Picture this: you’re doomscrolling Twitter at 11:47 p.m. when you see it—your favorite billionaire CEO just fired off a spicy subtweet at the President. No context. No chill. Just raw, billionaire-on-president beef sizzling on the timeline. Within minutes, the hashtags are flying, stock tickers are nosediving, and your group chat is debating whether to panic-buy canned beans or crypto.

But here’s the thing: when power players clash, it’s not just vibes and viral moments—it’s real-world chaos for entire industries. From EVs to real estate, these passive-aggressive power moves ripple out like a pebble in a pond of money. So if you thought their little feud didn’t affect you, think again. Let’s break down 12 industries that could be caught in the billionaire crosshairs—and why your grocery bill, plane ticket, or favorite TV show might never be the same again.

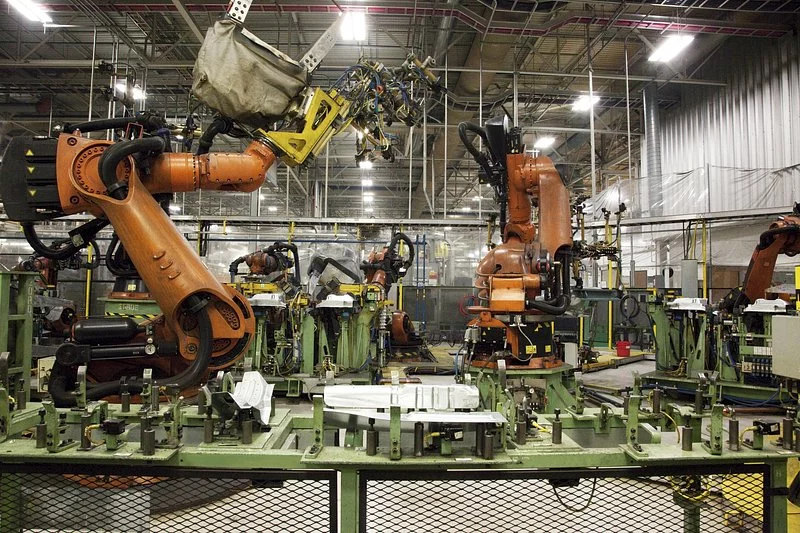

1. Electric Vehicles – When Tesla Takes the Wheel… and Swerves

Elon Musk doesn’t just build cars—he builds narratives, and right now, he’s steering straight into political turbulence. With tensions rising between Musk and the current administration over union policies, subsidies, and regulatory red tape, the EV industry could get stuck in gridlock. According to Bloomberg, the White House’s push for union-made EVs—and Musk’s aversion to unionizing Tesla’s workforce—has created a standoff with billion-dollar implications.

Why does that matter? Federal tax credits and infrastructure investments could start playing favorites, sidelining Tesla in favor of competitors who play nice with labor unions. That means less incentive for consumers to go electric with Elon’s rides, and more volatility for EV investors. Add in possible tariffs on Chinese-made batteries and things get even messier. If Washington decides to flex regulatory muscle, Tesla’s profits (and supply chain) might take a hit. Meanwhile, smaller EV startups are sweating, watching the playground fight that could reshape their funding and future. Bottom line: the future of green transportation might hinge on whether these two powerhouses can stop subtweeting each other and start cooperating.

2. Social Media – Welcome to the Algorithm Wars

When a tech mogul with a controlling stake in a major platform starts sparring with the government, the result isn’t just cringe tweets—it’s potential regulatory reckoning. Case in point: Meta CEO Mark Zuckerberg has come under fire from both political parties over misinformation, AI content moderation, and data privacy. The clash has intensified with proposed reforms to Section 230 and calls for stricter oversight on social platforms, as highlighted in a recent Brookings report.

If regulations pass, social media giants could be forced to change their entire business models—say goodbye to personalized ads as you know them. That’s billions in potential revenue loss, not just for Meta, but for influencers, small businesses, and marketing agencies who rely on these platforms to reach audiences. And you can bet TikTok, X (formerly Twitter), and YouTube are watching nervously from the sidelines. The content game could shift dramatically if moderation algorithms and ad targeting are heavily restricted. Users might notice less relevant content, slower app updates, or even subscription fees to make up the loss. The government wants accountability. The CEOs want autonomy. Meanwhile, Gen Z just wants their FYP back.

3. Pharmaceuticals – Pills, Profits, and Power Moves

Let’s be honest: Big Pharma and the White House have never exactly been besties. But when a CEO publicly calls out presidential plans to cap drug prices, things get spicy—and expensive. Stat News reported a tense standoff between Pfizer’s CEO and the Biden administration over Medicare price negotiations, which could reshape how life-saving drugs are priced and distributed.

If those negotiations go through, drugmakers might lose their golden goose: high margins on essential meds. That means cutbacks in R&D, higher prices for those with private insurance, and—wait for it—stock slumps. Smaller biotech firms also feel the squeeze since they rely on larger companies for acquisition funding and pipeline support. This isn’t just about insulin and cancer meds. It’s about the whole system potentially rebalancing in favor of affordability, which makes shareholders sweat. So while consumers may cheer for lower prices, the pharma industry is prepping for war, lobbying hard, and issuing veiled threats about innovation being “at risk.” Let’s just say the tension is prescription-strength.

4. Agriculture – Farming for Headlines

Imagine being a billionaire agri-tycoon and waking up to a new government policy that messes with everything from your water rights to your fertilizer costs. Welcome to the current climate between the White House and major agricultural players like John Deere and Cargill. As Reuters reported, the clash over water usage, environmental regulation, and crop subsidies could mean major upheaval for the food supply chain.

New climate-related executive orders are already forcing companies to reduce emissions or risk losing government support. That means costlier tech upgrades, more red tape, and shrinking profit margins. In retaliation, some agri-CEOs are pulling back on domestic investment and threatening to automate jobs at a faster clip. Farmers in the middle? Caught between government mandates and corporate cost-cutting. The irony? While billionaires feud with bureaucrats, the price of your romaine lettuce goes up again. Delicious.

5. Aerospace – Ground Control to Ego Major

Billionaire beef gets extra spicy when space is involved. Jeff Bezos and Elon Musk have both butted heads with the administration over federal contracts, space policy, and NASA favoritism. An Astronomy report recently outlined how Musk’s SpaceX and Bezos’ Blue Origin are locked in a cosmic battle for dominance—and the President is increasingly being pulled into the orbit.

When contracts are awarded based on politics instead of tech, things go sideways fast. Billions in federal funding for lunar missions, military satellites, and orbital broadband could suddenly shift. That means delays, layoffs, and investor panic in the aerospace sector. If one CEO gets iced out, their projects might grind to a halt, while competitors scramble to pick up the pieces. It’s not just about rockets anymore—it’s about which billionaire gets to colonize Mars with government backing. The result? Earthbound economic turbulence.

6. Semiconductors – Chips on Their Shoulders

If there’s one thing tech billionaires hate more than taxes, it’s supply chain disruptions. And when the President starts throwing shade over chip manufacturing or tightening export rules, the semiconductor sector starts sweating bullets. CEOs in this space thrive on global partnerships, especially with Taiwan and South Korea, so any whiff of trade drama or tariffs has ripple effects. It’s like threatening the chef right before dinner service—everything goes sideways, fast.

Suddenly, factories delay shipments, carmakers halt production, and everyone from iPhone users to Xbox gamers starts feeling the lag. These microchips might be small, but they’re powering the entire global economy. So when government policy puts national security or domestic production ahead of global efficiency, the tension turns techno-political. Billionaire execs, already salty over inflation and tax reform, may retaliate by delaying U.S. investments or rerouting supply chains. And let’s be real, they’re not above making public statements that spook the market. That kind of drama gets Wall Street jittery and consumer prices climbing. All because someone blinked during a Washington briefing. Bottom line: if billionaires and bureaucrats don’t learn to play nice, we’ll all be rebooting our routers a little more often.

7. Real Estate – Building a Wall Between Politics and Profit

Ah, real estate—where zoning laws, interest rates, and billionaire bravado all crash into each other like an overpriced HOA meeting. When the President pushes policies that tighten lending, cap short-term rentals, or rezone land use, big-name property moguls start sweating through their tailored blazers. Billionaire developers thrive in regulatory gray zones, so any move toward tighter oversight feels like a threat to their kingdom.

Suddenly, luxury condos get delayed, commercial projects stall, and affordable housing becomes a buzzword everyone loves but no one funds. These billionaires aren’t shy, either—they’ll take to social media, lobbying channels, or news interviews to claim the policies are “anti-growth.” And let’s not forget how quickly a billionaire can flip the narrative from “neighborhood revitalization” to “government overreach.” The result? Real estate stocks wobble, buyers freeze, and renters get hit with higher prices because developers start passing costs down the chain. Oh, and mortgage lenders? They’re caught in the crossfire too. It’s like Monopoly, but with actual billions on the board. If this feud keeps escalating, the only people winning are the ones already living rent-free—in their heads.

8. Energy – Gas, Grudges, and Green Dreams

When a billionaire oil exec gets into a spat with a President pushing clean energy, you know it’s about to get messy. The energy industry is already walking a tightrope between profit and public perception, and these high-profile feuds add a whole new layer of volatility. One minute, fossil fuels are getting subsidized. The next, they’re public enemy #1 in a climate change speech.

These policy shifts aren’t just philosophical—they hit energy companies right in the wallet. Permits stall, taxes increase, and oil futures start looking like crypto charts. The big names in fossil fuels start slashing budgets or moving operations offshore, while renewables scramble to absorb the spotlight—and the pressure. It’s not uncommon for billionaires in this space to fire back with ad campaigns, think tank funding, or very dramatic shareholder letters. Meanwhile, the average person is wondering why their gas bill feels like a second rent payment. As the feud drags on, investments become riskier, utilities start hedging, and innovation slows under the weight of political chess. The irony? Whether you drive electric or gas, you’re still paying for the drama.

9. Media & Entertainment – Lights, Camera, Congressional Hearing

When billionaires who own media empires start feuding with the Oval Office, it’s not just tabloid fodder—it’s an economic power play. Think streaming giants, broadcast networks, and production studios that rely on regulatory goodwill, broadband access, and advertising flexibility. If the President starts slamming one of these CEOs for pushing “divisive” content or monopolizing narratives, expect fireworks. And not the fun kind.

Suddenly, FCC regulations get stricter, M&A deals get blocked, and platforms start self-censoring to avoid being the next political punching bag. That’s when industry insiders panic. Producers hit pause, advertisers pull budgets, and your favorite show gets mysteriously “delayed.” These billionaires aren’t just influencers—they’re cultural architects. So when they get slapped with political consequences, it shakes the whole sandbox. Behind the scenes, contracts stall, actors get nervous, and entire studios pivot to safer, less edgy content. What was once prestige TV becomes prestige damage control. And just like that, the drama behind the camera becomes more real than what’s on screen. Stay tuned—literally.

10. Retail – Shopping Sprees and Supply-Chain Shade

Retail billionaires love to play capitalist chess, but when the President flips the board, things get wild. Whether it’s tariffs, tax policy, or labor regulations, these changes can throw a whole supply chain into chaos. Suddenly, the CEO of your favorite fast-fashion brand is in a Twitter war over import duties, and everyone’s prices go up just in time for holiday shopping. Great.

Retail is incredibly sensitive to both consumer behavior and political climate. A new regulation here, a minimum wage bump there, and next thing you know—warehouse operations start lagging and shipping times double. The big bosses may respond by offloading costs, cutting staff, or threatening to move operations out of the country. And let’s be real, they know how to make a media splash doing it. For the shopper, this means higher prices, fewer discounts, and slower restocks. For smaller retail brands? They’re caught in the fallout with none of the PR budget. And for workers? More instability in an already shaky gig economy. Billionaire vs. President may sound like a reality show, but it hits your cart total faster than you think.

11. Banking – Interest Rates and High-Stakes Ego

When Wall Street billionaires start throwing elbows at the President over interest rates or banking regulations, you know something big is brewing. These are the guys who practically breathe in Federal Reserve memos and exhale market forecasts. So when the administration hints at banking reform, or backs new taxes on financial transactions, the big dogs start barking.

Expect immediate market volatility, panicked sell-offs, and press releases dripping with passive-aggressive economic jargon. Banking execs thrive in deregulated environments, and anything that smells like oversight gets them fuming. They might cut lending, slow down investments, or pull back from riskier sectors altogether—just to flex. And you better believe they’ll lobby hard, with enough dollars to fund a mid-sized nation. The tension doesn’t just stay on Capitol Hill. It flows right into mortgage rates, small business loans, and retirement portfolios. You’ll see headlines about “economic stability” while wondering why your credit card APR jumped by 3%. And let’s not forget—the billionaires never pay the price directly. They pass the tab to the rest of us. Congrats, we’re all co-stars in this banking beef.

12. Transportation – Planes, Trains, and Billionaire Pains

If your daily commute feels chaotic, there’s a non-zero chance a billionaire and the President are having a turf war. Whether it’s over public infrastructure funding, airline regulations, or high-speed rail investments, transportation billionaires are deeply invested in the fine print. And when they don’t like the fine print, they go full scorched earth.

This might mean delaying new rail systems, pulling funding from green transit startups, or lobbying to kill congestion taxes. Meanwhile, airlines get grumpy about stricter emissions standards or worker protections, and start nickel-and-diming passengers like it’s a competitive sport. Think less legroom, more hidden fees, and delayed routes while execs do damage control. If the feud goes nuclear, airport expansions get shelved and major metro projects stall. That means fewer jobs, more traffic, and longer travel times for everyone. Not exactly the jet-set fantasy we were promised. Transportation should move people forward—not stall because of billionaire egos. But here we are, stuck in political traffic.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.