Medical procedures that seem routine from a clinical perspective can be financially catastrophic for people living on fixed incomes. The gap between what Medicare and supplemental insurance cover and what surgeries actually cost has grown wide enough to swallow decades of careful saving. These twelve procedures represent the most financially devastating surgeries for retirees and fixed-income adults—not necessarily the rarest or most complex, but the ones most likely to leave people choosing between recovery and financial survival.

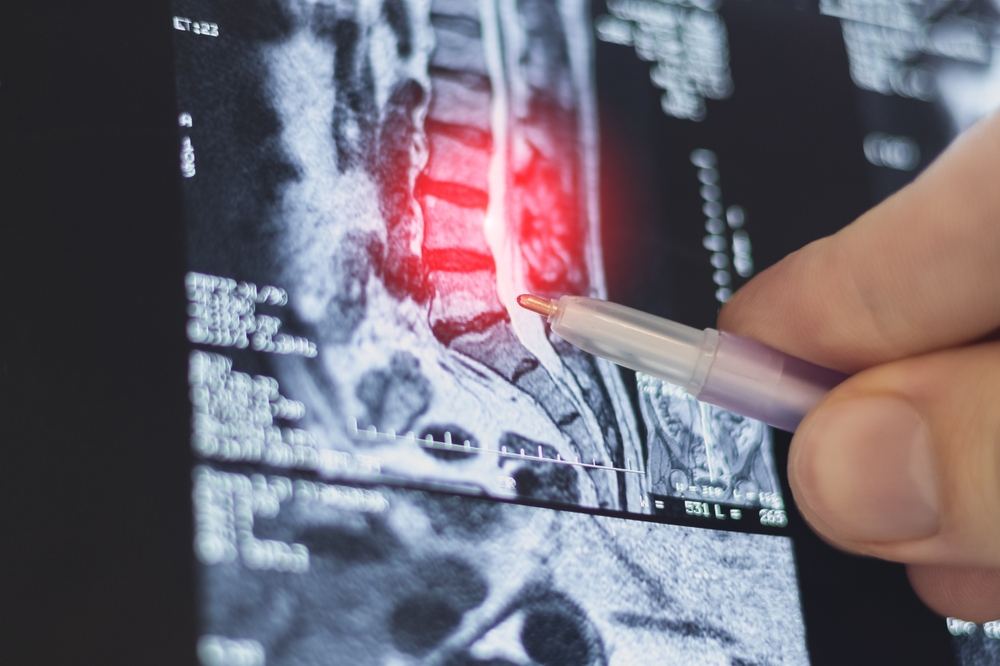

1. Spinal Fusion Surgery

Spinal fusion regularly costs $80,000-$150,000 depending on the number of vertebrae involved and whether complications arise. Medicare covers a significant portion, but 20% coinsurance without a cap means out-of-pocket exposure can reach $15,000-$30,000 before supplemental coverage kicks in—if it does. For someone on $2,000 monthly Social Security income, that’s a year or more of total earnings wiped out by a single procedure.

What makes spinal fusion particularly devastating is the recovery timeline. Patients typically can’t work for 3-6 months, and complications requiring revision surgery—which occur in roughly 20% of cases—reset the financial clock entirely. Many fixed-income patients are discharged from the hospital into debt they’ll carry for the remainder of their lives.

2. Hip Replacement

Hip replacement costs between $30,000 and $70,000, and while Medicare Part A covers the inpatient hospital stay, the 60-day benefit period creates a dangerous window of exposure for patients with complications or slow recovery. The $1,600 deductible per benefit period and daily coinsurance charges for extended stays add up rapidly for patients who can’t be discharged on schedule. Rehabilitation facility costs after discharge—often necessary and not always well-covered—can add another $10,000-$20,000.

The secondary costs catch most people off guard. Home modifications for safety during recovery, prescription costs, follow-up imaging, and physical therapy copays accumulate alongside the primary surgical costs. Patients who require revision surgery within five years, which occurs in roughly 5-10% of cases, face the full financial burden again with a diminished ability to recover economically.

3. Open-Heart Surgery (Bypass or Valve Replacement)

Open-heart procedures regularly run $150,000-$300,000 total, making them among the most expensive surgeries anyone can face. Medicare covers most of the hospitalization, but the intensive care stay, surgical team fees, anesthesiologist bills, and cardiac rehabilitation program each generate separate charges with their own cost-sharing requirements. Patients without strong supplemental coverage face multiple overlapping deductibles and coinsurance charges from providers who all bill independently.

Cardiac rehabilitation—medically necessary after bypass and valve surgery—runs $200-$400 per session, with typical programs requiring 36 sessions. Medicare covers 80% after the deductible, leaving patients responsible for $1,400-$2,900 in rehabilitation costs alone before counting the surgical bills. Fixed-income patients who skip rehabilitation to avoid costs face higher complication rates, creating a cruel choice between financial and physical recovery.

4. Colorectal Surgery

Colorectal resections for cancer or serious bowel disease cost $50,000-$120,000 and frequently involve complication rates that extend hospital stays and trigger additional procedures. The temporary or permanent colostomy that sometimes follows requires ongoing supplies costing $100-$300 monthly—expenses that continue indefinitely on a fixed income. Medicare covers ostomy supplies, but coverage limits and gaps in specific products mean many patients pay significant out-of-pocket costs every month for years.

The psychological and practical dimensions compound the financial strain in ways that are easy to underestimate. Dietary modifications, follow-up colonoscopies, specialist visits, and potential chemotherapy if cancer is involved each add separate layers of cost. Patients who enter surgery with modest savings often emerge into financial devastation before they’ve fully processed the medical reality of what they’ve been through.

5. Kidney Surgery and Dialysis

Nephrectomy—surgical removal of a kidney—costs $30,000-$80,000 and is often followed by monitoring and lifestyle modifications that carry ongoing costs. When kidney disease progresses to failure requiring dialysis, the financial picture becomes permanently altered. Dialysis runs $70,000-$90,000 annually, and while Medicare does cover ESRD, the transition period before full coverage begins can expose patients to catastrophic costs.

The 90-day waiting period for Medicare ESRD coverage—during which patients still need dialysis three times weekly—represents tens of thousands in potential exposure for people without comprehensive supplemental coverage. Even after Medicare kicks in fully, dialysis patients face transportation costs, dietary supplement expenses, and medication costs that fixed incomes struggle to absorb. Many dialysis patients describe a permanent state of financial precarity that began with surgery and never resolved.

6. Cancer Surgery With Reconstruction

Surgical cancer treatment—mastectomies, tumor resections, head and neck surgeries—varies enormously in cost but routinely exceeds $50,000 when reconstruction is included. Reconstruction, which surgeons and patients often consider medically and psychologically necessary, may be classified differently by insurers, creating unexpected coverage gaps. Fixed-income cancer patients frequently face the simultaneous financial burdens of surgery, chemotherapy, radiation, and reconstruction, with each generating separate billing.

The financial toxicity of cancer treatment is well-documented in medical literature but rarely discussed with patients before surgery. Studies show that cancer patients spend down savings, liquidate retirement accounts, and accumulate debt at rates that fundamentally alter their financial trajectories. Fixed-income patients often enter cancer treatment with fewer resources and emerge with none, having exhausted everything during a treatment course that sometimes spans years.

7. Lumbar Laminectomy and Disc Surgery

Lumbar disc procedures cost $50,000-$90,000 and are among the most frequently performed back surgeries in older adults, making them one of the most common financial threats to fixed incomes. Failure rates requiring revision surgery are significant—studies suggest 10-40% of patients require additional procedures within a decade. Each revision carries its own full cost burden, creating a potential cascade of surgical expenses from what initially seemed like a single procedure.

The post-surgical physical therapy requirement compounds the cost in ways patients don’t anticipate. Medicare covers physical therapy but applies a financial limitation that patients can exceed during normal recovery from major back surgery. Patients who hit the therapy cap face continuing treatment costs at full price precisely when they’re most physically vulnerable and financially depleted.

8. Aortic Aneurysm Repair

Aortic aneurysm surgery—either open repair or endovascular stenting—costs $50,000-$200,000 depending on the approach and complexity. Emergency repair, which occurs when an aneurysm ruptures unexpectedly, carries dramatically higher costs due to intensive care requirements and the surgical complexity of emergency intervention. Fixed-income patients who survive emergency repair often emerge to financial devastation compounding their physical recovery.

The long-term monitoring requirements after aortic repair add sustained ongoing costs. Annual or biannual imaging studies, specialist visits, and potential reintervention for endovascular repairs—which have higher reintervention rates than open surgery—create a permanent elevated cost burden. For someone living on Social Security, the combination of initial surgical costs and ongoing monitoring expenses represents a financial commitment the income was never designed to support.

9. Total Knee Replacement

Knee replacement costs $30,000-$60,000 per knee, and bilateral replacement—replacing both knees, sometimes simultaneously—can double those figures. Medicare coverage follows the same cost-sharing structure as hip replacement, with deductibles, coinsurance, and rehabilitation costs adding thousands to the base procedure expense. The number of knee replacements performed annually in the US has grown substantially, making this one of the most common financial shocks fixed-income patients face.

The rehabilitation intensity required for good outcomes works against fixed-income patients specifically. Adequate physical therapy is essential to recovery but generates significant copay obligations over the typical 8-12 week program. Patients who cut therapy short due to cost face higher rates of stiffness, poor outcomes, and potential revision surgery—another situation where the financially cautious path leads to worse medical outcomes and ultimately higher costs.

10. Prostate Cancer Surgery (Radical Prostatectomy)

Radical prostatectomy costs $20,000-$50,000 for the procedure itself, but the total financial impact expands significantly when staging tests, hospital fees, anesthesia, and follow-up care are included. Robotic-assisted prostatectomy—now the standard approach—generates additional facility fees that aren’t always well-covered. The incontinence and erectile dysfunction that commonly follow surgery require ongoing management through medications, devices, or additional procedures that continue generating costs for years.

The financial burden falls disproportionately on fixed-income patients because the ongoing management costs don’t have a clear endpoint. Incontinence supplies, medication for erectile dysfunction, pelvic floor physical therapy, and psychological support for quality-of-life impacts all accumulate monthly. Men who entered surgery financially stable sometimes describe the subsequent years as a slow financial erosion driven by costs they weren’t warned about before consenting to the procedure.

11. Cataract Surgery With Complications

Basic cataract surgery is relatively affordable and well-covered by Medicare, but complications or the choice of premium lens implants can transform a routine procedure into a significant financial event. Premium intraocular lenses that correct astigmatism or eliminate the need for reading glasses cost $1,500-$3,000 per eye above what Medicare covers, and many patients aren’t clearly informed this will be out-of-pocket. Surgical complications including posterior capsule rupture, infection, or retinal detachment require additional procedures that generate their own cost-sharing obligations.

Cataract surgery is one of the most common procedures performed on Medicare patients, making it a particularly widespread source of unexpected costs. The gap between patient expectations—”Medicare covers cataracts”—and financial reality creates genuine hardship for fixed-income patients who didn’t budget for premium lens costs or the possibility of complications. Many fixed-income patients accept suboptimal outcomes from standard lenses specifically because the premium option is unaffordable, illustrating how financial constraints shape medical decisions in retirement.

12. Emergency Abdominal Surgery

Emergency abdominal procedures—bowel obstruction repair, appendectomy with complications, perforated ulcer surgery—combine high surgical costs with unpredictable intensive care stays and zero opportunity for financial preparation. Costs range from $30,000 for straightforward cases to $200,000+ when complications require prolonged ICU admission and multiple interventions. The emergency nature means patients have no time to verify coverage, shop providers, or make any of the financial preparations that might soften the blow.

The financial devastation from emergency surgery is compounded by the recovery period that follows. Fixed-income patients discharged from emergency abdominal surgery often need home health aides, dietary modifications, wound care supplies, and follow-up procedures that continue generating costs during recovery. The combination of a large sudden bill with sustained ongoing costs is the pattern most likely to permanently alter a fixed-income person’s financial situation—there’s simply no recovery path that doesn’t involve liquidating savings, taking on debt, or both.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.