Retail therapy is a term we’ve all heard, and it sounds like an innocent enough way to unwind. However, when your shopping habits become more of a coping mechanism than a genuine hobby, things can get tricky. You might even convince yourself it’s all part of your self-care routine. But how do you know when you’ve crossed the line into addictive behavior? Here are 13 signs you might be more into retail therapy than you’d like to admit.

1. The “Add To Cart” Button Is Your Best Friend

You find yourself adding items to your cart without a second thought. It’s almost an automated action—open the app, see something nice, and bam, it’s in your cart. According to consumer psychologist Kit Yarrow, the act of adding items to your cart can trigger a dopamine rush. It’s a fleeting moment of joy that keeps you coming back for more. But if your cart is constantly full, it might be time to rethink your habits.

Once you start, it’s hard to stop. The thrill of adding items to your cart is addictive, and you often lose track of time. You promise yourself it’s the last item, yet there’s always something else that catches your eye. The cycle repeats until you finally check out. If this sounds familiar, it’s a sign that retail therapy has taken over your shopping habits.

2. Packages Arrive, But You Forget What You Ordered

You know the drill: a package arrives, and suddenly you’re unboxing something you swear you’ve never seen before. It’s like receiving a gift from past you. This is a sign that your buying decisions are becoming impulsive. You’re clicking “buy” without considering what you really need. If you frequently find yourself surprised by your own deliveries, it’s worth examining your shopping patterns more closely.

Sometimes, you even order the same item more than once because you forgot you already bought it. It’s an amusing but telling symptom of compulsive shopping. It’s not just about forgetting; it’s about the lack of mindfulness in your purchases. The excitement of the purchase overshadows the practicality of the product. If this resonates, reassess why you’re buying what you’re buying.

3. You Rationalize Purchases As “Investments”

You’re constantly justifying your buys as necessary or long-term investments. The phrase “treat yourself” is your mantra, and it gets you every time. Research by consumer behavior expert Dr. Thomas Gilovich suggests that people tend to rationalize indulgent purchases as investments in their happiness. But if you find yourself repeatedly using this justification, it’s time to ask if these are genuine investments or just momentary cravings. The distinction matters more than you think.

Investments are often misinterpreted to mean anything you deem worthy at the moment. That $200 pair of shoes isn’t just footwear; it’s a statement piece. But statements don’t always need to be made at the cost of your financial well-being. Make sure that your investments align with your financial goals, not just your immediate desires. If these “investments” are creating more regret than joy, it’s time to reassess.

4. You Can’t Go One Week Without Browsing

You might not buy something every day, but browsing is a daily ritual. It starts innocently enough; you’re just seeing what’s new or what deals are out there. However, if a week can’t pass without at least a casual scroll through your favorite online stores, that’s a red flag. This habit could mean shopping is more of a comfort than a necessity for you. It’s part of your routine, like morning coffee or checking emails.

When browsing becomes a compulsion, it’s not just about finding deals; it’s about the escape it offers. It’s easy to tell yourself you’re just looking, but inevitably, looking leads to buying. That “just browsing” mentality can quickly spiral out of control. If shopping apps are your go-to during downtime, consider what else could fill that space. You might be surprised at how much easier it is to curb if you find alternative activities.

5. You Feel Guilty But Keep Doing It

Every purchase brings a twinge of guilt, but it doesn’t stop you. The guilt may fade after the thrill of buying, but it never entirely disappears. Licensed clinical psychologist Dr. April Benson notes that guilt is a common aftermath of compulsive shopping because it often stems from unmet emotional needs. If your purchases are driven by emotions rather than necessity, this cycle of guilt is a key indicator of an underlying issue. It’s worth seeking out healthier emotional outlets.

The feeling of guilt might also come from realizing how much you’ve spent or how unnecessary the item was. Yet, despite the regret, you find it hard to break the cycle. It’s like a bad habit you can’t shake. You justify it, make excuses, and convince yourself it’s okay. If guilt is a recurring theme after shopping, it’s crucial to address the root cause of your spending habits.

6. You Hide Purchases From Others

You’ve started sneaking packages into your home or peeling off price tags before anyone sees. It’s not that you’re doing anything illegal, but there’s an element of secrecy in your shopping habits. The need to hide your purchases isn’t just about avoiding judgment; it’s about shielding yourself from facing the truth. When transparency is missing, it’s a sign that your relationship with shopping is a bit rocky. If you have to hide it, maybe it’s time to question why.

Concealing purchases often stems from a fear of criticism. Maybe you’ve heard comments about your spending before, or you just don’t want to face questions about your decisions. Either way, the secrecy adds to the stress and guilt associated with shopping. If you’re finding that hiding purchases is becoming the norm, it might be time to reassess your spending habits. Transparency is vital for healthy relationships, both with others and yourself.

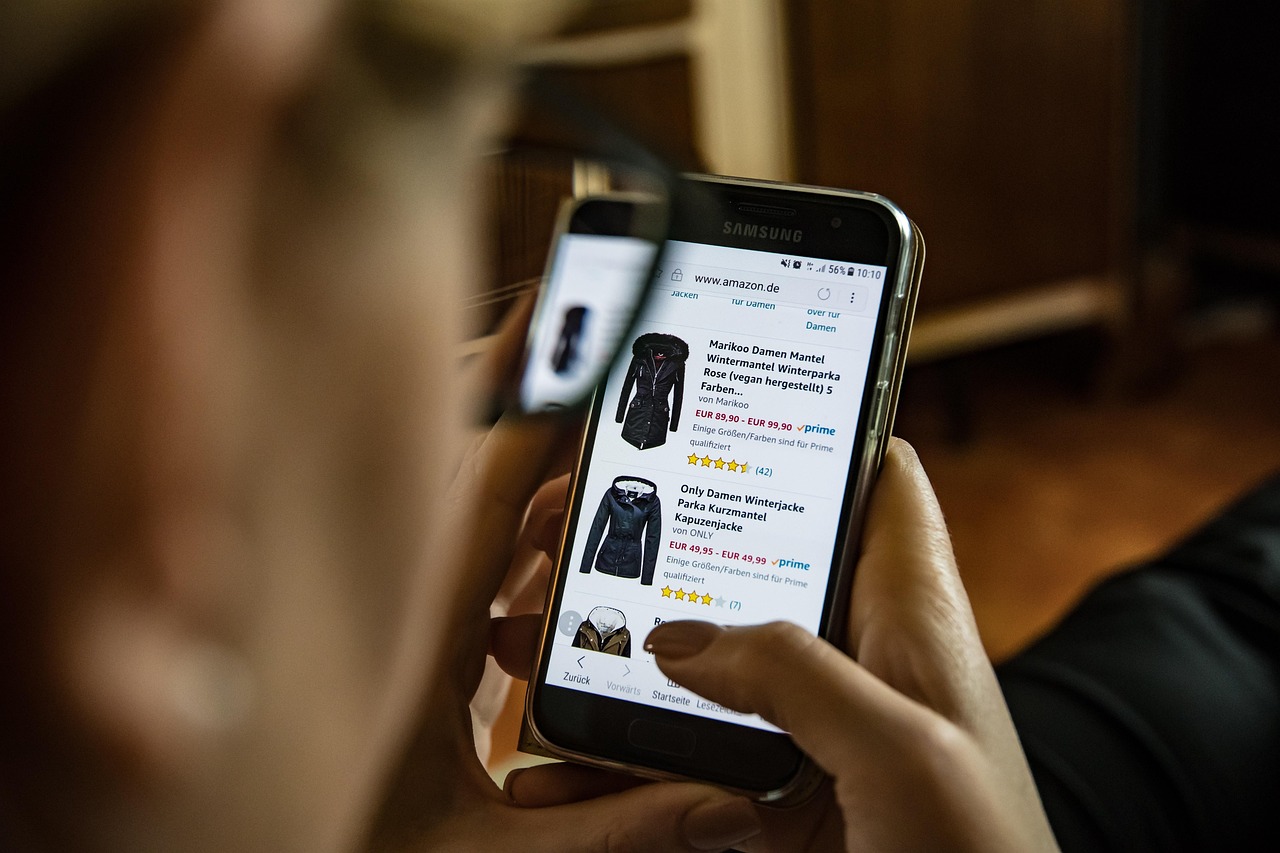

7. Shopping Apps Are All Over Your Phone

Your phone is a treasure trove of shopping apps, always ready for a quick purchasing fix. They’re just a tap away, and the convenience makes it hard to resist. According to behavioral economist Dan Ariely, the accessibility of shopping apps can exacerbate impulsive buying behaviors, as they make it too easy to shop without second thoughts. If these apps are taking up prime real estate on your home screen, it’s worth pondering their impact on your habits. Sometimes, deleting them can be a powerful first step towards change.

The habit of keeping these apps signals more than just convenience; it shows dependency. It’s like keeping a candy jar on your desk when you’re trying to cut down on sweets. Having instant access means instant gratification, which doesn’t help if you’re trying to cut back. If you’re serious about breaking the cycle, consider removing some of these apps. The extra step it takes to access them might curb your impulse to shop.

8. You Have A Closet Full Of “Just In Case” Items

Open your closet, and you’ll see items that haven’t seen the light of day. They’re the “just in case” clothes or gadgets that you bought on a whim. You keep telling yourself that one day you’ll need them, but that day never comes. The reality is, these items are collecting dust more than adding value to your life. It’s a classic case of over-preparation for non-existent scenarios.

The “just in case” mindset extends beyond clothes and into various facets of your purchasing habits. Whether it’s kitchen gadgets, tech accessories, or workout gear, you’re stockpiling things for hypothetical situations. These purchases often stem from a fear of missing out or being unprepared. But in reality, they add clutter and stress to your life. Reevaluate what you need versus what you think you might need someday.

9. Sales Are Irresistible To You

The word “sale” is like a magnet, pulling you in even when you have no particular need. Discounts become a reason in themselves to buy, regardless of the actual usefulness of the item. It’s easy to get swept up in the excitement of a good deal. But what’s the point of saving money on something you didn’t need in the first place? This mindset can lead to a closet full of items that never see the light of day.

Sales are tricky because they create a sense of urgency. It’s a fear of missing out on a deal rather than missing out on the product itself. If discounts are your kryptonite, take a step back and evaluate why that is. Ask yourself if the item is something you’d pay full price for. If the answer is no, it’s probably not something you truly need.

10. You Find It Hard To Let Go Of Items

Your home is full of things you should have parted with long ago. The idea of decluttering is daunting because each item feels like a part of you. There’s an emotional attachment to things, whether they’re used or not. They may not even hold significant value, but letting go feels like a loss. If this sounds familiar, it’s a sign that shopping is fulfilling an emotional void rather than a practical need.

Holding onto items isn’t just about the objects themselves; it’s about what they represent. Maybe it’s a memory, a promise of future use, or simply the comfort of having them around. But when your space is overflowing, the emotional toll can outweigh the comfort. It’s essential to differentiate between sentimental value and emotional clutter. If you struggle with this, consider starting small and gradually working your way through your belongings.

11. Browsing Is A Go-To Stress Reliever

You had a bad day, and your first instinct is to start scrolling through your favorite retail sites. Shopping becomes a distraction from reality, a way to numb the stress temporarily. But when browsing becomes a coping mechanism, it’s not serving its intended purpose. It’s not addressing the root cause of your stress, only masking it. If shopping is your escape, it might be time to find more sustainable ways to deal with stress.

Shopping as a stress relief can quickly transform into a dependency. You start associating the act with comfort and relaxation. However, the temporary high fades, leaving you with more than you bargained for—literally and figuratively. It’s crucial to find healthier ways to cope with stress, whether through exercise, hobbies, or talking things through with a friend. Consider other outlets before defaulting to retail therapy.

12. You Constantly Compare Your Purchases

You often find yourself comparing what you have with what others own. It’s not just about keeping up with trends; it’s about keeping up with people. This comparison game leads to unnecessary purchases that don’t reflect your personal needs or style. You’re buying to fit in rather than to fulfill genuine needs. If your shopping habits are driven by comparison, it’s time to reconsider.

The need to compare often stems from a desire for validation. You want to feel like you’re part of a group, like you belong. But building your identity based on others will only lead to dissatisfaction. Your worth isn’t determined by what you own. If comparison shopping is a habit, focus on what genuinely brings you joy instead of what everyone else is doing.

13. Return Policies Are Your Safety Net

You frequently rely on return policies to justify impulsive purchases. It’s the safety net that allows you to buy without committing. Knowing that you can always return an item makes it easier to click “buy now.” But if returning items is a regular part of your shopping routine, it’s a sign of a deeper issue. You’re purchasing without real consideration of need or desire.

Returns should be the exception, not the rule. If you’re always returning items, it’s time to question why you’re buying them in the first place. The cycle of buying and returning is not only time-consuming but also emotionally draining. It’s an indication of impulsivity, not necessity. If you’re leaning heavily on return policies, it might be time to evaluate your purchasing decisions more critically.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.