You ever look at your bank statement and think, “What the heck is SunCloud Premium Plus and why is it charging me $11.99 every month?” Congrats, you’ve officially entered the subscription Twilight Zone. Retirement is supposed to be about peace, hobbies, and maybe finally finishing that 500-piece puzzle—not death by a thousand auto-renews.

But sneaky subscriptions are everywhere, dressed up as “convenience” or “self-care,” quietly draining your budget while you’re just trying to enjoy your Tuesday golf game. These little charges fly under the radar because they’re small, repetitive, and deceptively harmless—until you add them all up and realize your monthly burn rate rivals your grandkid’s college loan payments. So before your fixed income turns into a disappearing act, here are 12 subscription traps that are silently wrecking retirement budgets. Spoiler: canceling just three of these might feel better than a 5% market rally.

1. “Free” Trial Offers That Turn Into Monthly Bills

Ah yes, the siren song of “Try 30 Days Free!” lures in even the savviest retirees. Whether it’s vitamins, audiobooks, or online workout classes, the catch is always buried in the fine print. You forget, they charge. And because it’s just $12.95 here or $19.99 there, it blends right into your statement like a financial ninja.

MarketWatch points out that many people are billed for months (or even years) without realizing it. These companies are banking on your forgetfulness—and they’re winning. Set calendar reminders for any free trial you start. Better yet, use a one-time virtual card or burner email to avoid long-term entanglement. If you don’t use it more than twice in 30 days, it’s not a subscription—it’s a scam in slow motion.

2. Streaming Services You Forgot You Had

Netflix, Hulu, Prime Video, Disney+, Apple TV+, Paramount+, Max… at this point, your “cord-cutting” habit costs more than the old cable bundle. Most people sign up for one or two during a free trial binge phase and then forget to cancel when the show ends. According to The Wall Street Journal, the average household spends over $200 a month on digital subscriptions—and many don’t even realize it.

Retirees, in particular, may not notice overlapping charges when payments are auto-debited from multiple cards. And let’s be real, how many times can you rewatch NCIS before realizing CBS isn’t worth the $9.99? Take ten minutes to review every streaming app you’re signed into. Then ruthlessly cancel the ones you barely use. You can always re-subscribe later if a new season drops. Your wallet will breathe a sigh of relief—and so will your sanity.

3. “Senior Wellness” Memberships with Hidden Auto-Renewals

That $19.95 monthly subscription to a digital meditation app or “might sound innocent—but check the terms. These services often come with auto-renewals that are difficult to cancel and barely offer more than what you can find on YouTube for free. They prey on the promise of aging gracefully, but mostly just age your bank account.

Consumer Reports says that health-related subscriptions, especially those marketed to older adults, are some of the trickiest to get rid of. Some even require you to call during specific hours to cancel—because nothing says “zen” like hold music. If you’re paying for “exclusive access” to pre-recorded sleep meditations or affirmations you never use, it’s time to reassess. Wellness shouldn’t cost you your well-being. Especially not when there are free, better options everywhere.

4. Monthly Product Boxes You Forgot You Had

Once upon a time, you were hyped about your monthly wine box, craft kit, or luxury socks subscription. But now the boxes pile up unopened—or worse, you keep forgetting they’re even coming. These services capitalize on novelty and convenience, but they’re sneaky budget vampires if they stop bringing you joy. And unsubscribing can feel like breaking up with a pen pal.

ABC 9 warns that retirees often underestimate the cumulative impact of small product-based subscriptions. A $29/month box you don’t use is $348 a year. Multiply that by a few forgotten boxes and boom—there goes your next vacation. Take stock of what you’re actually using. Cancel what you’re not. Marie Kondo your subscriptions: if it doesn’t spark joy or deliver actual value, unsubscribe.

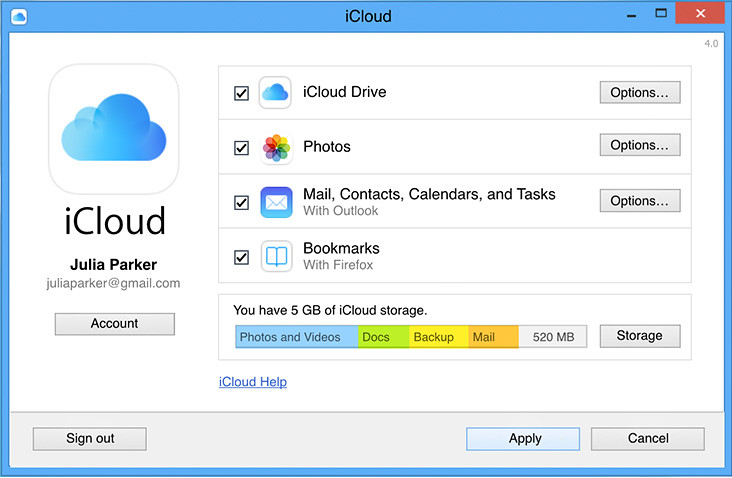

5. Cloud Storage Plans You Don’t Actually Need

Google Drive, Dropbox, iCloud—those extra 100GB plans sound harmless until you’re paying for all three and only use one. Many people upgrade once when their device threatens to stop backing up photos, then forget about the monthly charge. These fees are easy to miss, especially when they’re tucked into app store receipts or bundled with phone bills.

NBC 26 found that over half of consumers underestimate how much they spend on subscriptions by nearly $100/month. And cloud storage is one of the most overlooked culprits. Most retirees don’t need more than one service—and rarely need the max plan. Audit your cloud use, consolidate your backups, and downgrade or delete the rest. Unless you’re storing the Library of Congress, 2TB of cloud space is overkill. Don’t let your budget get buried in digital fluff.

6. Magazine and Newspaper Subscriptions You Never Read

There’s something charming about receiving a fresh Time or National Geographic in the mail, but let’s be honest—how many issues end up in the “read later” pile that becomes permanent décor? For retirees, old-school subscriptions can feel nostalgic, but nostalgia doesn’t pay the bills. Many print publications automatically renew at higher rates, and digital access fees often piggyback on top. If you’re not actively reading them, you’re basically paying for clutter.

Some magazines even lock you into annual billing cycles with zero warning. That $49.99 charge in January? You blink and miss it. Review your reading habits and ask yourself: do I really need five health magazines telling me to drink more water and stretch? Probably not. If you’re still getting magazines for the crossword alone, there are free apps for that. Cut the cord and reclaim your coffee table.

7. App Store Subscriptions From Your Tablet

Retirees often rely on tablets for convenience, but app stores make it way too easy to sign up for things you didn’t mean to. A meditation app here, a puzzle game there—before you know it, you’re paying $7.99 a month for things you forgot you downloaded. Some apps offer “premium” upgrades for ad-free use or bonus features, and they auto-renew faster than you can say “where did this charge come from?”

The sneaky part? These charges often don’t show up with obvious names on your credit card bill. They’re buried under generic transaction codes like “Apple Services” or “Google Play.” If you’re not combing through your statements, they can fly under the radar for months. Head to your App Store subscriptions section and audit every single one. If you haven’t used it in over a week, cancel it. Don’t let your iPad run your finances.

8. Gym Memberships And Online Fitness Platforms

Staying active is important—but paying $40 a month for a gym you haven’t visited since 2022? Not the move. Whether it’s a traditional gym or a virtual fitness class, these subscriptions can quietly rack up charges even when your workout consists of walking the dog and calling it cardio. Some gyms require you to cancel in person, which is ironic considering you’re not going in the first place.

Online platforms can be even trickier—charging annual rates after a “$1 for 30 days” promo. Fitness guilt is real, but financial guilt lasts longer. Audit your movement goals and see if they actually require a subscription. There are tons of free YouTube workouts or even community center classes that don’t cost a dime. If you’re not sweating from the subscription, cancel it and do a victory lap around your budget.

9. Identity Theft Protection Plans You Didn’t Know You Had

Some people do need identity protection, especially if they’ve been victims of fraud or have a lot of online accounts. But others get auto-signed up through their bank, insurance, or a random promotion—and keep getting charged without realizing it. These plans typically cost $9.99 to $29.99 a month and are often bundled with credit monitoring services you might not use.

The sneaky part? You might’ve opted in by clicking a checkbox when signing up for something else. It’s easy to think “Oh, that’s probably necessary,” when in reality, it’s overlapping with free services you already have access to. Call your bank and double-check if you’re enrolled in any protection plans. If you are, ask what they actually cover—and whether you even need it. You could be paying for peace of mind you already have.

10. Loyalty Clubs That Charge You To Save

Retail loyalty clubs used to be simple—spend more, save more. Now? Some of them require monthly fees just to access “exclusive” deals. Think of store memberships like warehouse clubs, but without the giant jars of peanut butter to justify it. You’re paying $12.95 a month for 10% off…if you remember to use it.

If you’re not shopping frequently enough to offset the cost, you’re basically giving away money. These subscriptions thrive on forgetfulness and FOMO. The idea of losing access to “member deals” keeps people paying long after the benefit’s dried up. Audit all retail club memberships and calculate whether you’re actually saving anything. If not, cancel and enjoy your financial freedom—no coupon code needed.

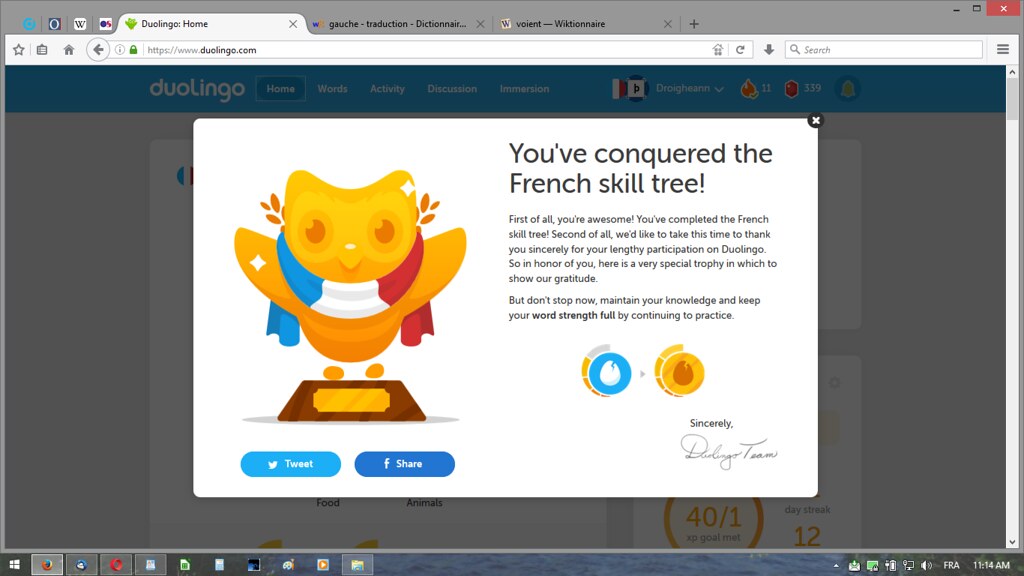

11. Language Learning Or Skill Apps You Gave Up On

Duolingo, MasterClass, Babbel, Rosetta Stone… we all had good intentions. But after three weeks of “¿Dónde está la biblioteca?”, the motivation fades and the subscription lives on. These platforms are excellent—if you actually use them. Otherwise, they’re just digital gym memberships for your brain.

Some charge annually, which makes the initial commitment feel painless—until next year’s auto-renewal hits like a surprise tax bill. If you’re not actively logging in weekly, ask yourself if this subscription is helping you grow or just draining your budget. You can always come back when you’re ready. But right now? It’s okay to say adiós. Financial literacy is its own kind of fluency, after all.

12. Password Managers With Multiple Tiers

Yes, protecting your passwords is important. But many people start with a free password manager and end up subscribed to the “pro” plan without realizing it. These services often upgrade your plan after a trial or nudge you into paying for features you don’t even use. Meanwhile, your login habits haven’t changed, and now you’re out $60 a year.

Retirees in particular can get stuck paying for multiple tools that do the same thing. Unless you’re managing 200 logins for international bank accounts, the basic tier is usually enough. Audit your account and look for duplicate services. If you’re using both a paid password manager and your browser’s built-in one, pick a lane. Keep your passwords safe—but keep your wallet safer.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.