For years, Trump was the billionaire whisperer—the tax-cutting, regulation-slashing wildcard who promised to make America rich again. But now, some of the wealthiest people on the planet are backing away. Why? Two words: economic chaos. Between threats of sweeping tariffs and unhinged social media commentary that sends markets into convulsions, the former president’s unpredictability is starting to feel less like strength and more like financial sabotage.

These billionaires aren’t pearl-clutching over politics. They’re watching their portfolios get rattled, their industries destabilized, and their patience wear thin. Loyalty only lasts as long as the returns do—and these titans of capital are starting to say it out loud.

1. Warren Buffett Has Made It Clear: He Hates Trade Wars

Warren Buffett has always been pragmatic, not performative—and Trump’s obsession with tariffs doesn’t pass the Berkshire Hathaway sniff test. While Buffett never directly endorsed or attacked Trump in classic headlines, he’s repeatedly denounced trade wars as “foolish” and counterproductive. According to Yahoo, he believes tariffs act as a tax on consumers and create long-term instability.

Buffett has pointed to the damage done to manufacturing supply chains and international goodwill. His warning is simple: when you mess with free markets to score political points, you burn the bridge that led you to profit. And for someone whose portfolio spans everything from railroads to energy, Trump’s erratic economic playbook is more risk than reward.

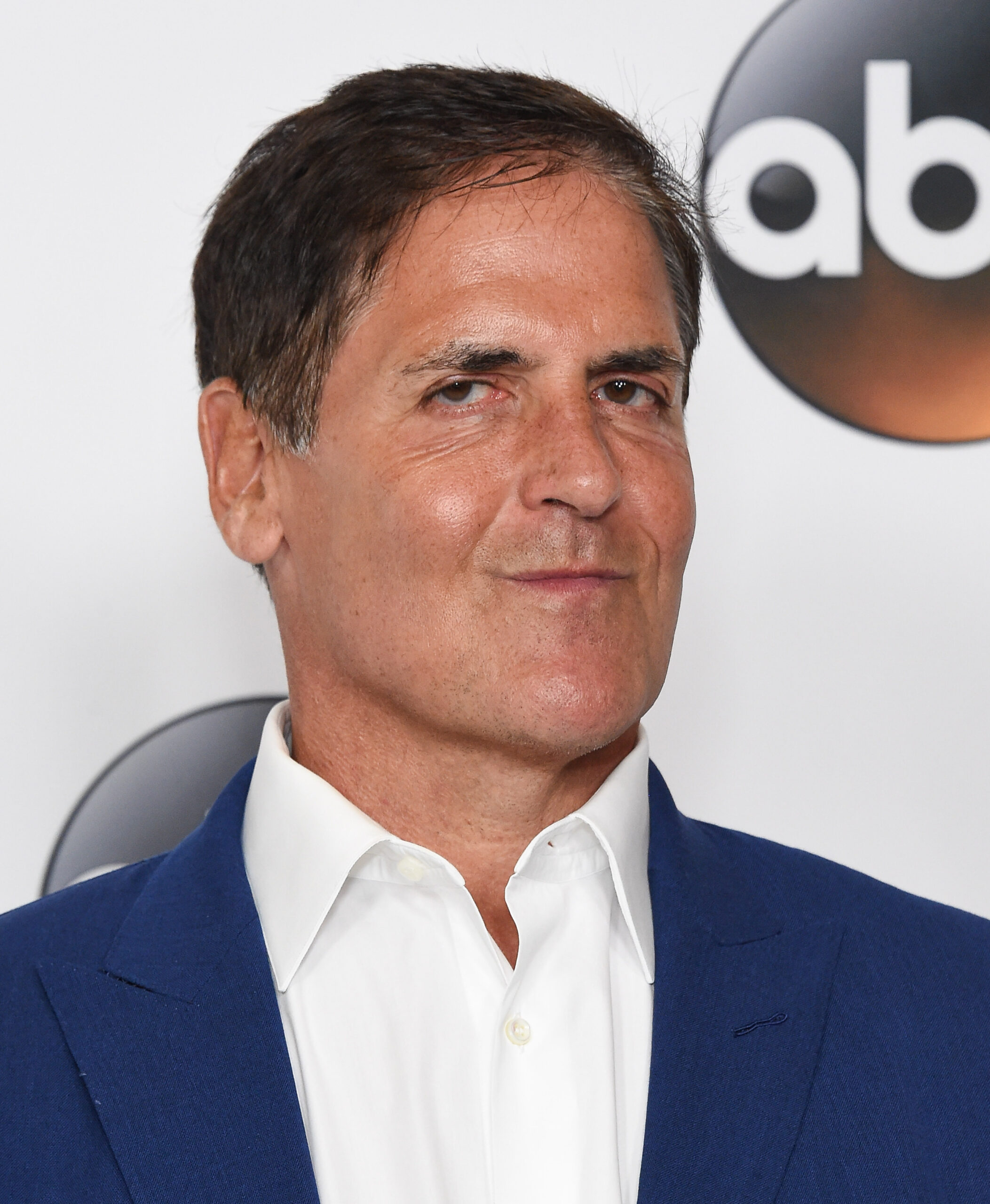

2. Mark Cuban Is Loud, Wealthy, And Fully Over It

Mark Cuban has never been one to keep quiet, especially when his billions are on the line. The tech mogul and NBA owner was once cautiously curious about Trump—but those days are long gone. According to Business Insider, Cuban has publicly scorched the former president for his economic volatility, calling his tariff strategy “stupid” and “bad for business.”

Cuban, who made his fortune in tech and streaming, says the instability caused by Trump’s China policy has hurt small and midsize businesses more than it’s helped American workers. He’s even floated the idea of backing more moderate, business-savvy candidates in the future. When Trump starts tweeting, Cuban starts calculating the damage.

3. Ray Dalio Thinks Trump’s Economy Is A Bubble Waiting To Burst

Ray Dalio, founder of Bridgewater Associates and one of the most influential investors in the world, has repeatedly expressed concern over Trump’s economic tactics. While he doesn’t name names often, as reported by Fortune, Dalio has warned that protectionism, political extremism, and short-term thinking could lead to what he calls a “paradigm shift”—aka, a market crash in slow motion.

Dalio believes Trump’s tariffs and America-first policies have weakened global trust in U.S. financial leadership. He’s flagged inflation risks, monetary policy distortions, and geopolitical tensions—most of which he subtly attributes to the Trump-era economic model. And when Ray Dalio says the economy’s fragile, billionaires listen.

4. Jeff Bezos Isn’t Just Feuding—He’s Financially Opposed

The Trump-Bezos feud is personal, public, and also deeply financial. While Trump took every opportunity to bash The Washington Post and Amazon on Twitter, Bezos quietly structured his empire to withstand the storm. But behind the scenes, he’s no fan of Trump’s tariffs—which hit Amazon’s global supply chain hard, driving up costs and complicating operations.

Bezos has avoided a full-frontal political attack, but his strategic investments tell the story. He’s backed climate policy, international logistics, and pro-trade globalism—all a direct counterweight to Trump’s isolationist vision. When the richest man in the world starts hedging against your economic philosophy, that’s not shade. That’s strategy.

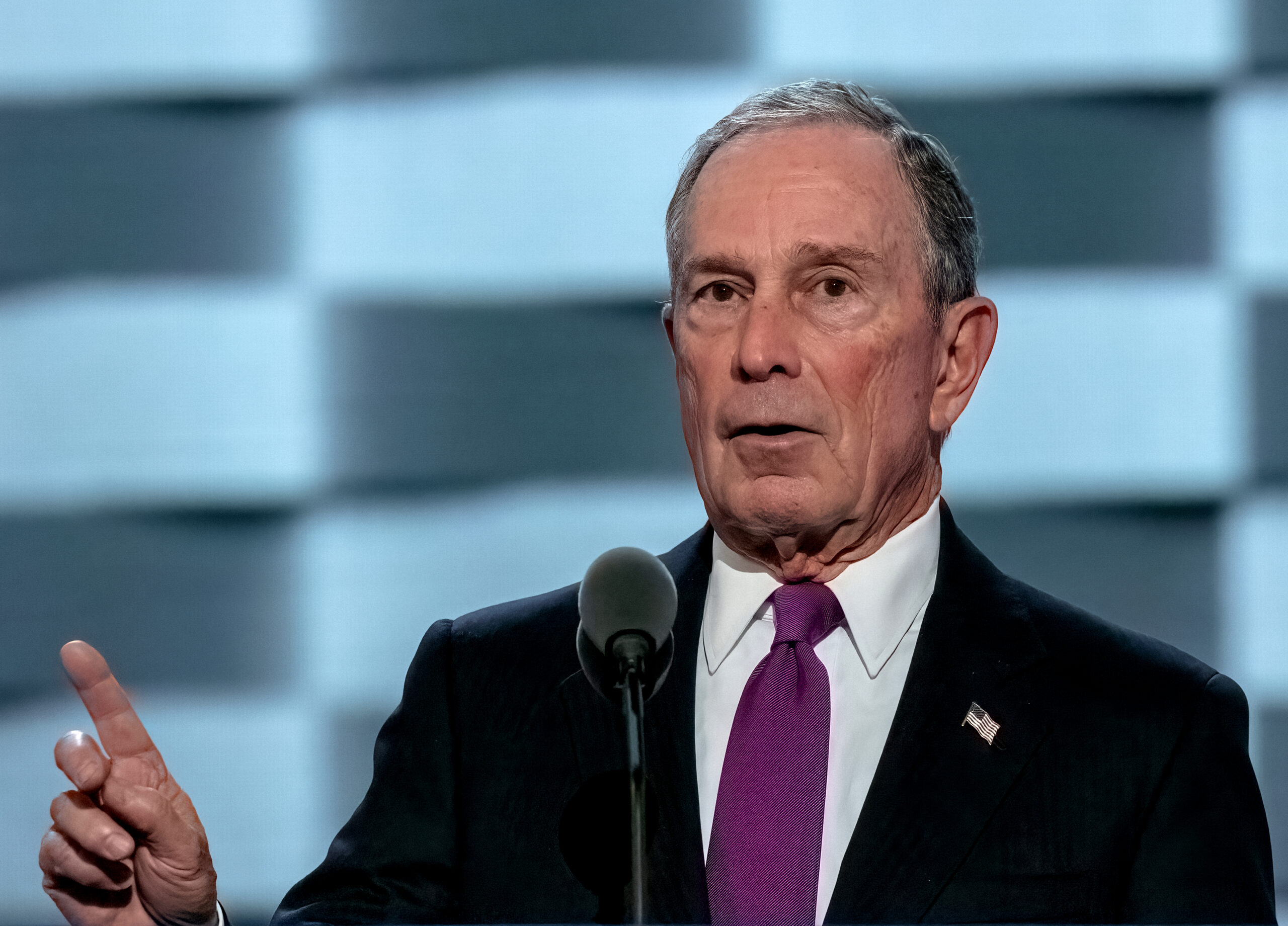

5. Michael Bloomberg Has Put His Billions Where His Beliefs Are

Michael Bloomberg didn’t just dislike Trump’s economic policy—he spent hundreds of millions trying to replace it. The media and finance mogul, who briefly ran for president in 2020, has long criticized Trump’s approach to trade, taxes, and Wall Street. Bloomberg has called tariffs “a blunt instrument” and warned that Trump’s fiscal plans “mortgaged the future.”

He’s donated vast sums to moderate, pro-business candidates who favor international cooperation and clean energy innovation. And with investments across global markets, Bloomberg knows exactly how fragile investor confidence can be. Trump’s unpredictability isn’t just annoying—it’s expensive.

6. Bill Gates Believes Trump’s Policies Are Economically Regressive

Bill Gates rarely gets overtly political, but he’s taken multiple public swipes at Trump-era policies—especially those that disrupt global cooperation and long-term innovation. Gates has criticized Trump’s stance on climate, immigration, and trade, saying they all undermine the very structure that allowed American businesses to dominate the world economy.

While Gates doesn’t talk stocks or tariffs as much as others on this list, his foundation’s work depends on global trade, stability, and science-driven policy. Trump’s volatility in those areas threatens more than money—it threatens momentum. Gates isn’t turning on Trump to protect his billions. He’s protecting what those billions were built to fund.

7. Elon Musk Has Gone From Ally To Eye-Roller

Elon Musk once sat on Trump’s economic advisory councils, but that bromance fizzled fast. Tariffs on Chinese goods hit Tesla hard, especially as it tried to expand globally. Musk publicly complained that trade wars made it harder for American companies to compete—especially in EV manufacturing, where supply chains are deeply international.

Though Musk has since leaned into political chaos in his own way, he’s grown increasingly dismissive of Trump’s unpredictability. His focus on innovation, global markets, and data-driven disruption doesn’t vibe with economic chest-thumping and tweet-fueled inflation. Musk may love Twitter, but he hates economic instability.

8. George Soros Thinks Trump Is Dangerous To Capitalism

George Soros is the billionaire conservatives love to hate—but his disdain for Trump runs deeper than political ideology. Soros has described Trump as a “con man” whose policies threaten global markets, democratic institutions, and the rule of law. He believes Trump’s economic nationalism destabilizes the delicate balance that modern capitalism relies on.

Through his Open Society Foundations and market commentary, Soros has warned about rising authoritarianism, trade decoupling, and the erosion of investor confidence. He’s not just worried about returns—he’s worried about regimes. For Soros, Trump’s economy isn’t just wrong. It’s a red flag with a dollar sign.

9. Ken Griffin Says Tariffs Are Hurting Real Business

Ken Griffin, founder of hedge fund giant Citadel, isn’t known for hyperbole, but he’s been direct about his concerns. He’s publicly criticized the Trump administration’s tariff-heavy approach, warning that it creates uncertainty and hurts U.S. competitiveness. As a billionaire who thrives on stability, Griffin sees Trump’s policy whiplash as bad for business.

He’s backed candidates who push for free trade and has emphasized the importance of predictable, market-friendly leadership. Griffin’s portfolio spans everything from tech to energy, and Trump’s volatility makes all of it harder to manage. It’s not about partisanship—it’s about math.

10. Howard Schultz Believes Trump’s America Hurts The Global Bottom Line

The former Starbucks CEO has been vocal about his opposition to Trump-style economics. Schultz has criticized the former president’s leadership as divisive and short-sighted, arguing that tariffs, immigration crackdowns, and political chaos undermine the values that help U.S. businesses thrive globally.

Schultz, a self-made billionaire, understands branding—and from his POV, America under Trump isn’t just unstable, it’s unattractive. Investors, international partners, and consumers don’t respond well to chaos. And for someone who built an empire on consistency, Trump’s wild-card style isn’t edgy—it’s bad for business. Period.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.