In today’s fast-paced digital world, financial wisdom is just a click away. Whether you’re an investment newbie or a seasoned saver, following the right financial influencers can provide you with the insights and motivation needed to boost your savings and make informed financial decisions. These financial influencers are not only experts in their fields but also relatable voices who share knowledge that can truly transform your financial journey.

1. Get Inspired by the Financial Wisdom of Tiffany “The Budgetnista” Aliche

Tiffany Aliche, affectionately known as “The Budgetnista,” is a force to be reckoned with in the personal finance space. Her journey from a preschool teacher to an award-winning personal finance educator is nothing short of inspirational. Tiffany’s goal is to help women, especially those from marginalized communities, realize their financial dreams. She is the creator of the Live Richer Challenge, which has helped over a million women save and manage their money better. Her down-to-earth advice and relatable teaching style make complex financial concepts accessible to everyone.

Tiffany shares her expertise through her social media platforms, her book “The One Week Budget,” and her podcast, “Brown Ambition.” She’s not just about budgeting; she also covers investing, credit building, and building generational wealth. Following Tiffany can help you develop a practical and optimistic approach to your finances. According to Forbes, she has been instrumental in increasing financial literacy among women. If you’re looking to skyrocket your savings with a mix of motivation and practical tips, Tiffany is your go-to financial influencer.

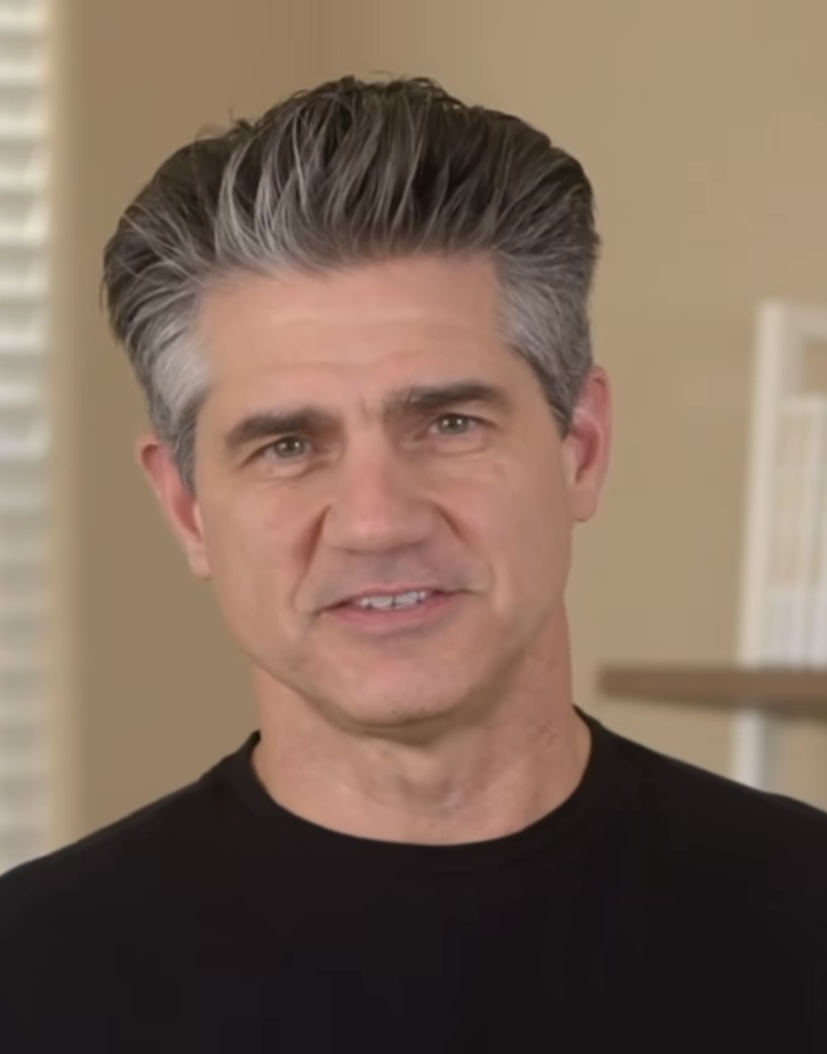

2. Learn the Art of Smart Investing with Ramit Sethi

Ramit Sethi, the author of the best-selling book “I Will Teach You to Be Rich,” is renowned for his straightforward and effective approach to personal finance. He emphasizes the importance of automating finances and focusing on increasing your earning power rather than just cutting back expenses. His philosophy revolves around living a rich life by spending extravagantly on what you love and cutting costs mercilessly on the things you don’t. Ramit’s advice is particularly valuable for those looking to enhance their investment strategies and grow their wealth over time.

In addition to his books, Ramit offers online courses that dive deep into personal finance and entrepreneurship. He’s also known for his engaging social media presence, where he shares daily tips and insights into building a prosperous financial future. Following Ramit can help you develop a mindset geared towards growth and abundance. As demonstrated in CNBC‘s feature on his work, he believes in the power of psychology and behavior in financial success. If you’re ready to take your investing game to the next level, Ramit Sethi is the influencer to follow.

3. Dive into Frugal Living with the Advice of Joshua Becker

Joshua Becker, the founder of Becoming Minimalist, is a leading figure in minimalism and financial independence. He encourages people to live a simpler, more intentional life by focusing on the essential and eliminating the excess. Joshua’s approach to personal finance is rooted in the idea that less is more, aligning financial freedom with a minimalist lifestyle. His insights are particularly helpful for those who want to reduce clutter, both physically and financially, and live more meaningful lives.

In his books and blog, Joshua shares practical tips on how minimalism can lead to a richer, more fulfilling life. His teachings emphasize that financial success isn’t just about accumulating wealth but also about creating space for what truly matters. According to The Guardian, Joshua’s philosophy has helped many people gain control over their finances. If you’re looking to simplify your life and finances while boosting your savings, Joshua Becker’s minimalist approach is worth exploring.

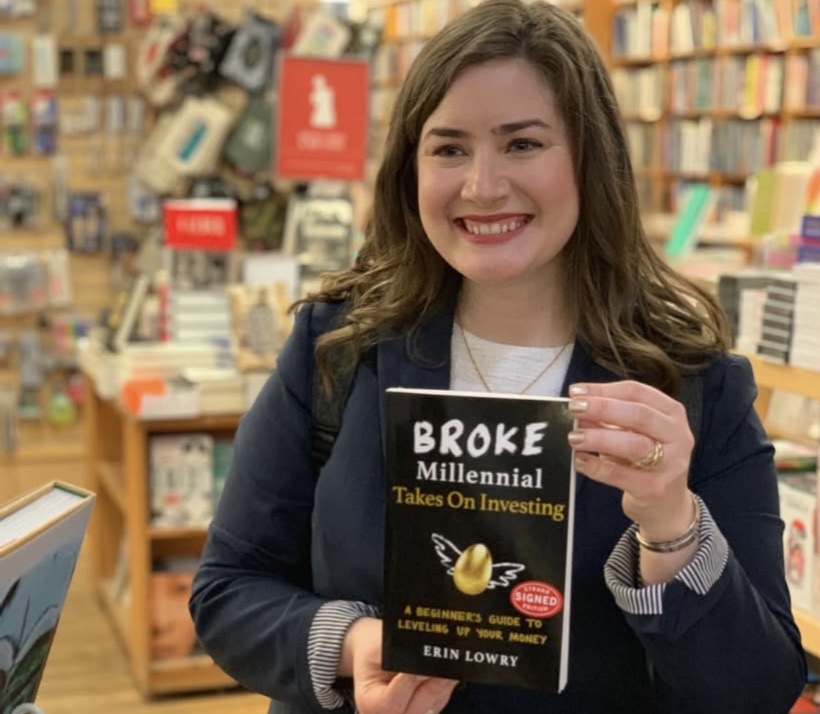

4. See Finances Through a Global Lens with Erin Lowry

Erin Lowry, the author of the “Broke Millennial” series, is a millennial finance expert who breaks down complex financial topics into digestible, relatable advice. Erin’s storytelling ability makes her a favorite among younger audiences who are navigating the tricky waters of student loans, credit cards, and first-time investments. Her approach is practical and inclusive, acknowledging the diverse financial challenges faced by today’s younger generations. She often covers topics like negotiating salaries, tackling debt, and starting with small investments.

Erin’s work goes beyond traditional financial advice by addressing the emotional and psychological aspects of money. Her books and blog are filled with anecdotes and real-life examples, making her financial tips easy to understand and apply. She also engages with her audience through social media and podcasts, providing a continuous stream of insights and encouragement. If you’re a young adult looking to take charge of your financial future, Erin Lowry’s perspective can be a great guide.

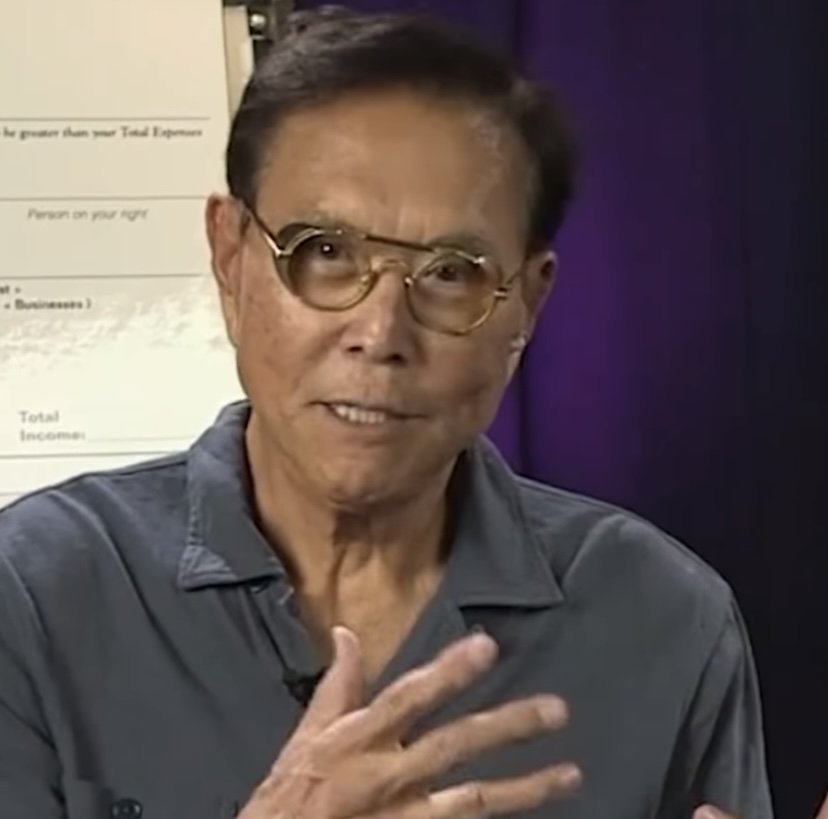

5. Master the Game of Money with Robert Kiyosaki

Robert Kiyosaki, the author of “Rich Dad Poor Dad,” is one of the most influential figures in personal finance education. His book has sold millions of copies worldwide and has inspired countless people to rethink how they manage money. Kiyosaki’s teachings focus on the importance of financial education and literacy as the means to achieve financial freedom. He emphasizes investing in assets over liabilities and understanding the difference between the two.

Through his Rich Dad Company, Robert provides resources and tools for those looking to improve their financial intelligence. His books, seminars, and online courses cover a wide range of topics from real estate investing to entrepreneurship. Robert’s insights encourage people to think creatively about their finances and to take proactive steps towards wealth accumulation. If you’re eager to learn about building wealth and financial independence, Robert Kiyosaki’s lessons offer valuable guidance.

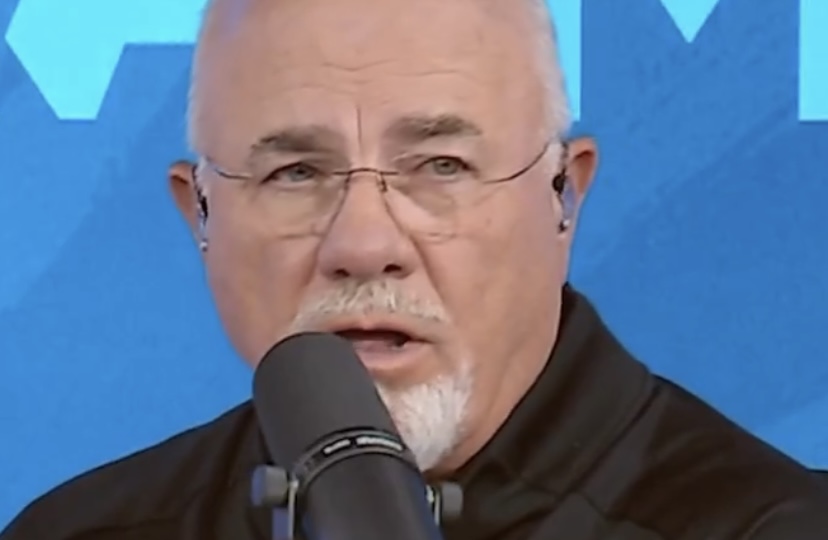

6. Find Financial Motivation with Dave Ramsey’s Proven Strategies

Dave Ramsey is a household name when it comes to personal finance and debt management. Known for his no-nonsense approach, Dave advocates for living debt-free and building wealth through disciplined financial planning. His “Baby Steps” program has helped millions of people get out of debt and build a solid financial foundation. Dave’s radio show and podcasts provide practical advice on budgeting, saving, and investing, making financial literacy accessible to all.

Dave’s philosophy centers around living within your means and making purposeful financial decisions. He encourages people to focus on long-term goals, such as retirement savings and paying off their mortgages. Through his Financial Peace University, Dave offers courses that delve deeper into his financial principles and strategies. By following Dave Ramsey, you’ll gain insights into achieving financial peace and independence, empowering you to take control of your money.

7. Follow Suze Orman for Unmatched Financial Security Advice

Suze Orman is a trusted financial advisor and author known for her straightforward, empowering financial advice. Her expertise spans across various financial topics, including retirement planning, estate planning, and insurance. Suze’s approach is centered on taking control of your financial future by making informed decisions and avoiding common financial pitfalls. Her books, such as “The Courage to Be Rich,” provide readers with actionable steps to achieve financial security.

Suze is a frequent guest on television and radio shows, where she shares her insights and answers questions from viewers. Her engaging style and ability to simplify complex topics make her advice accessible to a wide audience. Suze’s experience and knowledge make her a valuable resource for anyone looking to secure their financial future and make smart money decisions. By following Suze Orman, you’ll be equipped with the tools and confidence needed to navigate your financial journey successfully.

8. Get Real with Personal Finance Blogger J. Money

J. Money, the founder of Budgets Are Sexy, is a personal finance blogger known for his candid and humorous take on money management. His blog is packed with real-life stories and practical advice on budgeting, saving, and investing. J. Money’s unique perspective on finance encourages readers to embrace their financial quirks and find joy in managing their money. His transparency about his own financial journey offers relatable insights and inspiration.

Through his blog and social media, J. Money engages with his audience by sharing his financial victories and challenges. His approach is refreshing and down-to-earth, making personal finance feel less intimidating and more approachable. J. Money’s commitment to financial transparency and authenticity resonates with those who appreciate honest, real-world advice. By following J. Money, you’ll find encouragement and motivation to tackle your financial goals with confidence and humor.

9. Embrace Financial Independence with Mr. Money Mustache

Mr. Money Mustache, the pseudonym of Peter Adeney, is a prominent figure in the financial independence and early retirement movement. His blog chronicles his journey to financial independence and offers readers a blueprint for living a frugal, purposeful life. Mr. Money Mustache’s philosophy revolves around saving aggressively, spending intentionally, and embracing a minimalist lifestyle to achieve financial freedom. His witty and irreverent writing style makes financial independence an exciting and attainable goal.

Peter’s insights and strategies challenge conventional notions of success and encourage readers to question societal norms around money and consumption. His emphasis on living below your means and investing wisely has inspired many to pursue a more intentional and fulfilling life. Mr. Money Mustache’s approach empowers individuals to take control of their finances and create a life centered around freedom and choice. If you’re seeking financial independence and a fresh perspective on money, following Mr. Money Mustache will provide valuable guidance.

10. Unlock the Secrets of Wealth with Chris Hogan

Chris Hogan, a financial expert and author, is known for his expertise in retirement planning and building wealth. His book “Retire Inspired” provides a roadmap for achieving financial security and independence in retirement. Chris’s approachable style and practical advice make complex financial topics accessible to a wide audience. His focus on intentional planning and disciplined saving empowers individuals to take charge of their financial futures.

Chris’s insights and strategies are not only about numbers but also about mindset and behavior. He encourages people to dream big and create a vision for their financial future while providing actionable steps to achieve those dreams. Through his books, podcasts, and speaking engagements, Chris inspires individuals to pursue financial goals with confidence and determination. By following Chris Hogan, you’ll gain valuable insights into building wealth and securing a prosperous retirement.

11. Leverage the Power of Money Education with Bola Sokunbi

Bola Sokunbi is the founder of Clever Girl Finance, a platform dedicated to empowering women to take control of their finances. Her mission is to provide women with the knowledge and tools needed to achieve financial independence and security. Bola’s work focuses on education and empowerment, offering courses, articles, and resources on budgeting, saving, investing, and managing debt. Her relatable approach and commitment to financial literacy make her a trusted resource for women seeking financial empowerment.

Through her platform, Bola shares success stories and actionable tips that motivate women to pursue their financial goals. Her emphasis on community and support creates a welcoming environment for women to learn and grow in their financial journeys. Bola’s dedication to financial education and empowerment resonates with those seeking to break free from financial constraints and build a brighter future. By following Bola Sokunbi, you’ll be inspired to take charge of your finances and achieve your financial dreams.

12. Discover Practical Money Tips with Clark Howard

Clark Howard, a consumer expert and radio host, is known for his practical money-saving tips and advice. His mission is to help people save more, spend less, and avoid scams, providing consumers with the knowledge they need to make informed financial decisions. Clark’s straightforward approach and focus on consumer advocacy make him a trusted voice in the world of personal finance. His advice covers a wide range of topics, from travel savings to credit card management.

Clark’s radio show, podcast, and website offer a wealth of resources for individuals looking to improve their financial well-being. His commitment to helping people navigate the complexities of personal finance empowers individuals to take control of their money and make smarter financial choices. By following Clark Howard, you’ll gain access to a treasure trove of practical tips and strategies for saving money and avoiding financial pitfalls. If you’re seeking down-to-earth financial advice, Clark Howard is a must-follow influencer.

13. Navigate the World of Financial Planning with Jean Chatzky

Jean Chatzky, a financial journalist and author, is a leading voice in personal finance education. Her approachable style and practical advice make her a trusted resource for individuals seeking to improve their financial literacy and security. Jean’s work spans across various media platforms, including books, podcasts, and television, where she shares insights on budgeting, investing, and retirement planning. Her focus on financial empowerment and education resonates with diverse audiences.

Jean’s ability to break down complex financial topics into easy-to-understand advice makes her insights accessible to people at all stages of their financial journeys. Through her articles and speaking engagements, Jean provides actionable steps to help individuals achieve financial health and well-being. Her emphasis on education and empowerment encourages individuals to take control of their financial futures with confidence. By following Jean Chatzky, you’ll gain valuable knowledge and guidance for navigating the world of personal finance.

14. Gain Financial Insight with Farnoosh Torabi’s Relatable Advice

Farnoosh Torabi is a financial expert, author, and podcast host known for her relatable and insightful approach to personal finance. Her work focuses on empowering individuals to take control of their finances and achieve financial independence. Farnoosh’s podcast “So Money” features interviews with financial experts and influencers, providing listeners with diverse perspectives on money management and wealth-building. Her approachable style and practical tips make her advice accessible to a wide audience.

Farnoosh’s expertise spans across various financial topics, including budgeting, investing, and career development. Her emphasis on financial education and empowerment encourages individuals to make informed financial decisions and pursue their financial goals with confidence. Through her books, articles, and podcast, Farnoosh inspires individuals to take charge of their finances and create a prosperous future. By following Farnoosh Torabi, you’ll gain valuable insights and inspiration for improving your financial well-being.

15. Experience Financial Growth with the Expertise of Patrice Washington

Patrice Washington, known as the “Money Maven,” is a financial expert and author dedicated to helping individuals achieve financial success and well-being. Her work focuses on teaching people how to manage money, build wealth, and create a life of financial freedom. Patrice’s holistic approach to personal finance emphasizes the importance of mindset, behavior, and spirituality in achieving financial success. Her books, podcasts, and speaking engagements provide individuals with the tools and inspiration needed to transform their financial lives.

Through her platform, Patrice shares practical advice and success stories that motivate individuals to pursue their financial goals. Her emphasis on financial education and empowerment encourages individuals to take control of their finances and create a life of abundance and prosperity. By following Patrice Washington, you’ll gain valuable insights and inspiration for achieving financial success and well-being. If you’re ready to experience financial growth and transformation, Patrice’s expertise is an invaluable resource.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.