In today’s digital age, financial scams are lurking around every corner, waiting to prey on unsuspecting individuals. It’s crucial to arm yourself with awareness and knowledge to spot these scams before they wipe out your hard-earned savings. With the right mindset and a keen eye, you can navigate the financial world more safely. Here are 13 ways to spot a financial scam before it’s too late.

1. The Too Good To Be True “Deal”

When an investment or financial opportunity promises sky-high returns with little to no risk, your scam radar should be tingling. According to the Federal Trade Commission, scammers often lure victims with promises that are simply too good to be true. Think about it: if it was that easy to make money, wouldn’t everyone be doing it? Always question the feasibility of such offers and consider seeking advice from a financial advisor before diving in.

Moreover, scammers often use high-pressure tactics to persuade you to act quickly, preventing you from doing your due diligence. If someone insists that you must “act now” or miss out forever, it’s a big red flag. Genuine investment opportunities will give you time to think things over and to consult with trusted advisors. Trust your gut; if something feels off, it probably is.

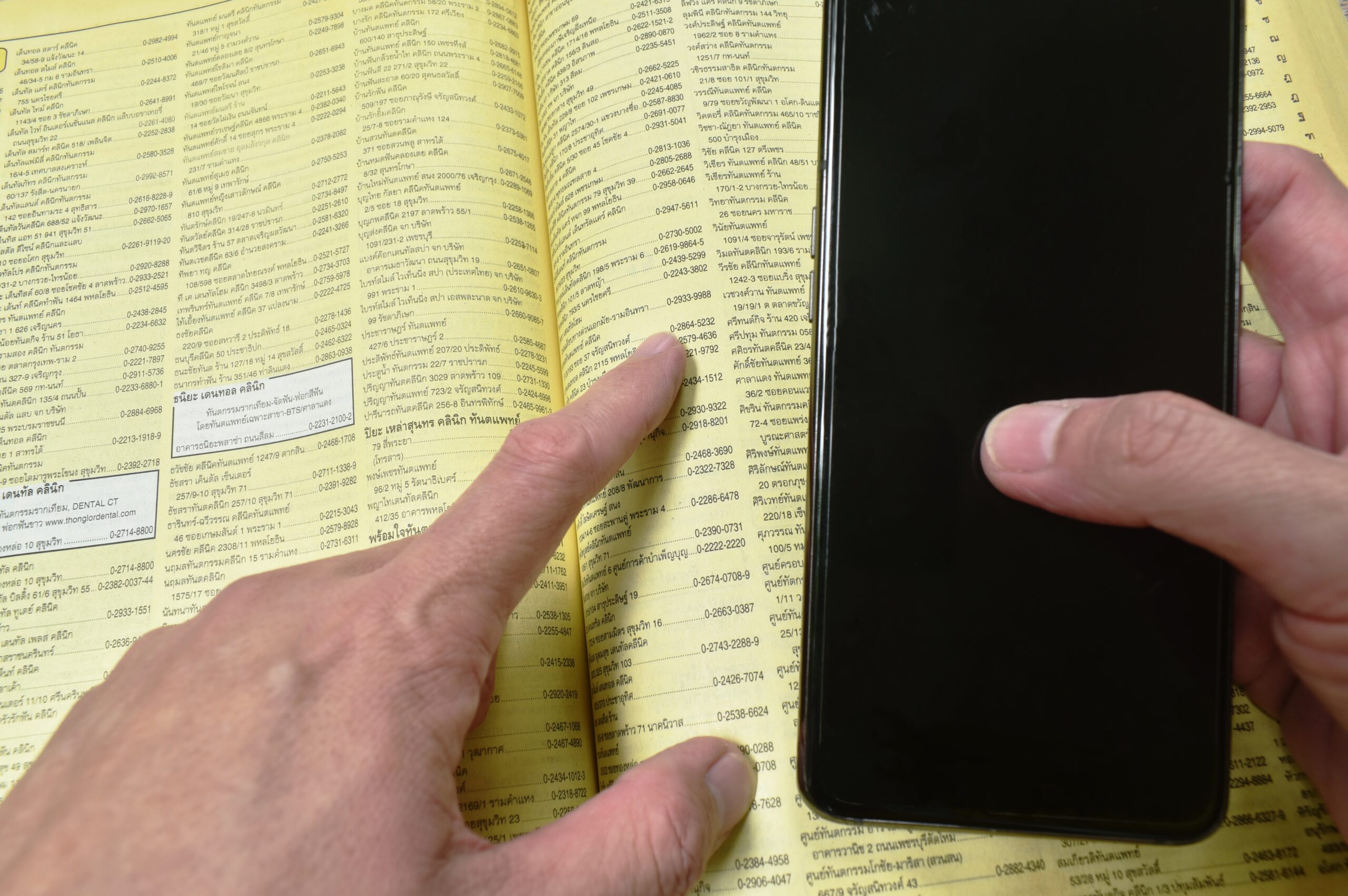

2. The Unfamiliar Or Untraceable Source

Scammers are experts at creating websites and emails that appear legitimate. However, a quick background check can often reveal inconsistencies. Look for contact information and verify the organization’s credibility through independent sources. A reputable company will have a track record and a verifiable online presence. You can often trace their history through trusted sites like the Better Business Bureau.

Additionally, check for reviews or complaints about the company. Be cautious if you can’t find any information or if there are numerous negative reviews. Don’t dismiss your instincts; if everything about the company seems too mysterious or vague, it might be best to steer clear. Protecting your finances starts with knowing who you’re dealing with.

3. They Ask For Sensitive Information Right Away

Legitimate financial institutions will not ask for your personal details via email or phone without proper verification. If you receive unsolicited requests for sensitive information like your Social Security number or banking details, pause immediately. Scammers often use such tactics to gather information quickly before you catch on. The Department of Justice website advises never to give out personal information unless you have verified the request independently.

Sophisticated scams might even impersonate real companies by mimicking their communication styles. Always verify any requests by contacting the company directly using official contact details. Remember, financial institutions have secure methods of communication and will not initiate requests for sensitive data out of the blue. Protect your information as if it were your lifeline—because it is.

4. They Appeal To Your Emotions

Scammers often exploit emotions to get you to act irrationally. Whether it’s the promise of a once-in-a-lifetime opportunity or a fabricated crisis, these tactics aim to cloud your judgment. They might tell you a moving story that tugs at your heartstrings, hoping you’ll react impulsively. In such situations, take a moment to separate emotion from logic.

When faced with emotionally charged situations, it’s helpful to step back and evaluate the facts. Ask yourself if the story is plausible and whether the alleged urgency is real. Consult with family, friends, or financial advisors, as they can provide a more objective perspective. Remember, if someone is pushing too hard on your emotions, they might not have your best interests at heart.

5. There’s A Lack Of Transparency

Transparency is a hallmark of legitimate financial dealings. If a company is hesitant to provide clear information about their operations, fees, or the risks involved, it’s a warning sign. You should be able to understand where your money is going and what you can expect in return. Legitimate businesses will be open about their practices and policies.

A lack of transparency can manifest in various ways, such as evasive answers or complicated terms that are difficult to decipher. Be wary if documentation is unclear or if you’re not given enough time to review contracts or agreements. Reputable companies will welcome your questions and provide clear, concise answers. Remember, your financial security is at stake, so don’t settle for anything less than full disclosure.

6. There’s Pressure To Keep It A Secret

If you’re ever told to keep an investment opportunity a secret, consider it a glaring red flag. Scammers use this tactic to isolate victims, preventing them from seeking advice or discovering the scam. They might claim it’s a special opportunity for a select few, but the reality is, they’re trying to keep you in the dark. Transparency and openness are important in any financial transaction.

Discussing your financial decisions with someone you trust is a great way to gain insights and avoid pitfalls. Scammers know that the more people involved, the more likely it is that someone will recognize the scam. Always be wary when asked to keep something secretive, especially when it comes to your finances. Trust is crucial, and any legitimate offer will withstand public scrutiny.

7. The Communication Is Unprofessional

Pay attention to the quality of communication you receive from potential financial partners. Poor grammar, spelling errors, and unprofessional language are red flags. Legitimate companies take pride in their professional image and communication standards. If the communication seems rushed or lacks polish, it’s worth investigating further.

Additionally, be cautious of emails that don’t address you personally or contain generic greetings. Scammers often send bulk emails to large groups, using generic terms to address everyone. Authentic businesses will know how to spell your name and provide personalized service. Trust your instincts; if the communication feels off, it might be best to avoid engaging further.

8. The Payment Method Is Strange

Scammers often request payment through unconventional methods such as gift cards, wire transfers, or cryptocurrency. These methods are hard to trace and reverse, making them ideal for fraudulent activities. A legitimate financial entity will offer standard payment options like credit cards or bank transfers. Be wary of anyone insisting on unusual payment methods.

If you’re unsure about a payment request, take time to research the transaction method. Consult with your bank or financial advisor to ensure that it’s secure and legitimate. Scammers often claim that these methods are for your convenience, but in reality, they benefit the scammer. Protect your assets by insisting on secure and traceable payment options.

9. The Offer Is Time-Sensitive Without Reason

Beware of offers that require immediate action for no apparent reason. Scammers use urgency to override your rational thinking and push you into hasty decisions. They might claim that the deal is only available for a short time, pressuring you to act quickly. However, legitimate opportunities are usually available for reasonable periods.

Take the time to evaluate any time-sensitive offers critically. Ask for detailed information and verify the claims independently. Consult with trusted individuals to get a second opinion. Remember, opportunities should withstand scrutiny and not require rushed decisions. Pressure tactics are a clear sign that something might be amiss.

10. The Testimonials And Reviews Seem Fake

Scammers often create fake testimonials and reviews to bolster their credibility. Look for inconsistencies or overly positive reviews that seem too good to be true. Authentic reviews will have a mix of positive and negative feedback, reflecting genuine experiences. Investigate further if the testimonials lack detail or sound repetitive.

You can also check review sites and forums for unbiased opinions. Be wary if you can’t find any third-party reviews or if the company discourages you from seeking external feedback. Genuine businesses welcome transparency and encourage customer reviews. Trustworthy testimonials will be verifiable, helping you make an informed decision.

11. There’s A Lack of Licensing Or Accreditation

Authentic financial institutions and advisors will have the necessary licenses and accreditations. Verify these credentials independently through official channels. Scammers might provide false credentials or omit this information altogether. Licensing information should be readily available and easy to verify.

Ask for proof of accreditation and research the relevant regulatory bodies. Be wary of vague responses or reluctance to provide this information. Regulatory bodies ensure that financial entities operate under strict guidelines. Your financial security relies on working with licensed professionals who adhere to industry standards.

12. The Offer Doesn’t Align With Your Goals

Scammers might present offers that don’t align with your financial goals or risk tolerance. They often use generic pitches to appeal to a broad audience. A legitimate financial advisor will tailor their advice to suit your individual needs and objectives. Be cautious of offers that seem disconnected from your personal financial plan.

Take time to assess whether the opportunity fits into your long-term goals. Consult with trusted advisors to ensure alignment with your financial strategy. Avoid deviating from your plan due to enticing offers that don’t resonate with your objectives. Staying focused on your goals helps protect you from distractions and potential scams.

13. The Whole Things Feels Off

Never underestimate the power of your intuition. If something feels off, take the time to investigate further. Your gut feeling can be a powerful tool in identifying potential scams. It’s okay to be skeptical and ask questions until you’re satisfied.

Trust your instincts and don’t feel pressured to make decisions until you’re ready. A genuine opportunity will withstand scrutiny and provide ample time for consideration. Consult with trusted individuals who can provide perspective and advice. Remember, your intuition is an important defense mechanism against scams, so listen to it.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.