There’s a lot of buzz surrounding Trump’s proposed stimulus check plan. As people continue to navigate economic uncertainties, the idea of receiving a financial boost directly from the government is both enticing and, admittedly, a bit confusing. You’re probably wondering if this plan will actually materialize and what it means for your wallet. To help demystify the situation, let’s break down what you need to know about Trump’s stimulus check plan.

1. The Basics of Trump’s Stimulus Check Plan

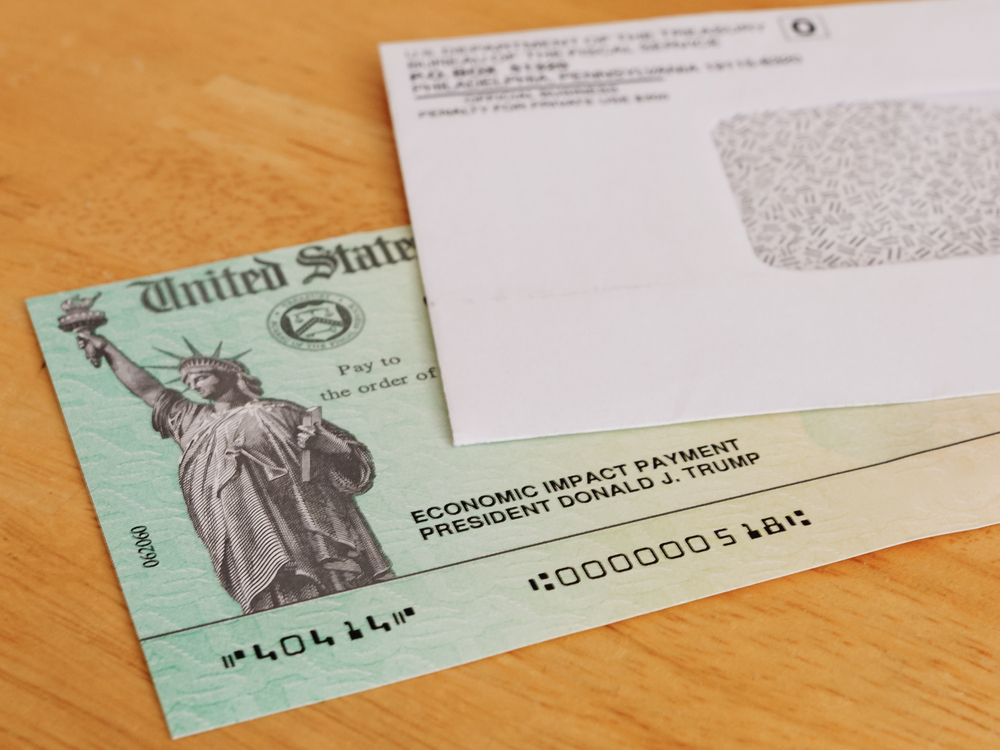

At the core of Trump’s stimulus check plan is the concept of direct cash payments to people, similar to the checks distributed during the COVID-19 pandemic. The goal is to stimulate economic activity by increasing consumer spending, thereby boosting businesses and helping the economy recover. You might be thinking, “Isn’t this just like last time?” In many ways, yes, but Trump believes that increased payments will have a more significant impact.

According to a report from The New York Times, the plan suggests higher amounts per person compared to previous distributions. This means you could potentially see a larger check in your mailbox. But, of course, it’s important to remember that suggesting a plan and getting it approved are two different things. As of now, it’s more of a proposal than a guarantee.

2. Economic Impact and Intended Goals

The primary aim of the stimulus checks is to increase disposable income, encouraging people to spend on goods and services. By putting more money directly into your hands, the expectation is that you’ll spend more, driving up demand and supporting businesses. Trump’s plan is banking on this cycle to jumpstart economic growth.

However, you might be wondering if this short-term boost can lead to long-term economic stability. Critics argue that while stimulus checks can provide temporary relief, they don’t address systemic economic issues. It’s like putting a band-aid on a deeper wound — it helps, but doesn’t heal everything. So, while it might be a step in the right direction, it’s not the ultimate solution to all economic woes.

3. Congressional Approval: A Major Hurdle

For any stimulus check plan to move forward, it must first gain approval from Congress. This is where things often get complicated and political agendas can play a significant role. You might recall that previous negotiations for stimulus packages were lengthy and contentious, with different parties pushing for varied priorities.

According to a piece in Politico, bipartisan support is crucial, but not always easy to achieve. If history serves as a lesson, you can expect some debate about the size and eligibility of these proposed checks. It’s a negotiation game, and until all sides agree, those checks are just hypothetical. So, patience will be key in the coming months as discussions unfold.

4. Who Stands to Benefit?

When it comes to who gets the checks, eligibility criteria are likely to resemble previous stimulus plans. Typically, payments are determined by income thresholds, with the aim of aiding those most in need. You might breathe a sigh of relief if you fall into a lower income bracket, as you’d likely qualify for full benefits.

That said, there’s always a catch when it comes to government funds. Higher income earners might find themselves phased out or receiving reduced amounts. The plan aims to balance support with fiscal responsibility, but it’s a fine line to walk. As details emerge, you’ll want to stay informed about where you stand.

5. Potential Roadblocks and Criticisms

Critics of the stimulus check plan argue that it could exacerbate the national debt without solving underlying economic issues. Some economic experts warn that indiscriminate distribution of funds might not be the most efficient use of resources. It’s a valid concern, especially if you’re worried about long-term fiscal health.

In an article from CNBC, economists suggest alternative measures such as targeted relief or infrastructure investment. These approaches might yield more sustainable economic benefits. While the promise of a quick cash infusion is tantalizing, it’s important to consider the broader implications. The effectiveness of any plan depends not just on the immediate impact, but on future economic stability.

6. The Timeline: When to Expect Updates

You might be curious about how soon these checks could become a reality. Unfortunately, the process is often slower than anyone would like. Once a plan is proposed, it undergoes rigorous debate and amendment discussions in Congress before any approval.

Delays can occur at any stage, from Congressional approval to distribution logistics. While you hope for expedience, it’s wise to remain patient and realistic about the timeline. Updates are typically released in stages, so staying tuned to credible news sources is your best bet for staying informed. Knowing when to expect potential changes can help you plan accordingly.

7. Public Sentiment and Political Implications

Public support for stimulus checks often reflects broader economic anxieties. When people feel uncertain about their finances, support for direct payments tends to increase. It’s worth acknowledging that these sentiments can influence political decision-making and urgency.

According to a survey by Pew Research Center, a significant percentage of people support additional stimulus payments, especially in the wake of economic downturns. This approval can pressure lawmakers to act swiftly and decisively. However, public opinion is just one piece of the puzzle. Political negotiations will ultimately shape whether the plan proceeds or stalls.

8. How to Prepare in the Meantime

While the future of stimulus checks hangs in the balance, there are steps you can take to prepare. First, keep track of any legislative developments and understand how they might impact your financial situation. It’s also wise to continue budgeting wisely and saving where possible, just in case the plan faces further delays.

You might also consider exploring other forms of financial assistance or resources available in your community. Preparing for various outcomes can help you stay resilient, no matter what unfolds. The promise of a stimulus check is enticing, but it’s not something you should rely on entirely. Being proactive about your finances is always a sound strategy.

9. How Much You Could Actually Receive

One of the biggest questions on everyone’s mind is how large these potential checks might be. While Trump has floated the idea of “substantial” payments, no exact figure has been finalized. Some early reports suggest they could exceed past stimulus amounts, but this is still speculative. Until a formal bill is drafted, any specific number remains uncertain.

You’re not alone if you find the lack of clarity frustrating. After all, it’s tough to plan or set expectations when the range feels so open-ended. What we do know is that the size of the payments will hinge on budget negotiations and the political appetite for more federal spending. Keeping expectations flexible is the safest approach for now.

10. How Businesses Might Be Affected

Stimulus checks don’t just impact individuals—they can also influence businesses in meaningful ways. If consumers suddenly have more cash on hand, industries like retail, hospitality, and transportation may see a noticeable uptick in spending. That’s one of the core reasons these payments are proposed: to help kick-start stalled sectors. However, the extent of the impact depends on how much people actually spend versus save.

For business owners, potential stimulus checks could bring a short-term burst of activity. But relying on that boost alone isn’t a long-term strategy, especially in uncertain economic climates. Many experts warn that temporary relief won’t fix deeper issues like labor shortages or supply-chain challenges. So while the plan could help, it’s not a magic wand for the broader business landscape.

11. How States Could Respond

Federal stimulus plans often ripple into state-level decisions, affecting everything from budget priorities to local relief efforts. Some states may use the increased economic activity to justify additional support programs or temporary tax pauses. Others might take an opposite approach, tightening budgets to prepare for future financial uncertainty. The variation can make predictions tricky, depending on where you live.

For individuals, understanding your state’s policy trends can help you anticipate indirect benefits or drawbacks. A generous state response could amplify the effect of stimulus payments, while a restrictive one could dampen it. Keeping an eye on local news is just as important as following federal updates. Your location may influence how far your stimulus dollars ultimately stretch.

12. What It Means If the Plan Doesn’t Pass

There’s also the very real possibility that the plan may not move forward at all. If that happens, many people counting on relief might need to reassess their short-term financial strategies. While disappointing, it’s important to remember that stimulus checks aren’t the only form of support government bodies can offer. Other programs—such as expanded tax credits, unemployment assistance, or targeted relief—could still emerge.

In the absence of new stimulus payments, financial experts often recommend focusing on emergency savings and income stability. It’s worth exploring community resources, charitable support networks, and any available state-level programs. No single plan—or failure of a plan—defines your financial security. Preparing for multiple outcomes keeps you grounded during economic uncertainty.

This article is for informational purposes only and should not be construed as financial advice. Consult a financial professional before making investment or other financial decisions. The author and publisher make no warranties of any kind.