complete with a fake luxury car and a promise of riches that never existed. The scammers kept her on the hook with professional-sounding instructions, official-looking emails, and nonstop pressure. Once she realized it was a scam, the money was long gone, and the scammers? Poof.

Stay Sharp Tip: Legitimate lotteries don’t make you pay to claim your prize. If someone asks for cash before you see the goods, it’s a scammy red flag waving right in your face.

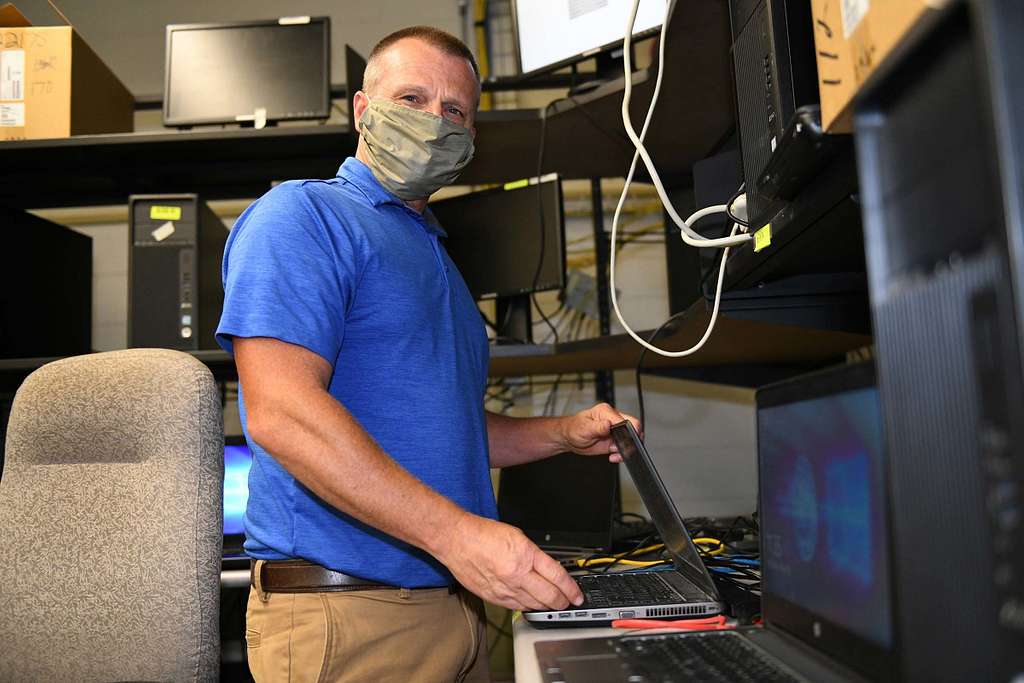

2. The “Tech Support” Trap

Your computer starts acting up, and boom—a big red pop-up tells you you’ve been hacked. It urges you to call tech support right now. You panic. You dial. And just like that, you’re talking to a scammer pretending to save the day—for a fee, of course. They might even sweet-talk their way into remote access, and now your personal data is their personal playground.

Per Fortune, these fake tech support operations are shockingly lucrative and specifically target older Americans unfamiliar with modern digital threats. Victims are often convinced to download malware-laced software or fork over hundreds for bogus repairs. It’s the equivalent of someone breaking into your house after you invited them in to help fix a leaky faucet.

Stay Sharp Tip: Real tech companies don’t randomly reach out about “errors” on your computer. If in doubt, shut it down and call official customer service—not the number that just popped up on screen.

3. The “Grandchild in Trouble” Call

You’re watching reruns of Matlock when the phone rings. “Grandma, I’m in trouble,” the voice pleads. Your heart skips a beat. The story is just convincing enough to sound real—maybe it is Jimmy. He says he’s been arrested or is stuck overseas and begs you not to tell mom or dad. You’re ready to wire money immediately. But is it actually your grandson?

According to Senior Living, this emotional manipulation tactic has exploded in recent years, with scammers using voice spoofing to mimic loved ones. They bank on urgency and love—two things that make people act before verifying. Sadly, it works more often than you’d think.

Stay Sharp Tip: Call the real family member directly, or check in with someone who can confirm their whereabouts. Don’t let panic override your common sense.

4. The “Government Official” Impersonation

Your phone buzzes with a stern voice claiming to be from the IRS, telling you you owe money—or worse, you’re about to be arrested. No time to think, they say. You need to act now. They even give you a fake badge number and caller ID that looks real. Pretty soon, you’re giving up your Social Security number or paying “fines” with gift cards. (Yep, seriously—gift cards.)

As reported by Market Watch, impersonator scams involving the IRS, Medicare, and Social Security are among the fastest-growing cons aimed at older adults. These scammers know just how to strike fear into your heart—and your wallet.

Stay Sharp Tip: Government agencies don’t call and threaten you with jail time. They send letters, not ultimatums via phone. If someone says otherwise, hang up.

5. The “Romance” Ruse

You meet someone online. They’re flirty, kind, and call you “babe” by the second message. You chat every day. They’re abroad, or maybe in the military, or caring for a sick parent. Then one day they say, “I need a little help, just until payday.” The emotional hook has already been set—and now the scammer reels you in for money.

According to the Huron Daily Tribune, romance scams raked in over $1 billion in losses last year, with boomers being one of the most affected groups. Scammers invest weeks, even months, building digital relationships just to make a big cash grab. They’re smooth, convincing, and relentless.

Stay Sharp Tip: If someone you’ve never met in person asks for money, it’s not love—it’s a con. No matter how sweet their texts are.

6. The “Reverse Mortgage” Racket

So, you’ve built up equity in your home over the years, and now someone’s offering you a way to tap into that wealth without selling your house. Sounds like a dream, right? Enter the reverse mortgage scam. Fraudsters pose as financial advisors or government officials, convincing seniors to take out reverse mortgages and then siphoning off the proceeds. They might even persuade you to sign over the deed to your home.

These scammers often target older adults who are house-rich but cash-poor, exploiting their need for financial security. They use complex jargon and high-pressure tactics to confuse and coerce. Before you know it, you’ve lost your home and your savings.

Stay Sharp Tip: Always consult with a trusted financial advisor before making decisions about your home equity. Be wary of unsolicited offers and never sign documents you don’t fully understand.

7. The “Charity” Con

Your phone rings, and a heartfelt voice tells you about a tragedy—a natural disaster, a sick child, a struggling veteran. They ask for a donation to help, and your compassionate heart wants to give. But hold on—how do you know this charity is legitimate?

Scammers exploit your generosity by creating fake charities or impersonating real ones. They often strike after major disasters, knowing people are more inclined to help. They might pressure you to donate immediately, often via wire transfer or gift cards.

Stay Sharp Tip: Before donating, research the charity through reputable sources like Charity Navigator or the Better Business Bureau. Never feel pressured to give on the spot.

8. The “Investment” Illusion

You’re approached with an incredible investment opportunity—high returns, low risk, and it’s exclusive just for you. Tempting, right? But if it sounds too good to be true, it probably is. Investment scams lure you in with promises of wealth, only to leave you penniless.

These scams often involve complex financial jargon and fake credentials. The scammer might even show you fake documents or testimonials. They prey on your desire for financial security and independence.

Stay Sharp Tip: Always consult with a licensed financial advisor before making investments. Be skeptical of unsolicited offers and do thorough research.

9. The “Medical Alert” Malarkey

You receive a call or see an ad offering a free medical alert system, often claiming it’s already paid for by a family member or Medicare. All you need to do is provide some personal information. Seems harmless, right?

In reality, these scammers are after your personal and financial information. They might bill you for services you never agreed to or use your details for identity theft. Some even send you a device and then harass you with calls demanding payment.

Stay Sharp Tip: Be cautious of unsolicited offers for medical devices. Verify with your healthcare provider or insurance company before accepting any equipment.

10. The “Sweepstakes” Swindle

Congratulations! You’ve won a big prize—a car, a vacation, or a large sum of money. All you need to do is pay a small fee to claim it. Exciting, isn’t it? But this is a classic sweepstakes scam.

Scammers use this tactic to collect fees and personal information, promising prizes that never arrive. They might even send you a fake check, which will bounce after you’ve sent them money.

Stay Sharp Tip: Legitimate sweepstakes don’t require payment to claim a prize. Be wary of any contest you didn’t enter and never pay to receive winnings.

11. The “Utility” Urgency

You get a call from someone claiming to be from your utility company, saying your bill is overdue and your service will be cut off immediately unless you pay now. Panic sets in, and you rush to make a payment.

But this is a scam. The caller is not from your utility company, and they’re hoping fear will make you act without thinking. They often demand payment via gift cards or wire transfers.

Stay Sharp Tip: Utility companies typically send written notices before disconnecting service. If in doubt, hang up and call the company directly using the number on your bill.

12. The “Online Shopping” Sham

You’re browsing online and find an unbelievable deal on a product you’ve been wanting. You place an order, but the product never arrives. Or worse, your credit card is charged multiple times.

Fake online stores are rampant, especially on social media platforms. They lure you in with low prices and then disappear after taking your money. Some even steal your personal information for identity theft.

Stay Sharp Tip: Shop only on reputable websites. Look for secure payment methods and read reviews before making a purchase.

13. The “Facebook Friend” Fiasco

You get a message on Facebook from your cousin Carol. Or… at least you think it’s Carol. She says she’s in a government grant program that gave her $50,000 and thought of you right away. All you have to do is click the link and apply. Sounds generous, right? Too bad it’s not her—it’s a scammer who cloned her profile.

These digital impersonators are prowling social media, creating convincing fake profiles using photos and info scraped from the real deal. Once they’ve gained your trust, they’ll either trick you into sending money or steal your personal information under the guise of helping you “qualify.” Some even ask for your login info to “help you apply,” then lock you out of your own account and use it to scam your friends.

Stay Sharp Tip: If a friend messages you out of nowhere asking for money or offering you free government cash, pick up the phone and call them. And always double-check the profile—look for weird spelling, empty timelines, and zero mutual friends.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.